Borrowers hit again

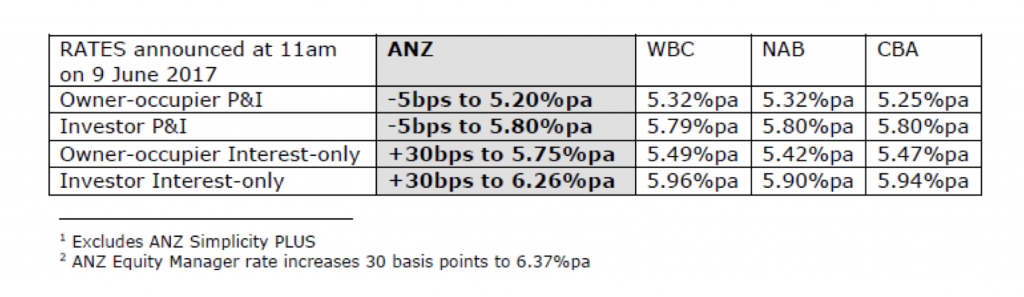

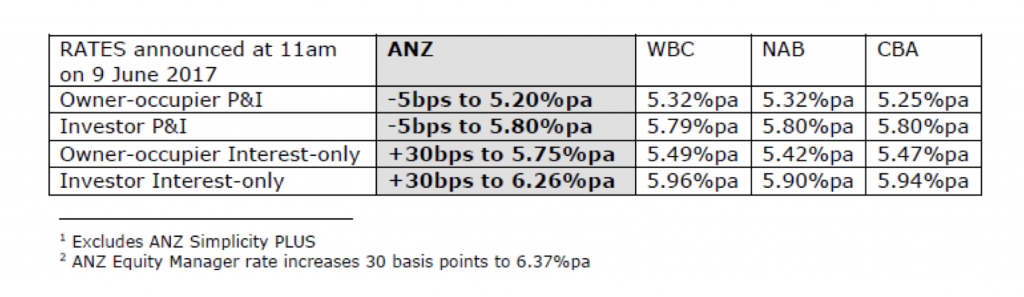

The following table reveals the financial stress on interest only mortgagors is mounting.

Yesterday at 11am, the ANZ lowered the interest rate on Principle & Interest mortgages by 5 basis points but raised rates on interest only loans by 30 basis points. Keep in mind that the Reserve Bank has not raised rates. This is an out-of-cycle move by the ANZ which will be followed by the other banks in short order, and combined with the discount to the P&I rate suggests the bank is acutely aware of the problem of too many interest-only loans that will need to be refinanced in the next couple of years.

And as further evidence of the awareness of the problem ahead, we have been told that Westpac is not accepting any interest-only refi’s. That means that of you are on an interest only mortgage and paid an extra million dollars at auction for that house because you thought it would only cost you an extra $45k per year in interest, think again. Switching to P&I will cause your payments to rise by as much as 40%.

Households with heavy debt burdens now face regularly rising interest rates, flat property prices at best, equally flat wage growth and the possibility of non-discretionary energy bills rising by as much as 20% in July. And if those households want to sell, expect a lot more supply to compete with and fewer buyers because the banks have blacklisted so many suburbs and or raised the deposit requirements for investors.

Shares in retailers, retirement village operators, property developers or building material suppliers anyone?

MORE BY RogerINVEST WITH MONTGOMERY

Roger Montgomery is the Founder and Chairman of Montgomery Investment Management. Roger has over three decades of experience in funds management and related activities, including equities analysis, equity and derivatives strategy, trading and stockbroking. Prior to establishing Montgomery, Roger held positions at Ord Minnett Jardine Fleming, BT (Australia) Limited and Merrill Lynch.

He is also author of best-selling investment guide-book for the stock market, Value.able – how to value the best stocks and buy them for less than they are worth.

Roger appears regularly on television and radio, and in the press, including ABC radio and TV, The Australian and Ausbiz. View upcoming media appearances.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

Thank you for the article.

I was just wondering where the balance might be for the banks in hiking interest rates, and then putting borrowers under pressure, that could potentially give themselves an own goal on their balance sheets

With a large holding of mortgages

Its a balance between a problem now or a much bigger one later.

Given that the Montgomery Fund holds both CBA and WBC you must think that these banks can survive this coming storm without share price reductions. Can you explain your thinking a little?

These holdings have been extensively trimmed since last year and are on constant watch.