Distracted by sentiment? You’ve missed 16 per cent!

Over the last six months, we have provided a growing list of arguments favouring investment in equities. We have shown the compression of P/E ratios of 2022 rendered high-quality companies cheap, and we’ve revealed arithmetic demonstrating investors will receive a return commensurate with the earnings growth rate of the company they buy even if stocks don’t become popular again.

Additionally, we provided historical evidence revealing very poor years are followed by good years, and poor years tend to be isolated rather than clustered. Most recently, we showed short periods of extreme volatility ignore fundamentals and influence investors to believe there’s more or worse to come, but in fact, they are followed by long periods of low volatility where the importance of fundamentals returns.

In the short-run, the market reflects nothing more than the hopes, fears opinions or views and aspirations of countless irrational people. Consider, for example, those that fear losing money but buy after strong share price roses regardless, because of an even greater fear of missing out. Consequently the stock market is not that smart over the short-term, because market prices are a reflection of our irrational neighbours.

Consider the market gyrations over the last few days and ask yourself; is good news bad news, or is good news good news?

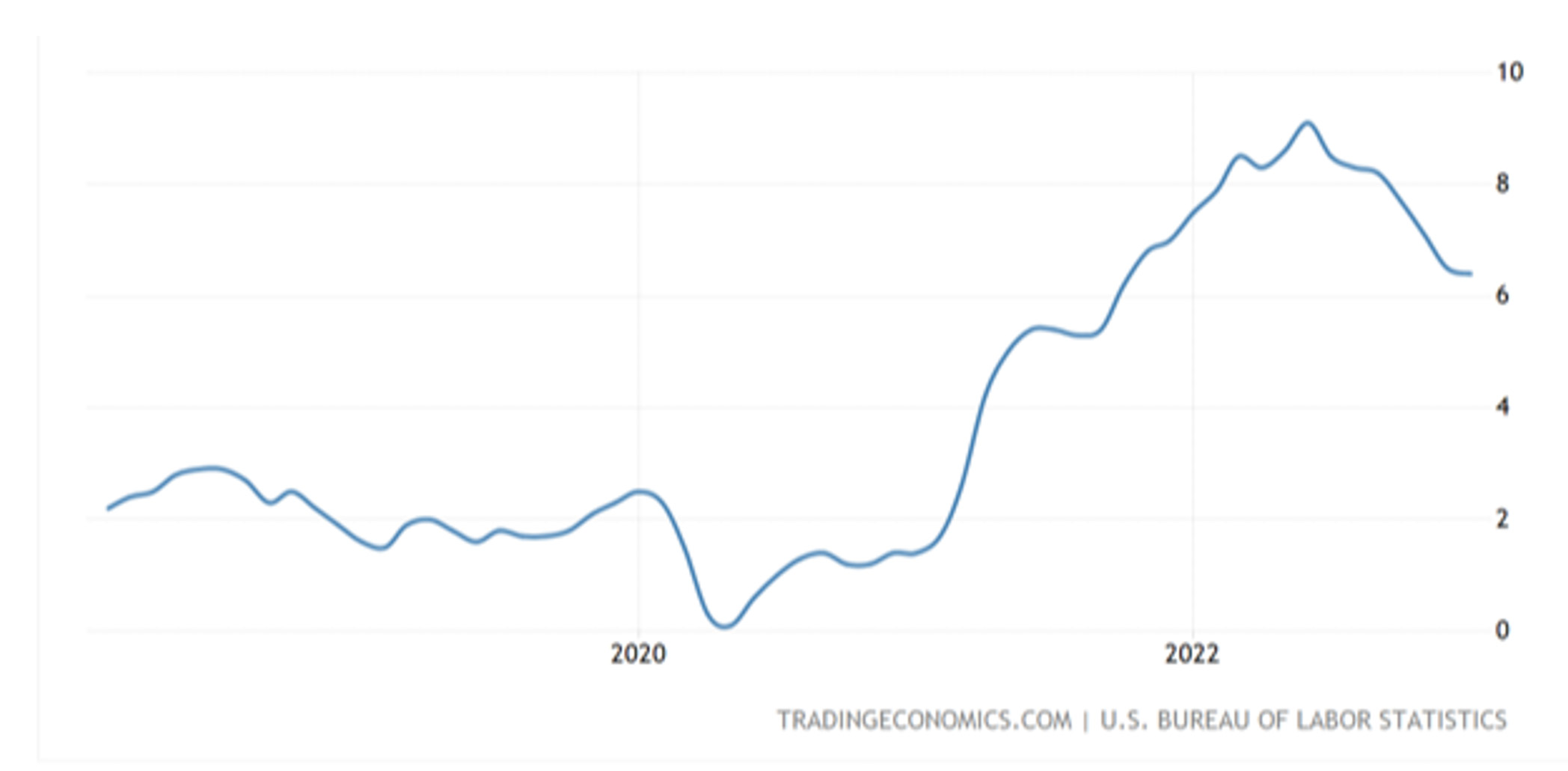

On Tuesday this week, the Nasdaq – the most interest rate sensitive of the major U.S. indices sold off initially after confirmation January inflation hadn’t slowed as much as expected. The annual rate came in 0.1 per cent lower 6.4 per cent (Figure 1.), down from 6.5 per cent the month before. On a monthly basis however, inflation reaccelerated from 0.3 per cent to 0.5 per cent. Short-term Treasury Yields broke through five per cent for the first time since before the GFC in 2007 amid expectations of further hikes by the Federal Reserve. Eventually and despite the apparent bad news, the Nasdaq clawed its way to a positive finish, closing up one per cent.

Figure 1. U.S. Inflation (annual)

Then on Wednesday, prior to the market opening, those expectations of further rate hikes were all but confirmed when U.S. Commerce Department announced January retail sales rose a much stronger-than-expected three per cent. With unemployment sitting at a five-decade low, further rate hikes are likely and probably without any risk of tipping the economy into recession. The Nasdaq closed almost another one per cent higher, and on its highs.

It’s not uncommon for markets to fall amid fear an ‘event’ might occur and then rally when the event does occur. That reason alone is a good enough one to separate yourself from the market’s distracting noise, to isolate yourself from reports of what prices have done, are doing or predictions of what they will do.

Revisiting a framework and thinking longer term

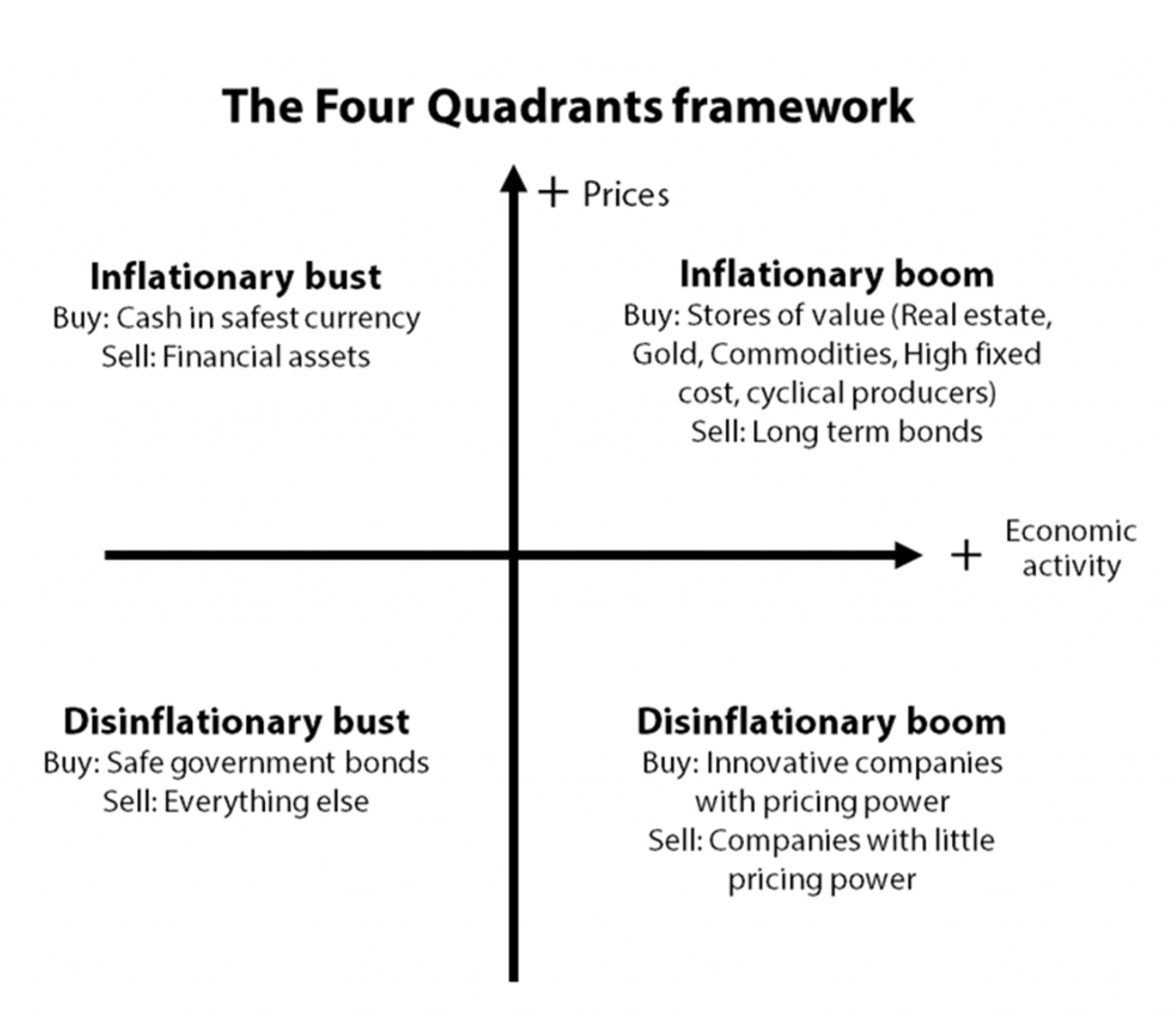

Back in 2021, I posed the question; Where does one invest knowing the stock market likes disinflation but detests inflation and deflation? We also presented the following framework developed by Gavekal Research and first presented in 1978. Building on that work in August and September last year, we argued a disinflationary boom would justify a rally in innovative tech companies with pricing power.

Figure 2. 1978: Where to invest during booms and busts, inflation and disinflation

We know the U.S. economy is growing, which means we are on the right-hand, ‘boom’, side of the matrix in Figure 2. With an inflation rate of 6.4 per cent, the U.S. economy is still experiencing inflation, making Gold, Real Estate, Commodities and high fixed cost, cyclical producers investments worthy of consideration. But that inflation rate is coming down, as seen in Figure 1. A declining rate of inflation is known as ‘disinflation’, and we know central banks are committed to bringing the rate down to their targets of 2-3 per cent.

The rest of the year could therefore be defined by a disinflationary boom (Bottom Right Quadrant in Figure2.), which means all those compressed P/Es of last year, really do make ‘innovative companies with pricing power’ (think of the stocks held in the Polen Global Growth Fund and The Polen Global Small and Mid Cap Fund) suddenly more attractive.

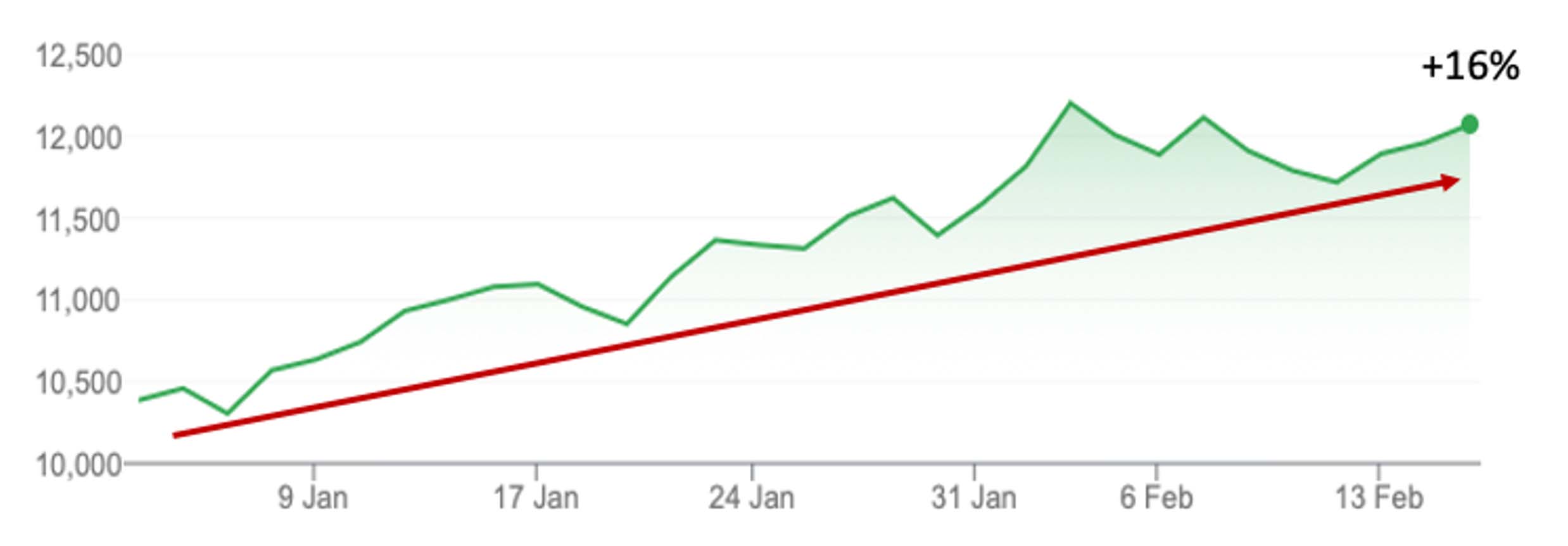

The broader ‘disinflationary boom’ environment might perhaps explain the 16 per cent increase in the Nasdaq since the beginning of the year (Figure 3.). Most investors would be happy with that return over an entire year, but it’s occurred over just six weeks.

Figure 3. Nasdaq up 16 per cent (3 Jan 2023 – 15 Feb 2023)

The market’s daily noise and bipolar reactions to news and data are infuriatingly distracting. If you can stand back and see that which is important – the bigger picture, and the longer-term trends – you will be far better armed and therefore better prepared to take advantage of the market’s short-termism.