Does the market offer value?

Over the long haul, the equity market tends to offer a pretty good deal. Compared with holding cash, investors assume a significant amount of risk, but that risk is generally well-rewarded with higher returns. If your timeframe is long enough, the risks tend to even out somewhat, and the returns compound meaningfully. Staying in cash for twenty or thirty years would normally be a dreadful investment strategy.

At the same time, it pays to be mindful of value. For example, investors who bought into the US NASDAQ Index at the height of the last tech boom faced a 15 year wait before the Index recovered the levels it reached in 2000. This is an extreme example, but it illustrates the point that paying too much for equities can set you up for a long stretch of disappointment.

With that as context, where does the Australian equity market sit at the moment, relative to “fair value”?

At Montgomery, we take pride in being able to gauge value, and we aim to preserve flexibility by holding higher levels of cash when valuations start to become expensive. Trying to understand where we should sit is something that takes up quite a bit of our time.

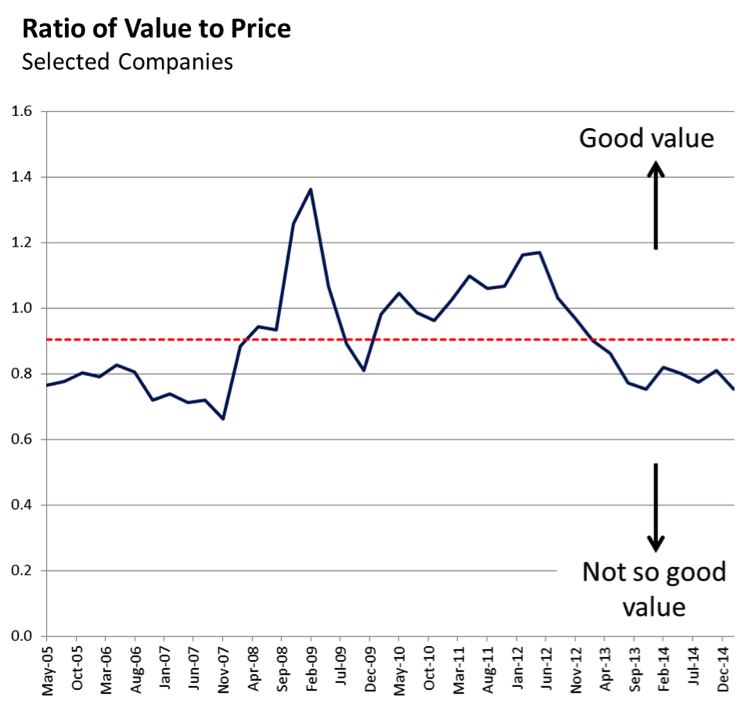

One good way of addressing the value question is to use automated valuation tools to map out the path followed by the market as it meanders between cheap and expensive. We frequently run this type of analysis by feeding a set of companies into our valuation systems, and working out the ratio of value to price over time. We tend to focus on companies that are reliable earners, and therefore “easy” to value. By estimating the value of our sample companies in a consistent (ie. automated) way, we end up with a measure that is free from the biases and mood swings that creep into human judgements.

The chart below shows the result of such an analysis over the last ten years. Where the ratio is high, the sample companies are trading at relatively attractive prices, and where it is low, value is becoming scarce.

What the chart seems to be telling us is:

- For a period following the GFC, valuations generally were attractive. This should come as no surprise, as a great many investors became disillusioned with equities during the GFC, and were subsequently reluctant to pay much for them; and

- More recently, valuations have more or less fallen into line with pre-GFC levels. In this context, they do not appear outrageously expensive, but they certainly offer less compelling value than they did a few years ago.

This leaves us in a slightly uncomfortable middle ground. From here there is the potential for equities to deliver quite reasonable long-run returns, so it doesn’t make sense to be all in cash, but there is also the real possibility of a swing back towards better value, so it makes sense to hold some cash, and have the option value that comes with it.

So that is what we’ll do.

Tim Kelley is Montgomery’s Head of Research and the Portfolio Manager of The Montgomery Fund. To learn more about our funds please click here.