Deflationary pressures in China – be careful what you wish for

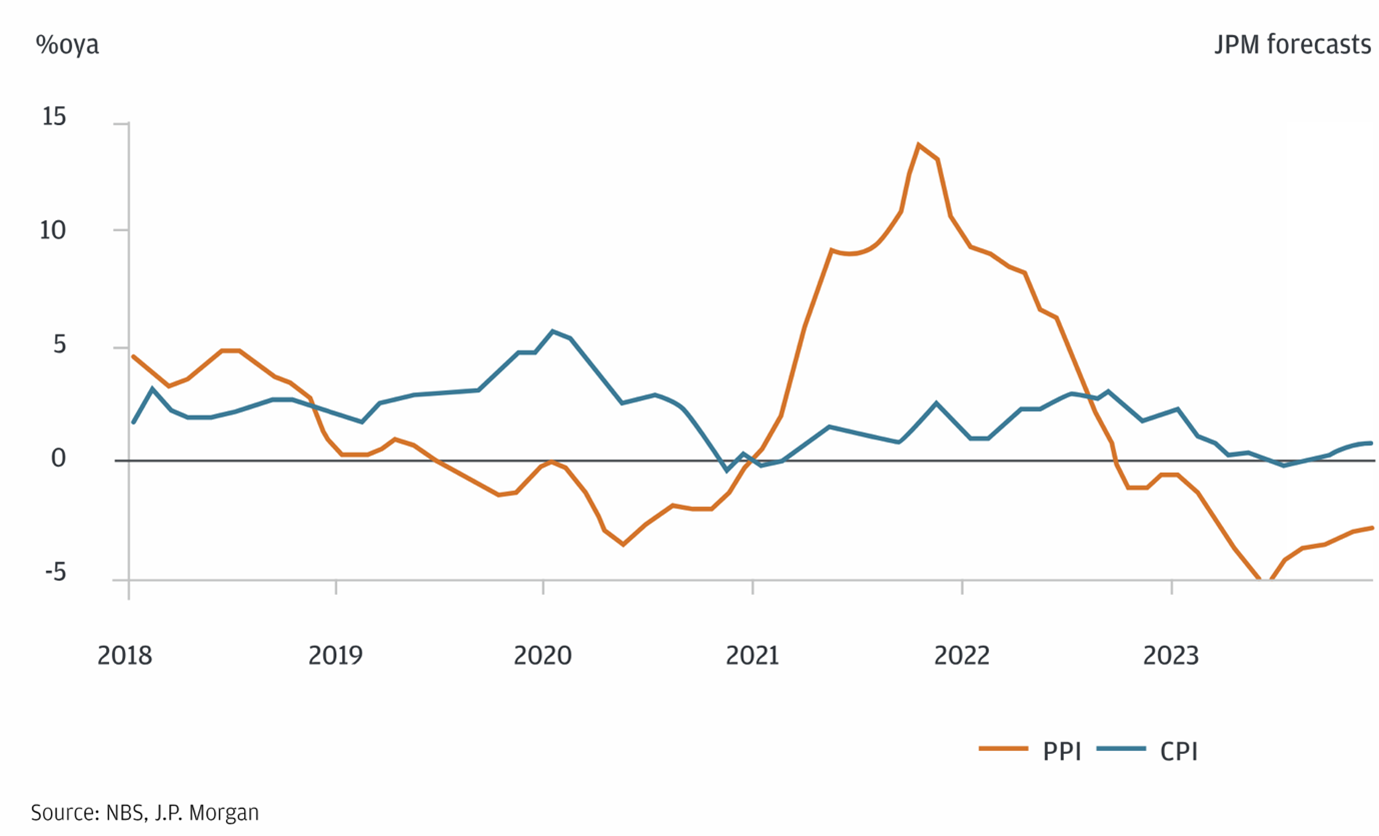

Until recently, China’s decelerating inflation was welcomed by the West, as it led to lower imported prices and helped reduce inflationary pressures. However, China’s consumer prices fell for the third consecutive month in December 2023, delaying the expected rebound in economic activity following the lifting of COVID-19 controls. For calendar year 2023, CPI growth was negligible, whilst the producer price index declined by 3.0 per cent.

China’s inflation dynamics

Chinese consumers are hindered by the weaker residential property market and high youth unemployment. Several property developers have defaulted, collectively wiping out nearly all the U.S.$155 billion worth of U.S. dollar denominated-bonds.

Meanwhile, the Shanghai Composite Index is at half of its record high, recorded in late 2007. The share prices of major developers, including Evergrande Group, Country Garden Holdings, Sunac China and Shimao Group, have declined by an average of 98 per cent over recent years. Some economists are pointing to the Japanese experience of a debt-deflation cycle in the 1990s, with economic stagnation and elevated debt levels.

Australia has certainly enjoyed the “pull-up effect” from China, particularly with the iron-ore price jumping from around U.S.$20/tonne in 2000 to an average closer to U.S.$120/tonne over the 17 years from 2007. With strong volume increases, the value of Australia’s iron ore exports has jumped 20-fold to around A$12 billion per month, accounting for approximately 35 per cent of Australia’s exports.

For context, China takes 85 per cent of Australia’s iron ore exports, whilst Australia accounts for 65 per cent of China’s iron ore imports. China’s steel industry depends on its own domestic iron ore mines for 20 per cent of its requirement, however, these are high-cost operations and need high iron ore prices to keep them in business. To reduce its dependence on Australia’s iron ore, China has increased its use of scrap metal and invested large sums of money in Africa, including the Simandou mine in Guinea, which is forecast to export 60 million tonnes of iron ore from 2028.

The Chinese housing market has historically been the source of 40 per cent of China’s steel usage. However, the recent high iron ore prices are attributable to the growth in China’s industrial and infrastructure activity, which has offset the weakness in residential construction.

Whilst this has continued to deliver supernormal profits for Australia’s major iron ore producers (and has greatly assisted the federal budget), watch out for any sustainable downturn in the iron ore price, particularly if the deflationary pressures in China continue into the medium term.

The real issue is “can you trust the numbers out of China” ? China’s GDP, inflation etc. will be “whatever the party says it is”, not what it really might be.

Thanks Chris.

That is a fair point.

I think we need to look at third party data, such as the iron-ore price or electricity demand – where the figures have less chance of being manipulated.