Analysing Nvidia’s growth trajectory and valuation challenges

In this week’s video insight, I delve into Nvidia’s (NASDAQ:NVDA) remarkable trajectory, from a key player in the autonomous car industry to a soaring tech giant, and its subsequent 1300 per cent rally. However, beyond Nvidia’s individual narrative, I confront the core challenge of valuing growth, dissecting the balance between growth rate and sustainability over time.

Transcript:

Hi everyone, I’m Roger Montgomery, and welcome to this week’s video insight.

I have recently written a blog post about Nvidia. Nvidia shares were recommended to me on the 27 February 2018 when I attended a private investor pitch for an investment in an autonomous vehicle startup called Zoox. At the time, Nvidia was the chip supplier to the booming autonomous car fad. And even though the shares fell about 45 per cent between February and December 2018, they have rallied about 1300 per cent. While I now find myself asking whether Nvidia may succumb to its own success, the way Cisco (NASDAQ:CSCO) did when it helped install the infrastructure for the internet – which only needed to be done once, the bigger question is one about how to think about the value of growth.

So today, I want to chat about a fundamental concept of company valuation. Specifically, we aim to understand how future dividends contribute to a company’s present value.

Company valuation, in theoretical terms, boils down to calculating the present value of all expected future dividends. Importantly, this stream of dividends consists of two comp

Estimating present dividends is straightforward, but the real challenge arises when forecasting future growth.

The way to think about future growth is to break it down into two key dimensions: the growth rate and the sustainability of this rate over time (this will have implications for decisions about Nvidia). It’s crucial to consider both aspects because the reality is that no company can sustain rapid growth indefinitely. Nvidia’s triple-digit growth rate today cannot be sustained forever because it would eventually gobble up the world, which is impossible.

Analysts often focus on short-term growth rates, but they tend to overlook the sustainability of these rates. And this oversight can significantly affect valuation accuracy.

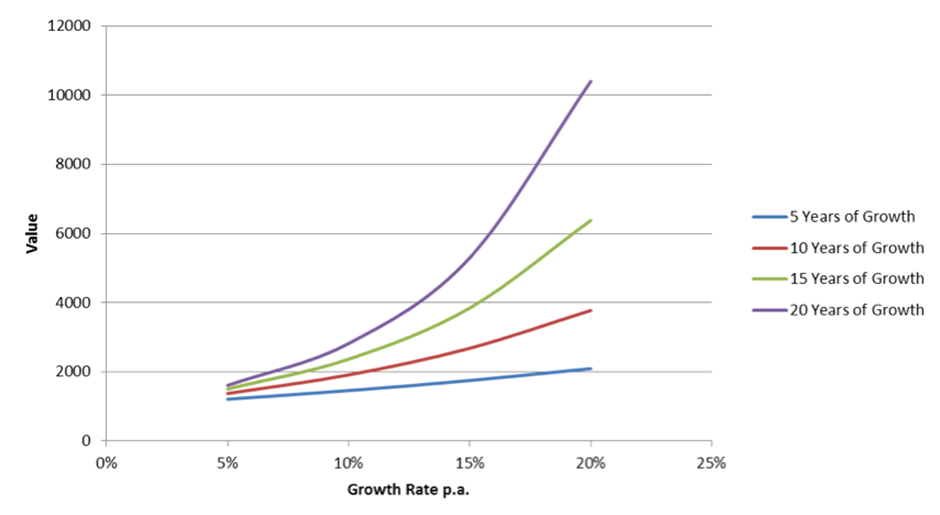

To illustrate, have a look at this chart produced by my friend and former colleague, Tim Kelley. It displays the values of dividend streams under various growth scenarios, ranging from modest to aggressive and over different time frames.

What you can see is that the duration of growth (how long the growth is sustained) has a more significant impact than you might have thought. For instance, a growth rate of 8 per cent per annum sustained over 20 years (the purple line) is far more valuable than a 20 per cent growth rate that only lasts for five years (the blue line).

How long do you think Nvidia can sustain its current growth rate? As its base of previous sales gets bigger, it would have to sell ever more graphic processing units (GPUs) just to maintain its comps.

Of course, looking ahead 20 years poses its challenges, yet it’s essential to evaluate the long-term viability of a company’s growth. Factors such as market saturation (how many more customers are going to buy Nvidia GPUs and how many more do current customers need?) as well as vulnerability to industry changes also have to be considered. Will artificial intelligence (AI) need as much computational power if AI is asked to find a way to reduce its computational power requirements?

Of course, companies with longer growth horizons simplify investment decisions. They lead to lower portfolio turnover, reduced transaction costs, and less capital gains tax liability, aspects famously capitalised on by investors like Warren Buffett.

Everyone’s excited about growth for the next three years but often, share prices are priced as if that growth will carry on indefinitely. And that’s rarely, if ever, the case.

All very true, including those last few points about portfolio turnover, transaction costs and tax liability, which dilutes overall value and can also lead to a larger Accountant’s bill each year.

That’s spot on Adrian. Thanks for sharing.