Are your profits recurring?

With school holidays well and truly underway, plenty of my peers are also taking a few days off here and there to take their kids to the football finals, duck up to the beach or entertain. That offers plenty of time to review your portfolio with recurring profits in mind.

With school holidays well and truly underway, plenty of my peers are also taking a few days off here and there to take their kids to the football finals, duck up to the beach or entertain. That offers plenty of time to review your portfolio with recurring profits in mind.

Stability and predictability are two key words that many investors are unlikely to have heard in recent times and two important components of the ‘toolkit’ that may have gone astray. But at all junctures of the business cycle, stability and predictability are helpful investment partners.

Irrespective of whether you are building a portfolio from the ground up or are reviewing your current holdings, it is vital that you ensure your portfolio is always pointed in the right direction. Few, if any are able to reliably and predictability predict short-term share prices so there is relevance, if not necessity, in ensuring the very best opportunity is given to your portfolio. When a recovery transpires and investors are willing to accept risk again, the portfolio constructed from businesses with some stability and predictability to their revenues and earnings streams will have an excellent chance of outperformance.

While there are many definitions of what constitutes ‘stable’ and ‘predictable’, in terms of business analysis, recurring revenue would be the one I would use. And if you built a portfolio of such businesses, would it matter if this week a country defaulted on its debt or another had its credit rating downgraded? These issues are both temporary in nature and only likely to impact share prices, not the economics of the business.

Long-term contracts are the best form of recurring revenues and these contracts take many forms; There are of course the obvious long-term contracts, such as a mobile phone plan, internet or TV subscription, a car lease or a property tenancy, but less obvious are the long-term contracts we have with our own bodies to feed them, clean them and take out the waste. We have a long-term contract with our teeth, our cutlery and our toilets and these contracts ensure Coles and Woolworths, Kelloggs, Procter & Gamble and Kimberley Clark have millions of customers buying their consumables frequently and with monotonous regularity. In other words – recurring revenue.

Knowing that a percentage of revenue can be relied upon to come in the door each year allows a business to budget, rewarded staff consistently and plan expansions with fewer surprises.

And if you are buying a small piece of such a business, you can sleep more comfortably at night ‘knowing’ that your share will always have value even if the share price halves or worse.

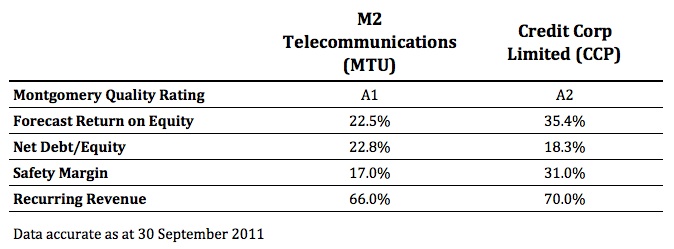

The following two businesses are examples of companies we hold in The Montgomery [Private] Fund, and that we believe display the characteristic discussed.

M2 Telecommunications is a reseller of telecommunications equipment and services into the $6 billion SMB Telecommunications market. While dominated by Telstra (ASX:TLS) with 80 per cent market share, M2 is the seventh largest Telco in Australia with a 4.5 per cent share.

Two thirds of the business’s revenue is recurring via traditional fixed voice services, mobile (phone and broadband) and wholesaling services. Typically, contracted revenue is on 2-4 year terms giving management a significant amount of predictability.

It is due to this predictability that management have forecast 15 per cent earnings growth for FY12 and have the ability to self-fund a couple of large acquisitions, which Vaughn Bowen has moved aside from day-to-day duties to focus on.

Credit Corp – With new management installed and a demonstrated focus on transparency and sustainable growth, 70 per cent of collections are now on recurring payment arrangements.

This frees up collection staff to focus on those clients that are finding it harder to repay their liabilities and drives efficiencies across the group. Not only this, but the degree of certainty has allowed management to invest in even more self-funded ledger purchases and forecast earnings of $21m-$23m in FY12.

Additionally, the businesses offer the following financial metrics:

High Montgomery Quality Ratings (MQR), high forecast ROE’s, low debt levels, a Safety margin and high, recurring revenues have attracted us. After conducting your own research and seeking and taking personal professional advice, I’d be interested to know whether these companies or any others meet your recurring revenue test.

Go ahead and use this blog post as the beginning of a thread listing companies with solid recurring revenue and earnings.

Given the time to be interested in stocks is when no one else is, now is the time to go through your portfolio and determine those holdings that have a component of revenues that are recurring.

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 stock market service, 30 September 2011.

A bit off topic here but in all reality why do we still follow the lead from wall street?Why don’t you guys start spreading the word around to the big super fund managers and funds of funds to stop selling and being pussies and start pushing the market up. Maybe other nations will follow our lead.These are the guys that are destroying our wealth.If one were to look at unemployment and all other economic indicators then you’d see why Australia is in a much stronger position than any country in the western world but yet there are no leaders among us who have the courage to lead the way but instead follow the gullible,ludicrous and comical leads from wall street.Where are the fund managers with balls of steel.The market is still cheap and 5000 should have been a minimum today.Who cares about the debt laden countries. We are the real leaders and everyone else will and should follow.

Hi Mark.

The contrary opinion would be that if you KNOW the market is cheap you will want it to remain cheap for as long as possible so you can load up on quality stocks. Makes sense no? Many people would argue that the “experts” do this all day every day and so we cannot be beaten. My opinion is that fund managers and other insto’s, who rely on this for a living are unfairly bound by several factors. Some are bound by the constraints of the fund themselves. They have to buy top 20 or 200 stoocks. They have to weight their portfolios in a certain way whether they think the stocks are worth it or not. Also, they are frightened of losing their jobs, and so will often sell good stocks to preserve capital and show a return each quarter. Or at the very least, show that their returns are no worse than anybody elses. Since these guys control the majority of the market you should use this to your advantage. Of course, if your time frame is less than 5 or 10 years then this could be a problem. If not, then this is an opportunity. Personally, I hope that the market doesn’t rise for the next five years. But that’s just me.

Hi Marc

It would be nice if “other nations” follow our lead,however its mostly other nations (nationalities)and short sellers that are doing the main selling on our markets.

They can rarely be beaten.

Cheers

Zoran

Roger

I have been re-reading some of my investment books over the last few months. It is interesting when comparing the methods of some of the great investors such as Peter Lynch, John Templeton, Anthony Bolton, Philip Fisher and, of course, Warren Buffet: each employs his own methods for calculating value but what they all have in common is searching for great companies with a competitive advantage. It is both a qualitative and quantitative approach.Their tireless research and disciplined approach in buying value is what seems to contribute to their fantastic performance.

This blog “Are you profits recurring” is a timely reminder to research the quality and continuity of the revenue stream in addition to checking that revenues are increasing and margins are improving. Yet again, a thought provoking blog. Applause! Grant

Thank you very much Grant.

Another 3 months have passed since MCE year end and still no announcements in respect of new work. Not really living up to the hype are they ?

Peter

So perhaps the next announcement if not a large order win, needs to be a profit guidance update?

Hi Roger

Thank you for explaining on YMYC how MCE was bit “economical” with bad news and over

excited with good.

Picture is much clearer.

I have today removed your photo from my dartboard.

Cheers

Zoran

Delighted to hear it.

Hi Roger,

Are you sure MCE needs orders of $114m in the next few weeks to meet it’s guidance? For contracts, revenue is recognised under the percentage of completion method. Your assumptions seem to be based on them needing to fully complete an order before any revenue is recognised. With expanded production capacity, they may also be able to reduce the amount of time it takes to complete orders. A lower AUD won’t do any harm either to revenue.

I am not saying they will necessarily meet guidance, I am just disagreeing that it is already determined that they won’t.

No. As each day passes, they need even more than that now, to meet FY12 guidance. They told me if they need to retool it can take eight months to complete an order and even longer to get paid! You are right on the adopted revenue recognition technique but it’s cash flow not accounting rev that got them here. If they don’t need to retool they can complete an order in 1-3 months less time….so either way it’s coming down to the wire. I do hope something’s comes down the pipe soon.

Hi Michael

In my view they wont meet guidance I think……………….

just get over it.

Look further out in my view.

We are still looking for the businesses in the right space longer term…………Nothing has changed here…………

Good points.

I tend to agree with Ash. The ‘big picture’ still looks bright, but there a couple of question marks over management….I’m inclined to put them down to inexperience in the public sphere rather than incompetence or dishonesty. I expect they will miss their only recently issued guidance and I suspect the share price will be dealt with harshly. I must admit, I was sorely tempted to buy some more last week but I do have enough already (would have made a quick 30% if I had though!).

If (IF!) they perform to expectations over the next few years – Henderson running at or close to full capacity – then recent prices will look outrageous and those selling recently will wonder what they were thinking. Still, there are a few ifs and maybes so it is a case of caveat emptor before you carpe jugulum with this one.

In my opinion.

I note one of the Directors (Paul Wright) bought $130,000 worth of shares today (Wednesday). Maybe he knows something that is coming up?

Steve

Yep saw that Steve.

He already owns about 2M shares so this is not a big addition but rather see him buying than selling

Thanks

MCE Directors Share Transactions (Direct & Indirect)

Only 1 3Y notice has been lodged since Oct 2010

This is for Paul Wrights Super Fund

Which bought 42,366 shares for $130,382($3.23Ave)

In 2010 during Sept & Oct

Aaron, Max, Paul

all sold shares to exercise 1,000,000 options at .60c

For instance Aaron

Sold 700,000 shares for $2,765,00($3.95)

Bought 1,000,000 for $600,000 ($0.60)

Taking 2.1M away

The other 2 directors had very similar transactions

Only one has choose to buy again

Which does show some hope

Although it is less than 1% of the total holdings

Regards

Macca

Y

I have been re-reading the Essays of Warren Buffet and a line in that reminded me about my stance in regards to MCE since i first heard about it and especially during December last year or January this year when it was hard to discuss any company on this blog that wasn’t MCE.

“I would rather be certain of a good result than hopeful of a great one”. This was mentioned in a paragraph basically surrounding the whole “i don’t understand it so i can’t value it, if i can’t value it i will stay away regardless of the potential prospects” type of discussion. As i have no idea about this market i have always stayed away from the company and while some saw it as a kind of holy grail of company i thought any investment i made in it would be speculating, so better yet to avoid it and if it is a massive success than congrats to those who took the chance.

I have read comments from people who follow this company that state that whilst MCE are not getting many orders through, neither are their competitors. I agree with Roger, that if they don’t get orders through and can’t there for live up to any guidance (if there was any) they have made in the past they should let everyone know.

Roger

Question, When is enough enough?

I’ve been accumulating FGE over the last year or more and now find it makes up about 15% of my portfolio and is overall showing a small loss. On my figures it looks a great buy and is undoubtedly an A1 company. Better than many others in the portfolio.

The question is a general one. Do I stick to the principle of re-balancing the portfolio in proportion of margin of safety or do you have another principle that will limit the holding in a single company, the risk/concentration becoming to great. When is enough enough?

Hi Roger,

I can’t offer any advice but I can tell you that our maximum initial positions are lower and I think the value investing community here may have a thing or two for you to consider. You should consider personal professional advice.

Roger,

I agree with RM’s comments but I also adopt an approach that with the small cap companies as compared to the large cap companies with the same ROE, MOS, Debt etc it sis prudent to take a much smaller position as they are unproven companies and have not yet generated sustained ROE over many uears.

That is why they fall further in bad times and as they go through their business cycle IV’s and thus MOS will vary dramatically.

I lhad 9% in MCE and gtot stung by much more than the cost of the book like many other bloggers with other small cap companies but it is a lesson well learnt and it won’t happen again.

Hi Kent,

Just my view but you should never make your investment decesion on price action.

These small caps get sold of but insome cases the value does not change.

I never mark my weath by what the market says.This is both on the up side and the downside.

If MCE does not need to raise capitial they are very very cheap….2013 price is more than double from here……..If you do your research there are lots of orders coming……..I just hope you have not sold out too soon…………..Patient is the key here.

Cheers and best of luck

Thanks Ash, I believe I have invested in better stocks with the same MOS etc etc and I buy on value not price, always appreciate your comments and good lck with MCE

Hi Ash,

I think the problem with MCE is that they appear to have been less than honest regarding what their situation is. It may be inexperience in dealing with shareholders, but in any case hopefully they will have learnt to keep shareholders informed.

I must admit that it raises a question in my mind about the benefits of talking to management when making an investment decision – scuttlebutt etc etc. I would be interested in your views.

The problem for some here with MCE is the steepness of the decline. As I have mentioned, if you bought at the capital raising or thereabouts, then you are needing more than a doubling to get back to your initial purchase price. Some may take confidence from your 2013 value, but there are a couple of serious “ifs” in your assessment – if they dont need more capital and if they get the work. 2013 appears a long time to make it back. I hold my MCE and will do so, but only until it becomes apparent to me that I have made a mistake and they are not the company I thought they were. Maybe it is better to sell and then reinvest somewhere that appears more secure?

regards

Steve

Hey Steve,

Hope things are good in Japan, I worry for you guys and I hope it is all good.

On MCE most who did their research will realise that earnings are lumpy……..If you have a look down the pipeline then lots of orders are coming……I just can’t tell you when…2012 may be dreadful so may 2013 but they are in a good space and things will be very good in the future………….just my view………

Hey Ash,

Thanks for the well wishes. All is as good as can be expected when it’s Japan. One day this country will decide that profits instead of market share is important and only then will it be worth making some investments.

I agree about the lumpy earnings and the longer term outlook. But as I said this makes it timing the purchase critical. I have made purchases in the past only to see them drop and in many cases this cant be helped, but the decline in MCE is very large. I think it highlights Buffett’s emphasis on steady or increasing earnings.

I hope all is well out west. I miss Queensland and Brisvegas.

regards

Steve

Roger as a general rule I never have more than 9% in a single asset class. ATM gold is 9% of my portfolio and that is as high as it will ever go. If you are sitting on a pile of cash or have large term deposits that you keep rolling over then you already have a principle that limits the risk of holding a single stock, albeit one with a MOS >50%. If you feel the need to hold more than 10% in a single company you may want to talk to some ex Valueable investors that “bet the farm” on MCE at $8.50 per share, margin loans and all. Sometimes its the slow and steady accumulation of A1/A2 stocks across a variety of sectors that will over time consistently beat the market 9% p.a average return.

Hi Roger

I find that 15% is good when youI have 6-7 stocks in your portfolio,but if you have 15-20 stocks than 5% to 7% of portfolio in each stock is good.

My general rule is : the more stocks in portfolio the smaller the percentage in each.

Cheers

Zoran

Roger, “When is enough enough”

I noticed a LIC with 35% holding in one company, although it was a capital return arbitrage.

I’ve had a few similar ones (RHG WPG) up to 15% which usually reduce in a short time frame.

Main things I look at are low debt, good earnings and reasonable dividend, with about 6 stocks at about 10%. If any somehow go above that they are reduced.

Shares that do not meet that criteria, small caps, low volume traded,\would be under 5% weighting.

Dividends have recently come up here and more often in recent discussions and fund managers’ presentations.

They might contribute a large part of performance for the next few years.

John W

Roger,

Why do you keep pushing CCP?

It has not been enough for you to have been burnt once?

Regards,

Delighted to discuss any stock. Dont “push” any. If you have a different opinion or insights about ccp or any stock, it would add to the blog to share.

Last week I attended an investiture luncheon as a guest of a mentor and friend who was appointed to the Order of Australia. Amongst the many things I have learned from my friend through my working life is the importance of not questioning people’s motives. I have been victim of this and there are few things that I have seen or experienced which more quickly break down working relationships.

I note, in the message below the box that I am currently typing into, that Roger wishes to ensure that the ‘highest levels of integrity and comaraderie’ are maintained on this blog. During a particularly difficult situation at work, my friend referred often to the motto of the Most Noble Order of the Garter (the highest order of chivalry existing in England, established in 1348):

Honi soit qui mal y pense (Old French: shame upon him who thinks evil upon it)

May we therefore uphold this motto!

Excellent comment Ken. It’s comments like these that ensure that the Blogs are of A quality and not C “quality”. And this blog appears to be A quality.

There are so many unpleasant blogs on the net – ones that I never revisit.

PeterB

On the topic of long term contracts. MACA Limited (ASX:MLD) is an interesting one.

Average contact length is nearly 4 years. Order book at $1.3bn (yearly revenue currently ~$250m) with some contracts running all the way to 2020.

This appears to be a bit of a rarity in the mining services industry and one of the things that attracted me to this business.

MACA is interesting. As you note, it has long term contracts, but with relatively unknown mining companies. What happens if the distal end falls out of minerals prices and those companies get into strife or certain projects become unviable?

MACA has a small increase in revenue contracted already for the current year so there is a reasonable chance that they’ll get some more before the end of the financial year. Certainly well worth a look at the right price IMO. I don’t actually own any at present.

Hi Roger,

Thanks for the interesting post.

Looking at the true company cash-flow for M2 & Credit Corp, CCP is the stand out for me with positive cash flow of $24M, M2’s $2.2M negative according to my figures.

Companies that I’ve looked at recently that have also done well (in terms of delivering solid 2011 company cash-flow) include:

1. Acrux (ACR) at $64Mil,

2. MACA (MLD) an old favourite at $13Mil,

3. Oroton ($17M) and

4. K2 Asset Management (KAM) at $23M .

These businesses also have good ROE,

At the other end of the scale, QR National’s report in early Sept looked nice and glossy, but the figures certainly were not, delivering company cash-flow of negative $386M. Not one for me and many of the folk on here I’m sure..

Still keen on researching more on DTL, which I like a lot and I’m a fan of Matrix (with the current MOS) mainly due to the potential of Henderson, now it’s fully operational.

Thanks Again,

Mark H

Are the ROE figures the wrong way around for MTU and CCP? I am getting the exact opposite!

Also see you blog post below: Would a dash of income and yield help you survive? MTU and CCP have their ROE mixed up.

I’m puzzled as to how CCP is forecasted to have a 2012 ROE of 35.4%. As at June 30th 2011 they had Equity $104,341,000 and Issued Shares 44,875,000. I make that a BV of $2.32. CCP is forecasting an undiluted 2012 EPS of 46c-51c. If they achieve the top of that range, that only gives an ROE of 21.98%. They would have to achieve an EPS of 82c to make an 35.4% 2012 ROE based on their BV as at July 1st 2011.

Roger, I find that most subscription services have occasional mistakes in their calculations and get shares mixed up sometimes. With the A1 service will we still have to do our own calculations to double check? I suspect we probably will. However, I know I make more mistakes than any subscription service and it takes me a lot longer.

We use arguably the worlds most trusted (and certainly the world’s most expensive!) data. And then we employ a full time data integrity officer just to be sure. We are delivering the best, to be the best. Simple recipe.

So Roger, are you saying the figures in the Blog post are correct?

Roger, Thanks a lot. Brilliant, I can hardly wait.

Talk about recurring profits. Here are all the Buffett Partnership letters from 1959 to his retirement in 1969. Makes for great holiday reading.

http://www.ticonline.com/buffett.partner.letters.html

CCP is a bargain..

I bought a handbag yesterday (for my wife!) at the Coach concession in DJ’s Bourke St Mall. Here’s the scoop courtesy of the two lovely shop attendants there:

1. Business is good esp when on sale which is often;

2. They see Oroton as their no 1 competitor. Similar price point, competitive design, well marketed and good customer service;

3. MIMCO offers little competition, design average and merchandising confusing. Poor customer service but same price point as ORL and Coach.

I’ll let you know if the bookkeeper lets me deduct the purchased item – ( market research ?) which will be unlikely !

Great work Brad and thanks for sharing your insights here. Please buy Oroton next time!

Will do, if it matches my outfit….

Interestingly I asked them “who is your no 1 competitor” straight away they answered Oroton and rattled off what impressed them as I outlined. No leading questions from me.

They were prettty unimpressed with mimco.

Will pass it on to Sally. Actually don’t need to. Sally will see it.

You should see me at La Senza, can’t get me out of the store

Roger when you talk to Sally Ask her How the new stores in HK, KL & Singapore are going, Many of the worlds top brands are opening up in this area for the “rich in Asia”,

I believe Orotons move into this market could be a major inflection point .Maybe Doubling profits in 4 to 5 years

Go Sally; Go Super Sally

For me Oroton rates as well as MTU & CCP

I hold shares in all 3 stocks

Regards

Macca

The Asian stores are currently losing money. Not surprising given the Oroton brand is unknown in Asia. Expect this to fail.

Peter

Peter, I don’t hold ORL but have previously done some reading and investigating. I recall reading in the 2010 annual report that Sally was very positive about the entry to Singapore. Your comment has reminded me to read the latest annual report! I’m not much of a shopper (particularly for handbags)but I was impressed last year by the various outlets on Orchard Road and at Marina Bay Sands Resort. I was glad I kept my wallet in my pocket (and that my wife kept her purse mainly in her handbag). No doubt premium locations catering to a particular clientelle to whom brand means everything and pricepoint is less of any issue than it is to me! Glancing now at the 2011 Investor Presentation ORL note, with respect to their Asian stores: ‘momentum in customer database growth and celebrity interest’. Sounds positive to me but I will read on.

A store in these types of locations is, in itself, a (the?) major advertisement of the brand – good place to start anyway!! I remember quizzing my secretary about Oroton – said she couldn’t afford to buy one (i.e. a handbag) but would if she could. Then she said – investigate “Guess”. I’d never heard of “Guess” but ‘guess’ what – I later recognised the “Guess” store in Ion Mall Orchard Rd. I could later understand why Oroton established a presence there.

Hi Roger, Macca,

Business in Asia is different to business here.

You have to advertise heavily, and do a lot of marketing,these are expensive items. You are locked into rents of 3,5 or 10 years and if you are starting out and not achieving good sales,it draws on capital from other sources. I wish them well in Asia but I think it will take time to break even.

Great to get some input

I agree there is a lot of risk When you move overseas

The next year needs to be closely monitored

Peter

Where did your info come from

I thought HK was profitable

All other stores losing (as would be expected)

Thanks

Macca

Hi Brad, Roger

I have heard numerous other comments that Mimco aren’t really relevant. A common term i have heard regarding Mimco is “i just don’t get what they are trying to be” so i guess this falls straight into the confusing merchandising comment.

I think one thing that Oroton in Australia has going for them i sthat bigger overseas brands that have similar products might not see it as that much of an attractive market (small population, distance etc) and have only token merchandise in DJ’s. Oroton is then allowed to invest on having a superior supply chain and distribution and have gained a significant foothold.

I think there are some new product lines that oroton could diversify into but they don’t appear to be doing so.

Nice bit of scooping Brad. Not surprised with what you found but it helps knowing that my experiences and opinions are being backed up by others.

Thanks Andrew. Distance and population hasn’t stopped Zara and others, but it may cause the less efficient to reflect before embarking on competing.

Lew Frankfort as taken Coach from a small leather goods manufacturer to a global brand with $3bn in sales, over the past 30 years.

Sally McD has transformed Oroton from a sleepy local Australian brand into highly recognized luxury accessories company expanding into Asia, the worlds largest luxury market.

MIMCO is owned now by private equity. Does it now have the same drive, soul? Many say not…..

You have to invest in superstar managers.

The CEO is selling shares as if Oroton is trading way above it’s intrinsic value, so that is not a good sign.

I remember this exact type of conversation happening sometime last year, despite her selling shares Oroton still had a reasonably good result. From what i can tell she is basically selling options that she was awarded, probably just has a better use for the cash at present. Maybe she wants some cash to diversify her own investments. We don;t know.

I think it has been said on here a number of times that there can be many reasons for a CEO selling shares but only one reason for why they are buying.

I am not too fussed with Sally selling her shares, it doesn’t change my view of the business. She still owns a pretty fair number of ORL shares i think it was around 690k.

Hey Andrew,

I remember Greg Mac comments vividly because I thought it was so funny.

Went something like this.

Hey Roger I hope your mate Sally is renovating here house.

That aside very good results from ORL in a tough enviroment.

We all (CEO’s included) buy shares for one reason only and that is that we think they are good value. However, there are many reasons for us to sell shares. Yes, one of those reasons can be that we think they are overpriced but it’s not the only reason and whilst it’s important for us to acknowledge Sallys share movements we should be careful not to jump to (possible) wrong conclusions regarding her motives for selling.

Hi Roger,

I topped up another $5k of MTU into my SMSF today, I wouldn’t have had the courage to buy in this market without your insights and the wonderful knowledge from the blog members

It is a comforting feeling knowing that most of my SMSF shares are in your MQR group of investment grade but not all of them purchased with enough MOS however I’m still learning

Can’t wait for Skaffold to start.

Hi Roger,

I own CBA shares which I would say pass the recurring revenue test, any of the big banks would for that matter. With mortgages lasting 25 years earning both interest and fees that’s a very reliable source of income.

The numerical part of the MQRs relate to the performance of a business. So I am wondering why is it that the A1 above (MTU) has a forecast ROE of 22.5%, but the A2 (CCP) has a better ROE of 35.4%. What am I missing here Roger, do you not consider ROE as the most significant factor in determining the performance of a business?

Dave.

I always find it curious that so many investors base their questions on assumptions that may not be correct. There are more than 30 data points that comprise the ratings. Roe is one but not the only one. If roe is better but 35 other ratios not so, then it would make sense to have a lower rating.

Perhaps you could answer investors questions by first asking them to state the assumption(s) that they have about the company first before they answer the question. As a science teacher I find that many of my students are able to answer their own questions, if they double check that any assumed facts are in fact correct. Often the mere reminder of “please check your pre-work” allows the error to be amended and the correct answer to be worked out for themselves.

Sound advice Simon. Thank you.

One that comes to mind is REA, although there subscriptions are 12 month, the terms of conditions for these subscriptions have a clause which states that they will continue to roll over until the agent makes the decision to terminate their subscription which is unlikely seeing that they are the market leader and almost to the point f them being “just the way we do business”. Also, if a subscriber wants to terminate the subscription they could still ened to pay out the rest of the subcription.

This means that there is a good base already contributing revenue per year to the company and they can then work on increasing that revenue base.

As of June 2011 they had 9536 paying agents and an average revenue per user of around $1,456 and agents make up 76% of total revenue for australia.

CCP is an interesting one because the current stock price is quite low ($3.90). According to my numbers, with book value at $2.30 and EPS of $0.48, I figured that I’m paying $1.60 for their earnings stream and $2.30 for their assets. I am hoping if they fall to $3.00 then it would be even more value. The only downside I can see is that I am not sure how big the shareholder class action settlement is going to be.

Certainly a potential elephant in the room. But, reading between the lines, I would expect any claim to be fully covered by insurance.

In my humble opinion, it will come down to a fight between the litigation funder and CCP’s insurers, not shareholders, on any settlement.

You may well get your wish – CCP at $3.00 – if the European debt crisis situation does indeed send shockwaves through the market. IF this were to occur, the result will most likely be a very negative outlook for the entire financial sector, which is where CCP resides. I have accumulated some CCP as well lately and would love a bigger bargain to be born in the future.

Another business that has high revenue streams, is of high quality, with attractive dividends is Hansen technologies (HSN). A little expensive in my book, but relevant to this post all the same.

Take care all,

Chris B

Just thought I’d add that close to 70% of HSN’s revenue is recurring.

re matrix

http://au.news.yahoo.com/thewest/business/a/-/wa/10358025/matrix-staff-angry-over-relocation/

Thank you Dino. Please continue to keep us up to date.

Seems it’s not just their shareholders that are kept in the dark. Management of this company is looking worse every day.

Peter

Mce offered employees positions at Henderson but were turned down. Some of those employees who then changed their mind down the road were then offered redundancies. Not usual practice. At least they were offered a move. I think alot of us made assumptions both plants would run at full capacity. As this is not the case (based on current orders) a trimming of the workforce seems a logical step and a good move from a potential shareholder point of view. Better that than having a legacy workforce sitting around in an empty plant. The bad press is another issue..

Should read “not unusual practice”. iPhone!

Henderson was indeed built to reduce labour costs

It’s interesting MattB,

I never assumed that both plants would continue to run – in fact I always thought that the plan was to close Malaga, but that if demand was significant that they might keep it open for a period of time after Henderson was operational.

…and this (Re: MCE)

http://au.news.yahoo.com/thewest/business/a/-/wa/10374174/matrix-lays-off-70-workers/

Reckon Limited (RKN) have 60% recurring revenue (and have increased this from 56% last year)

IRESS (IRE) have 80% recurring revenue (and have increased this progressively from 30% in 2006)

Blackmores (BKL) – people keep taking their vitamins

Coca-Cola (KO) – the soft drink aisle is the biggest aisle and normally closest to the front door in every supermarket because most people buy something from it

Industries that we mostly have to use also have a recurring nature to their revenue, ie insurers, fund managers, banks, electricity/gas providers

Hi Matthew R. With Coca-Cola, the Australian licence (from TCCC: The Coca-Cola Company) is held by CCL – Coca-Cola Amatil (Australia) Ltd – who most analysts regard as a quality company but possibly currently expensive. Seeing as your other three (RKN, IRE & BKL) are all Australian listed public companies, and CCL is the only Coca-Cola bottler listed on the ASX, do you consider CCL to be in the same league?

Disclosure: I own CCL through an employee share plan (and I am also – obviously – employed by them).

BTW, Foster’s acceptance of the SAB Miller bid is good news for CCL, because SAB Miller and CCL had already agreed that SAB would buy out CCL’s 50% of their Pacific Beverages joint venture (including the recently established Bluetongue Brewery) if the Fosters takeover proceeded. There’s not too much left standing in the way of that takeover now that the ACCC has agreed not to oppose it (announced on Wednesday). FIRB can’t really oppose it either given that they let Kirin buy out Lion Nathan.

The price that SAB will pay CCL for (CCL’s 50% of) PacBev is quite generous and should add 2 or 3 % to CCL’s NPAT this FY according to a recent news release by CCL.

Basically, the deal is that if SAB takeover Fosters (and they most certainly will), CCL has to exit the beer business (on previously agreed terms) and SAB will stay out of the soft drink (carbonated beverage, or CSD) business that CCL is in. This could mean (and probably will mean) that SAB will divest of most, if not all, of Fosters ARTD (Alcoholic Ready To Drinks, aka Alcopops, think: spirits with cola, and similar drinks) manufacturing, which I understand also includes some contract manufacturing of ready to drink spirits. As CCL already manufactures and distributes all Jim Beam and Canadian Club ARTDs in Australia, and have an enviable distribution network, they will be the logical manufacturer and distributor of any of those similar products that Fosters currently handles but that SAB may wish to divest of. This may result in a positive re-rating of the CCL in time.

All of this information is publicly available by the way (or I wouldn’t be repeating it here). Coca-Cola Amatil (Aust) Ltd (CCL) still bottles and distributes Coke, but they are more and more becoming a diversified bottler of a huge range of drinks – for instance, Mt Franklin and other bottled water brands, Jim Beam & Canadian Club RTDs, Goulburn Valley Fruit Juice and Flavoured Milk drinks, plus they also own a coffee brand and they have a canned food division (SPC Ardmona).

CCL have seemed a bit expensive to me at over $10 and especially when they top $12, which they regularly do, but they might be worth a bit more once the SAB takeover of Fosters is finalised and we see what CCL end up with.

G’day John,

Great stuff. This is the kind of insight the blog was set up to provide a platform for. SAB are being generous all round. Suggests to me bulking up to make themselves less palatable. What are your thoughts John?

Yes, Roger – I’d agree with that assessment. There’s been a lot of consolidation in the beer industry globally over recent years and everyone will be looking over their shoulders.

On a personal note, I’ve learned a great deal through Value.Able and through this blog, from yourself of course and from many other very gifted, generous, and knowledgeable contributors, so I’m glad to have contributed in a small way. I thought Nick Mason’s post on independent thought was especially well written and thought-provoking. Thank you everybody!

Indeed. And the insights blog is richer fir contributions too John.