Chasing viewers – Part 2

What a difference a few months can make in the share market. Back in February this year, we penned a short piece on Nine Entertainment (ASX: NEC), concluding that despite their shares looking cheap in a market which offered little in terms of value, it was a valuation that we believed the business probably deserved.

Well didn’t we look like fools.

In the space of a few short weeks, Nine’s market cap (price) climbed 26.6 per cent from $1.719 billion to a high of $2.177 billion. Naturally we paused to reflect – we were either very wrong, and yours truly had numerous phone calls from friendly stockbrokers telling us why we were, or, the market was simply short on ideas and viewed Nine Entertainment as attractive given its ‘undemanding’ valuation and turnaround to ‘growth story’ in the 2nd half.

We subsequently listened to a number of analysts in the industry tell us why we should change our view and how Nine was the pick in the space. We are always open to new information and ideas that challenge our standing. In this case however, we continued to anchor on our view that Nine’s prospects for the future looked less than promising. Because of this, it did not stack up as an investment candidate we could defend.

While watching a share price climb in the face of your alternate view is always painful, this is perhaps a good practical lesson. In the short-term prices for listed companies can and will do anything. They can be volatile and more often than not are likely to detach from the reality facing the business they represent.

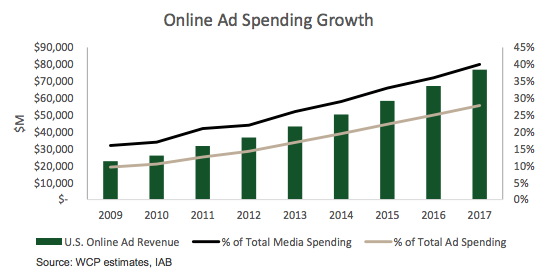

Time however is the friend of a good business, the enemy of the poor. And for Nine we don’t think time is on its side. Traditional Free-to-air (FTA) television is being disrupted with more and more viewers abandoning and consuming media content via other digital channels such as mobile phones and tablets because “I’ll decide what media programming I watch and when, not you”.

This is structural, enduring and there is very little an incumbent of old-technology can do to change its spots quick enough with disruptor business models already at scale and building brand awareness daily. Think Netflix.

Advertisers will simply change their medium of advertising to where eyeballs are going. If you offer new age TV content and delivery, good. If you don’t, then you are unfortunately caught between a rock and a hard place. Based on overseas markets, time is not FTA’s friend and therefore Nine’s recent downgrade and ‘shock’ (tongue in cheek) share price reaction should come as little surprise.

In case you missed it, here is the announcement with confirmation that the FTA advertising market continued its to decline in the 2nd half at a similar rate of that in the first (expect more in the future);

Nine Entertainment Co. (ASX: NEC) has today advised that it expects Group EBITDA (before Specific Items, and inclusive of Nine Live) for the year ended 30 June 2015 to be in the range of $285m to $290m. This compares with guidance provided at the AGM in November 2014of a result in line with the $311m reported in the prior corresponding period.

This reduction in earnings outlook reflects a softer than anticipated Free -To-Air advertising market in the second half which is now expected to be in low single digit decline, driven by particularly soft conditions in May and June.

Today Nine’s share price looks even cheaper and indeed is 10 per cent below where we did our last review. Still, we are not buyers and do not consider that just because something is cheap means it becomes more attractive and should be bought.

Investors who own Nine Entertainment Ltd, Seven West Media Ltd (ASX: SWM) or Southern Cross Media (ASX: SXL) may wish to dig a little deeper into the future prospects for these businesses. Combined, these three companies today have a market capitalisation (price) in excess of $4 billion.

What do you think they will have in 5 to 10 years time? Higher or lower?

What do you think they will have in 5 to 10 years time? Higher or lower?

Russell Muldoon is the Portfolio Manager of The Montgomery [Private] Fund. To invest with Montgomery, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Hi Russell

I thought the wholesale fund 500k plus was long short while the retail fund was long only.

Hi Tony, you are correct. Montgomery Global is long only, Montaka is the long/short variant and a wholesale fund.

Absolutely correct, FTA is yesterday’s tech. Is the Montgomery fund able to short stocks? It would seem to be easy money :)

And not just in Australia, FTA is in decline around the world. Whilst the Montgomery Fund is not able to short, the new global funds will be able to take advantage of structural declines, so make sure you are registered.