Looking again at value

In recent months we have looked at valuation from a few perspectives. Our conclusion has been that the Australian market is on the expensive side of fair value, but not to an alarming degree.

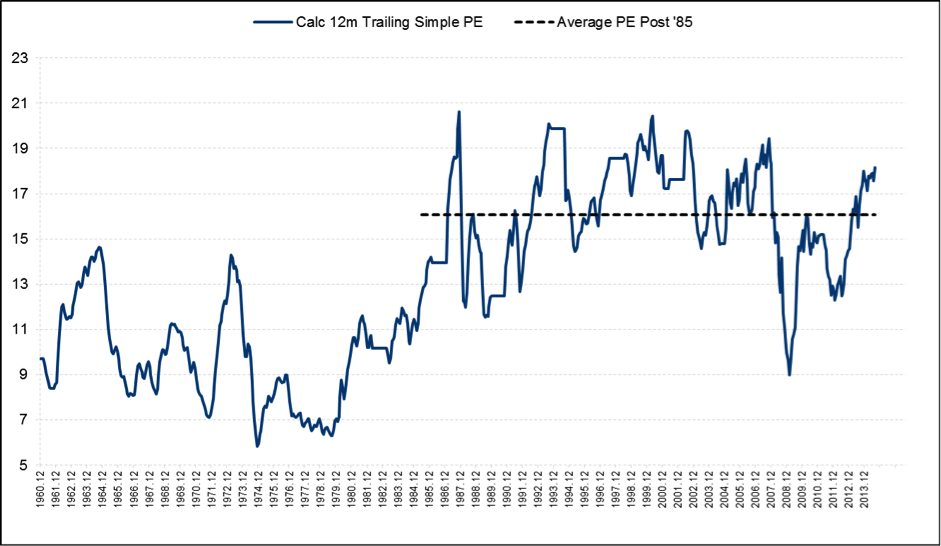

This week, we broaden our focus a little and look at a longer-run time series of data. In particular, we look at the 12-month trailing price-equity (P/E) ratio for the ASX 200 dating back to 1960.

P/E ratios are not a preferred value metric for us – we much prefer to use the results produced by our internal valuation models. However, those models feed on large volumes of detailed historical financial statement data, which isn’t readily available further back than about 10 or 15 years.

The long-run history of the P/E ratio for the ASX 200 is set out below. There are a few things to notice about this chart.

Possibly the main feature to jump out of this chart is that P/E ratios for the earlier decades are consistently lower than those of the more recent decades. This is an important point, because your conclusions on value depend on whether you believe that the experience of those earlier decades may be repeated, or whether you believe the change in the 1980s is a permanent one.

For our part, we note that the shift coincided with the transformation of the Australian financial landscape in the years following appointment of the Campbell inquiry in 1979, and the passing of the extremely high inflation rates that prevailed in the 1970s. While cause and effect are not easy to pin down, we are inclined to the view that the change in P/E ratios is structural, and we work on the assumption that the more recent experience is a better indication of what we might expect in future. You should be aware, however, that a different view could lead to different conclusions.

On the basis that the more recent experience is reflective of what we can expect in future, we calculate an average P/E for the market since 1985. With this as a benchmark, the following conclusions follow:

- The years since the GFC have provided an unusually good opportunity to buy equities. This reinforces the adage that it is good to be greedy when others are fearful.

- Currently, valuations seem to be the high side. However, valuations at this level and higher have prevailed for large sections of recent history, and so we cannot conclude that prices should fall any time soon.

Once again, we are left in a bit of a limbo land. We certainly aren’t buying equities with our ears pinned back, nor are we assuming the brace position. Rather, a “balanced” stance with a significant minority of our funds in cash remains the order of the day.

As Warren Buffett has pointed out:Interest rates act as gravity behaves in the physical world. You can jump higher on the moon.Compared with cash and residential property, shares are a better option.

Just a thought, but the introduction of compulsory superannuation in 1992 may have played a part.

Even that hasn’t prevented the corrections that have occurred since.

do you not think perhaps the rise of the internet and thus the ease with which ordinary people can buy and sell shares on their home computer has had an effect on valuations? also the ease with which we can access company information, reports, opinions & tips on the internet encourages ordinary people to “have a go”, and there is a vast and growing army of self directed investors and SMSF’s which never existed in the old days.

also the much cheaper brokerage fees from on-line brokers.

whereas in the 1960’s, 70’s and 80’s it was harder for ordinary people to buy shares or to access information about stocks. you had to find a stockbroker in person for advice and get charged substantial brokerage fees. this would have dissuaded many people from bothering with stocks, as it did to me until I first got on the internet in the late 1990’s.

it does have an effect, but the effect is both positive and negative as more people less committed to their investments also sell out in panic.

Online brokers who also give recommendations (that I would not follow since using Skaffold) are making a mint since this trend in easy trading from home. I feel a conflict in interest fuels these recommendations. The Rivkin team got out of the brokerage side to avoid this but CommSec still continues. It’s baffling to me how they get away with it. They even give free brokerage for certain numbers of trades per month, encouraging day traders I guess. Encouraging recklessness I feel. It’s unethical in my opinion. This should be part of the recent enquiry. I got into being a CommSec customer when they bought out BankWest and my trading account was with them via Avcol.