Shopping centre sales

Colonial First Property Retail Trust (ASX: CFX) recently released the sales figures of its tenants for the 12 months to 30 June 2013. CFX’s portfolio is mainly comprised of shopping centres in major centres, and half of its assets are in Victoria. While the figures do not provide a complete account of retail conditions in Australia, they do provide some insight into the performance of major retailers.

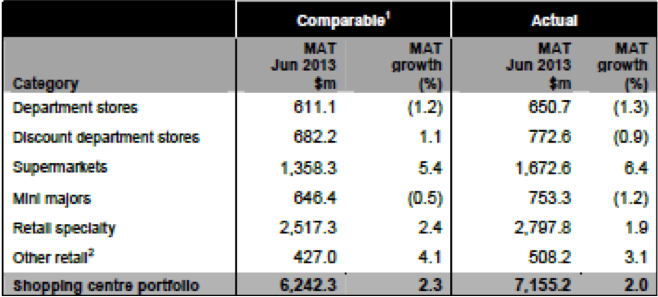

For the purposes of this post, I’d like to focus on the performance of department stores. Department stores have experienced relatively weak trading in the past 12 months, with Moving Annual Turnover falling by 1.2 per cent. Announcements from these department stores have frequently cited a “challenging” retail climate as a key reason for the slowing sales. More recently, the seasonal climate was being blamed, as it was not driving people to buy warm clothing.

While external factors can have a considerable impact on earnings, it is becoming increasingly obvious that management of these companies need to be alert to internal factors as contributors to their sales declines. After all, Speciality Retailers were not immune to the effects of a warmer winter, more scrupulous consumers, or the growing presence of online retailers, and yet sales for the category rose by 2.4 per cent during the same period.

With this being said, the consumer discretionary sector is inherently cyclical, and at Montgomery Investment Management we believe that investors need to be well aware of the ebb and flow of consumer sentiment. We believe a more reliable long term proposition for investment in the retail sector is in consumer staples. Businesses such as supermarkets have a lower risk of experiencing a material decline in sales as demand for their products is more stable across the economic cycle.

Interestingly, the recent performance from this sector suggests healthy growth as well. According to the CFX figure, supermarkets have generated 5.4 per cent growth in Moving Annual Turnover over the past 12 months.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Beth Codling

:

Recent shopping experiences at both Myer and DJ at Westfield Doncaster have been below par. Myer have no prices on children’s books. When I asked why I was told that staff didn’t have time to do it nowadays. Instead they have to scan the barcodes numerous times a day to give potential customers a price. DJ have many unattended registers with staff from other departments darting over if they see someone needing attention. They are often unable to answer what would be a simple question if it was their field of stock knowledge etc. and service is slow.

Lucien Heffes

:

I should have added that I don’t own any of the shares I mentioned in my comment.

Lucien Heffes

:

I don’t understand the point of this post other than to state the bleeding obvious.

“…..we believe that investors need to be well aware of the ebb and flow of consumer sentiment.” Not really a startling revelation! If you’re saying that consumer staples are less volatile than consumer cyclical stocks, well that’s not much of a revelation either.

If you’re saying that a 5.4% sales increase for supermarkets is a point of interest, well then how about a comment on current valuations? The same principle applies to specialty retail, i.e. how about a comment on current valuations. How many retailers are actually below their intrinsic value at the moment? Have you considered whether any readers of this post may dump DJS, MYR or any other shares and buy WES, WOW, MTS or any other stock without consideration to their intrinsic value? If this post is merely an interesting snippet of information from which no clear conclusion or recommendation can be drawn, I believe you should say so.

Roger Montgomery

:

Thanks Lucien. You just did and we’re grateful. I will also pass your feedback on to Ben.