Market commentary

-

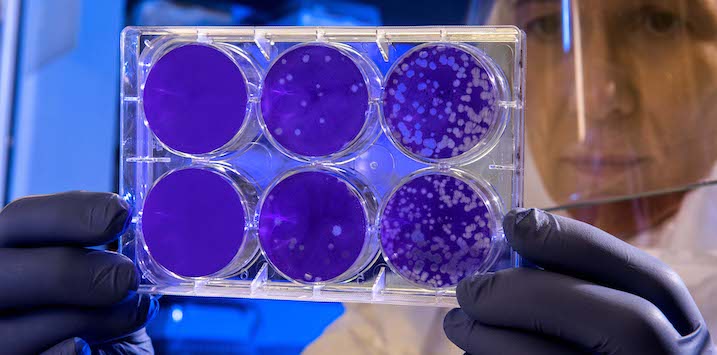

What is happening on the ground in China as a result of Coronavirus?

Joseph Kim

February 20, 2020

It has now been a month since coronavirus entered the global vernacular, with media coverage covering almost every conceivable angle possible, including the potential economic fallout. We monitor new cases and deaths very closely, especially for any signs of contagion outside of Hubei – the epicentre of COVID-19 – and the unfortunate passengers on the Diamond Princess cruise off the coast of Japan. continue…

by Joseph Kim Posted in Market commentary.

- 2 Comments

- save this article

- POSTED IN Market commentary

-

Two reasons this bull market is set to continue

Roger Montgomery

February 7, 2020

Since early 2009, soaring global markets have made shares an extremely rewarding place to invest. With profits likely to keep recovering, and interest rates and inflation likely to stay low, I see no reason why this bull market will not continue. continue…

by Roger Montgomery Posted in Economics, Global markets, Market commentary.

-

How has Coronavirus affected you?

Andreas Lundberg

February 5, 2020

The Coronavirus has led to big changes in the way many people in China eat, work and move about. But what about here, in Australia? How has it affected the way you live, and have you noticed any changes in your workplace or the places you visit? I’d value your feedback. continue…

by Andreas Lundberg Posted in Health Care, Market commentary, Tourism.

- 15 Comments

- save this article

- POSTED IN Health Care, Market commentary, Tourism

-

Observations of equity markets from previous viral outbreaks

Scott Phillips

January 28, 2020

Investors in Australia and around the world are understandably worried about the onset of a new disease (Wuhan Coronavirus – known as nCoV) and the implications for their investments, particularly as the medical profession develops their understanding of the disease. While the number of confirmed cases has increased from 282 to 4,474 in the past 7 days it is a moving tally. continue…

by Scott Phillips Posted in Editor's Pick, Global markets, Health Care, Market commentary.

-

Have low interest rates made risk assets too expensive?

Roger Montgomery

January 24, 2020

Around the world, plunging interest rates have led to a stampede by investors into risk assets, like shares and property. With the prices of these assets now looking quite inflated, investors need to do more research than ever to find under-valued assets. continue…

by Roger Montgomery Posted in Editor's Pick, Market commentary.

-

What really propelled the Aussie market in 2019?

Andreas Lundberg

January 20, 2020

Over the past 12 months, the soaring Australian share market has made most local investors feel pretty smart. However, for most part, it was falling interest rates, rather than rising company earnings, that kept the rally going. The question now is: how much longer can this bull market go? continue…

by Andreas Lundberg Posted in Market commentary, Market Valuation.

-

Farewell 2019, Hello 2020

David Buckland

January 2, 2020

After recording an excellent performance in the June 2019 half-year, both the US Nasdaq and S&P 500 led the way in the December 2019 half-year with a return of 12.1 per cent and 9.8 per cent, respectively, for a return over calendar 2019 of 35.2 per cent (US Nasdaq) and 28.9 per cent (S&P 500). And this excludes dividends. continue…

by David Buckland Posted in Economics, Market commentary.

- 6 Comments

- save this article

- POSTED IN Economics, Market commentary

-

2019 – the year in review

Joseph Kim

December 16, 2019

With the year coming to a close, I thought it would be interesting to look at 2019 in terms of some of the movements we saw in the ASX300 and its constituents. continue…

by Joseph Kim Posted in Editor's Pick, Market commentary.

- save this article

- POSTED IN Editor's Pick, Market commentary

-

Are we seeing a dissonance between credit markets & broader equity indices?

Roger Montgomery

December 12, 2019

UK Macroeconomic Strategist Michael Wilson has penned an interesting piece entitled “Involution” which came across my desk. It was interesting enough that I thought it worth sharing in its entirety. continue…

by Roger Montgomery Posted in Global markets, Market commentary.

-

US equities will head higher in 2020, says Credit Suisse

David Buckland

December 5, 2019

Our friends at Credit Suisse have fished out the crystal ball to give us a snapshot of the likely year ahead for US equities. The good news is that next year should deliver more solid returns for investors. continue…

by David Buckland Posted in Global markets, Market commentary.

- save this article

- POSTED IN Global markets, Market commentary