Best of the Best

The peak week for reporting season has a been a good one for plenty of companies owned by Montgomery funds.

Flight Centre (A1, ASX: FLT)

This week Flight Centre’s share price hit ‘popularity maximus’ after reporting a 20 per cent increase in underlying profit to $240 million and guiding investors to expect profit before tax this year would rise by 8 to 12 per cent, to $370 million to $385 million.

Flight Centre also announced that its final dividend would be 91 cents per share, an increase of 28 per cent on the prior year and another demonstration that investors are better off buying high quality businesses than they are chasing high dividend yields paid by poor quality companies.

Perhaps most interestingly, investors have moved on from fears that a lower Australian dollar would lead to a decline in outbound travel and instead now, rather more sensibly, see low airfares as the sustainer of travel volumes even in the face of a weaker currency.

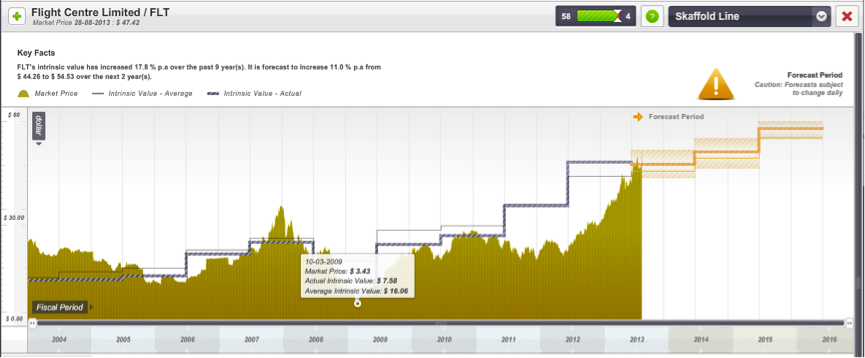

Fig.1 Flight Centre’s 10yr price and intrinsic value

The above chart highlights the forecast intrinsic value and upper and lower ranges based on analyst’s most optimistic and pessimistic forecasts for 2014, 2015 and 2016. Source: Skaffold.com

Ainsworth Gaming Technology (A2, ASX:AGI)

Ainsworth’s headline profit figure fell 19 per cent to $52 million but the result was affected by the fact that it paid tax this year, while it received a tax benefit in 2012. Looking at an operating measure (before tax profit) the business increased its profit by 50 per cent to $69.3 million. This exceeded the company’s own guidance of $65 million.

Impressive was the growth in revenue, the fifth consecutive rise, to $198 million but more impressive are the prospects. Revenue in South America is growing rapidly – up 77% in 2013 – but it amounts to just $19.6 million for the entire continent. In the world’s biggest market, the US, the company’s founder has plenty of experience (see Aristocrat) and while the revenues grew 66 per cent, the total revenue is still only $42.9 million.

Importantly for value investors, and those who like to estimate intrinsic value, the company indicated that it would target a payout ratio of 40 to 60 per cent after declaring a final dividend of 5 cents. 2013 marks the first year dividends have been paid.

Woolworths (B2, ASX:WOW)

Woolworths reported 6.1 per cent growth in underlying net profit, which reached $2.35 billion. The company also offered a range of growth forecasts from 4 per cent to 7 per cent. Importantly it noted that the upper end of that range would be dependent on improvements in consumer sentiment but it was nevertheless higher than our understanding of consensus estimates. Full year dividends hit $1.33, up 5.6 per cent on the previous year.

We think the profit should be reasonably higher due to expenses associated with Masters and Danks but it will be some time before these losses reverse, giving a boost to profits.

What we like about Wooworths has always been the strong focus on costs. There are nearly 50 people working on 150 cost projects. We also like the fact that there are 28 million weekly visits made by consumers to the company’s businesses.

What we don’t like of course is the cost to Australia’s food manufacturing and rural communities of the price competition between Coles and Woolies.

Sensible legislation needs to be enacted to ensure the price war between the two grocery giants results in less collateral damage.

Hi Roger

I, too, enjoyed Valuable and got a lot out of it. I constructed my own calculator in Excel (and cross checked it against your examples) and am able to produce IVs. However, it seems to me that the market either doesn’t understand IV or places little value on it as there seems to be little correlation between share price movement and IV for many companies I have investigated.

What is your view?

There are many companies who’s share prices track well above Iv for years, seemingly ignoring any such reference. then, quite all of a sudden, they come crashing back down. Newcrest is perhaps the best recent and very loud example…

Thanks for the update Roger, Your Woolworths one is interesting. I have to do a valuation focused case study on APE and have been honing my skills that they ask us to use on various companies.

Using a forecasting technique they have taught us i got revenue growth for WOW of 5.89% and NPAT growth of around 5-7%. So interesting to see their range worked out to be slightly similar (although still early days in the crystal ball reading world for me).

Woolowrths and Flight Centre are always two companies high on my list.

As they currently should be Andrew.

Thank you for the post and insight on these three well performing companies!

Another sound result (and outstanding long-term performer) was from Academies Australasia (AKG), This company continues to generate solid cashflow and invest in its business by mopping up minority shares in the collages that it owns, as well making outright acquisitions. What I like most is that AKG have a clear plan to grow steadily – in one of Australia’s largest export industries – education.

A no-nonsense management team, working hard for their shareholders, as it should be!

Hi Roger,

As a newbie share investor, I enjoy reading your insights and have taken a lot from Valu.able, so thank you.

Based on your last point regarding the Big 2 grocers – do you think Metcash represents value at the moment, especially with yesterday’s price drop on the back of the bleak forecasts?

Thanks and keep up the good work.

Its hard to want to own the third place getter, the way the current race has been set up. Think two hares and a turtle, with the turtle on his back at the start line.