Expensive Pizza

Domino’s Pizza (ASX:DMP) has been one of the standout success stories on the ASX in recent years. The business has achieved excellent financial metrics with good earnings growth, and shareholders have enjoyed exceptional returns over many years, with a +60 per cent share price gain in the past 12 months alone.

However, while we applaud the management of the business for excellent financial performance over this period, we wonder whether the share market might have pushed Dominos beyond a sensible valuation range.

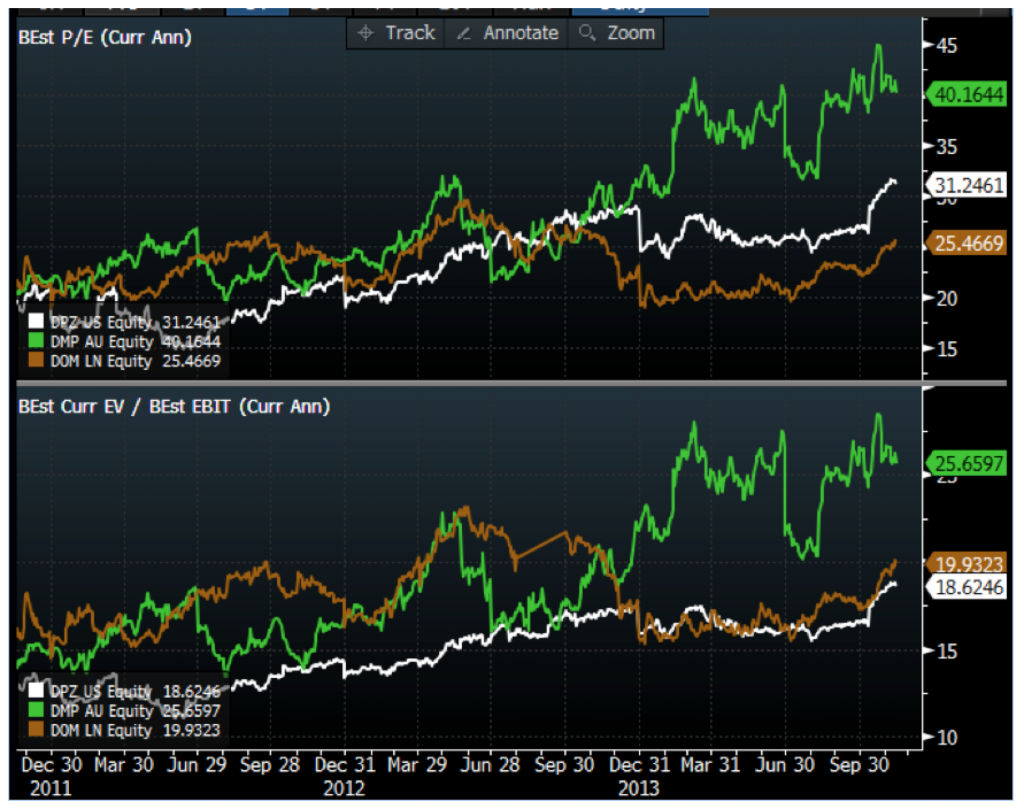

At the current price, Domino’s trades at around 40 times forecast FY15 NPAT and enterprise value is around 26 times forecast EBIT – big numbers in any language.

We note that separate listed companies in the UK and US hold the rights to own and franchise Domino’s stores in those countries, and, while those businesses have also been successful, Domino’s Australia appears to have moved into a class of its own in terms of trading multiples, as shown by the charts below.

It’s important to note that we haven’t studied the overseas versions of Domino’s in any detail, and can’t comment with authority on how these companies should be compared with the Australian vehicle. However, with the Australian stock appearing to trade at lofty multiples both in an absolute and relative sense, we wonder if the best shareholder returns may now be behind it.

For the time being, we’ll continue to admire from the side lines.

Note: Australia is shown in green, the US in white, and the UK in brown.

Hi

Have your views changed on DMP changed since their financials recently? The afterburners are running nitro!

Hi Mayank,

Its certainly the case that the share price has had the afterburners on. Our assessment of underlying value however, is that it is not keeping up. That can continue for quite some time, but in the long run value and price usually find some sort of common ground.

Tim

Hi Tim,

Thanks for the analysis. I just wanted to say isn’t a business technically worth the present value of its future cash flows minus debt? So therefore Dominos can be as high as 100 times FY15 earnings and still be considered ‘cheap’ (this is totally hypothetical of course)? The way I always thought of a company with a low PE is that it indicates the market hasn’t priced in much of its future cash flows/prospects and ‘can’ (not necessarily does) correlate with the best value.

Will be interesting to hear your thoughts.

Cheers

Adam

Hi Adam,

There are three common mistake assumptions about the PE ratio and all lead to misfortune. The first is the idea that a company on a low price earnings ratio is cheap. A company about to lose money, or a company with a very low rate of return on equity, may be expensive, even if it is trading at a low multiple of its present earnings.

The second is that a company on a high price earnings ratio is expensive. I demonstrate below that you can pay a price earnings of 20 times and still be getting a bargain.

The third is the idea that one can pay a high price earnings for a company displaying evidence of, or potential for, high earnings growth. Return on equity may be much more important than earnings growth in establishing whether a company is valuable.

Further, the following derivations of the price earnings ratio are perhaps evidence that the basic, original price earnings is not satisfying analysts, and so they have invented derivatives. To a man with a hammer, all problems are a nail, the following ratios and ideas represent derivations of that‘hammer’, or different ways to use it:

– Price to Earnings Growth (PEG) ratio

– The sector average price earnings

– The forward or forecast price earnings, based on prospective earnings per share, rather than historical or actual earnings

– The use of standard deviations of historical average price earnings ratios, to construct price earnings bands or ranges to discern when current price earnings are relatively low or high, and therefore whether shares are cheap or expensive.

Unfortunately, if a tree is rotten at its trunk, you cannot gain safety by climbing higher.

When the basic historical price earnings don’t work, it seems investors have resorted to new ways to mutate it in an attempt to improve results. In classic legacy-of-the-father style, the derivations of the price earnings can’t be better than the flawed tool upon which they are based. As Charles Munger humorously observed; you can mix raisins with turds, but they’re still turds.

There at least appeared to be a form of correlation between the three of them on a PE perspective till just after Sep 30 when DMP seems to have put its afterburners on. The previous relationship could indicate that you are entirely correct and that Dominos Aus is extremley expensive. When you look at the EV/EBIT lines after Dec 31 you see the same thing where US and UK seem to stay at similar levels whilst AUS lofts above it.

It is a great business and would like to own it at the right price. Obviously the current price is not that one.