“Dummies” Yielding Losses

Chris Joye (who wrote this piece about Montgomery) and whom I regard extremely highly, has written a useful piece for the Australian Financial Review today, which he has also distributed via email. It’s a piece that yield hungry investors MUST read. Too much money can be lost by not heeding his words and we couldn’t have written it better ourselves. Chris’ email reads below:

|

AFR: ANZ/NAB Hybrid Still Too Expensive (Equity for Dummies?)

From AFR Contributing Editor Christopher Joye

|

|

|

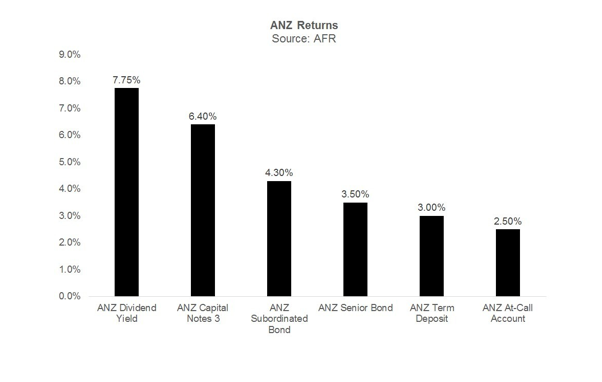

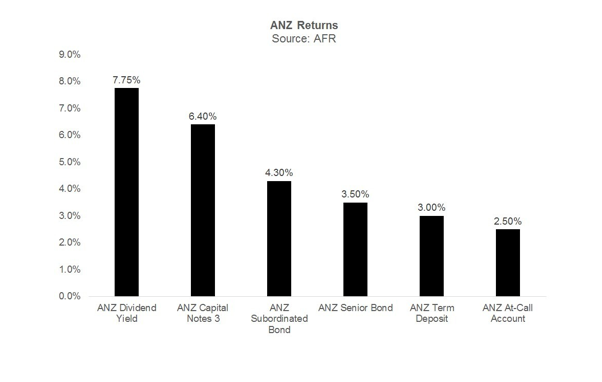

In the AFR I analyse the new ANZ “perpetual” hybrid security, which I think is still too expensive (ie, overpriced)—or too cheap for the bank, depending on which way you look at it. With ANZ’s grossed up dividend yield currently 7.75%, the circa 6% return on these equity hybrids does not give investors sufficient compensation for their risks (ie, you may be better off buying the equity).

One risk that virtually everyone has overlooked is the very real possibility that banks cut the hybrids’ entirely discretionary “distributions” (they are not “interest” that is a legal liability like you get with a deposit or bond), which is precisely what one leading bank treasurer recently told investors the bank would do in the next serious recession if they had to lower dividends to rebuild capital. This explains why another bank treasurer describes the hybrids as “cheap equity”, which is what they are formally classified as by APRA (ie, they count as going concern tier one capital).

I warned in the AFR before their ASX listing that CBA’s Perls VII, which mums and dads poured $3bn into only to suffer a 4% plus capital loss, were way too expensive with a 2.8% margin over the bank bill swap rate. Perls VII is now paying more than 3.6% over bills and I argue in the AFR today that the new ANZ hybrid, which will be closely followed by another NAB hybrid (thus flooding supply), should be paying investors more than 4% over bills (ie, greater than the 3.6% to 3.8% margin range being promoted by the bank).

The bottom line is that it’s a great deal for banks but a dud risk-adjusted bet for punters. You can read my analysis online here right now. The AFR is having technical issues and is currently not able to display my chart, which is enclosed for your benefit below.

|

|

|

|

|

MORE BY RogerINVEST WITH MONTGOMERY

Roger Montgomery is the Founder and Chairman of Montgomery Investment Management. Roger has over three decades of experience in funds management and related activities, including equities analysis, equity and derivatives strategy, trading and stockbroking.

Prior to establishing Montgomery, Roger held positions at Ord Minnett Jardine Fleming, BT (Australia) Limited and Merrill Lynch.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.