Q&A: The global opportunity with smaller, burgeoning companies

The global small and mid-cap (SMID) space is a vast and inefficient universe of opportunity where disciplined research can be an edge. We aim to deliver a differentiated portfolio that avoids the common pitfalls of smaller cap investing by applying a high-quality approach to this compelling asset class. Here are five key questions on Polen Capital’s Small and Mid Cap strategy, answered by Rob Forker, Portfolio Manager and Analyst.

1. What makes Polen’s Global SMID strategy distinctive?

Using a distinctive and concentrated approach, we want to fully extract the compelling risk/reward opportunity the Global SMID space has to offer. To us, that means beginning with disciplined, fundamental research and ending with owning only what we view as “the best of the best,” and nothing less.

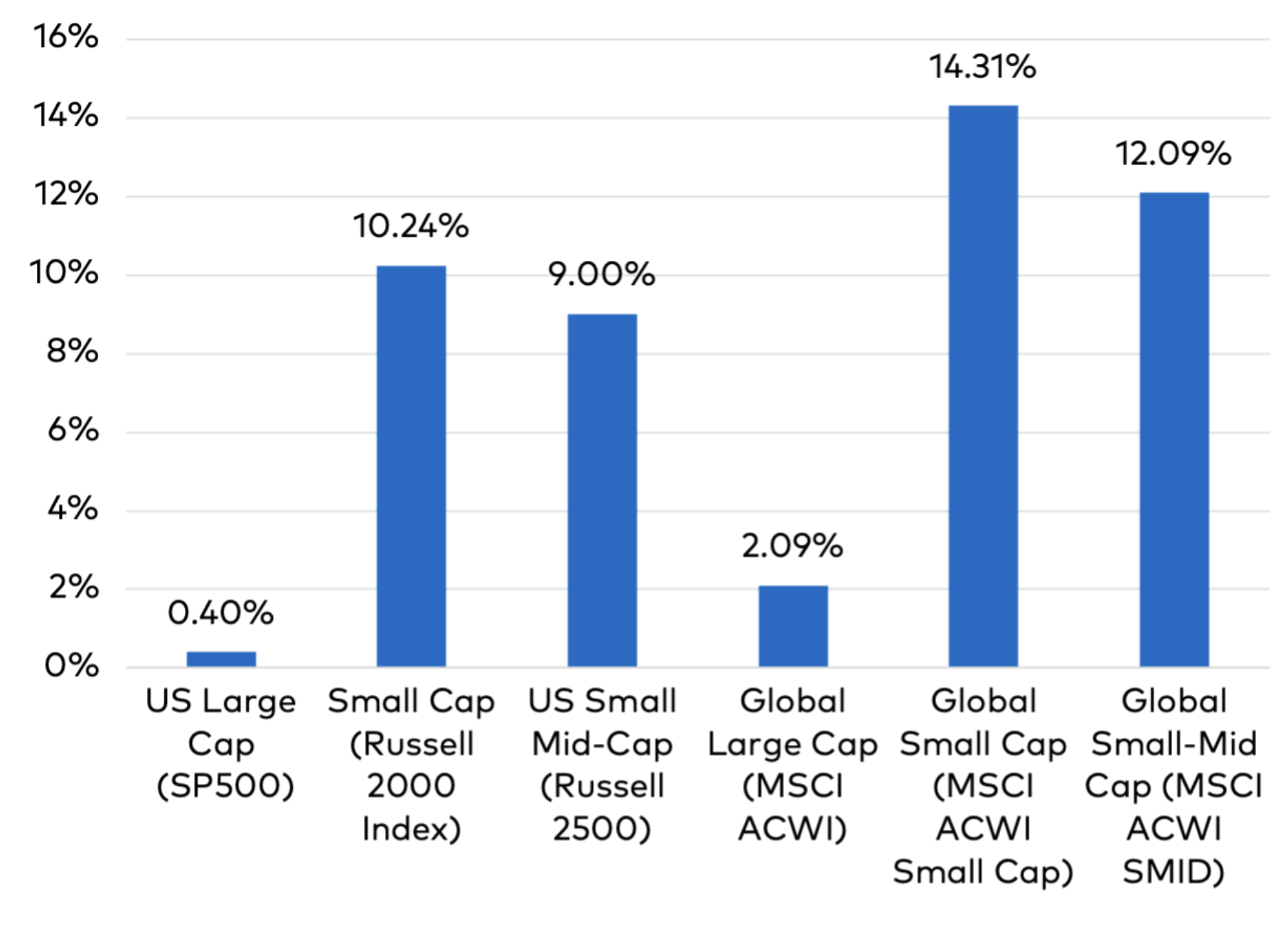

Global SMID is an under-covered market where information and research can be a real advantage for active and discerning investors, as shown in Figure 1’s depiction of sell-side coverage across investable universes. Through our bottom-up approach, our goal is to construct a best-ideas portfolio of what we believe are 30 elite companies.

Figure 1: % of Universe with Fewer than 3 Sell-side Analysts Covering

Source: Bloomberg. Data as of 6-7-2022. See the disclosures section for more information about the benchmark.

We’re looking across developed and emerging markets and at companies from $1 billion in market cap to approximately $50 billion. Overall, the menu of options is approximately 8,000 companies globally. By investing in a select number of both earlier-stage and smaller-but-more-established growth companies worldwide, we think the long-term compounding potential can be powerful.

2. How can you efficiently cover such a vast universe of companies?

The beauty of our high-quality approach is that we don’t need to cover the entire universe. The category is littered with what we view as lower-quality companies that would not meet our investment criteria. They often do not generate earnings, have too much financial leverage, or operate in cyclical industries. These businesses are of no interest to us.

Instead, we efficiently use our time, performing deep-dive research on only those companies that meet our hurdles for quality—our five guardrails.

- Real organic growth

- Stable-to-increasing profit margins

- High and/or expanding returns on equity and returns on invested capital

- Abundant free cash flow to reinvest in the business

- Strong balance sheet

Ultimately, we only seek profitable and financially sound companies that have an established and viable business model and can grow to be many times larger than their current size.

3. Why is now the right moment for an investor to consider Global SMID?

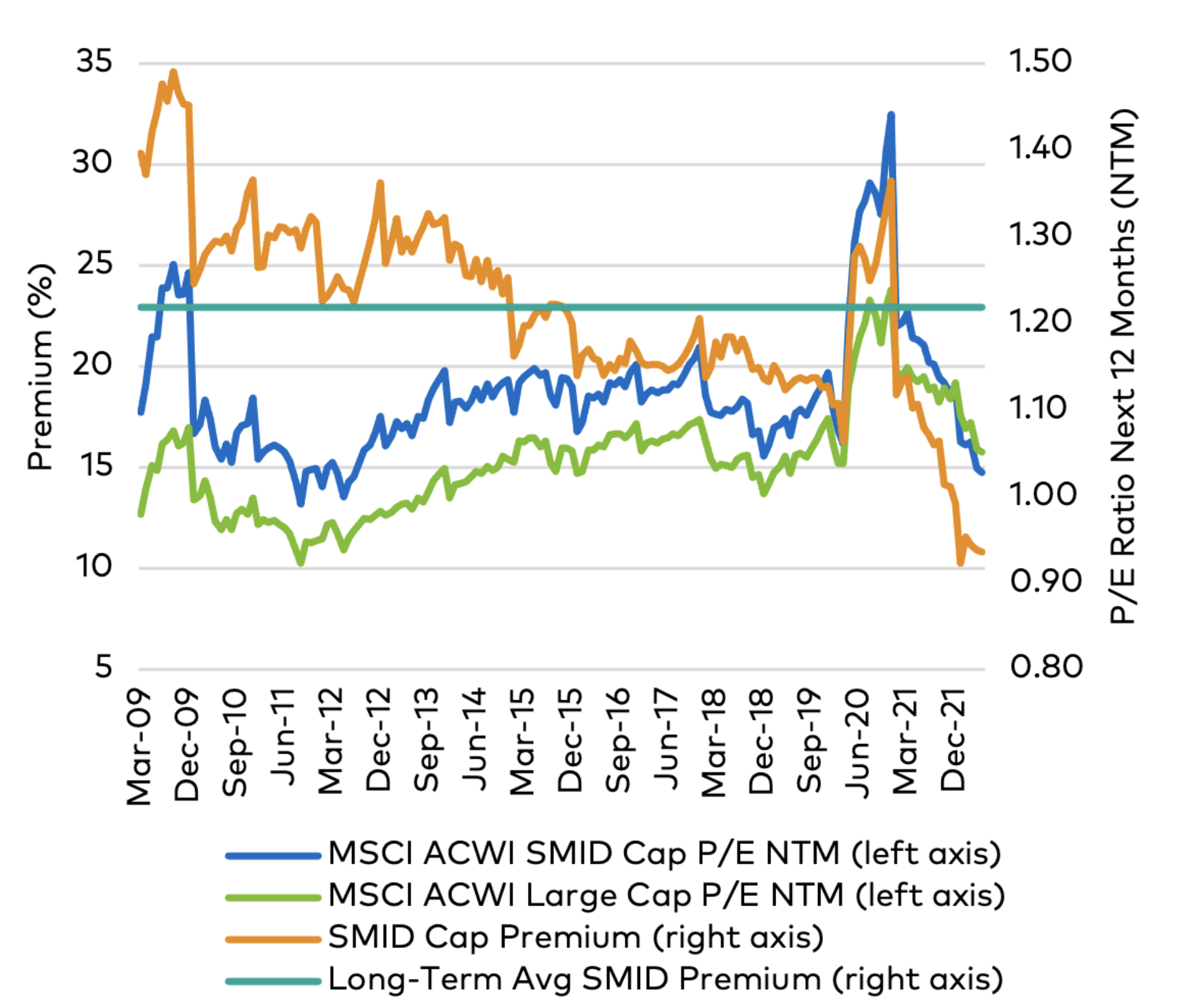

At an asset class level, the valuation opportunity in SMID is particularly notable. Small and mid caps typically trade at a premium to large caps, reflecting the higher growth potential in smaller caps. When comparing P/E (price-to-earnings) ratios across the two universes, as shown in Figure 2, we can see this dynamic.

Since early 2009, SMID cap has, on average, traded at a 22% premium to large cap, and this premium has been as high as 49%. Today, SMID cap is trading at a 6% discount to large caps, in its 99th percentile, which implies a valuation discount despite higher consensus EPS (earnings per share) growth estimates in SMID cap.

Figure 2: The Valuation Discount of SMID Cap

Source: Bloomberg. Data from 03-31-2009 to 05-31-2022.

Current opportunity aside, we believe that Global SMID can play a powerful role in many investors’ portfolios as a long-term strategic allocation. On a 10-year rolling basis, the broader SMID cap Index has outperformed the broader large cap Index 92% of the time. On a 5-year rolling basis, SMID cap outperformed large cap 76% of the time. On average, cumulative outperformance across 10- and 5-year time periods were 35% and 11%, respectively. When you then consider the additional alpha opportunities in SMID and the compelling risk-adjusted return benefits of controlling for quality, we have strong conviction in our approach.

At a strategy level, we have high confidence in the companies we own, and their valuations are attractive. To us, that feels like a coiled spring. The prolonged volatility in the market year to date has allowed us to opportunistically optimize the portfolio. Of course, it is nearly impossible to forecast the next war or other “risk-off” scenarios, but we believe the portfolio is well-positioned today, and, importantly, for the next three to five years.

4. How would a more inflationary environment affect your portfolio? Are you concerned about the impact of rising rates?

Inflation impacts the portfolio in two ways. We think about it in terms of “Wall Street” and “Main Street.” On Wall Street, the impact is straightforward and mathematical, with future cash flows discounted at higher rates. Said plainly, multiples have compressed. The more interesting and nuanced implications are for Main Street. Here, we are vigilant in studying consumer behavior. A key risk in this environment is reduced purchasing power.

Our research and experience show that financially sound companies that can self-fund their growth and are less reliant on external financing are well-positioned to adapt to this type of environment. Having financial flexibility allows companies to weather storms and be more offensive versus competitors, continuing to enhance their value propositions for their customers. Meanwhile, a high-quality brand and the ability to deliver value to customers often come with pricing power. Companies with these characteristics are typically led by skilled management teams that allocate capital effectively.

Sectors that traditionally do well in an inflationary environment are commoditized industries such as energy and materials. These are not areas of the market that typically fit within our guardrails; however, we believe the portfolio offers an alternative to this cyclical exposure that, in our minds, carries inherent and outsized investment risk.

Instead, we invest in businesses that we believe can compound earnings through the cycle, that are well-capitalized with strong pricing power and consistent earnings and profit growth. We believe these types of companies offer our clients an inflation hedge, as well as an opportunity to prosper well into the future.

5. What would you say to investors who wonder how Global SMID should fit into the context of their wider portfolio?

Many investors are familiar with U.S. or European small-cap strategies but may not have considered the benefits of a global approach to small cap. The Polen Global SMID Company Growth strategy offers both access to the global markets and the growth potential of smaller, earlier-stage growth companies with a long runway of opportunity. These companies may or may not be familiar by name, but we believe many of these companies have the potential to be tomorrow’s leaders.

The vastness of the opportunity set is exciting to us as we seek to identify what we believe to be the best growth businesses worldwide. The inefficiencies of the asset class leverage the strengths of Polen Capital’s active and time-tested investment philosophy.

You can learn more about the Polen Capital Global Small and Mid Cap Fund here.