Aristocrat buys Video Gaming Technologies

As already announced to the market, Aristocrat Leisure Limited (ASX: ALL) is preparing to undertake the biggest acquisition in its history, with an AU$1.494 billion all-cash takeover of US-based Video Game Technologies (VGT).

On the day of the announcement, we spent a number of hours researching and questioning management in order to better understand the deal. The outcome of this research was a clearer understanding of the acquisition, and a conclusion that the assets under consideration were of high quality and meaningfully better than Aristocrat as a standalone business.

In VGT, ALL can probably see what we can. Revenues are 100 per cent recurring and they are operated under medium-term contracts. They offer the chance to materially diversify products and revenue sources into new areas, whilst providing cross-sell and R&D sharing opportunities. To put VGT’s recurring revenue into perspective, ALL has just 15 per cent of its revenue generated on a recurring basis.

Just as important, because ALL and VGT operate in largely segregated markets, we also feel there is a low chance of any cannibalisation of future sales in ALL or VGT, nor is it likely for any brand confusion to occur.

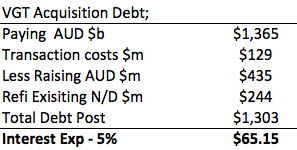

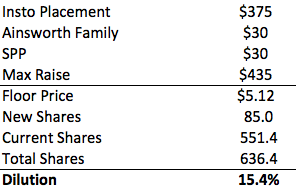

We then spent considerable time modelling the acquisition, which is being funded as follows. The deal will effectively result in ~15.4 per cent dilution to the existing business, and the creation of a new US$1,400b debt facility to consolidate all existing debt under one facility. This will also provides some head room for working capital.

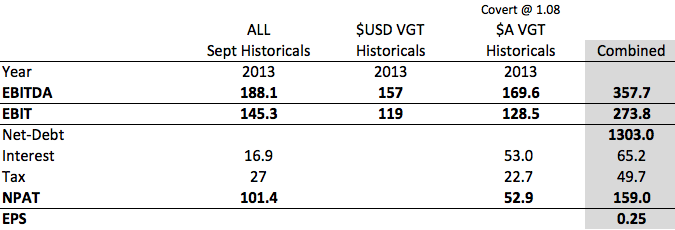

For AU$1,494b, ALL is purchasing VGT’s historical EBITDA of US$157m and EBIT of US$119m. When compared to ALL’s 2013 EBITDA of AU$188m and EBIT of US$145m, the size of the deal is clearly material.

As a starting point, the two together produce an EPS of $0.25 on 636.4m shares, as demonstrated below.

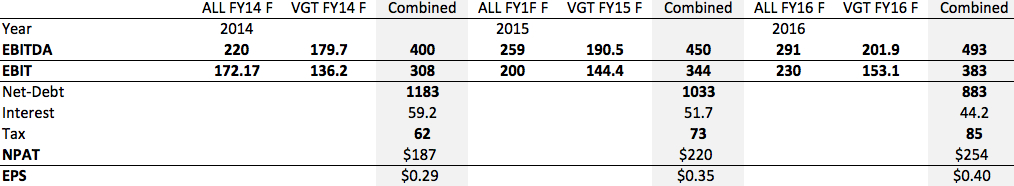

Taking this modelling further, we used current consensus numbers for ALL and then applied a 6 per cent CAGR to VGT’s numbers to account for: fee revenue growth, significantly increased scale and opportunities across gaming products for the combined group. All combined, the following picture resulted and a discounted cash flow (DCF) valuation of $5.90 versus an offer to participate in the $375m institutional placement was produced.

We saw a quality, 100 per cent revenue-recurring business under consideration with reasonable growth prospects at an 11 per cent discount; and collectively made a decision to participate in the raising. This potentially sees a 15.4 per cent dilution, but a much bigger business created.

The Montgomery [Private] Fund holds shares in Aristocrat Leisure Limited.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Iv noticed since the announcement that ALL’s share price has risen about 7% and AGI’s has fallen about 5%. Would the acquisition made by ALL effect the long term prospects of AGI? It will be interesting to see how these two unfold over the years…

Thanks

Tom

Don’t take your cue from prices!

Hi Russell

Just a question regarding DCF analysis, I have read a number of books that all use a different value for “g” (the terminal growth rate) in the DCF calculation. I was wondering what you guys at Montgomery use and why. I assume it is done on a case by case basis.

Regards

Pleasure Scott. The more you read, the more your mental networks will develop and overtime, it will become natural to know which way and which methodology is best to apply when tackling an investment opportunity. Never forget the first rule though: it has to be a quality business and one you can understand quickly.

I really enjoy reading your articles that detail how an analysis is done and the mechanics of making an investment decision.

Russell, thanks for making us all better investors.

All the best

Scott T