Caterpillar Inc.

Caterpillar’s 125,000 staff awoke this morning to hear that Jim Chanos, president and founder of Kynikos Associates, was on a short selling crusade.

Chanos believes the effects of hyper stimulation to the Chinese economy around 2009 is running out of steam.

“I believe the commodities super-cycle built on the back of the Chinese construction boom is coming to an end”.

At the recent CNBC Delivering Alpha Conference, Chanos said “commodity prices should revert to historical means with a viciousness in the next ten years”.

Roughly half of Caterpillar’s profits are tied to the capital expenditure of global mining companies, and it is well understood what is happening on that front.

Reversion to the mean in capital spending for mining equipment would strike deep into Caterpillar’s profitability.

As detailed in our blog of 24 April 2013 (click here), Caterpillar’s March 2013 Quarterly net income was down by 45 per cent to $0.88b on a 17.5 per cent reduction in revenue to $13.2b.

Their June 2013 Quarterly result will be announced on Wednesday 24 July.

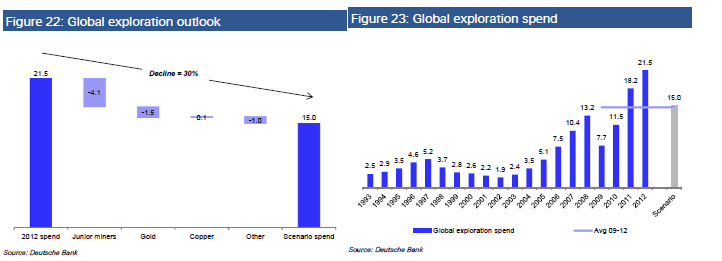

Meanwhile, Craig PongPan from Deutsche Bank believes long term global exploration expenditure will decline 30 percent to $15b from the 2012 peak of $21.5b.

A significant proportion of this decline will come from “junior miners”, while the fall in the Gold price suggests reduced exploration spend from that Sector.

Unsurprisingly, the Australian Small Resources Index was down 39 per cent in the six months to 30 June 2013.