Does it really matter if the RBA cuts again?

The Reserve Bank of Australia recently opted to leave interest rates on hold. But with key parts of the economy in decline, it may be just a matter of time before it has to cut again. The question is: how effective will a rate cut be?

It’s generally folly to predict whether the RBA will raise, cut or hold rates steady. And fortunately, we’ve not needed to predict economic data to know that we should be avoiding some sectors. Deteriorating individual company economics in some sectors and virtually insane valuations in others have both been sufficient to warn us, for example, to stay away from consumer facing stocks, and especially those demonstrating strong overseas growth priced for indefinite continuity. And our bias has had a lot to do with the outlook for the housing construction and retail sectors, which you might appreciate are the third and second largest employment sectors in Australia respectively.

So, what do we know?

- We know that residential approvals fell off a cliff late last year and earlier this year.Dwelling approvals have fallen from circa 280,000 dwellings at the peak to less than 170,000 dwellings. That’s a fall of 40 per cent.

- We know that approvals must lead construction activity, so at some point in the next six months housing construction activity is going to collapse.

- We know that the construction industry employs 9.6 per cent of the workforce and 37 per cent of those people are employed directly in residential construction. That’s 3.5 per cent of the workforce employed in residential construction which is about to decline 40 per cent.

- That means income growth for these workers (tradies etc.) is about to turn negative.

- Having spoken to several of Australia’s and NSW’s largest privately-owned house and land (H&L) package developers, we know that their pipeline is already down 50 per cent. Without a circuit-breaker (rate cut and looser credit availability) they will be laying off staff by Christmas. As an aside we also know that national vehicle sales have collapsed and listed car dealers such as AHG have downgraded. A dealer principal I have spoken to is laying off staff already.

- We know that the listed H&L developer Villaworld reported a greater-than-50 per cent decline in unit sales volume half-on-half earlier this year and we know that the listed AV Jennings reported a 90 per cent decline in profits (albeit unadjusted). More recently, Villaworld provided its 3Q19 update which underlined a continuation of weak conditions. In the four months to 30 April 2018, the company generated 266 sales or an average of 66 per month. To put this in perspective, in 2018, the company was selling 149 per month.The current run rate is the lowest since FY13.

- We can safely conclude that without said circuit breaker, already-anemic national wage growth will slow further and national unemployment will rise.

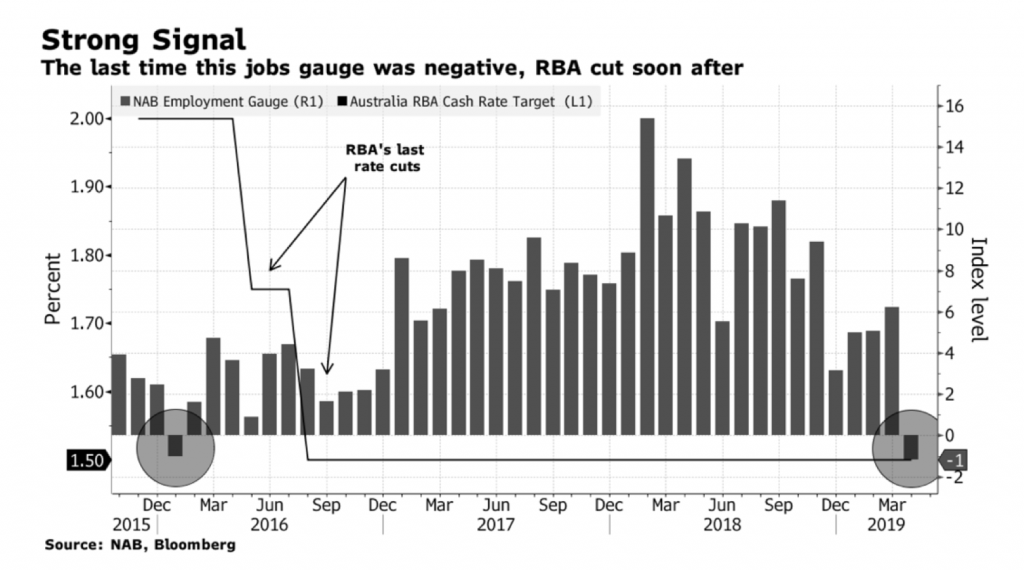

- As Figure 1. shows, the April employment index dropped from 6 in March to -1 in April. Given the points above, this should not come as a surprise. It is the weakest reading since January 2016 and the sharpest one-month fall since the GFC.

- The Reserve Bank of Australia (RBA) has excused its neutral stance by pointing to ongoing strength in the labor market.

More recently, the RBA has acknowledged that rates need to be lowered if unemployment increases.

Figure 1. A strong signal for the RBA to cut rates

It’s worth thinking about how a sharper-than-currently-expected slowdown in the Australian economy may affect the growth of businesses in your portfolio as well as their price multiples. Remember, sell side analysts tend to be slow in downgrading expectations, preferring to wait for company guidance. It’s also worth considering how effective a rate cut, combined with a reduction in APRA’s 7.25 per cent stressed mortgage assessment rate might be at re-stimulating lending, house prices and construction activity.

It’s worth thinking about how a sharper-than-currently-expected slowdown in the Australian economy may affect the growth of businesses in your portfolio as well as their price multiples. Remember, sell side analysts tend to be slow in downgrading expectations, preferring to wait for company guidance. It’s also worth considering how effective a rate cut, combined with a reduction in APRA’s 7.25 per cent stressed mortgage assessment rate might be at re-stimulating lending, house prices and construction activity.

Hi Roger.

Household debt in Australia is already at global record highs.

Part of the journey to this position was fuelled by low rates and irresponsible lending by banks and hence the royal commission.

Many other countries such as the USA and the UK have limits on gross income multiples lending for housing and or interest rate buffers such as we see now in Australia. Australia’s restrictions on lending are far from draconian.

So my question is simple.

Do you think a combination of very small rate cuts and a loosening of lending is going to have much of an effect on housing prices?

The risk I see is that we are just delaying the inevitable reversion of housing prices to a more sensible average. If they loosen the ease in obtaining credit then it simply throws late entrants under the bus. How much more can you inflate an already highly indebted market?

In fact as some economists have suggested we are just making a future correction more severe by adding more debt to an already highly leveraged housing market.

In many areas in Sydney the corrections have been extremely mild.

I get a sense that the chicken little narratives are merely coming from developers in areas that were grossly overvalued. Their clientele probably in the majority of 90-95% LVRs and are now not in steady supply now the banks require up to a 20% deposit.

As investors its useful to never underestimate the willingness of regulators to kick the can down the road so that a crisis is eschewed. “Not on my watch”. To answer your question “Do you think a combination of very small rate cuts and a loosening of lending is going to have much of an effect on housing prices?”. Yes, I think it will limit, if not fully stop, the falls. The question however doesn’t acknowledge the possibility that the RBA makes a larger cut, which in combination with a reduction by APRA of the 7.25% stressed mortgage test (yet to occur) would materially improve the prospects for house prices. I will add that in many suburbs there has been no decline at all. Manly just recorded a record house price last week and some of Sydney’s Eastern suburbs have just kept rising.

Hi Roger,

I’ve been following the blog for a few year now and I’ve got a few questions:

1- In your opinion, RBA’s decisions aside, What is the benfit of any rate cuts if it is not passed on to the consumers/borrowers?

2- In a recent interview, Ray Dalio mentioned the possible return of helicopter money? Given my question above, do you think that’s the government’s way of bypassing regulatorty restrictions to boost economy?

3- I remember you were advising strongly that interest rate will have nowhere to go but up. Have you revised your opinion lately?

Thanks

Jack

Hi Jack,

1) Little or no benefit to rate cuts that aren’t passed on.

2) No I do not. BTW Ray is an icon but he has predicted 5 of the last 2 financial crises and 10 of the last three recessions.

3) We don’t “advise” Jack but yes, the world is a dynamic place and it forces us to be equally open to pivoting 180 degrees when the outlook changes. But don’t get our domestic calls confused with our US calls. We write of any changes to our view here at the blog so you can read about them in past posts here on the blog. If you log in every day at about 4pm you should be able to see that day’s two posts. Stay in touch with our views here. We have however not changed our view for two years now on the outlook for Australian households, property prices, the construction industry and retail.