Titan Energy Services Limited

Appearing recently on Your Money Your Call, my fellow panelist recommended Titan Energy Services Limited (ASX: TTN), due to the strong growth in the Queensland coal seam gas industry. Titan’s share price has traded between $0.40 and $3.70 since its listing in late-2011, and at the current $2.13 it has a market capitalisation of $108 million. With only $11m of net debt (at December 2013), the enterprise value is $119m.

Titan provides services to the oil and gas, mining, pipeline, road and infrastructure sectors. Its main division, Atlas Drilling, provides coal seam gas drilling services from three company-owned and one leased production rigs. The rigs are located in and around the Surat Basin area. The Resources Camp Hire Division has grown the number of available rooms for hire from 674 to 1138 over the past year. These two divisions account for around 80 per cent of the company’s revenue and the Hofco Oilfield Equipment Services and Nektar Remote Hospitality (catering, waste and water) accounts for the balance.

Last week, Titan announced a cut to its earnings before interest and tax (EBIT) guidance to $18.5m for the year to June 2014, on the back of a delayed camp contract, lower camp room rates and the unexpected cancellation of a drilling contract for Atlas Rig 3. This was down around 15 per cent on previous expectations ($22m). EBIT was nevertheless up $4m (or 28 per cent) on the year to June 2013 ($14.5m).

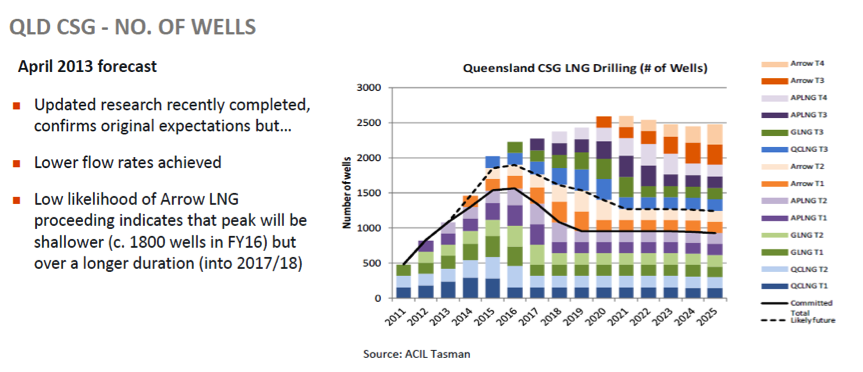

Montgomery grasps the growth opportunities available from the CSG sector over the next two years (see Figure 1 below), and we believe Jim Sturgess has done a fine job in transforming the company since being appointed Managing Director three years ago. We are, however, somewhat cautious when it comes to the short-term nature of Titan’s drilling contracts.

The following is an extract from the company’s latest trading update, published July 10.

“In the Atlas drilling business, Rig 1 is contracted until the end of August (2014), plus a three-month option. Rig 2 has just been re-contracted for three months, plus a three-month option. Rig 3 and Rig 4 are currently being marketed to prospective clients”.

Figure 1