Could the housing market be hit by tighter lending standards?

The Royal Commission into the Australian financial sector seems to be taking a dim view of the way lenders assess the expenditure of loan applicants. It’s possible it will recommend that banks check the actual level of spending of each applicant. This could have big ramifications.

The following statement was made by Kenneth Hayes, the Commissioner at the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry:

“An available point of view may be that there is a trade-off between administrative convenience and obeying the law. Now that’s a very awkward trade-off.”

The statement was made in connection with revelations that ANZ has used a benchmark called the “Household Expenditure Measure” or HEM as the base to assess mortgage applications for ~73 per cent of the loans it assesses.

Under the National Consumer Credit Protection Act 2009, banks must comply with something called Responsible Lending. This requires the banks to make “reasonable inquiries” about the customer’s financial situation, and to take “reasonable steps” to verify the customer’s financial situation.

Now, using such a benchmark might be appropriate in certain circumstances, but if we look at the benchmark a little bit more closely, it is immediately obvious that something is amiss:

- The benchmark has four different levels (1. Student 2. Basic 3. Moderate and 4. Lavish)

- The Basic level is almost the only level used by the banks for assessment of a four-person family (two adults and two school-age children), it estimates household expenses (including everything apart from rent/mortgage debt costs) of $32,400 per year.

- Just to put this in perspective, the old-age pension for a retired couple with no other income, but who own their home, which I guess can be seen as what the government considers the minimum level to provide a reasonable lifestyle, is $35,573 per year.

- Anyone who has kids knows that they are very expensive, so for a family of four to have lower expenditure than a retired couple would indeed lead to a very Basic existence…

- Even the Lavish level of the benchmark at expenditure of $58,320 per year, is in my view, not a very high level. Two kids in private schools would consume a substantial portion of this!

The witness from ANZ reasoned that using the HEM benchmark is practical, and it is not possible to do a deeper inquiry into an applicant’s level of expenditure, especially if the application comes through a mortgage broker. If they do not get an answer within 30-40 minutes, they will go somewhere else…

It has also been revealed that the other big banks are also, to approximately the same extent, relying on the same benchmark for their assessments.

In light of this, the quote from the Commissioner is understandable and should probably be interpreted that the Royal Commission will recommend changes to the way that banks assess the expenditures of applicants and require them to do actual checks on the level of spending.

UBS has done some analysis on this and the results are quite interesting. Their two basic assumptions are:

- Real household expenditure for a family with $100,000 gross income is probably closer to the Lavish level rather than the Basic level.

- The level of expenditure probably increases as your gross income increases as you are likely to want a nicer car, eat out more, take more holidays or send your kids to private school.

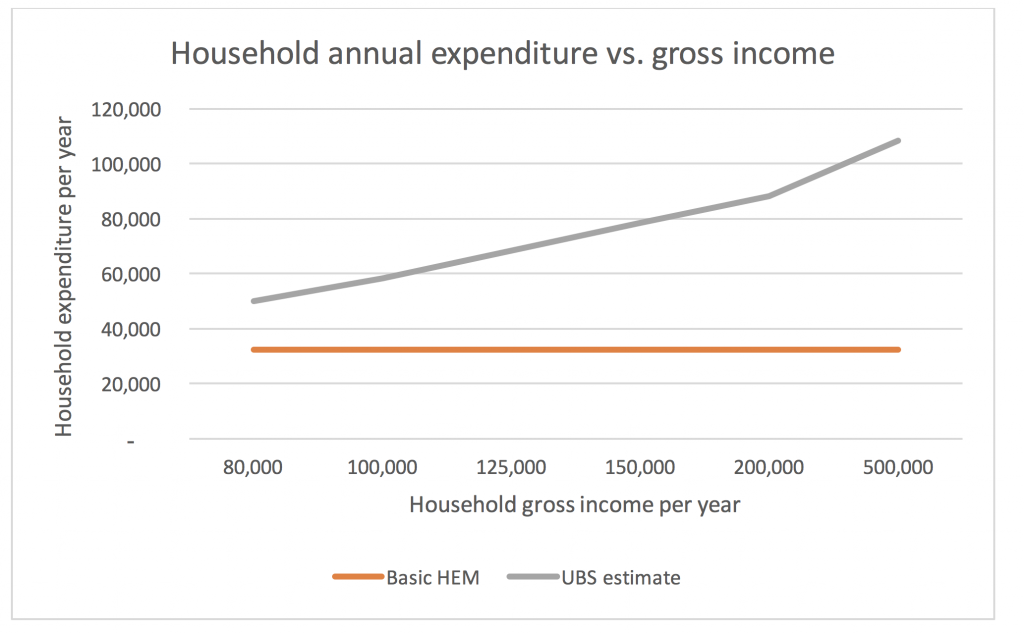

From these assumptions, UBS came up with expenditure that looks like the grey line in the chart below. As you can see, it is quite dramatically higher than the orange line which is what the majority of loan applications have used up until now.

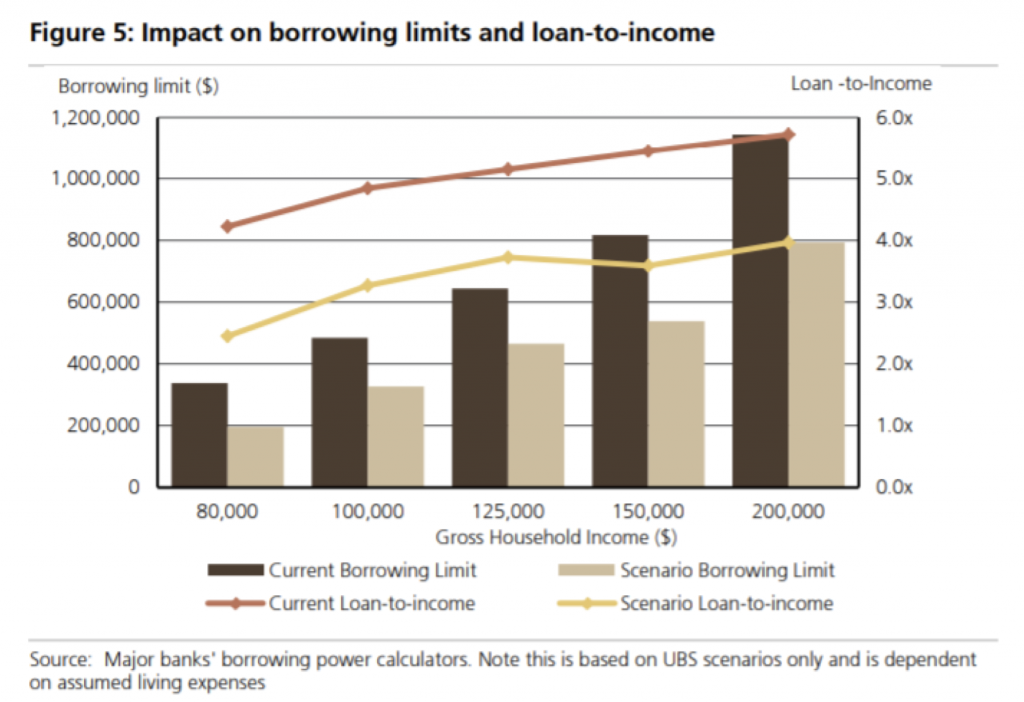

Armed with the numbers from this chart, they went to all the big four banks’ ‘How much can I borrow’ calculators and typed in the numbers. All the calculators gave pretty similar results so they took the average and plotted it in this next chart:

What we can see here is that there is a 30-40 per cent reduction in the amount borrowers can access from banks to buy property.

Now, if this comes true, we can expect a number of things to happen:

- House prices are set by where supply and demand meet over time. The demand must though be funded either by equity (actual cash that the purchaser already has) or debt. If the amount of debt available reduces by 30-40 per cent, it either must be replaced by more equity or by a reduction of demand (i.e. the price a purchaser is willing/able to pay). If no more equity is available, we should expect the ability to pay to reduce by 22.5-30 per cent (assuming a loan-to-value ratio of 75 per cent).

- More immediately, if banks are starting to do detailed assessment of a borrower’s actual expenditure instead of using a benchmark, we should expect a couple of things:

- Borrowers will no longer be able to rely on existing pre-approvals obtained by using the HEM benchmark as they can then find themselves in a position where they have won an auction but then the bank does not give them enough money to settle which would mean losing their deposit. We should therefore expect a sharp drop in clearance rates at auctions if/once the banks implement this.

- Processing times for mortgages will increase significantly, leading to a slower moving market.

- Longer term, if this change is implemented – and given the amount of loans that are currently on an interest only basis and that will be reset to principal and interest over the coming years and, in this process, potentially reassessed with higher levels of household expenditure – it is possible that borrowers might be faced with the situation of banks demanding that they “top-up” the equity in their homes (i.e. repay a bit of the loan) to be rolled-over to an additional interest only period.

Needless to say, it will be interesting to continue to follow what comes out of the Royal Commission and its recommendations. In the meantime, we are anecdotally hearing that banks have already started to more stringently assess loan applicants’ level of household expenditure.

The Royal Commission into the Australian financial sector looks like taking a dim view of the way lenders assess the expenditure of loan applicants. It’s very possible it will recommend that banks check the actual level of spending of… Share on XThis post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Hi Andreas,

The fact that a large number of buyers are investors and with rental yields becoming minimal (assuming capital growh will be far from what it has in the past) this kind investment is by no means attractive to an somewhat educated investor.

This should reduce the demand by a significant number and therefore impact hte demand?

Hi Elvir,

As a relative new observer of the Australian market, I was shocked by the level of propert speculation that takes place here (I actually rather call it speculation rather than investment as an investment should preferably give you a positive cashflow).

I wrote a blog post on 2nd of August last year looking at how the economics of an investment property looks like and if you do not have rising prices, it does not look good!

Given falling prices and very low yields together with tighter lending standards, we should likely see falling investor demand.

Hi Andreas,

I agree that the Household Annual Expenditure Vs. Gross Income table from UBS is probably quite accurate, however it’s missing the point of how much of that spending is discressionary.

Many families on high income (Mine included) have a large ability to cut back discretionary spending should interest rates rise, or indeed should we decide to take a much larger loan to fund a house upgrade.

The fact that we don’t have non-recourse loans leads me to believe it’s not accurate to consider families would choose to default on loans rather than remove their children from private schools or cut out the annual Chamonix ski trip etc.

Due to my arguments above, I wish to be able to enter into a borrowing calculator the cost of living that my family can achieve if we wish to. Not necessarily the costs that we are incurring right now simply “because we can”.

It certainly then follows that if I’m dishonest in my assertions to my lender it’s “My fault”, not the “Lender’s fault”.

Hi Jason,

Fully agree that many families have the ability to cut spending significantly. Defaulting on your mortgage, especially on your main residence, is likely your last resort and you will cut back everything else before you do.

The reason we keep such a close eye on the housing market is that the whole economy is impacted. The growth in consumption over the last few years have been driven by the “wealth effect” created by people feeling richer as the value of their property has increased (have a look at my blog post from June 19th last year). With this going into reverse, we are likely to see a “negative wealth effect” on spending which will impact a lot of businesses in a bad way.

The banks should not be in a position that requires them to verify the customer’s financial position and ability to pay. The banks should be assessing their own business risks as their primary consideration. The onus should be placed on customers to obtain from their accountant a certified document stating relevant information such as maximum monthly payments and maximum size of loan etc. The certified statement would avoid the conflict of interest issues that mortgage brokers and banks currently face, and would have them competing more keenly on the cost of a loan. The current situation where banks are meant to verify a customer’s financial position for “responsible lending” is a commercial square peg in a round hole – indirectly placing the banks in a position where they are indirectly (if not directly) providing non-independent financial advice to the customer.

The real issue highlighted by the RC is the tension between a large organisations desire to make profits and the commissions view of what level of detail should be applied to achieve those results. In the past banks would measure their Lending standards, for the most part, by the level of arrears and complaints / disputes in the portfolio. This standard seems to be insufficient according to the RC. On the other extreme the RC seems to think that their powers and wisdom is such that they can legislate and achieve some sort of perfect result, stamping out all wrongdoing in the financial services industry . All this legislation creates 1st order and 2nd order consequences that are unpredictable and create further moral dilemmas down the track. I think for the most part , large financial institutions in the wealth creation space , will not be able to operate & scale and meet the RCs compliance requirements (in the event that the RC likely recommendations are applied). In fact this was already reflected in ANZs recent decision to close down their consumer lending in the plant and equipment space during the 1st week of the RC. I’m sure this area was a highly profitable area of the bank.

Hi Con,

Thanks for your thoughts!

It is correct that banks have measured their lending standards by the level of arrears. We should remember that we have had a long period of falling interest rates and increasing asset prices which are perfect conditions to minimise arrears (it is cheaper and cheaper to borrow over time and rising asset prices means that there are always someone else prepared to lend…).

I agree that we will see some quite significant structural changes to which firms offer which services in the future.

I am amazed banking share prices have not fallen more. On one hand they may well face litigation for fraud and so on. On the other hand – with reduced money to play will their will be less profits. Finally, the housing bubble may well burst and there may well be mass defaults on home loan repayments. It would be good to a post on the safety of bank deposits given the government guarantee. Its beyond my understanding but I am aware analysts such as Martin North have been suggesting that the guarantees are not as secure as they may at face value look..

I cannot see how mass defaults could occur, unless a massive increase in the unemployment rate occurs.

regardless of the value ,or fall thereof, of my house, I will continue paying my mortgage. history has shown Aussies will keep paying their mortgages even if the world is about to end.

Another thought – ‘people will continue to pay their mortgages’ unless the courts give them a viable way out. That is, it is accepted that the initial loan is deemed fraudulent and they are given the option of exchanging their prior payments for giving up the house. In this case the banks would be hit really hard because if house prices have dropped significantly – the banks will be paying out huge settlements and also be unable to sell the houses for a good price. In the US one households can walk away ( and this is a viable circuit breaker) but in Aus the stakes are so much higher – because the debt follows the mortgagee for life. The government will need a circuit breaker and the courts maybe able to readily find one by lining up the banks for a hit.

Hi Andreas, what chance do you think there is that the terms of reference will be expanded in the RC? The stuff that’s coming out is the tip of the iceberg and the more we clean up the better for Australia in the long run. It’ll hurt in the meantime though. It seem to me like the housing market is going to cop it from all sides- rising interest rates, much stricter loans, abolishing negative gearing for existing homes, etc etc

Hi Dan,

Hard to say if the terms of reference will be expanded. That is a political decision and given the reluctance the politicians in charge had in getting the RC set up, it is hard to see that they will go much further given that there is definite near term downside to enforcing laws fast. It sure would though be better longer term to do a good clean.

And yes, it seems like the housing market is starting to face a perfect storm. The RBA talks about raising rates but I see that as very unlikely if the current trends in house prices continues. The increase in BBSW spreads will lead to increased funding costs for the banks so they will eventually have to raise rates if they want to protect their margins (the negative publicity with the RC might actually mean that they will not be so quick to do this).

Hi John and Con,

It is most likely correct that interest only loans rolling over will not be reassessed but it could potentially happen if house prices falls so that loan to value ratios deteriorates enough to make banks worried and they use this as leverage towards borrowers.

Will interest only loans be reassessed though? The banks will argue hey are existing loans simply rolling over so we may not know the answer for a while on this point.

The pre approval thesis is unlikely to play out as banks and brokers stopped using the HEM over 1.5 years ago.

As far as a large % borrowers not being able to qualify for the amount of debt that they currently hold, this is a very likely. However they will not be “reassessed “ unless the borrower applies for a new loan . Switching to PI from IO does not trigger a reassessment of the loan. So what you will have is a scenario where many people are literally trapped at the same bank on PI for a long time. The pressure of the higher rates and limited access to credit could trigger selling of homes and this is likely if rates continue to rise while borrowers transition from Io to PI