Australia leads the way on household debt

Australian households are far and away the most indebted among English-speaking nations. To my mind, it means the next interest rate move by the Reserve Bank will be down. If I’m right, then it may be time for investors to think about increasing their exposure to businesses that benefit from a weaker Aussie dollar.

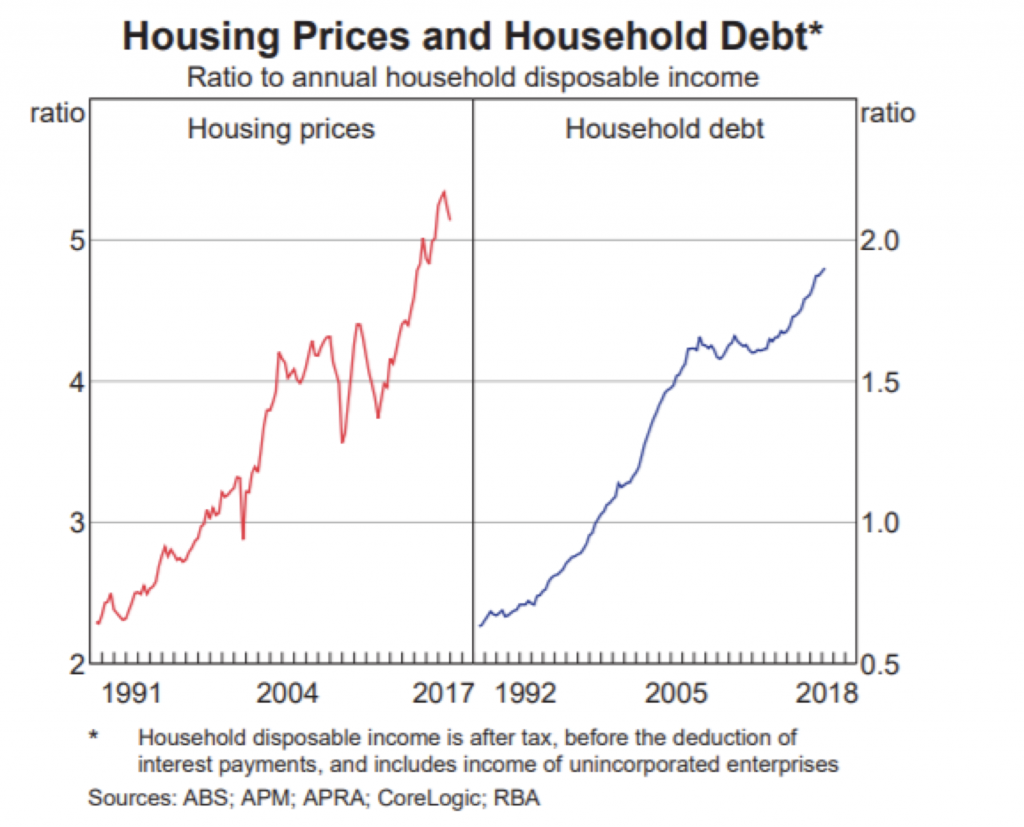

The high level of Australian house prices and household debt to income ratios can be seen in the chart from RBA below.

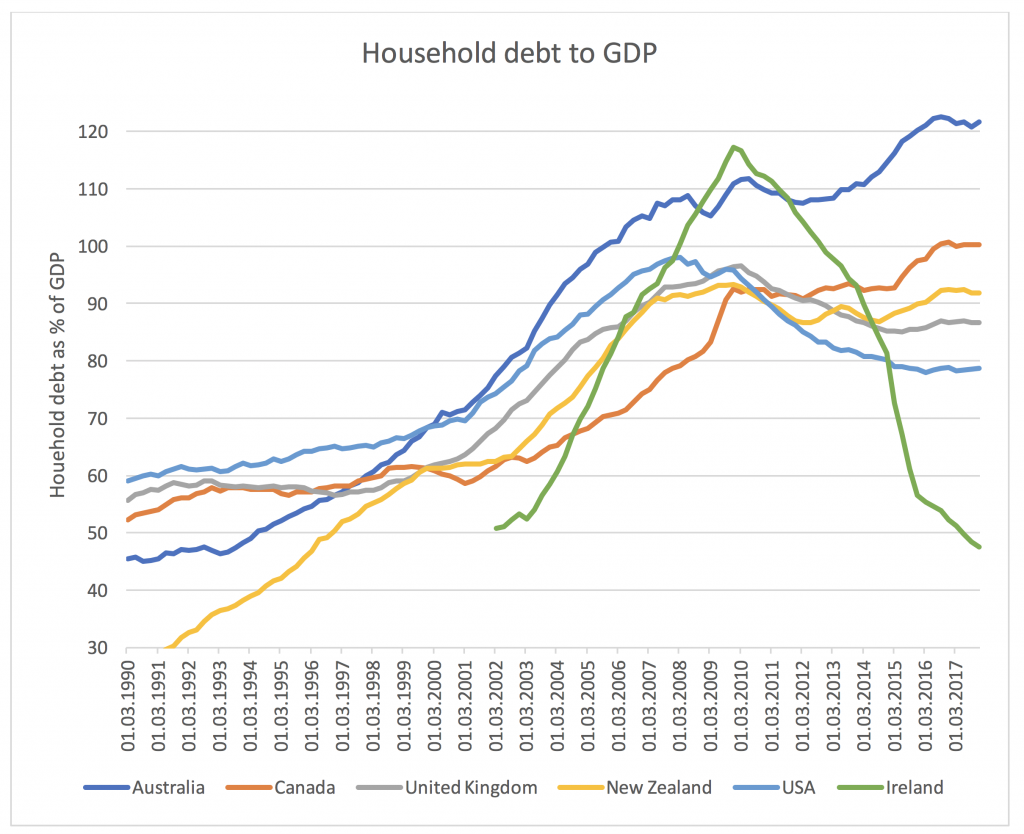

In the charts below I have compared Australia to other English-speaking countries that have similar levels of home ownership and attitudes towards debt due the similar legal systems and reasonably similar cultures. The Bank of International Settlements (BIS), the Central Bank of the world’s central banks, provides some interesting statistics on this, but unfortunately not the exact same metrics shown in the RBA chart above, so we have to instead look at household debt to GDP. This shows a reasonably similar picture to household debt to disposable income.

Source: The Bank of International Settlements

From this chart, it is worth pointing out that:

- All of the countries significantly increased their indebtedness from 1990 onwards up until the time of the Global Financial Crisis in 2007/2008. This is a reflection of the structural decline in worldwide interest rates that took place during this time period.

- From 2007/2008, UK, USA, New Zealand and Ireland (Ireland to an extreme extent!) have reduced their indebtedness while Australian and Canadian households have continued to increase their borrowing levels.

- Australian households are by a clear margin the most indebted, carrying around 50 per cent more debt that UK and US households.

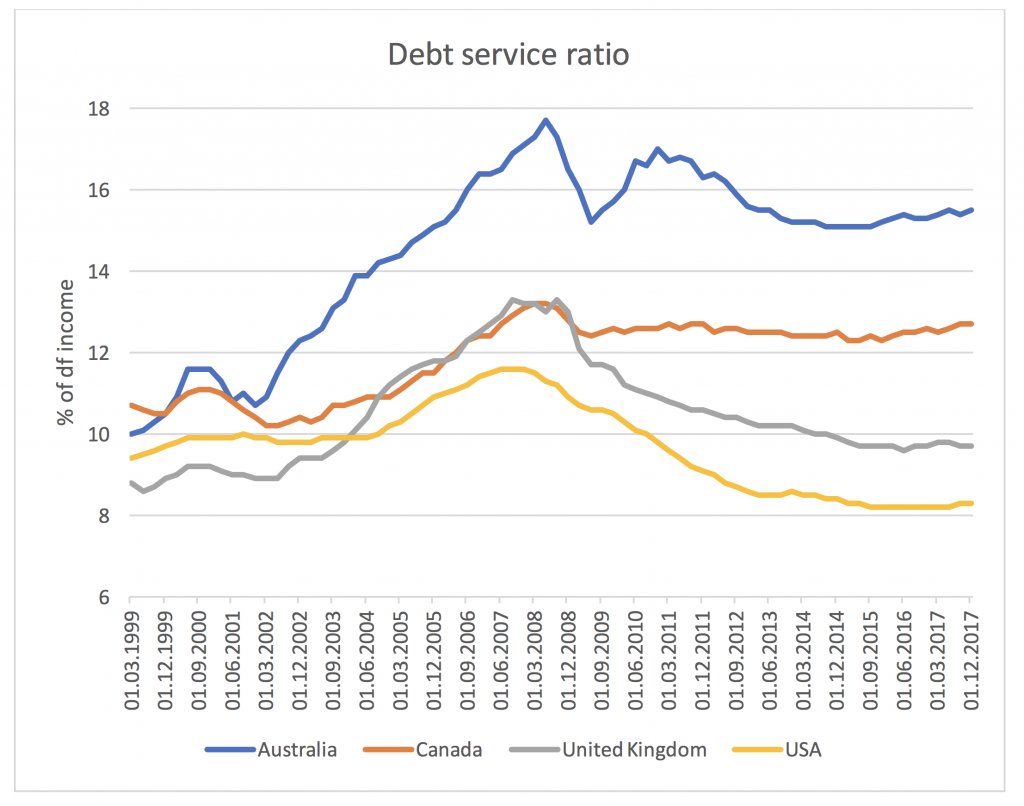

The BIS also provides debt service ratios on a household basis. This basically shows how much household’s income goes towards servicing their debt and is potentially an even better indication of how indebted households are, as there can be structural differences in interest rates and repayment profiles between different countries. Unfortunately, the BIS does not provide this data for New Zealand and Ireland.

Source: The Bank of International Settlements

- We can again note that Australia is by far the most indebted country out of these four spending 15.5 per cent of household income to service their debt.

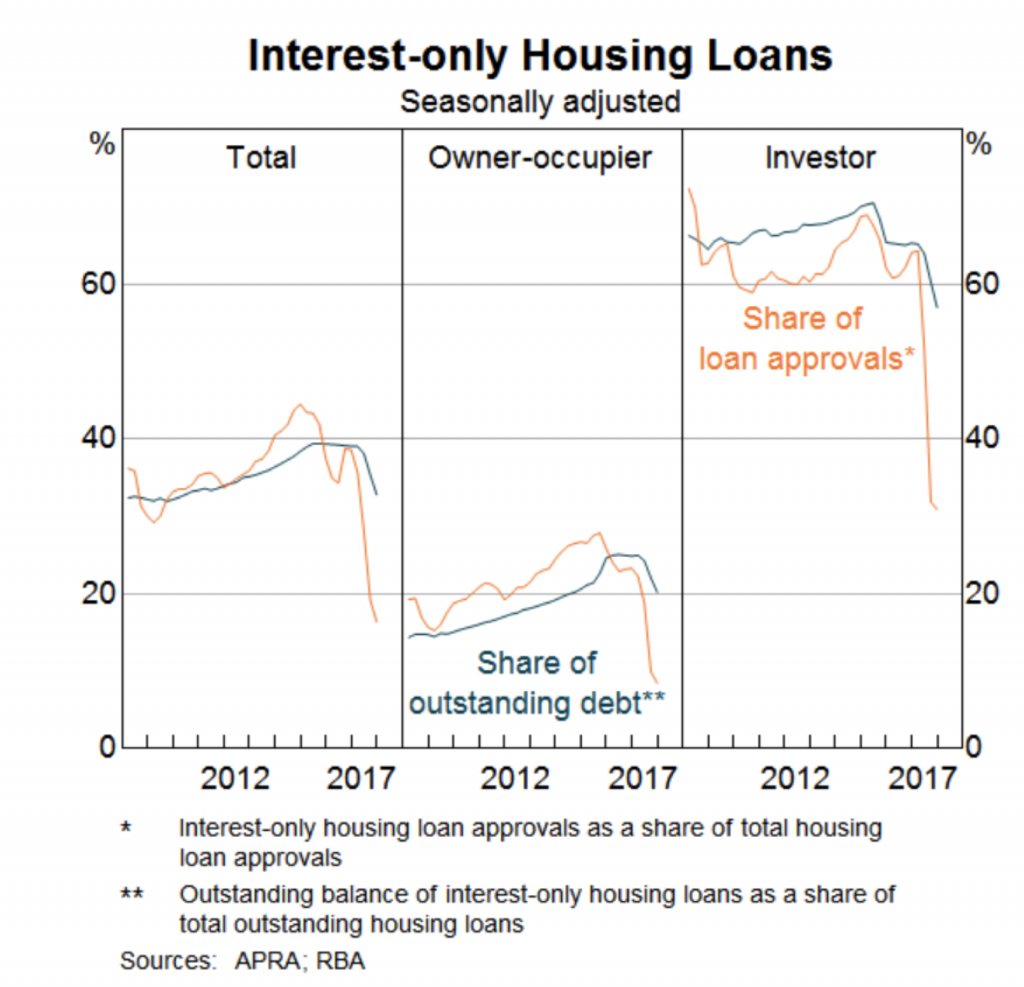

- We should also note that as the chart below shows, over 30 per cent of the outstanding mortgage debt in Australia is interest only and as we have described in a number of blog posts, APRA’s limits on interest only lending means that a lot of people will have to start paying back principal as well over the coming years which means that the debt service ratio will further increase. I unfortunately don’t have the statistics for the other countries when it comes to the percentage of non-amortizing loans available.

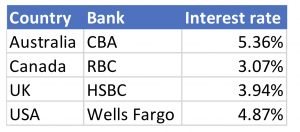

- One of the reasons that Australians are more indebted on this metric is that interest rates are slightly higher in Australia compared to the other countries (see table below) but the difference is not big enough to account for the much higher level of debt service ratio.

The interest rates are sourced from the homepages of some of the biggest banks in each country and as far as possible, I have tried to choose loans of similar length and features (i.e. predominantly variable rate loans even though the default loan in US is a fixed rate loan).

From a comparison with other countries, it is clear that Australian households are very indebted. From this, I draw two main conclusions:

- In a world of generally rising interest rates, you should therefore try to minimise investments that are exposed to the strength of Australian consumers. This is exactly how we are positioned in The Montgomery Fund.

- Even though the RBA has indicated that the next move in interest is up, I very much struggle to see them disregarding the household indebtedness in their decision-making process. I believe it is more likely that they will eventually have to cut interest rates rather than increase and this will have very negative implications for the Australian dollar. This means that you should try to seek out exposure to investments that will benefit from a weaker AUD.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Hi Andreas,

Do you really believe the RBA would cut from 1.5% again? Would they be really that stupid to further discourage foreign investment? 150 basis points are futile in comparison to the household debt Australians have taken on.

Hi Peter,

It is hard to say for sure but given the length of time they have kept the rate this low while the rest of the world has started to increase rates indicates they are very sensitive to domestic asset prices.

Andreas,

Can you please add to your statement regarding your suggestion that the next move by the RBA will be down. Do you think that the ‘Big 4’ will be able to pass on this cut (should it occur)? I have read articles that indicated that the Big 4 will be forced to introduce out of cycle rate rises due to overseas funding pressures.

It will be interesting in the event the RBA cut rates but the banks have no option but to raise rates. The social outrage.

Hi Andre,

If the RBA were to cut rates, I think it would be very hard for the big 4 to not at least cut a little bit. I would be very surprised if they passed the whole cut through though as they are indeed facing increasing funding cost from other parts of their balance sheets (see Stu Jacksons blog post from a couple of weeks back).