What are the best venture capital bets?

There have been a number of high-profile IPOs in the US this year – with the ride-sharing Apps Uber and Lyft being two of the most prominent. The combined valuation of the two listings at IPO was >US$100bn (Uber $82bn, Lyft $24bn), a higher valuation than every company on the ASX aside from the mighty BHP.

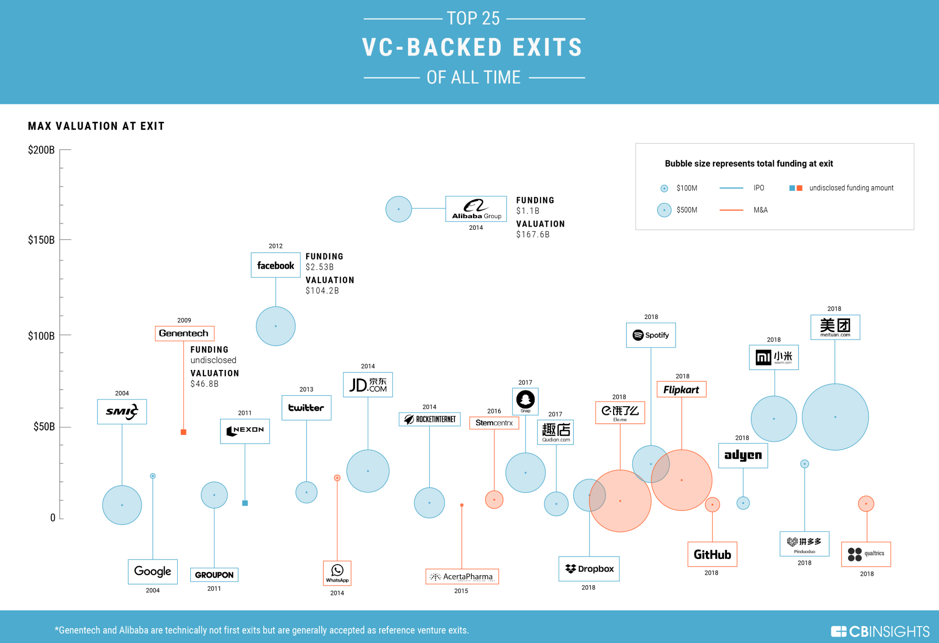

While I am not going to delve into the appropriateness of the valuation of these ride-sharing apps or other tech unicorns – I thought it was interesting to look at where Uber ranked in terms of the All-Time best venture capital bets.

As a bit of history, Benchmark – a San Francisco based venture capital firm, reportedly invested US$9m in Uber in an early stage funding round in 2011. At the IPO price of US$45 per share, the paper value of its holding had increased to $6.75 billion, which excludes its prior sale of $900 million worth of stock to SoftBank prior to the IPO. The return represents a staggering 850x return on its initial investment over an 8-year period, although it’s worth noting Benchmark still holds ~150m shares, or 9 per cent of Uber.

So how does investment compare to other venture capital bets and their subsequent valuation at exit? The below graphic illustrates:

You can click on the image to open a larger graphic.

A couple of things to note:

- Facebook – Accel Partners invested ~$13m in 2005, which was worth $9 billion at the IPO valuation of $104 billion at US$38 per share in 2012. The shares are now trading at $190 per share. This equated to a return of over 700x.

- Whatsapp – Sequoia Capital invested $60 million in Whatsapp, which was reportedly worth ~$3 billion at the time of sale to Facebook. The transaction involved Facebook shares, which appreciated in value over the time of the transaction.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Joseph Kim

:

While there is an element of luck in almost every investment, I do believe most VC investors are aware of the low success rates of their “bets” given the blue-sky involved in many of these ventures.

Luke Joseph

:

I don’t think Venture Capital relies on luck. They are fully aware that most of their bets will fail. The ones that succeed more than make up for the failures.

Chris

:

Important not to confuse luck with skill.

For every bet (which is essentially what these are), there are many others (both punts and persons) that have lost money, you tend not to hear about the losses, and tend to hear more of the success stories.