We introduce the ‘smashed avocado’ index

Last October, demographer and author Bernard Salt wrote that millennial hipsters should spend less on ‘smashed avocado and crumbled feta’ and more on saving for a home deposit. His comment sparked a furious cross-generational debate – the idea that millennials can’t afford to buy a home simply because they spend too much on brekky appeared ludicrous.

So we thought it would be fun, and enlightening, to start a blog series called the ‘smashed avocado index’.

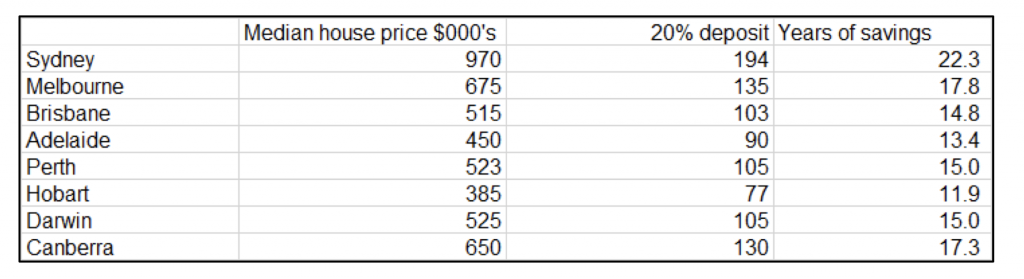

The intent for the index is for it to be constructed for each city in Australia on a monthly basis. We take the median price of a house in each city and calculate from a 20% deposit.

We can then compute the number of years an avid avo toast brekky eater would need to wait before purchasing their own slice of the Australian dream.

We firstly assume that the cost of brekky is $12.95 (round to $13). The cost of smashed avo on toast can vary widely but with a guess of $12.95 we’re probably not far off the mark. Hence the cost for a week of avo brekkies is $91.

These savings are then deposited weekly into a bank account earning 5% interest. This is well above what you might currently expect from a term deposit but we’re assuming that rates eventually normalise sometime in the distant future.

The results are in the first table below. Millennials (this writer included) will be looking at a good 22 years to buy a house in Sydney. Sure, we could buy an apartment, which would be cheaper (depending on location), or move further out of the metro area, but still, that’s a lot of missed brekkies!

Hobart is by a decent stretch the best place to live if, as a millennial, you’re keen to get back to your guilty avo indulgence. Here we’d only need to sacrifice brekkies for 12 years.

But wait, there’s more!

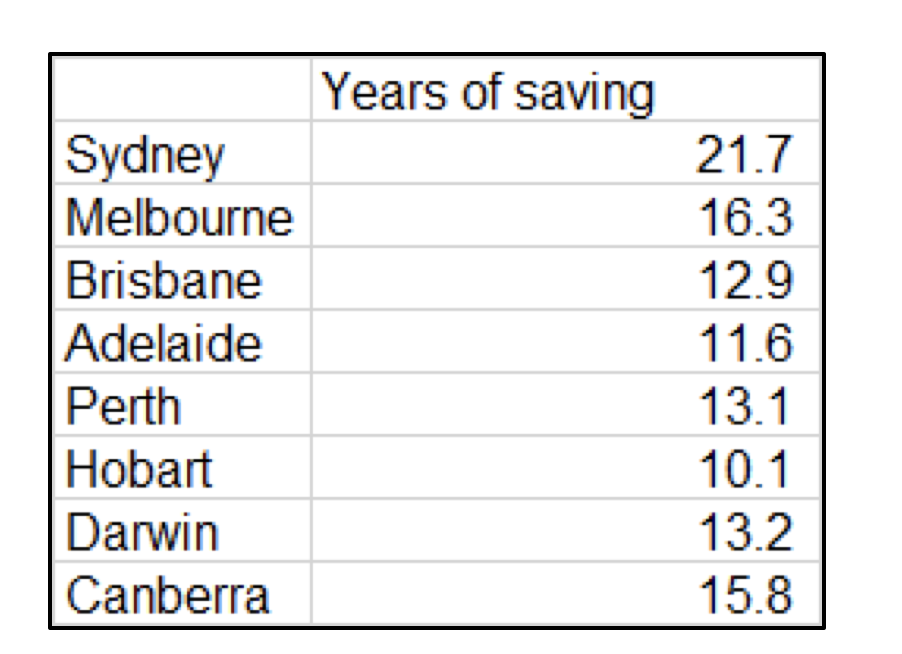

Our forecasts don’t incorporate any consideration that housing may appreciate over the circa 15–20 years that a millennial is skipping their morning avo. More brekkies must be sacrificed to account for this issue. We hence add in a gradient against our savings rate in order to approximate future property price appreciation.

But we can also deduct some brekkies if property prices were to fall, dragging down the required deposit. Property prices probably need a correction at some point (my crystal ball is refusing to tell me when, which is a bother….) but let’s simply assume that property crashes by 30% tomorrow and then grows at 2.5% from there on and rerun the results.

Hobart’s looking much better now, only 10 years until the return of brekky! However in Melbourne we’re waiting at least 16 years and in Sydney 22 years!

This blog was written tongue in cheek, but we’re sure the message is clear. If the cost of housing is perceived by potential millennial buyers to be too high, the rational consumer will substitute spending towards life’s other pleasures in order to maximise their economic utility.

For the record, the writer has not once ordered smashed avocado on toast for breakfast.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Marcus

:

The US Debt Ceiling meetings are approaching and it will put a nail on the cofin for financials and developers in OZ land….

SGP has been a start on SHORTs…. and it will continue to do so via re-testing $4.03’s soon and below…

ANZ, BEN, HVN, SCG, the $ AUD dollar are also some of the best SHORTs plays around IMHO….

cheers

Roger Montgomery

:

thank you for sharing thodse suggestions Marcus

Jason

:

How does the index look when you take inflation into account? Or are we predicting that smashed avocado breakfasts still cost $13 in 22 years time?

I’m hoping the latter, having bought a house a couple of years ago and being allowed to enjoy breakfasts (and lattes) again!

Matthew Bull

:

If it’s 22 years of saving in Sydney, and the market crashes by 30% tomorrow, how is it still 22 years of saving after the crash?

peter

:

Don’t forget your self respecting hipster will pay $10.00 for a pint or two of Melbourne Bitter after work. and a few extra on weekends. You can add an extra $100 a week to your mix.

And remember that 10 grand you blew on that overseas holiday to Pategonia? Pretty soon that 22 years of saving can be whittled down to about 8.

Chris

:

My credentials are that I belong to the same age group as Salt. However, do not assume that means I agree with him! Salt’s absurd advice that an individual’s lifestyle be subjugated to residential property purchase is symptomatic of a malaise with dysfunctional grip on the Aussie psyche. No sacrifice must be spared to feed the Moloch that eats cities. Unfamiliar as I am with most of Salt’s views, he should first observe that we’ re cursed with wrong-headed leaders who shamelessly aid and abet expensive housing. The self-same pollies insist on treating residential property as an asset whose value is to be defended, if not inflated, by inequitable taxation concessions and other stupidities. If remarks by one-time treasurer Hockey, equally callous and inane, are representative, the LNP will quite happily accept social dislocation and urban poverty if it will benefit property investors. My respect for Salt’s competency in this area would improve were he to use his influence to call out those numerous incumbent politicians who want to prolong the property bubble at all costs. Lest he be accused of supporting Joe Hockey, to his ignominy.

Patrick Murphy

:

What if the millennial hipsters choose to wash it down with a large organic soy latte? How would that affect the cost?

(Just kidding)

Scott Shuttleworth

:

I’d imagine perpetual renting awaits said hipster!

Ashley

:

Hi Scott , just a thought , no self respecting hipster would enjoy their avo brekky with out a caramel latt’e , which is another $4:50 into the mix ????

Scott Shuttleworth

:

Hahaha, great one Ashley!

spiro

:

HI Scott, out of curiosity, over the very long term how much should property values increase each year? Given CPI is approx. 3%, I have it a guess that property capital values increases would be circa 4%. Would like to know your thoughts.

Scott Shuttleworth

:

Hard question to answer Spiro…but housing is a commodity (can be differentiated in some cases but a commodity regardless. Hence would expect it to increase by inflation over the long term….

But…

There are instances in which property can rise by more than this…for example what we’ve seen historically, since demand has been above that of supply.

So in order to form a view property price appreciation, you’d need to consider what factors drive demand, what factors demand supply and the magnitude of the imbalance. This is hard to answer, but then add in that these factors will vary by location, making the answer even more complex.

I’ve attempted to solve the above but my efforts haven’t been successful. All I can say is that as a value maximising consumer, prices look expensive – i.e. there’s plenty of other things I could do with my income that would provide a higher level of utility.

Paul Audcent

:

I alternate porridge with Wheatabix and look at me I’ve already reached the grand old age of 75! Have my own house and garden so I learnt to save in my mid twenties. Missed out on a lot tasty brekkies though!, The kids were the sad beneficeries of my cooking skills!

Scott Shuttleworth

:

Thanks Paul. Nice work on the penny-pinching too!