Aura High Yield SME Fund: Letter to Investors 17 June 2022

This week the NAB released the May monthly business survey, reporting an easing in confidence but a strong outlook for conditions.

Australian Businesses 1

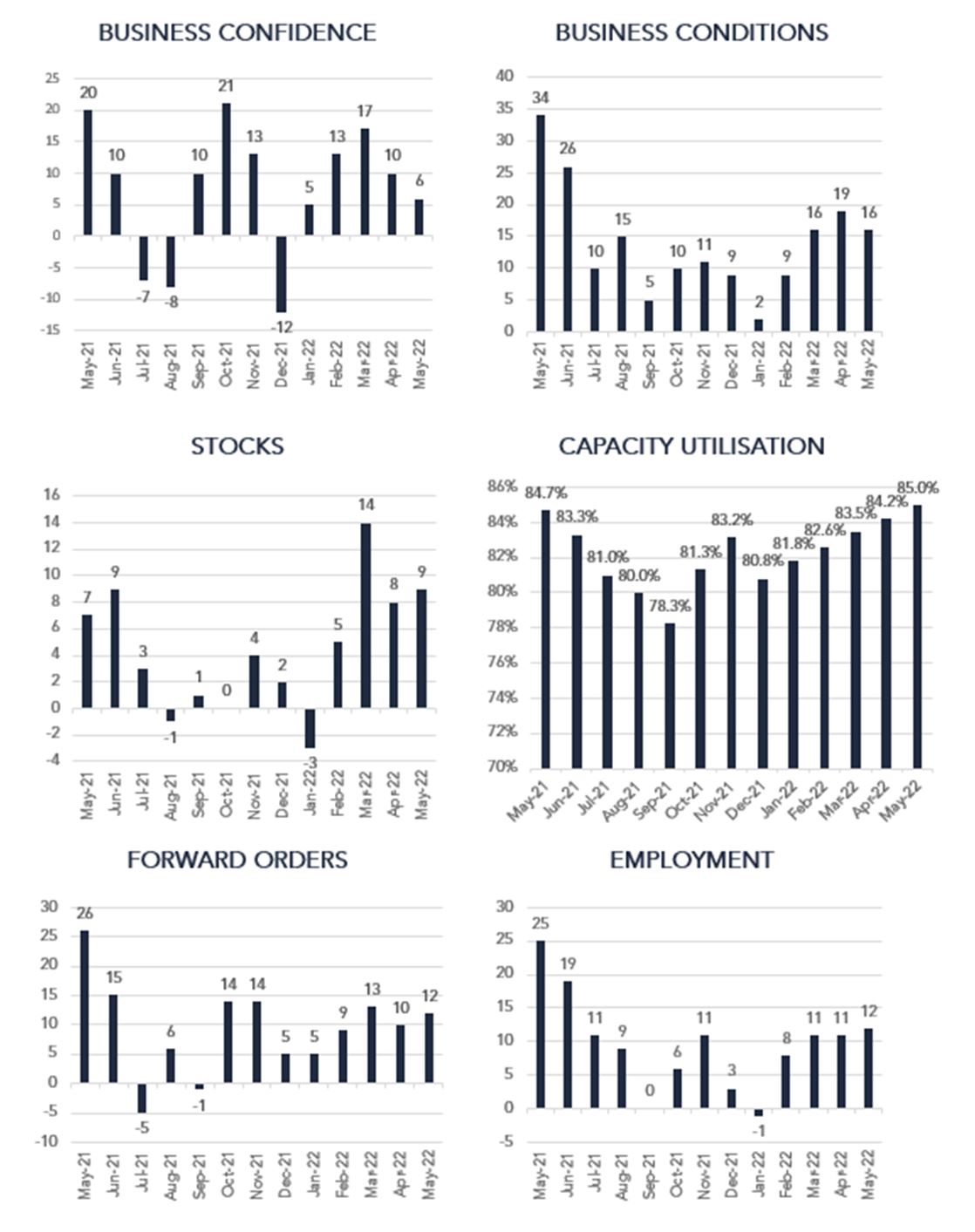

The NAB Business Survey for May 2022 reported:

- Business Confidence fell 4 points to +6 index points. It now sits just above the long-term average. The wholesale and construction industry led the drop in confidence.

- Business Conditions eased 2 points sitting at +16 index points, still well above average.

- Leading indicators demonstrated some improvement, with capacity utilisation rising to 85 per cent and forward orders rising to +12 index points.

Both business conditions and confidence eased in May, given the current economic conditions and market movements at play. There is a strong fear of uncertainty and a pessimistic outlook given ongoing inflationary pressures and global market volatility. Despite these ongoing threats, conditions and confidence remain well within positive territory. Understandably, confidence is edging lower, although confidence is still sitting above the long-run average largely due to emerging risks, as businesses face a new environment of higher inflation, rising interest rates and concerns around global growth. Despite these fears, forward indicators suggest that businesses still maintain a relatively positive outlook for the Australian economy.

Overall, conditions remain strong. Forward orders reported a rise from the prior month, meaning businesses are placing orders in advance to meet ongoing expected levels of demand. Capacity utilisation, sitting at 85 per cent, reached record highs that were previously reported before the disruptive Delta outbreak in 2021. The hope is that this will boost investment and hiring opportunities over the coming months.

Input cost growth eased from record highs in April with both labour cost and purchase cost growth contracting. On the other hand, output cost growth remains elevated at 3.8 per cent with the cost of final goods and retail price growth increasing due to inflation. Businesses are continuing to report elevated price inflation and with little evidence of lower demand. At this stage, this is still a risk to consider over the coming months as consumers adapt to the price increases. An elevated CPI read in Q2 remains likely.

The survey results remain relatively strong and imply sustained economic growth in Q2 2022. Inflationary pressures and RBA decisions will play a major part in the trajectory of business conditions and confidence in the coming months.

Labour Force – May 2022 2

Seasonally adjusted estimates for May 2022

- Unemployment rate remained at 3.9 per cent,

- Participation rate increased to 66.7 per cent,

- Employment increased to 13,510,900,

- Employment to population ratio increased to 64.1 per cent,

- Underemployment rate decreased to 5.7 per cent, and

- Monthly hours worked increased by 17 million hours.

The employment level increased for the seventh consecutive reporting period following the easing of lockdown restriction in late 2021. At 30,000, the average level of employment growth over the past three months continues to sit at a stronger level than before the pandemic, which was only achieving around 20,000 people per month.

In line with the trend of increasing levels of employment, we are also continuing to see an upward trend in hours worked.

Employment and Hours Worked Seasonally Adjusted

However, there has been an uptick in the number of people working fewer hours than usual due to illness, injury or sick leave. With Omicron and Influenza circulating, the number of people working fewer hours reached 780,500 in May 2022 – the highest level recorded since the start of the pandemic.

Portfolio Management Commentary

Significant market and economic shifts continue to play out and drive market volatility and uncertainty. The NAB Business Survey delivered some positive results with businesses still maintaining strong levels of confidence and conditions. We are keeping a close eye on these shifts to ensure our portfolio is built to adapt to market and policy movements.

We maintain a cautious outlook and are positioning the Fund accordingly. As stated in our previous communication, our close and long-standing relationships with our lenders and strong knowledge of their underlying loan portfolios mean that we are confident in the quality of the underlying exposures. This provides us with confidence in our Fund’s performance.

1 NAB Business Survey– May 2022