It’s a matter of perception

For every equity that trades, there is a buyer and seller. Often there are functional reasons for selling, such as paying down a loan, paying tax, distributing an inheritance, or meeting retirement spending needs. Putting those aside, another reason for selling is the harbouring of a negative outlook on the share market in general or the sector or individual stock. But there is also a buyer on the side, who may hold the polar opposite view and outlook.

And if we assume both investors have access to the same information, the difference in outlook can only be attributed to a difference in perception.

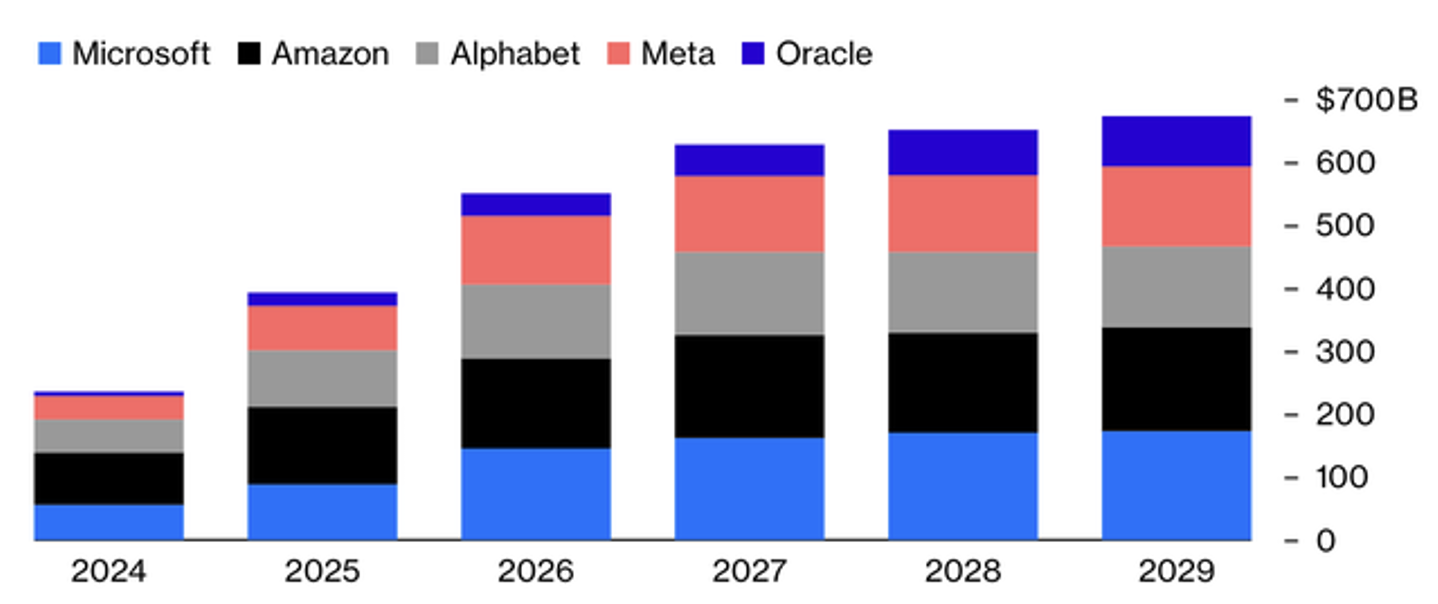

Take for example the spending by artificial intelligence (AI) hyperscalers on their infrastructure buildout, estimated to be US$3 trillion by 2029.

Figure 1. U.S. ‘The Hype 5’ to invest US$3 trillion by 2029

Source: Bloomberg

Spending billions, or even trillions on a long-term basis can be unpalatable for stock market investors because of the risk of declining asset turnover. When sales as a percentage of capital expenditure declines, investor realise returns will be lower or delayed, neither of which is exciting.

AI chips, which are the most significant expense for every gigawatt of AI data centre capacity, are also expected to have shorter lives than the general-purpose technologies of the past.

A perceived mismatch between the production lifecycle of AI chips and the period over which buyers are depreciating them has led famed short seller, Michael Burry to establish a large short position in Nvidia and Palantir, with the latter’s share price up 170 per cent this year and up 1000 per cent in the last two years.

According to Bloomberg, the total depreciation of the ‘Hype 5’ hyperscalers in Figure 1., could reach nearly a quarter of a trillion dollars by 2027. And with hyperscalers extending the period over which they depreciate their chips and servers from three years in 2020 to six years today, it’s understandable some investors are worried that profits are being artificially enhanced by this accounting trickery.

Indeed, when Nvidia announced a new Blackwell chip earlier this year, CEO Jensen Huang joked that the value of its predecessor, the Hopper, would deteriorate. Nvidia now releases new AI chips on an annual basis, versus the two-year cycle of the past.

But not everyone sees this as a problem. Infrastructure giants like Google, Oracle and Microsoft have said their servers could be useful for up to six years. Microsoft said in its latest annual filing that its computer equipment lasts two to six years.

Moreover, depreciation is a non-cash charge, so while lower annual depreciation charges might boost profits, those profits are an accounting construct anyway, and it’s the cash flow most investors are focused on. If chip prices come down, as is the habit of all technology, replacing aging chips will get cheaper, aiding cash flows.

There are other aspects of the AI boom that some think point to a bubble, and others dismiss as inconsequential. One is financing.

The bears believe that an increasing reliance on debt is a sign that the hyperscalers have insufficient cash available to fund their aspirations. Almost 10 per cent of all corporate bonds issued this year have been for AI projects.

Others look at the same data and conclude the financing is through operating cash flow.

By way of example, Amazon is expected to generate US$22 billion this year despite a US$123 billion capital expenditure (capex) bill. By 2027, Amazon’s capex is expected to reach US$145 billion, with US$76 billion in free cash flow.

Those with a bullish disposition believe the increase in debt is not a sign of cash flow pressure; instead, it’s a reflection of adequate cash flows with a desire to share the risks.

What about valuations?

Many point to the historically high price-to-earnings (P/E) ratios of the S&P 500, the Nasdaq and the Mag-7 and label them extreme. Others look at the same ratios and conclude there’s nothing to see here.

Figure 2., shows the Shiller CAPE (Cyclically Adjusted P/E) ratio for the S&P500 all the way back to 1870, and reveals the market is expensive, indeed, very expensive.

Figure 2. Shiller CAPE (Cyclically Adjusted PE) Ratio, 13 November 2025

But others conclude tech valuations don’t look outrageous, especially with companies like Nvidia generating rapid profit growth. The bulls note the average forward price-to-earnings (P/E) ratio for the tech-heavy Nasdaq Composite Index is about 29 – a high number, but not exorbitant for a basket of fast-growing companies. They also note the ratio exceeded 32 in 2021. The bulls also note that P/E ratios have recently decreased. For Nvidia, Microsoft and Broadcom, for example, P/E ratios have declined 10 per cent in the last three months.

And returning to financing for a moment, if the growing debt pile was a problem, wouldn’t we see issues in the bond market?

Despite demand for borrowing expected to increase materially if Morgan Stanley’s US$3 trillion data centre buildout estimate transpires, yield spreads have witnessed only a muted reaction. The bond markets seem unperturbed.

Even a chart doing the rounds (Figure 3.) has elicited opposite conclusions.

Figure 3. Big Tech’s ambitions – Investment grade corporate option adjusted spreads

Source: Bloomberg

Bearish investors point to the widening of spreads for tech companies, since the beginning of October, as a sign of investors pricing in doubts about tech company build-out ambitions. The bulls point to the fact that spreads have now merely adjusted to the same level as all other companies.

Despite a huge demand for loans yield spreads for tech companies with investment-grade ratings now merely have the same yield spread as all investment-grade companies.

Conclusion

Investors looking at the same data can arrive at very different conclusions. Some will see only the positives, others, only the negatives. When the late Charlie Munger was asked what made him a successful investor, he replied, “My guesses are better than yours.” How investors and, therefore, markets react to information is almost impossible to predict. For that reason, you should stick to your portfolio construction and portfolio management principles and processes – at least annually, rebalance your portfolio back to the weights that reflect your risk tolerance and financial needs.

Even if you believe the market is expensive, you shouldn’t run for the exits. What you can do, instead, is rebalance. The gains from one asset class that has performed much better than historic averages and the other asset classes can be rebalanced back to their initial weights. And those gains can be rotated into those asset classes that have generated relatively lower returns. Should markets correct, you will have capitalised on a boom. And if markets continue to soar, you still retain the exposures that reflect your stage of life and risk tolerances.

Disclaimer

The Polen Capital Global Growth Fund own shares in Nvidia. This article was prepared 18 November with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade these companies you should seek financial advice.