Domestic vs. international gas prices

I have previously shared my view on Australia’s high energy prices and why investing in new coal producing power is a bad idea. Today, I would like to revisit what has happened in international liquefied natural gas (LNG) markets and compare it to what is happening to domestic gas prices.

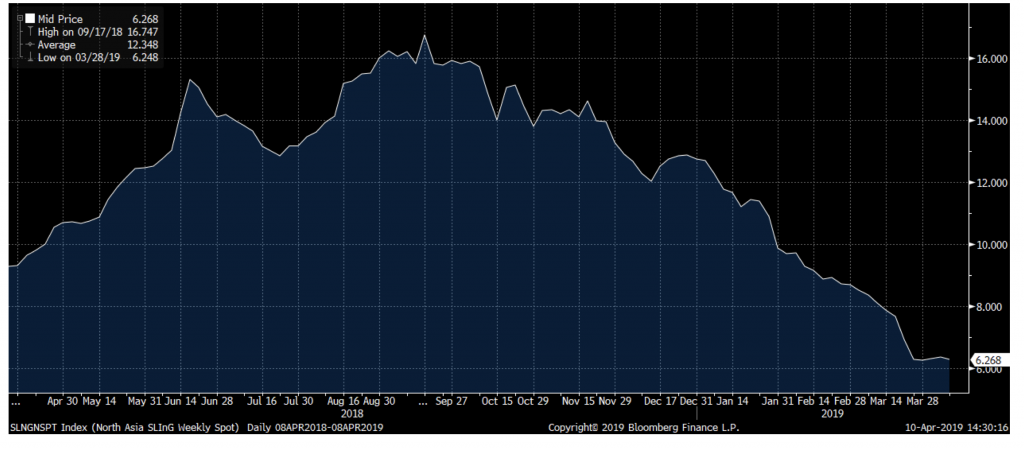

Spot price of LNG in Asia

First let’s start with looking at the spot price of LNG in Asia. This is the price that the Australian east coast gas producers can receive if they sell LNG to for example China (the chart is in AUD/mmBTU and the values should be multiplied by 1.055 to get to AUD/GJ which is what the domestic gas market is quoted in):

Source: Bloomberg

As we can see, there has been a steep fall in prices of around 60 per cent since the peak in September last year.

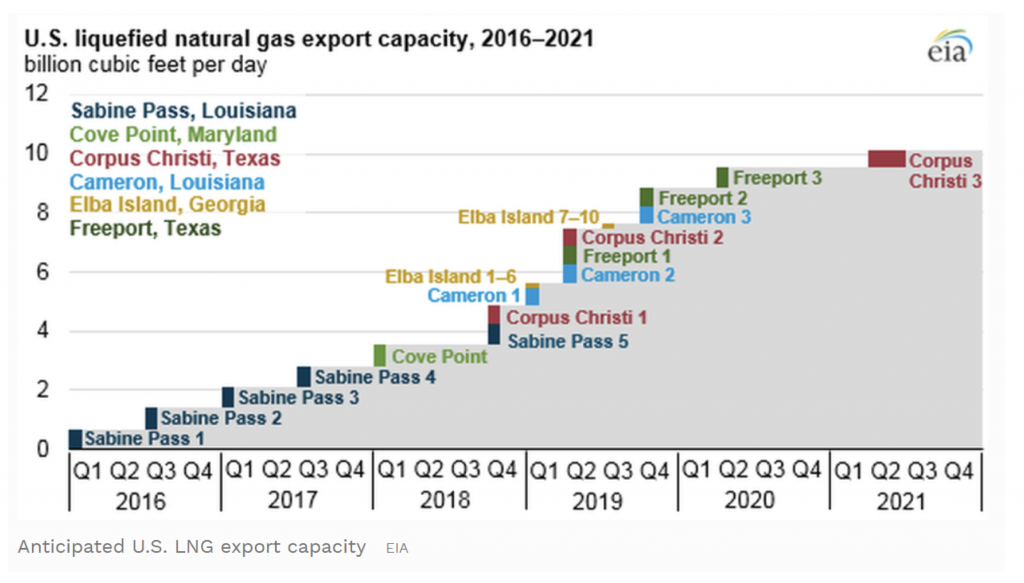

This has been driven by a supply glut as the existing large produces like Qatar and Australia have scaled up production and the US has opened several more export LNG terminals in 4Q18 and 1Q19 and are now approaching the 3rd place in export capacity just a few years after the first export terminal was opened in early 2016:

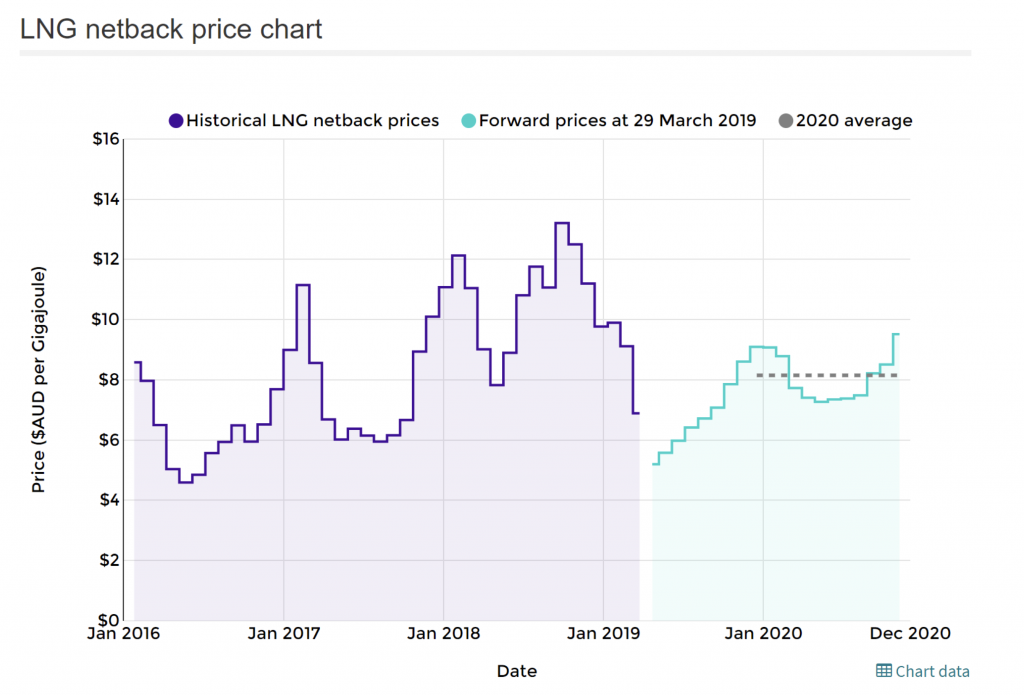

This is also reflected in the LNG netback price chart that shows the implied netback spot price on the east coast should be around AUD6/GJ (although this chart is currently 12 days old and would likely show an even lower forward curve if updated today given what has happened in the LNG spot market):

Source: ACCC

Notwithstanding all the caveats that ACCC discloses, they state on their website that “an LNG netback price represents the price that a gas supplier would expect to receive from a domestic gas buyer to be indifferent between selling the gas to the domestic buyer and exporting it.”

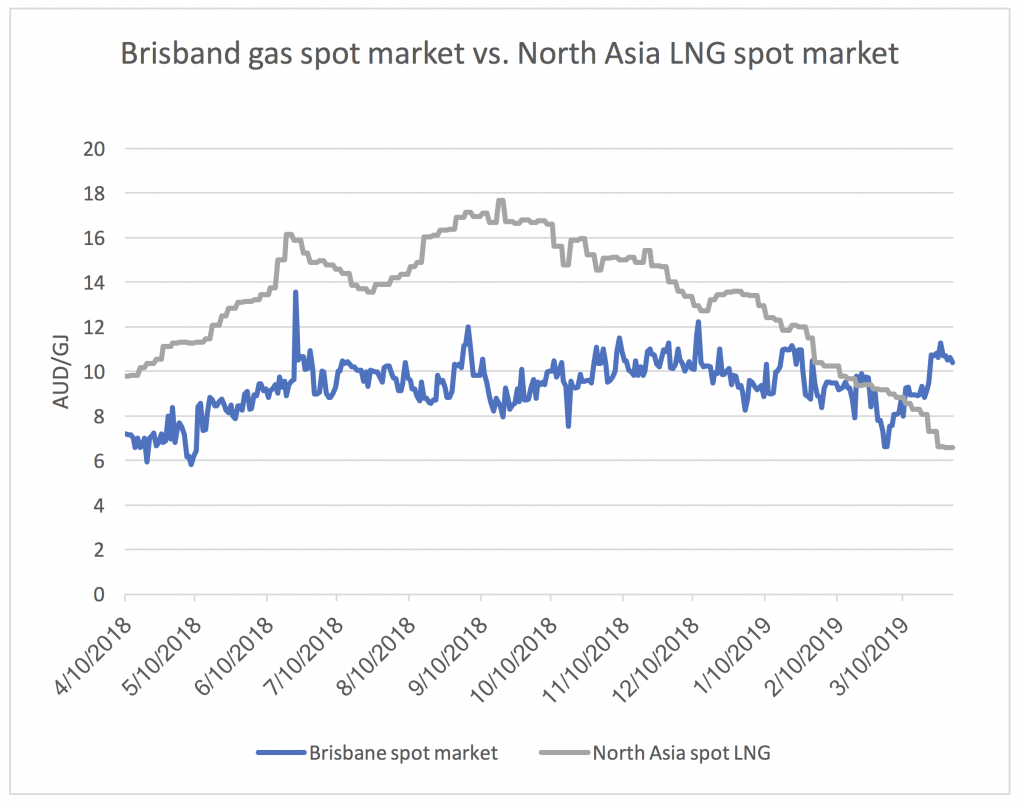

It is therefore interesting to then look at what has happened to domestic gas prices. In the chart below, I have used the Brisbane spot prices as that should be what we can compare with the LNG netback prices from ACCC.

The chart is actually quite alarming as it shows that it is currently 66 per cent more expansive to buy a GJ of gas, produced in Australia, in Brisbane than it is to buy the same GJ in North Asia after it has been liquified and shipped there which would add at least a couple of dollars per GJ in cost.

The importance of gas pricing

As I have written before, the price of domestic gas is of major importance to the Australian domestic economy as it:

- Is the major price setter in the electricity wholesale market. For each AUD/GJ in difference on the price of gas, we should expect a ~10/kWh difference in the wholesale cost of electricity as an open cycle gas turbine in general operates with a heat rate of around 10. The wholesale price of electricity feeds directly into both consumers spending power as electricity is something you cannot live without so you will sacrifice other spending to not be cut off and also into the economics of energy intensive manufacturing businesses reducing their willingness to operate and create jobs.

- Natural gas is a major direct input for a range of industries ranging from anyone who makes anything containing plastics to anyone who makes fertilizers and explosives (Incitec Pivot and Orica) or even paint (Dulux).

It would appear to me that the producers of gas would be incentivised to try to keep the domestic price of gas high as they have significantly more market power here than in the global LNG market.

If this condition persists, a case that the Australian Domestic Gas Security Mechanism (which provides The Minister for Resources to compel LNG exporters to limit exports or find new gas source in case of domestic shortfall) should be triggered can surely be made as it is certainly not in the nations interest that domestic gas users pay significantly higher prices than buyers of the same gas in China no matter what anyone’s definition of a shortfall is?

I have previously written about the reason that Australia has high energy prices and why investment in new coal producing power is a bad idea and most recently why LNG import terminals are not a great idea.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

John Russel

:

Hello, do you think that the average cost of 1.23 USD for one liter of gasoline and 0.91 USD for one liter of diesel in Australia is normal?

Source: http://confiduss.com/en/jurisdictions/australia/infrastructure/

Andreas Lundberg

:

Hi John,

I have to say that gasoline and diesel prices are not my prime area of expertise as I have focused much more on the natural gas market in the past.

Generally gasoline and diesel prices in Australia are cheap in an international perspective (apart from US) due to relatively light taxation. This also means that prices will be more volatile than in other countries as the cost of raw material (= oil price which is volatile) and cost of production accounts for a bigger portion of the total costs.

steven lock

:

Hello Andreas,

Do you have a view on domestic solar storage and whether this is something that will be viable anytime soon that will make a difference, are there opportunities with companies involved.

Andreas Lundberg

:

Hi Steven,

I have not run the numbers on domestic storage for a while now but the cost reduction in batteries for electric cars are continuing and that will drive down the cost for domestic storage eventually. When I last ran the numbers, it did not make economic sense to install compared to staying connected to the grid but from memory, it would only take 3 to 4 years of 10% per year cost down in storage cost before it makes general sense to install storage. Once it makes economic sense, we will see some very interesting dynamics as more and more people will leave the grid meaning that the cost of the grid will be shared by fewer users (generally described as the electricity death spiral).

I have not seen any direct opportunities with domestic storage of electricity in the public market. It will be negative for utilities like Origin/AGL due to lower electricity volumes sold and I would think the network owners like Spark and Ausnet in the long term as their regulated returns must come under pressure eventually for political reasons as it will be the lower socioeconomic segment that will have to bear the increased cost of the grid as they cannot afford to install solar/storage or rent or live in an apartment.

xiao fang xu

:

Mr. Andreas you are entrepreneur, you spot opportunity to make ton of money with arbitrage — but you can not do it, why?

Because of Government laws and regulations you can not go and buy where is cheaper and sell where is more expensive.

Government is problem always not greedy individuals and free market.

Andreas Lundberg

:

Hi Xiao,

I am generally a fan of free and open markets and believe that markets are the best mechanism to achieve an optimum solution. My views are a bit different when it comes to natural resources of a finite nature where I believe that the utility should primarily belong to the people of the nation where the resource is located. Rules and regulations should be designed to enable extraction of the natural resource in a way that provides just enough incentives for private companies to invest but that still makes sure that the majority of the benefits accrues to the people of the nation that owns the natural resource.

Unfortunately, Australian gas market is one of the best examples of a very badly designed system which is obvious from the fact that Australian gas consumers are paying more for gas than buyers of the same gas in China.

The best system that I have seen internationally is the Norwegian Petroleum Tax system which has very steep marginal tax rates once a certain return is achieved (http://taxsummaries.pwc.com/ID/Norway-Corporate-Taxes-on-corporate-income). Much better than a royalty based system as Australia has.