A deep dive on the Aura High Yield SME Fund Part 1: A guide to SME lending

In May 2022 Montgomery announced a partnership with Aura Funds Management to offer their Australian credit strategies to Montgomery investors and interested parties. This is Montgomery’s first partnership outside of equities into credit and specifically private debt, which is a niche asset class getting a lot of attention for its consistent income and uncorrelated returns to those more traditional asset classes.

The first strategy we offer in partnership is the Aura High Yield SME Fund, which has a solid 58-month track record of delivering a compound annual return of 9.72 per cent after all fees paid monthly as income with zero volatility to the underlying unit price since inception.[1] The Fund has achieved this return through lending to Australian Small to Medium Enterprises (SMEs), a growing part of all Australian industries yet one largely underfunded from a business lending perspective. In this article I outline how the Fund provides financing to this segment of the market and the way it looks to manage risk in lending.

How do you lend money to the SME market?

The Fund provides financing to non-bank loan originators, or lending platforms, who in turn assess the loans and provide lending to the SME market. There are currently seven lending platforms, with no single loan exposure greater than 5 per cent of the total business loan pool. Some of these lenders specialise in specific areas of the SME market, from Agriculture to Invoice Financing, by way of example. A common feature of these lending platforms is that they are fintech enabled and can assess and issue loans very efficiently. There are two levels of broader due diligence occurring, at the Fund level assessing the risk framework, lending behaviour and capital position of the platforms themselves, and at the platform level assessing the underlying borrower and credit eligibility of the SME themselves.

What does the average SME look like that you are lending money to?

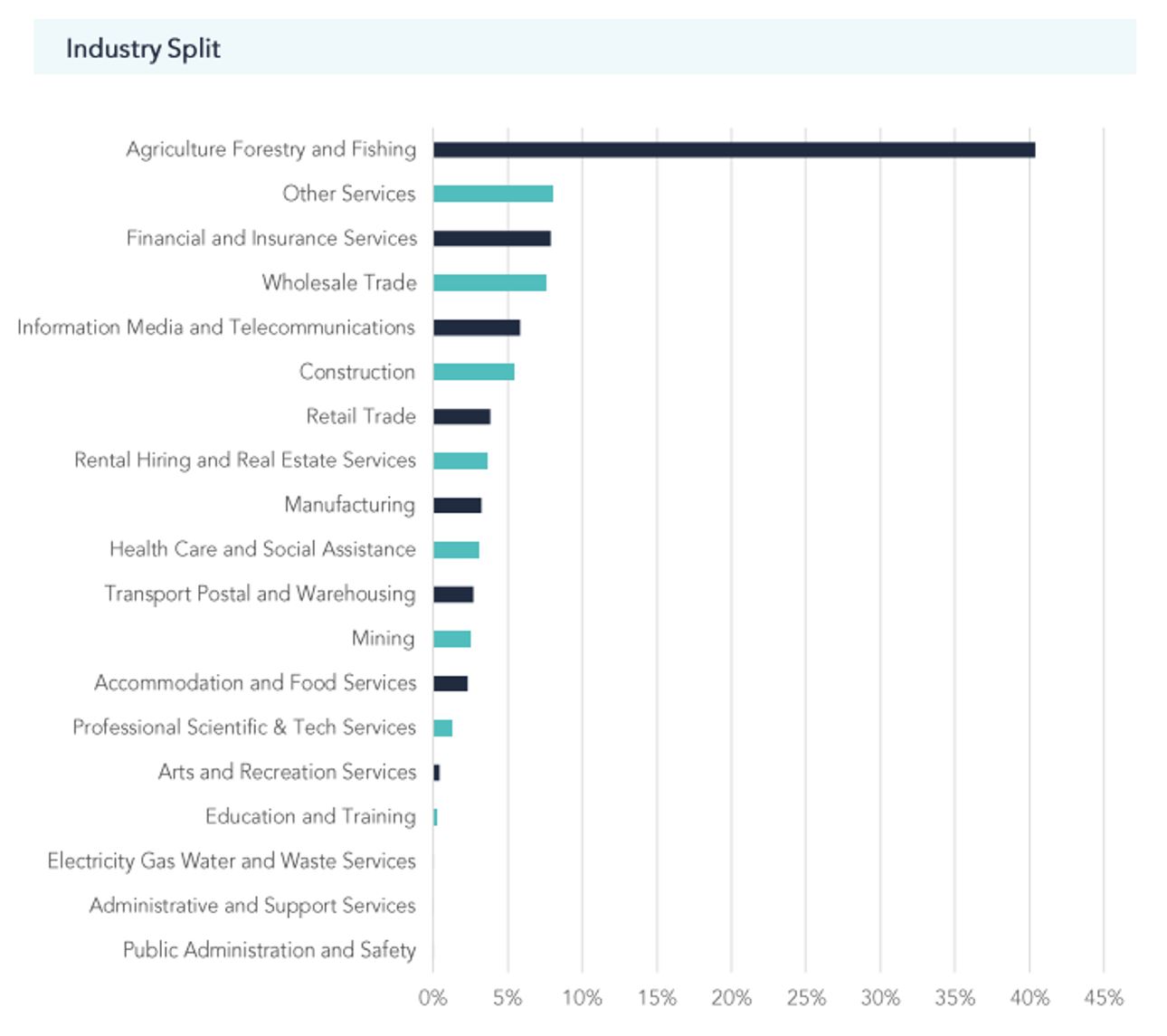

An SME by definition is a small or medium sized business which employs anywhere from 5 to 199 employees. These businesses operate across all sectors of the Australian economy. By way of example, the fastest growing sectors in the small business category according to the Australian Bureau of Statistics (ABS) in Financial Year 2020/21 was Retail followed by Transport, Postal and Warehousing. Similarly, the fastest growing sectors in medium business category according to the ABS over the same time period was also Retail followed by Construction. Importantly, small businesses were cited by the ABS to be a key driver of Australian industry financial performance outcomes in Financial Year 20/21.[2] Consequently, the Fund can access thousands of SME businesses across all sectors with breakdown of the Fund’s aggregate industry exposures as at April below:

Source: Aura 30 April 2022

Are all the SME loans written by the Fund secured?

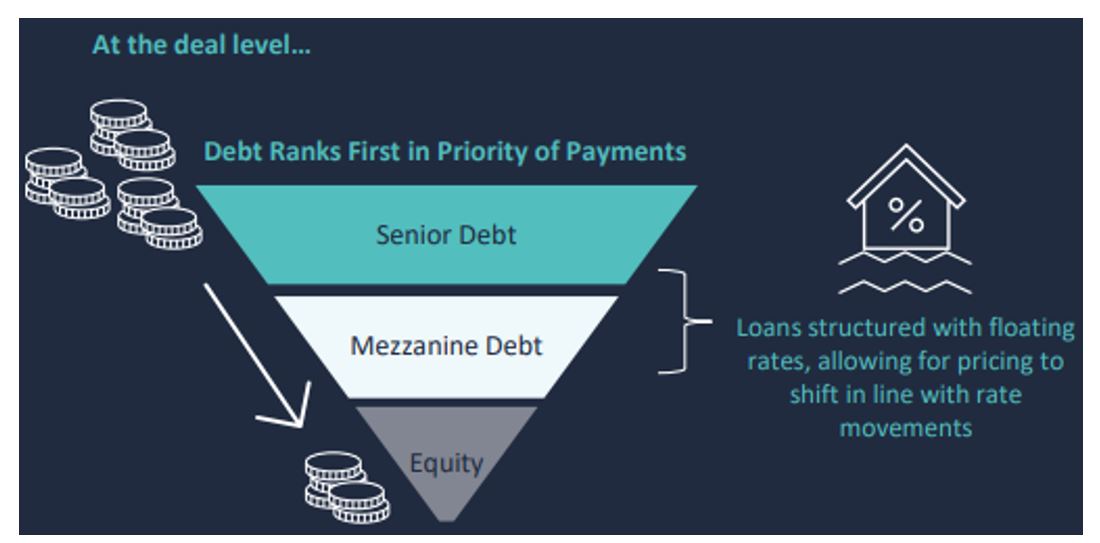

There are two levels of security to consider in the Aura High Yield SME Fund. The first is at the deal level through subordination. As seen below, mezzanine debt sits above equity in the capital stack as a priority payment. The Fund holds both Senior and Mezzanine notes. The second is at the loan level through security. Some of these loans can be with varying levels of security, with the most common being property, plant or equipment, and director guarantees. At the origination level, the Fund can further negotiate in some instances the lending platform to take first loss up to a certain amount.

Source: Aura 30 April 2022

Is the SME end of the market risky? How do you manage this risk?

A lot of people see the rates in which finance is provided in the SME market (anywhere from 10 per cent to 15 per cent) and straight away optically associate this with being high risk, particularly when you compare this to residential mortgage rates. A key consideration for lending rates in the SME market is the lack of availability of direct bank lending, particularly for smaller and shorter-term loans, and sources of finance for non-bank lenders. This gap in financing coupled with the continued growth in the SME market has seen non-bank technology enabled platforms as the preferred provider of finance, particularly around industry specific financing needs. Like any lending, and given where these loans sit in the capital stack, there is still risk.

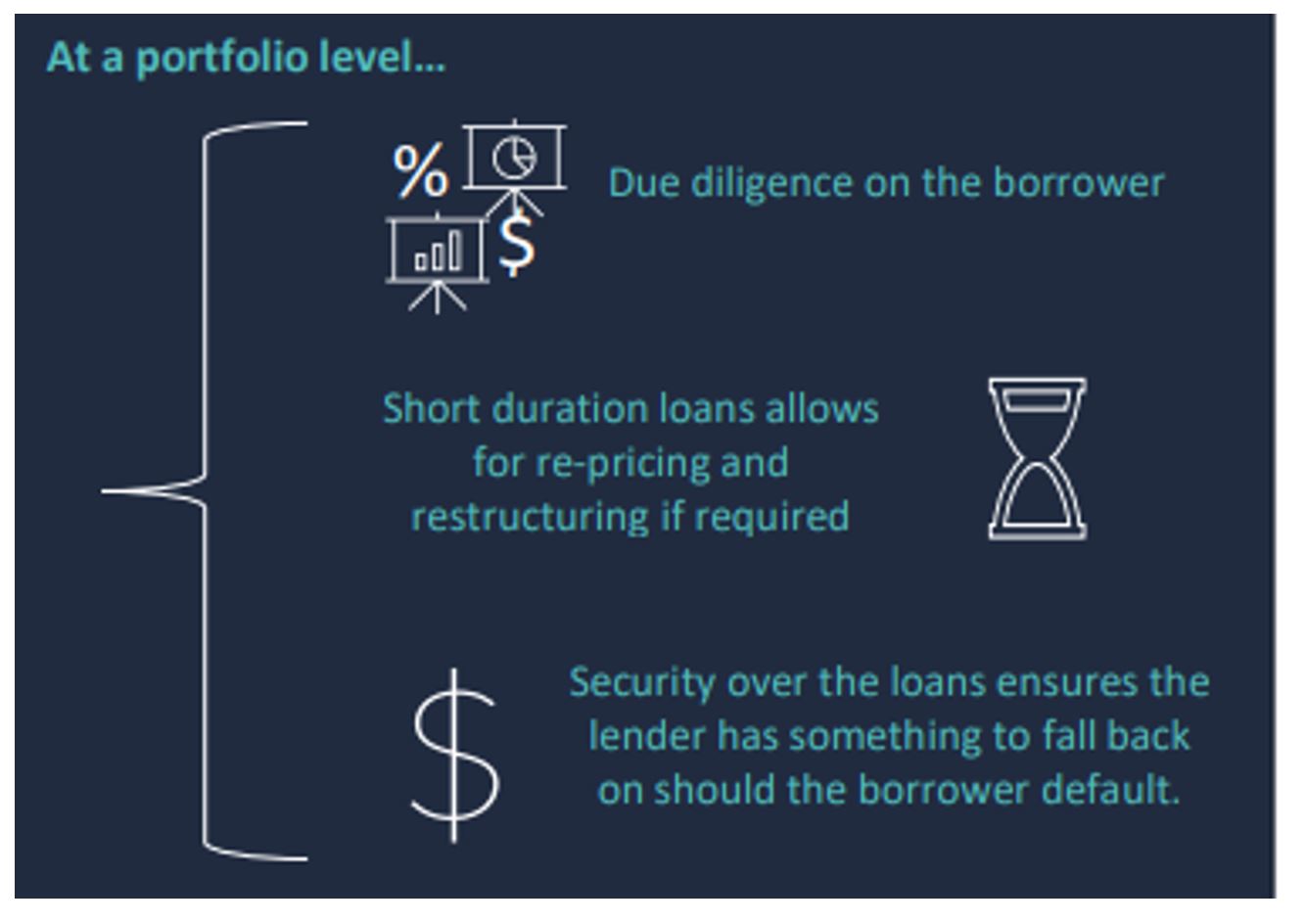

The Fund looks to manage this risk in three mains ways, as illustrated below.

Firstly, Brett Craig as Portfolio Manager and his research team do very detailed due diligence on the lending platform and the SME’s they are financing. In fact, the Fund at any time has full visibility of the underlying business loans aggregated through the platform and can have ability to dynamically manage loan terms at the origination level.

Secondly, the Fund seeks diversification from a lending platform, loan size and loan duration perspective. As noted, the Fund is providing financing to seven providers with no single loan exposure able to be greater than 5 per cent of the total business loan pool.

Furthermore, the Fund as at April end has almost 7,000 underlying loans where the average loan size is smaller in nature, being just above $120,000. In fact, no individual loan is more than 2 per cent of the underlying business loan pool. Additionally, about 70 per cent of the aggregated SME loans have duration of less than 12 months with an average across the business loan pool of just 4 months. Finally, as mentioned above, there is also varying levels of security that can be provided to the lending platform in the case of default.

Source: Aura 30 April 2022

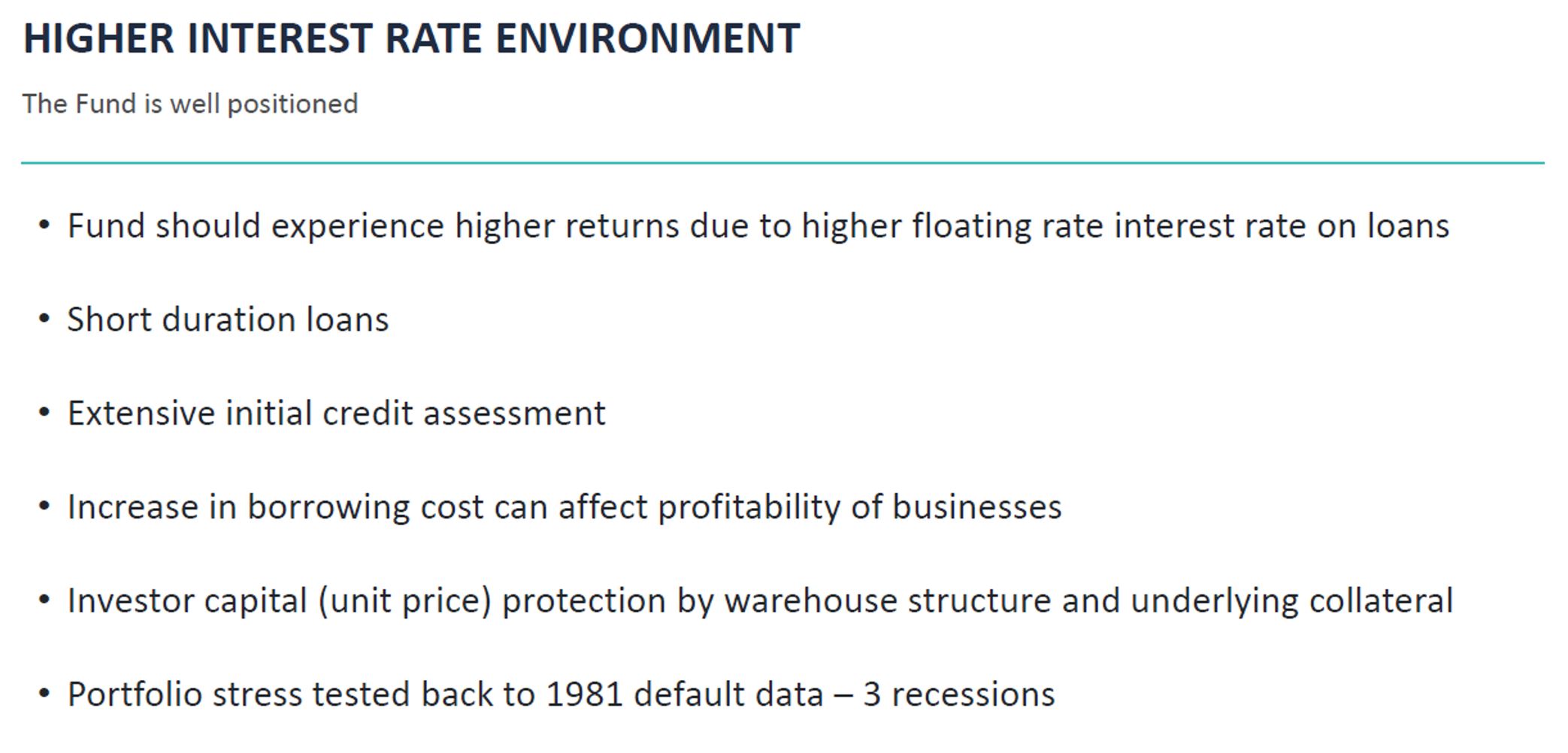

How is the Fund positioned in a world of rising interest rates?

There are six safeguards:

Source: Aura 30 April 2022, assumes no substantial increase in defaults due to higher repayments. Capital is not 100 per cent guaranteed

You can read our next article discussing some of the requirements to invest in the Aura High Yield SME Fund: Part 2: How does investing work?

You can learn more about the Aura High Yield SME Fund here.

[1] As at 30 April 2022. The Fund’s inception was 1 August 2017.

[2] https://www.abs.gov.au/statistics/industry/industry-overview/australian-industry/latest-release

IMPORTANT INFORMATION

DISCLAIMER

Units in the Aura High Yield SME Fund (Fund) are issued by Aura Funds Management Pty Ltd (ABN 96 607 158 814, Authorised Representative No. 1233893 of Aura Capital Pty Ltd (ABN 48 143 700 887, AFSL No. 366 230)) (Aura). Aura is the trustee of the Fund and a subsidiary of Aura Group Pty Ltd. This information is for wholesale or sophisticated investors only and is provided by Montgomery Investment Management Pty Ltd (ABN 73 139 161 701, AFSL No. 354 564) as the authorised distributor of the Fund.

An investment in the Fund must be through a valid paper or online application form accompanying the Information Memorandum.

The information provided is general in nature and does not take into account your investment objectives, financial situation or particular needs. Before making an investment decision you should read the Information Memorandum and (if appropriate) seek professional advice from a licensed financial advisor to determine whether the investment is suitable for you. The investment returns or repayment of capital of the Fund are not guaranteed. The value of an investment may rise or fall and you may risk losing some or all of your capital. Past performance is not a reliable indicator of future performance.