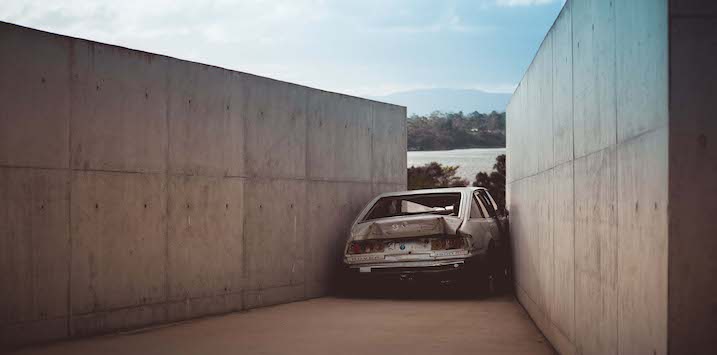

Australia heads for a car sales crash

Is Australia’s debt-fuelled party about to end? It looks like it. National new car sales have fallen off a cliff. This new era of belt tightening poses a threat to the national economy.

We like to keep tabs on various industries, particularly those that might accurately reflect purchasing behaviour. The record level of household debt, suggests a ‘belt-tightening’ deleveraging is occurring. If that is true it would be no surprise to find sales volumes of big-ticket items declining from prior levels.

According to the Federal Chamber of Automotive Industries, national new car sales plunged in February from year ago levels, consistent with the picture that has been painted by the data since at least November last year. National new car sales are now at seven-year lows with just 87,102 new vehicles sold in February nationally, down 9.3 per cent year-on-year.

Victoria (-11.7 per cent) and NSW (-11 per cent) produced the sharpest declines. Passenger vehicles were 21 per cent lower overall, with private sales down 22.5 per cent, while business purchases declined 21 per cent. The Government purchased 2.1 per cent more vehicles.

The SUV segment saw overall sales down 6.3 per cent with private sales down 5.6 per cent business sales down 13.3 per cent and the government down 4.4 per cent.

By Brand, Audi is down 35 per cent, Land Rover down 32 per cent, Honda is 22 per cent weaker, Holden is down more than 18 per cent and even Toyota has not been spared down 10.5 per cent. Ford and Mercedes are off by between 5 and 7 per cent. You might recall Mercedes suffered very steep falls in November (down 43.5 per cent in NSW).

These falls suggest we have yet to reach the bottom in activity for car dealerships and it also suggests that ‘belt tightening’ is a present threat to the economy and jobs.

jimbo james

:

Roger, you recently mentioned this household deleveraging phase playing out over the ‘next couple of years’. How do you rationalise that timeframe? Debt levels are extreme, can they be dented in such a relatively short period? Is there some form of analysis you could point us towards? Cheers.

Roger Montgomery

:

Thanks Jimbo, I should have said “at least” the next couple of years. According to various academic papers on the subject of deleveragings, they typically last 6-7 years. We aren’t officially deleveraging yet in Australia but the anecdotal evidence suggests credit growth may soon be slower than GDP growth, which would ‘officially’ mark the start of a deleveraging.

jimbo james

:

Makes sense when you consider that lost decade or so after the 1980s excesses. Thanks Roger, keep up the great work, you are and have been miles in front of the economentariat on this.

matthew eakin

:

Great little read again Rodger.

Like REA would you think that a similar play could occur with Car Sales. That is, if people / families are not purchasing NEW cars and instead (assuming) purchasing will continue* would these sales occur through the Car Sales platform. Thus the paradoxically the ‘belt tightening’ is beneficial to the Car Sales business. Thoughts welcome.

* whether at a lower clip or not would need to be explored.

Alex

:

As someone who has worked in the industry for 16 years the true extent of the slowdown is often masked initially.

Dealers typically receive large target based payments and simply can’t afford not to hit target. For my medium size prestige dealership it equates to around $150k per month. A car counts as a sale for the VFACT figures when it is registered so dealers and manufacturers register vehicles to hit target.

When the market slows there is generally a build up of these preregistered cars. At some point the dealers and manufacturers have to stop doing this and sell down existing resistered cars at the expense of new sales. This has a double effect on sales in a slowing market and is often why you see these 30%+ declines in brands sale figures.

Love your work Roger!

Roger Montgomery

:

Thanks Alex. Great to hear from the coal face.

Greg McLennan

:

G’day Roger,

We picked up a brand new 2018 Ford Ranger last week for $15000 off the RRP. Seemed like desperation on the part of the dealer.

Roger Montgomery

:

Was that the Raptor? Keen to hear what the price drop was in percentage terms.

Greg McLennan

:

It was the mid-spec XLS 4×4 pickup and 29% off the list price. I think they threw it out there as burley to get a few people sniffing around. I guess it worked because a guy came in 30 minutes after us wanting to buy it but he was too late and ended up buying one of the other ones there for a few thousand more which was still a pretty steep discount.

andrew ronan

:

It’s all unfolding exactly how you described it years ago Roger, property falls first which is leading to wide spread effects in retail etc, it’s the classic negative feedback doom loop in action, one tends to get after basing your entire economy on a monstrous asset bubble, take note AGAIN all Keynesians. Bubble economics are bad for your countries health, as seen previously, and previously, and before that.

But if you ask the RBA, they will tell you it’s all the fault of tight fisted bosses who won’t pay higher wages to workers so they can afford a couple of million for a unit and an Audi.

The -%35 Audi number is no suprise, it’s the first purchase one must make after making your first dollar in realestate. And that is almost compulsory if your a realestate agent. Along with very expensive sunglasses and shoes.

I bet the next shoe will drop soon, but the penny sure as hell won’t, again.

You just can’t make this up.