Companies

-

G8 Education Update

Russell Muldoon

October 4, 2013

Since we wrote our first post here, G8 Education (ASX: GEM) has continued to be very active on the financing and acquisition front. We have adjusted our timeline of events for 2013 below to incorporate the new developments continue…

by Russell Muldoon Posted in Companies.

- 18 Comments

- save this article

- POSTED IN Companies

-

Boart Longyear – drilling itself out of a hole?

Ben MacNevin

October 3, 2013

Boart Longyear (ASX: BLY) owns the world’s largest fleet of drilling equipment, and in doing so has amassed considerable debt. The downturn in the mining sector brought the company perilously close to breaching its debt covenants, and while management was able to refinance the debt earlier this week, we are unconvinced that this has given the company a lot of breathing space. continue…

by Ben MacNevin Posted in Companies, Insightful Insights.

- 3 Comments

- save this article

- POSTED IN Companies, Insightful Insights

-

Acquiring growth

Ben MacNevin

September 27, 2013

Ansell (ASX: ANN) is a company that has grown its earnings by 7 per cent a year for the past 6 years. But rather than doing it organically, it has primarily done this by purchasing other companies. continue…

by Ben MacNevin Posted in Companies, Insightful Insights.

- save this article

- POSTED IN Companies, Insightful Insights

-

Exploring Miclyn Express Offshore

Tim Kelley

September 25, 2013

One potentially interesting opportunity in the market at the moment is Miclyn Express Offshore (MIO), which provides support, crew and utility vessels to the offshore oil and gas industry. MIO is 75 per cent owned by private equity players Champ and SEA6, and has received from them a conditional, indicative, non-binding proposal to acquire the remaining shares, at a price of $2.20 cash. continue…

by Tim Kelley Posted in Companies.

- 3 Comments

- save this article

- POSTED IN Companies

-

Time for ResSleep?

Ben MacNevin

September 20, 2013

Resmed is a company that manufactures machines and masks for sufferers of sleep apnea. At Montgomery, we believe that Resmed is a quality business with strong fundamentals. Despite both funds being shareholders, none of our team has trialled the products first hand. Until now. continue…

by Ben MacNevin Posted in Companies.

- 6 Comments

- save this article

- POSTED IN Companies

-

Is $0.80+ unreasonable for BGL?

Russell Muldoon

September 19, 2013

Bigair (BGL) is a small business with a market capitalization of just $126m, so the chances are you’re unlikely to be familiar with the story. But perhaps importantly, you don’t need to be a rocket scientist to quickly get a handle on the business’s underlying drivers which we think can be broken out into two core elements. continue…

by Russell Muldoon Posted in Companies.

- 2 Comments

- save this article

- POSTED IN Companies

-

How excited should we get about big 4 bank valuations?

Tim Kelley

September 18, 2013

The big four banks have attracted a fair bit of media comment recently. On one hand we are told that some international investors can’t understand the lofty valuations attached to Australian banks and are shorting them in volume. On the other hand we are informed that these international investors do not properly understand the Australian context, and will surely get burned on their shorts. continue…

by Tim Kelley Posted in Companies, Financial Services.

- save this article

- POSTED IN Companies, Financial Services

-

Can Bernie turn Myer (MYR) around?

David Buckland

September 16, 2013

Since returning to the share-market four years ago in a listing we described as too hot to handle HERE, the economics of Myer’s operations have deteriorated. We forecast this back in 2009 in our blog piece entitled Would You, Should You Buy Myer? Stakeholders involved in the recent annual July 2013 review will be questioning whether CEO Bernie Brookes can turn this department store business around.

by David Buckland Posted in Companies.

- 1 Comments

- save this article

- POSTED IN Companies

-

WHITEPAPERS

Double edition white paper: ARB & Speciality Fashion Group

Roger Montgomery

September 13, 2013

In this month’s subscriber-only white paper, Roger analyses two companies: ARB Corporation and Speciality Fashion Group. What are the prospects for these two businesses?

by Roger Montgomery Posted in Companies, Whitepapers.

- 12 Comments

- save this article

- POSTED IN Companies, Whitepapers

-

Seeking Perfection* (*with apologies to George Orwell)

Ben MacNevin

September 13, 2013

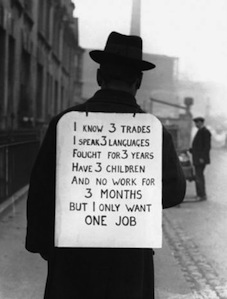

It was a rather gloomy week of economic data releases – total job advertisements in Australia and New Zealand were down by 2 per cent for the month of August, while unemployment rose from 5.7 per cent to 5.8 per cent over the same period. And yet the share price of Seek, Australia’s leading employment classifieds website owner, has risen by 1.7 per cent over the week. That raises the question; why are the rising unemployment headlines not having the same adverse impact on the company’s performance as they once did? continue…

by Ben MacNevin Posted in Companies, Economics, Insightful Insights, Value.able.