Can Rupert Murdoch sell homes in the US?

REA Group Ltd (ASX: REA) announced that they are partnering with News Corp (Nasdaq: NWS), a majority owner of REA, to acquire US-based company Move Inc (Naqdaq: MOVE) for a total of US$950 million. As per the chart below, Move Inc has an interesting history, and has most recently benefitted from the recovery in the US housing market.

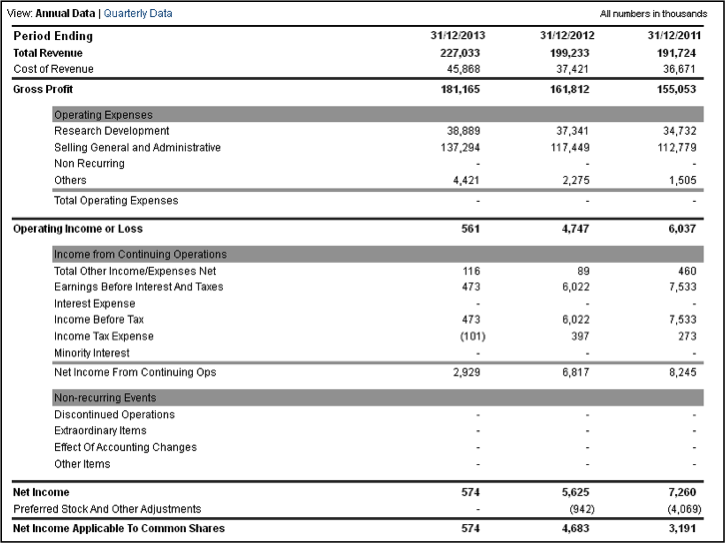

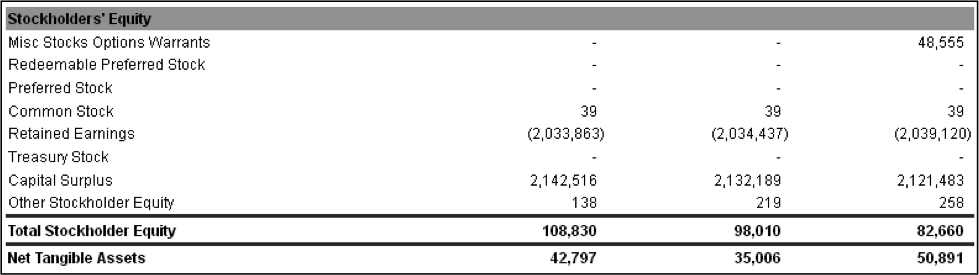

In terms of deal structure, REA is putting up $200 million and News Corp $750 million for a 20/80 split of ownership – and what are they getting in return? Let’s look at what we know. On a financial basis, Move Inc doesn’t look too promising, with profits significantly down over FY13 to below $1 million. Even more concerning is the vast quantity of retained losses ($2.03 billion) stored on the balance sheet – obviously indicating that profitability in this firm has not been the norm.

Over the long term, $200 million isn’t a significant amount of money for REA (relative to REA’s $5.66 billion market capitalisation). If this investment was completely lost, it’s clearly negative – however, the upside if the venture works out is vast. Determining which outcome is most likely will take us some time. We do know that in these sectors, typically the number 3 or number 2 player struggles for profitability, whilst the number 1 player earns well in excess of their cost of capital (note: Domain is somewhat of an outlier given it has captured key market niches, this is not always achievable). After the merger of Zillow and Trulia, it seems likely that this combined entity will take the number 1 position, whilst Move Inc is left in second place. If this occurs, will REA fall in value by a significant amount? Probably not.

The deal does offer a degree of benefits to all individuals. For example Move Inc will gain exposure to a wider range of customers through News Corp’s various US business segments. REA gains exposure to the United States and can share best practices/technology with Move Inc (notably a mutual benefit). News Corp of course can hedge its declining real estate classified business, and potentially benefit if Move Inc defies the norm and becomes excessively profitable. In addition, the 80/20 ownership structure provides tax benefits to New Corp.

On the surface, $950m seems a lot of money to pay for a company with FY13 NPAT of less than $1m. News Corp on their conference call justified the price in terms of the potential that can be realised from the US real estate sales marketing budget longer term. Perhaps what was really paid for was a seat at the table in a discussion with Zillow.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY