Arrium Limited

Fifteen months ago we wrote a piece on a not so favourite stock, Arrium Limited (ASX: ARI), and tried to explain why it was in such poor financial health.

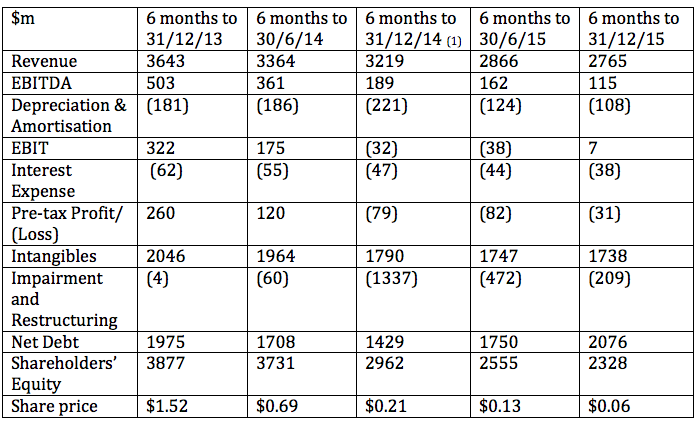

As part of Montgomery’s remit to assist with the financial education for our investors and readers we believe the Arrium Limited example, particularly over the thirty months to 31 December 2015, is instructive in using fundamental financial data to avoid a front-page newspaper disaster.

Observations follow:

- Despite raising $756m through a deeply discounted 1:1 rights issue at $0.48 per share in September 2014 (1), Arrium’s Shareholders’ Funds have declined from $3.877 billion to $2.328 billion in the two year to 31 December 2015.

- As per the link above: “the company said $732 million (of the September 2014 rights issue) would be used to reduce debt, which stood at $1,708 million at 30 June 2014. This was more than triple the earnings before interest and tax (EBIT), from continuing operations, in fiscal 2014 of $530 million. Pro-forma net debt would therefore be cut to $976 million, assuming the operating environment didn’t get worse”. When the net debt figure for 31 December 2014 came in at $1,429 million, or $453 million higher than the pro-forma number, I believe alarm bells were ringing loudly for even the most optimistic shareholder.

- The disastrous fundamentals continued over the twelve months to 31 December 2015, with net debt jumping $647 million to $2.076 billion, while Shareholders’ Funds declined $634 million to $2.328 billion

- Impairment and restructuring has been a constant with this figure aggregating to $2.082 billion over the thirty months to 31 December 2015. Despite this, Intangibles have declined by only $308 million from $2.046 billion to $1.738 billion over the two years to 31 December 2015.

Readers should be aware that management tend to treat “impairment and restructuring” as “one-offs” and severe this figure from “normalised earnings”. In a declining business, I believe this is rarely the case.

To think – some investors said farewell to their Arrium shareholding at $6.00 per share in mid-2008 – and now the administrators, Korda Mentha, will be working hard to save 5,000 jobs at the Whyalla Steelworks.

To learn more about our funds, please click here, or contact me, David Buckland, on 02 8046 5000 or at dbuckland@montinvest.com.

Net gearing increased every year from 2010 and ROE was rarely much above 10% from 2004 onwards. Out of interest I just looked up a Value.Able valuation of Arrium I did in 2013 which estimated 2013 intrinsic value to be around $0.75, with a forecast intrinsic value of $0.02 in 2014, $0.11 in 2015 and $0.19 in 2016 (without the benefit of knowing future developments, which arguably justify the continued share price decline). At the time, with the SP nearing $1.50 I shared the valuation with a close friend who being an employee had a decent size holding, and suggested they might want to investigate the balance sheet further. I’m not sure if they did investigate, but they kept their holding, at first saying they expected the share price to recover to $5-6 and later (in 2015) that they had lost so much on it, there was “no point” selling. In hindsight, it seems ARI was somewhat of a time bomb.

Yes, and what a time bomb it has been for the 5,000 Whyalla staff!

Very unfortunate for staff and contractors who rely on Arrium for employment. One would hope contracts and entitlements are honoured to the fullest extent.

A sad yet inevitable situation. Surely any deal that can be found can only be short term and is doomed to delay its eventual closure?

Although I read that now they are being swamped by offers, I wonder how many of these will result in actual orders being completed. Should a company stay alive, even if un-competitive on price, based on customer’s good will?

There is an argument to say that every country should produce at least some steel, for defence projects etc so we aren’t reliant on overseas materials.

We have huge amounts of iron here in Australia and yet it’s cheaper to ship the iron to China and then they ship back steel?

Tristan

Thanks Tristan,

I think the problem is if a business is uncompetitive over the very long-term, then failure is more likely.

That is tariffs and government support won’t necessary go on for ever.

And a poor balance sheet just accentuates any difficulties.