Are governments wasting money on new infrastructure?

After many years of under-investment in infrastructure, Australian governments have recently been on an infrastructure spending frenzy. Some projects have been worthwhile. Others have not. Is it time to pause and think more carefully about the way public money is spent?

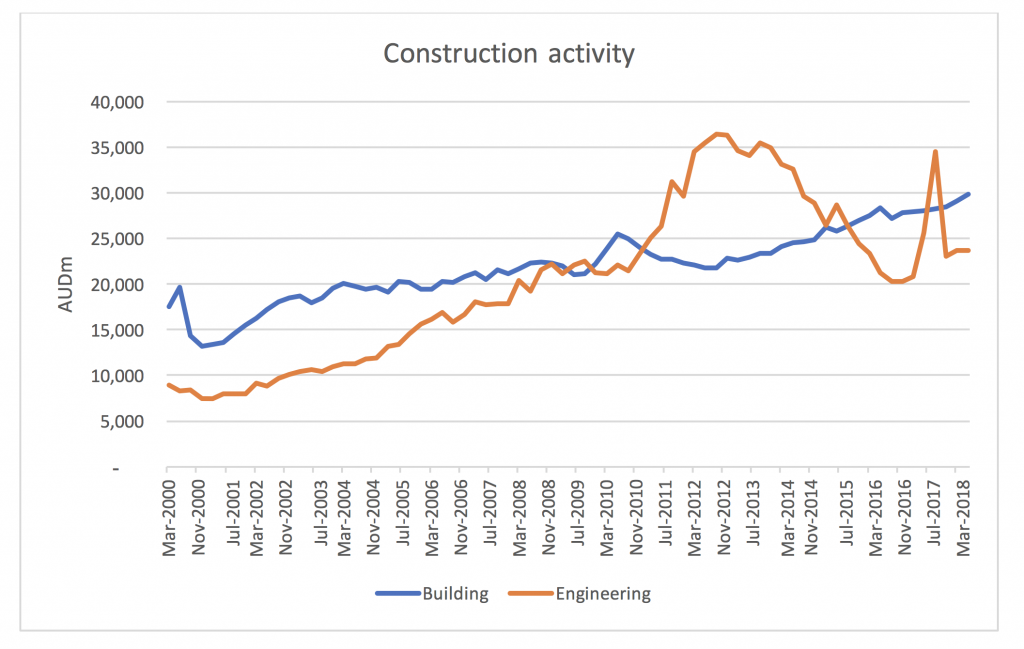

Construction activity is an important driver of the economy in Australia. Australian Bureau of Statistics (ABS) reports construction activity split by Building (commercial and residential real estate) and Engineering (Infrastructure). Since the end of the mining boom in ~2012, Building has been the major driver of activity in the construction sector as the chart below shows.

Source: ABS

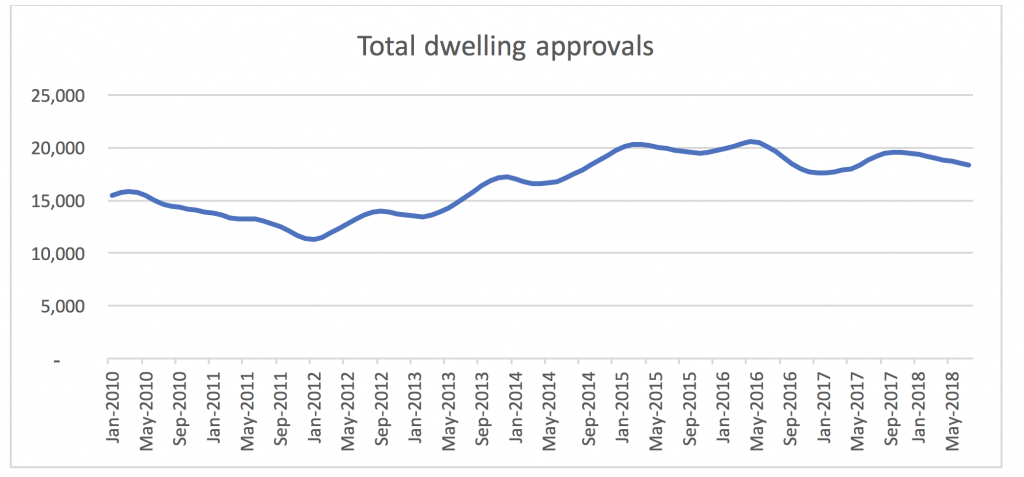

Recently, we have started to see a downturn in dwelling approvals across the nation as we can see in this chart:

Source: ABS

This downturn in dwelling approvals does mean that construction activity related to Buildings cannot be expected to grow and will most likely go backwards over the coming years as there is a good time lag between an approval and the actual construction of a building.

This means that we need to have good growth in infrastructure spending for the total construction sector to be healthy.

Infrastructure spending is generally controlled by government at different levels and, as a taxpayer, I am quite keen that the governments spend the tax I pay in the most efficient and value creating way possible.

Even though Montgomery’s offices are not in central Sydney, I am almost daily visually reminded of a project that I think it is fair to say does not meet the above criteria. This is the light rail project linking Sydney CBD with Randwick.

The NSW government contracted the Spanish construction company Acciona to construct the project and it is becoming quite clear that this project looks to be a complete disaster with big delays and massive cost over-runs.

- Acciona recently sued the NSW government for $1.2 billion claiming that they had been misled by the government about the cost of modifying underground utilities that were needed to be moved to enable the construction of the light rail. This is very a significant additional cost to the initially projected $2.1 billion and it also looks like the project will be at least 1 year delayed leading to further cost to the economy due to the congestion caused by the construction activity.

- Last week, 60 businesses and landlords launched a class action lawsuit against the NSW government asking to be compensated by at least $40 million for the loss of income from the delays despite having already paid out $9 million in rental assistance.

- Over the weekend, it was also revealed that the NSW government has guaranteed a loan for $500 million that the consortium constructing the light rail has taken out meaning that tax payers are fundamentally on the hook if the consortium building the light rail fails.

Maybe this is not surprising when we read that:

- Infrastructure NSW, the organisation set up specifically to advise the government on infrastructure spending recommended against the project and preferred additional buses with dedicated lanes before the investment decision was taken.

- The NSW Auditor-General found that even the initial cost blow-out from $1.6 billion when the project was announced in 2012 to $2.1 billion in 2015 when the final investment decision was taken was due to “mispricings and omissions”.

- Even the RBA governor Phillip Lowe has used the project as an example of “poor oversight”.

Given the pace that the Australian population is growing, it is clear that money has to be spent on infrastructure. But it is important that money is spent on:

- The right projects and

- That the projects are properly planned for and

- Are well executed.

I think it is fair to say that the light rail project fails on all three of these criteria…

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Scandinavian countries have a great reputation for public services in general. Being that you’re from Sweden I would be interested in your opinion of the difference between Australia and your home country in this regard. I imagine they are much better in adhering to your three criteria listed above. When including the energy sector farce that is occurring here I feel downright embarrassed. As a Swede you must be confused as to why this country is run so poorly when we have so much going for us. Or maybe I’m just being idealistic about the Scandinavians?

Hi Peter,

Sure but with the caveat that apart from one year (2016), I have not lived in Sweden since 2000 so my direct exposure is a bit dated :-).

There are a couple of things that comes to mind:

1. The details of infrastructure investments in Scandinavia is much more driven by the bureaucracy than by politicians. Spending on specific infrastructure projects tend not to feature as prominently in political discussions and in election campaigns but if it is a feature of a debate, the focus is instead on what the overall level of spending should be and then the actual decision on what money is spent on is much more up to the relevant departments (e.g. roads, energy, healthcare etc.) who are supposed to be best at deciding the details. I see both good and bad things with this. One good things is that the departments can take a longer term system wide planning view than politicians who are in office for a short time and can be tempted to throw money at projects that is beneficial in the short term for a political purpose. Bad thing is that it is harder to judge if the departments are doing an efficient job as the insight into the spending is much lower. If I compare Australia and Sweden, I would say that it works better in Sweden in physical infrastructure like roads and public transport and energy while the Australian healthcare system works better.

2. The level of economic rent seeking is much much higher in Australia than in Scandinavia. By rent seeking I mean the capturing a disproportionate amount of the wealth generated without creating more overall wealth. The prime example to compare is Australia and Norway. From the beginning of the development of the Norwegian North Sea oil assets, the government put in place a framework which managed to strike the right balance between providing enough reward for private operators to invest to develop the natural resources but that made sure that the majority of the value created over and above a satisfactory return on investment on the private capital flows to the state. They also realised that the oil is a finite resource that will eventually run out so they decided to not spend the money but to invest it to be able to be used once the oil runs out and economic activity could suffer. As a result, Norway is by far the richest country in the world with the worlds largest sovereign wealth fund of over US$1tr despite a small population of around 5m. Australia has not managed to capture even a fraction of the inherent value in its natural resources compared to Norway as the leakage to rent seekers has been much higher. The main difference is that Norway decided to tax profits while Australia has a royalty system taxing volumes which means that it is much harder for dial in the right level of taxation for Australia and much harder to prevent private firms from making supernormal profits. Because of this, investments in Australia is very focused on inherently low value added activities where it is easier to extract excess economic rent than on high value added activities where competition makes it harder to make supernormal profits. This is why you see much more high-tech and engineering based companies in Scandinavia than in Australia.

3. This is probably connected to the previous point. The level of political corruption is much higher in Australia. With political corruption I mean the influence that special interests can have on political decisions. The movement of people between the private and public sectors is something that should be encouraged generally but when you see people like Eddie Obeid enriching themselves through outright corruption and also examples like Andrew Robb, the former minister for trade, joining Landbrige as a consultant earning $900k per year immediately after finalising a trade agreement with China and leaving politics, something smells quite bad. Landbrige is a Chinese company which owns the leasehold on Port of Darwin and is closely connected to the communist party in China.

I do not want to hold the Scandinavian countries out to be a shining light of political governance as they have their own problems (mainly overly socialistic) but they do get certain things right and in particular, the longer term planning tends to be better.

Thanks for the long response. I really appreciate it. A lot of it confirms what I already thought but you filled in some gaps for me. It was actually somewhat cathartic reading this given how bad the media reports on this stuff ie the corruption and more particularly as you say the rent seeking that is going on in this country.

A timely discussion too given the Swedish elections this weekend. I will be watching with added interest now!

You could use the same three criteria for the Chinese infrastructure building, because I am sure that 2 and 3 are met, but criteria 1 is somewhat subjective.

Ironic, given the article immediately above it, in that China’s appetite for commodities depends on this.

Also, one person’s vision is another person’s folly. Las Vegas or Dubai are a prime example where, you have desert conditions and a scarcity of water, yet, they managed to make a thriving metropolis in the middle of it all. Most people would have looked at it and said it was a daft idea.

Time will tell with all these ‘ghost cities’ in China, but the more that it goes on, the less that it looks like they were “the right projects”.