CBA pays a dividend, but is there trouble down the pike?

Shareholders in Australia’s largest bank, the Commonwealth Bank of Australia, would have been relieved to read that the bank has delivered a decent full-year result – with a 98 cent dividend to boot. But the near term may not be so bright, with the bank pointing to earnings headwinds in the months ahead. Below is my summary of the key points from the full-year result.

Revenue declined relative to the six months to the end of December.

Net interest income growth slowed to an annualised rate of 2.7 per cent as a step-up in liquid asset holdings during the crisis diluted the net interest margin from 2.11 per cent in 1H20 to 2.04 per cent in 2H20. Average loan balances grew at an annualised rate of 3.2 per cent, which was actually a slight improvement on recent half yearly result.

Net interest margin is set to decline further in FY21, with management guiding to a reduction to around 2.00 per cent as a result of further lending rate compression relative to funding costs, as well as falling returns on CBA’s liquid asset holdings as a result of the material decline in bond yields feeding through the bank’s hedge book.

While the fall in the bank bill swap rate to yields below the RBA’s official rate provides some funding cost benefits, the impact for the major and regional banks is less than for non-banks given most of their funding is sourced from deposits. Non-banks tend to source funding almost exclusively from wholesale markets. As a result, all of their funding cost base will be benefiting from the unusually low BBSW-OIS spread at present, making them increasingly competitive relative to the banks.

Non-interest income declined relative to 1H20 due to falling fees from lower merchant transaction fees and trading revenues as well as an asset impairment charge. The impairment charge is likely to be non-recurring and trading revenue should normalise in future periods, resulting in some recovery in non-interest income in FY21.

Operating costs were stubbornly higher than market expectations due to ongoing customer remediation costs resulting from the Royal Commission, as well as the need to increase costs to support customers through the COVID-19 crisis. Excluding the remediation costs in each period, average daily operating costs increased 3.0 per cent on an annualised basis relative to 1H20. Last year management announced a goal of achieving a decline in operating costs in absolute terms in the medium term. While COVID-19 made this difficult to achieve in 2H20, the bank will need to accelerate its realisation of cost savings to meet this goal going forward.

One of the main focuses for the market was identifying any information that would help assess the risk to asset quality from the COVID-19 pandemic and resulting recession. Having raised a A$1.5 billion collective provision overlay in the March quarter, CBA’s bad debt provision charge fell to under A$300 million in the 3 months to June 2020. This is a similar quarterly charge taken in 1H20. This is not surprising given short-term benefits from loan deferral provisions, government stimulus payments and temporary reporting provisions provided to the banks by APRA.

However, these benefits are temporary and the true impact of the COVID-19 pandemic on asset quality will become visible once these support measures are removed. In the meantime, the market is looking for clues among the details of loan deferrals and assessments of risk being provided by the banks.

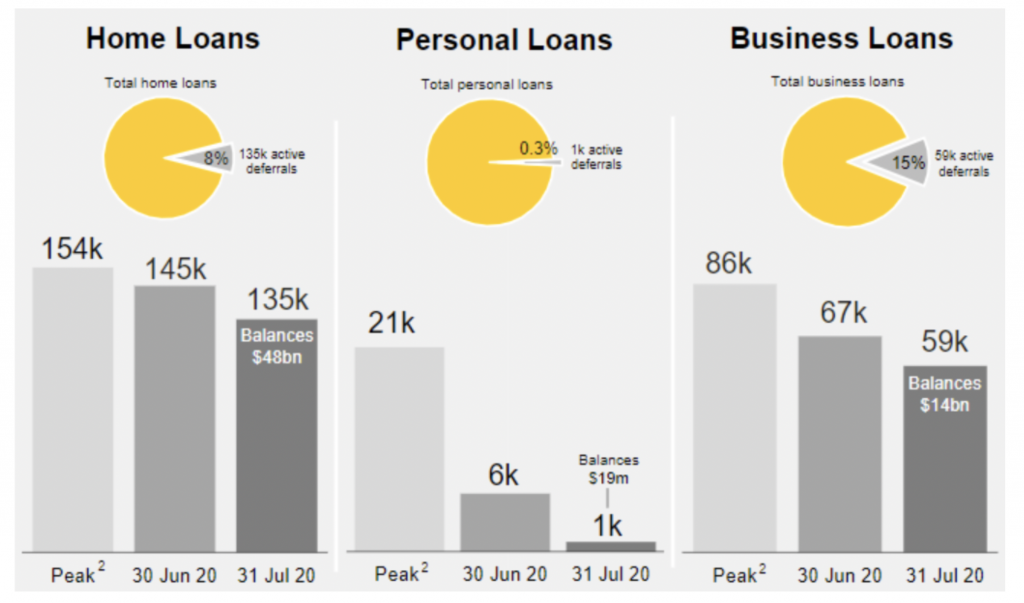

CBA noted that the number of customers and value of loans that are receiving repayment deferrals (total or partial) has been reducing since May.

Figure 1: Number of accounts receiving repayment deferrals

Source: CBA

In the mortgage book, CBA classifies 12 per cent of the accounts on repayment deferral as being very high risk. This compares to 23 per cent for business loans. This would equate to around A$9 billion of loans that the bank views as being very high risk at present. Of the business loans that are receiving deferrals, 89 per cent of the loans are secured.

The number of deferrals on personal loans has fallen to negligible levels over the last 2 months. This is likely due to the shorter hardship period offered on personal loans relative to mortgages, and the relatively high rate of interest charged on these loans.

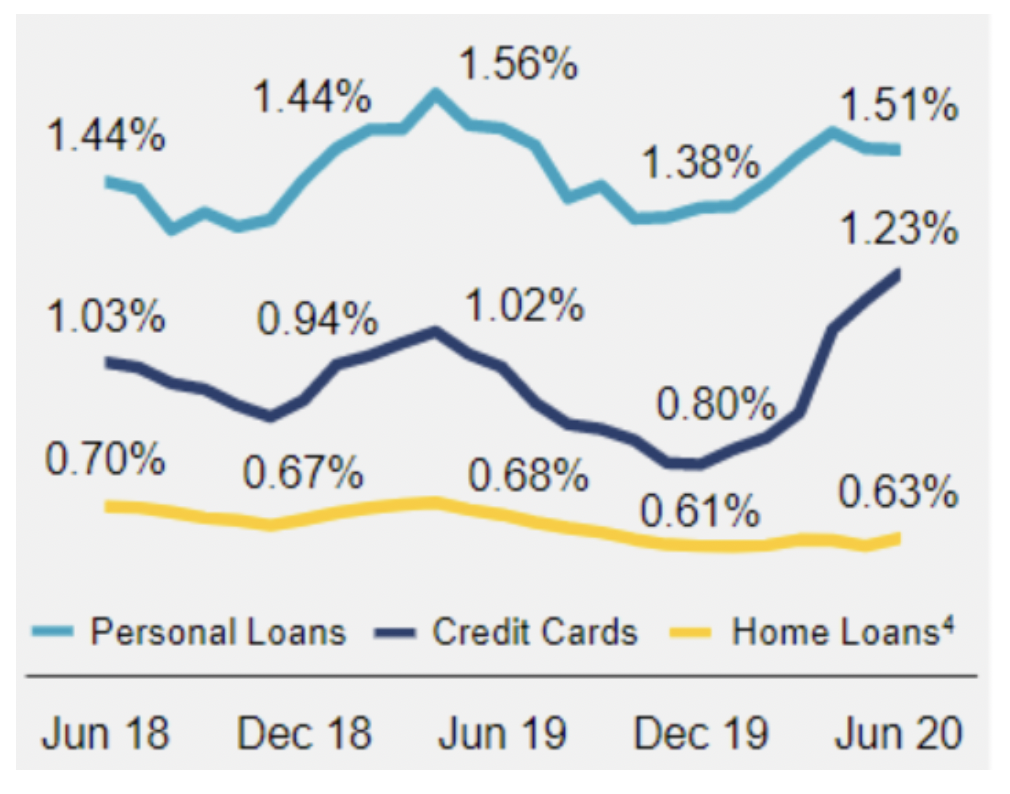

Interestingly, the rate of arrears on personal loans has not increased relative to the same time last year, despite the low proportion of accounts remaining on repayment deferrals. However, credit card arrears have increased materially. CBA commented that this was mainly due to falling balances as consumers paid off their credit cards, rather than an increase in the dollar value of arrears.

Figure 2: CBA Consumer Arrears by product type

Source: CBA

One concerning comment from CBA was that around 14 per cent of its current loan deferrals are for customers that are on JobSeeker. While a little over half of these are joint accounts, the ability to service these loans is likely to become more difficult as these Government payments begin to be wound back from the end of September. Additionally, CBA was unable to quantify the proportion of the mortgage accounts on repayment deferrals that belonged to people benefiting from JobKeeper payments.

For the business loan book, CBA estimated that 30 per cent of the businesses that were deferring repayments were receiving JobKeeper payments.

This highlights the risks faced by the banks, and the economy more broadly, when these Government payments are reduced and then removed.

The main positive from the result was CBA’s capital position. CBA is clearly the best capitalised of the major banks at present, reporting a CET1 capital ratio of 10.56 per cent at the end of June. It also expects to receive the proceeds from the sale of CFS, BoCommLife and CommInsure during FY21 which is expected to add another 0.58-0.69 per cent to the bank’s CET1 ratio.

The strong capital position and profits from the sale of CFS allowed the bank to pay a final dividend of 98 cents per share, which surprised on the upside.

The Montgomery Funds own shares in Commonwealth Bank. This article was prepared 14 August with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade Commonwealth Bank you should seek financial advice.

Shareholders in Commonwealth Bank would have been relieved to read that the bank has delivered a decent full-year result. Stuart Jackson summarises the key points from the full-year result. Share on XThis post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Hi Stuart

If about $9 billion of the CBA Loan Book is considered to be very high risk at present, then what is the Total Provision for Bad Debts to cover default on those very high risk loans?

Even If all that $9 billion of loans went bad, the Bank would still hold security over Assets that would cushion the overall Loss to the Bank, but having to sell those Assets below Bank valuation and into a potentially depressed market could result in the Total Provision for Bad Debts being inadequate and lead to some poor results going forward.

Knowing if the current Total Provision for Bad Debts is adequate is key to knowing whether the current Market price is justified.

Hi Max, The end result of all those loans going bad is a complex thing to calculate. First CBA would have protection from mortgage insurance a a reasonable % of the losses. Then just because a loan goes into liquidation doesn’t mean the draw down on provisions is equal to the loan value, it would be the loss after liquidating assets that were used as security for the loan. Then of course there are likely to be people and businesses get into stress as COVID continues to play out. As at 30 June 2020, CBA had loan provisions totalling A$6.4bn.