Companies

-

What to expect from REA Group?

Scott Shuttleworth

October 22, 2015

Yesterday we attended Citi Group’s ‘Fireside discussion’ with Tracey Fellows, CEO of REA Group Limited (ASX: REA).

Below we share a few noteworthy points from the conversation. continue…

by Scott Shuttleworth Posted in Companies, Property.

- save this article

- POSTED IN Companies, Property

-

Treasury Wine Estates – Part 2

Stuart Jackson

October 9, 2015

In the second part of my series on the investment case for Treasury Wine Estates (TWE) given its leverage to a falling Australian dollar (AUD), we look at what is already factored into the share price. continue…

by Stuart Jackson Posted in Companies, Insightful Insights.

- 2 Comments

- save this article

- POSTED IN Companies, Insightful Insights

-

Treasury Wine Estates – Part 1

Stuart Jackson

October 6, 2015

In this series of blogs, we will take you through an initial assessment of the investment case for a stock that potentially benefits from a particular investment theme. If the initial assessment warrants further investigation, we would then prepare a full investment case and valuation. continue…

by Stuart Jackson Posted in Companies, Insightful Insights.

- 3 Comments

- save this article

- POSTED IN Companies, Insightful Insights

-

Sweet as bro’

Stuart Jackson

September 21, 2015

One of the themes that has driven some stocks in the last 6 to 12 months has been food quality and safety in China. Stocks such as Bellamy’s (ASX: BAL) and Blackmores (ASX: BKL) have experienced extremely strong share price appreciations recently on this theme as demand from Chinese consumers for premium international brands with perceived food safety has driven significant sales growth. continue…

by Stuart Jackson Posted in Companies, Consumer discretionary.

-

Is Myer’s Equity Raising Throwing Good Money After Bad?

Stuart Jackson

September 14, 2015

Myer (ASX: MYR) recently surprised the market by pre-announcing its financial year 2015 (FY15) results and launching a deeply discounted 2 for 5 entitlement issue. While the FY15 results were roughly in line with market expectations, the greatest focus was on the company’s new strategy announcement. continue…

by Stuart Jackson Posted in Companies, Consumer discretionary, Insightful Insights.

-

Small cap series: Bellamy’s Australia Limited

Scott Shuttleworth

September 9, 2015

With reporting season out of the way, we now can continue our series in small cap stocks.

One clear outperformer has been Bellamy’s Australia Limited (ASX: BAL). For those unaware, Bellamy’s is a Tasmanian firm producing organic baby milk powder and formula. continue…

by Scott Shuttleworth Posted in Companies, Insightful Insights.

- 11 Comments

- save this article

- POSTED IN Companies, Insightful Insights

-

SEEK-ing Returns

Stuart Jackson

September 3, 2015

SEEK reported its 2015 financial year results on 19 August. While the result itself was in line with the reduced market forecasts following the trading update in late June, the outlook statement caused a significant reduction in forward estimates. continue…

by Stuart Jackson Posted in Companies, Insightful Insights.

- 11 Comments

- save this article

- POSTED IN Companies, Insightful Insights

-

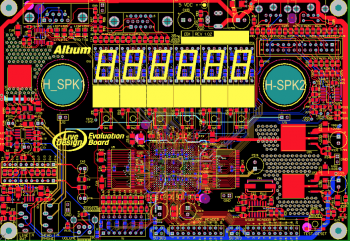

Altium – a big jump up in value

Scott Shuttleworth

September 2, 2015

Last week Altium Limited (ASX: ALU) provided its full year results for the 2015 financial year. Below we make a few notes on its progress. continue…

by Scott Shuttleworth Posted in Companies, Insightful Insights.

- 2 Comments

- save this article

- POSTED IN Companies, Insightful Insights

-

Jack of all trades

Ben MacNevin

September 1, 2015

Trade Me (ASX: TME) is one result from reporting season that caught our attention. What did we find upon further analysis? continue…

by Ben MacNevin Posted in Companies, Insightful Insights.

- 8 Comments

- save this article

- POSTED IN Companies, Insightful Insights

-

Is Burson Group a good buy?

Scott Shuttleworth

August 28, 2015

Burson Group Limited (ASX: BAP) again demonstrated the rewards reaped by those invested in value this reporting season. We met with management last week to discuss the result and we’ve posted below an ‘over-the-shoulder’ view of our notes. continue…

by Scott Shuttleworth Posted in Companies, Insightful Insights.

- 4 Comments

- save this article

- POSTED IN Companies, Insightful Insights