Aura High Yield SME Fund: Letter to investors 09 September 2022

The RBA has raised rates for the fifth month in a row bringing the cash rate to 2.35% with the expectation of reining in inflation by the end of the year. Largely in line with market expectations, the RBA raised the cash rate by 50 basis points. This is the highest cash rate since early 2015.

Monetary Policy Decision 1

The pace at which the RBA is raising rates is the most aggressive since 1994. With inflation set to peak later this year according to the monetary policy statement, the RBA has indicated that further rate rises will be necessary in order to bring it back towards the 2%-3% target range.

The bank’s central forecast is for inflation to be around 7.75% over 2022, just above 4% over 2023 before returning to the target range at 3% over 2024.

Uncertainty continues to cloud the RBA’s plans as most countries battle rising inflation, the Ukraine conflict continues and COVID-19 containment measures in Asia cause disruption on a global scale. Back home, prices are continuing to rise with strong demand, and we are dealing with a very tight labour market, upward wage growth and capacity constraints.

Household spending remains a key swing factor. With the full effect of interest rate rises not yet felt by mortgage borrowers, the extent to which the rate hikes are working is yet to be proven. Some indicators are beginning to slow down, with consumer confidence pulling back and housing prices significantly falling across the states and territories. The imbalance between supply and demand is evident as household spending remains strong, despite a slowing housing market and significant pricing pressures across household supplies and mortgages coupled with a tight labour market where upward wage growth is occurring.

With some market indicators responding to the cash rate increases and others remaining solid and steady, the RBA remains uncertain about how hard they will have to raise interest rates to reduce the current 6.1% inflation rate. The RBA has stated that the further increase in rates this month will help rein in inflation and create a more sustainable balance of demand and supply within the Australian economy. The lag in data also makes it difficult to determine the actual effect of rate rises at this stage, given the RBA has rapidly ratcheted rates over the last five months.

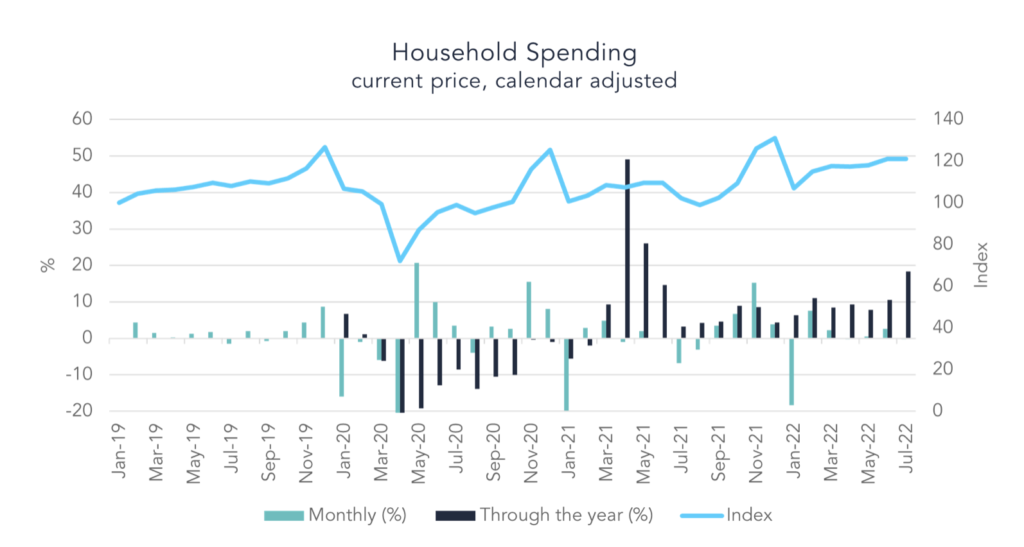

Monthly Household Spending 2

For the year through to July 2022:

- Household spending increased by 18.4%;

- Household spending increased for both goods and services by 28.4% and 9.5%, respectively; and

- Both discretionary and non-discretionary spending increased by 19.8% and 17.1% respectively.

July was the 17th consecutive month of annual increases in total household spending, with increases recorded across all spending categories.

Throughout the year, household spending increased across all nine categories with the largest increases being:

- Clothing and footwear up 45%.

- Transport up 35.4%.

- Hotels, cafes and restaurants up 34.9%.

This is off the back of extended lockdowns and significantly reduced COVID restrictions. Household spending increased throughout the peak of the pandemic allowing for greater spending opportunities over the past year.

Similarly, all states and territories reported increased household spending for the year, with the following reporting the strongest increases:

- NSW up 39%,

- SA up 23.9%,

- QLD up 14.8%

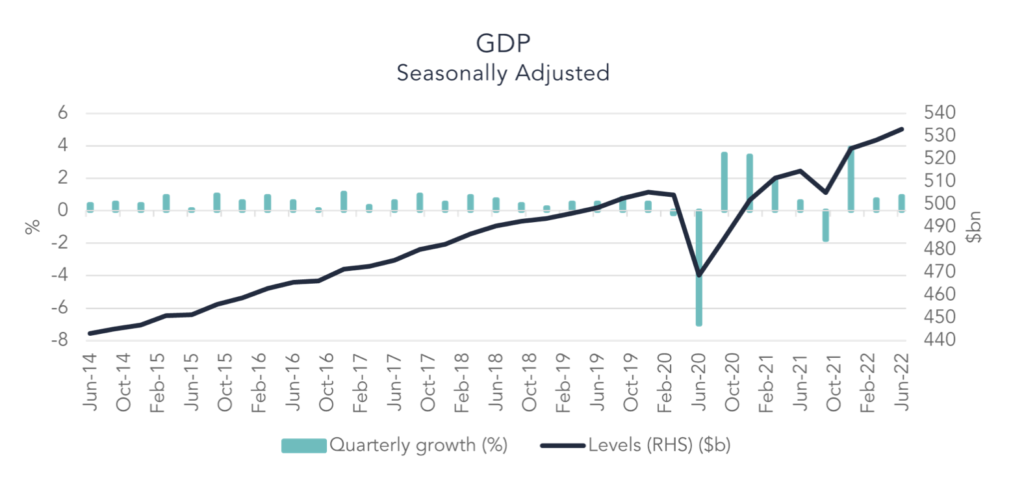

Australian National Accounts 3

For the June 2022 reporting period:

- The Australian economy rose 0.9% in seasonally adjusted chain volume measures.

- GDP rose 3.9% in 2021-22.

- Term of trade rose 4.6%.

- Household saving ratio decreased to 8.7% from 11.1%.

Household spending and exports were the main contributors to the June quarter growth, adding 1.1% to the rise in GDP. This is the third consecutive quarter of reported economic growth, which followed a contraction in September 2021 as a result of the Delta outbreak at the time.

Household spending was largely attributed to travel-related activities both domestically and internationally. The household savings to income ratio, on the other hand, fell for the third consecutive quarter given the increase in household spending outpaced the growth in household income. A 1% increase in household gross disposable income was a result of increased wage growth as well as growth in employment with a 0.9% rise over the quarter.

Exports also contributed 1.1% to GDP growth with both agricultural and mining goods and services exports. Services rose by 13.7% as international students returned to Australia. Imports on the other hand detracted from growth as Australians began to travel abroad once the travel restrictions were lifted.

Again, a lag in the data makes it difficult to determine the true effect higher interest rates have had on slowing household spending.

Portfolio Manager Commentary

Data from the RBA and ABS demonstrated that rate rises are beginning to cause some contractionary shifts in the market of the RBAs monetary policy decisions to date. Household spending remains strong and wage growth is consistent. As such, the RBAs decision to introduce another 50-basis point rise was no surprise. The RBA is advising that further rate hikes will be necessary which will directly flow through to the interest rates we charge to our lenders.

We are getting our funding pipeline set for this month. Lenders are continuing to fund high-quality loan opportunities which can be a challenge in the current market. We look forward to sharing our monthly results with you next week.

1 RBA Monetary Policy Decision – August 2022

2 Monthly Household Spending – July 2022

3 Australian National Accounts – June 2022