Performance to 30 September 2014

In the face of a poor market during the September 2014 quarter, both Montgomery products recorded very pleasing results. The Montgomery Fund (TMF) was up 4.9 per cent, while The Montgomery [Private] Fund (MPF) was up 4.2 per cent.

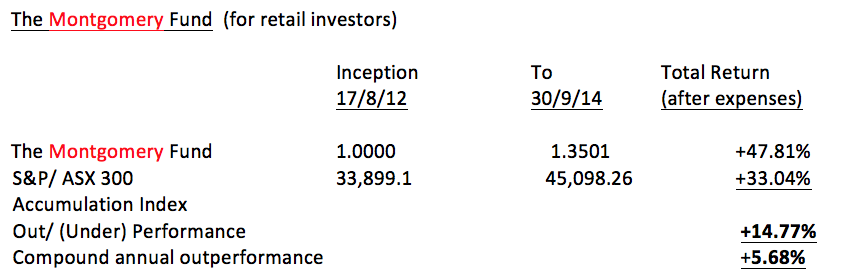

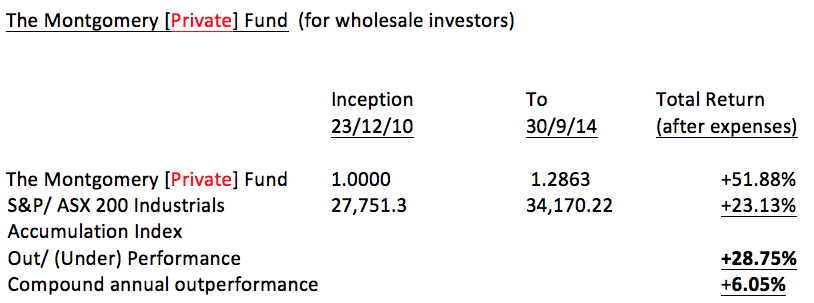

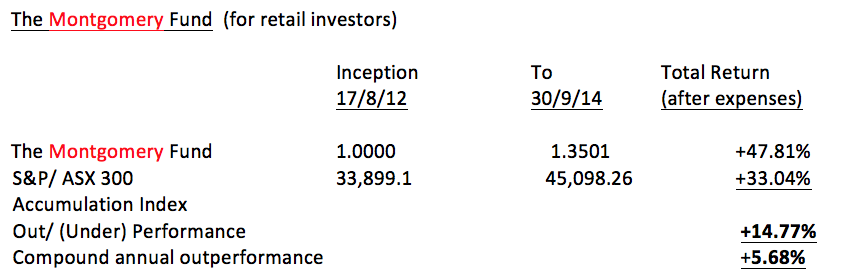

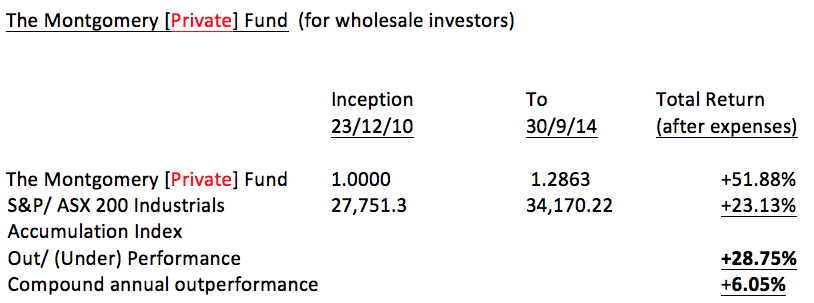

I have detailed the returns below for both products, since their inception to 30 September 2014, as well as their outperformance compared with their benchmark, and the compound annual outperformance. (This data is on an after expense, pre-tax basis, and assumes reinvestment of all distributions).

PERFORMANCE to 30 September 2014

MORE BY DavidINVEST WITH MONTGOMERY

Chief Executive Officer of Montgomery Investment Management, David Buckland has over 30 years of industry experience.

David is a deeply knowledgeable and highly experienced financial services executive. Prior to joining Montgomery in 2012, David was CEO and Executive Director of Hunter Hall for 11 years, as well as a Director at JP Morgan in Sydney and London for eight years.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

Geoff C

:

No, but I did wonder if that was the reason. Perhaps the fund’s performance would be better presented as “value of $1000 invested with distributions re-invested” (presumably $1478) than as simply the unit price?

Roger Montgomery

:

Will keep it in mind. Thanks Geoff.

Geoff C

:

I don’t quite see how 1.35 from a starting point of 1.00 is an increase of 47%.

Excel calculates your IRR as 15.2%p.a. and the index as 14.4%, an outperformance of 0.8% p.a. (using the XIRR function for those dates and values.

Roger Montgomery

:

Hi Geoff, Have you included the distributions and their reinvestment? When distributions are paid, the unit price is reduced by the amount of the distribution…