Why Chinese property worries affect us all

As you’ve probably read, China’s number two property developer, Evergrande, is on the verge of collapse, dragged down by excessive debt and an inability to take on more debt. Evergrande’s woes have helped send the price of iron ore plummeting – not to mention the share prices of our largest miners: BHP, Rio and Fortescue. My concern is that the problems besetting the Chinese property market will have repercussions well beyond the miners and their investors.

I wrote about this issue back on 1 July in this post and warned that the Chinese property development sector had the potential to drag down iron ore prices significantly as about 26 per cent of the world’s seaborn iron ore eventually ends up in Chinese property construction.

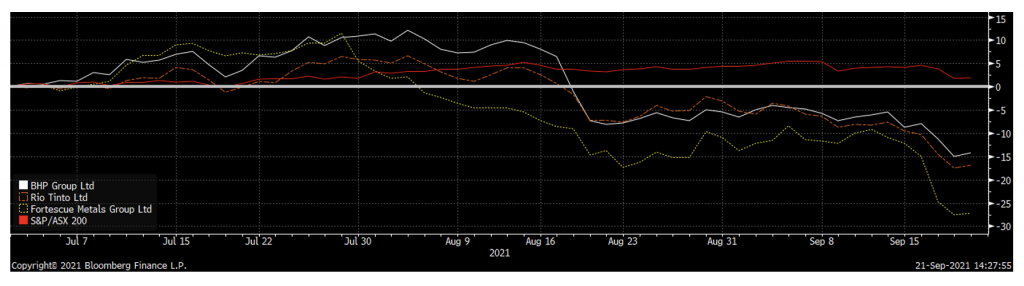

At the time of writing that blog, iron ore was trading at around $216/ton and as we can see from the chart below, the iron ore price has indeed plummeted and is, at the time of writing, trading at $93/ton – or down by 57 per cent in less than three months.

Source: Bloomberg

This steep fall in the iron ore price has translated into very sizeable falls in the share prices of the Australian iron ore producers with BHP and RIO falling by just over 20 per cent and FMG by close to 40 per cent since 1 July compared to the ASX300 which is virtually flat as this chart shows.

Source: Bloomberg

Montgomery funds have no exposure to the large miners, so our investors have thankfully not been impacted by these steep price falls but, given a large portion of Australia’s GDP derives from iron ore exports, this will have a significant impact on the GDP and the government’s budgets. So, indirectly, our investors will be impacted. For every $10/ton difference in price, Australia’s GDP is reduced by about $6.5 billion and the federal government’s tax receipts by about $1.3 billion. Comparing the current price or $93/ton to the $216 on 1 July, this translates into a difference of about $80 billion in GDP and about $16 billion in federal government income or about 4.0% and 3.2% respectively – so we are talking about significant impacts.

Now, the $200/ton iron ore price was never going to be sustainable and it was only a matter of time before it came down, and the federal budget was indeed assuming that prices would come down to $55/ton by March 2022, but the pace of the fall in prices is faster than most analysts predicted.

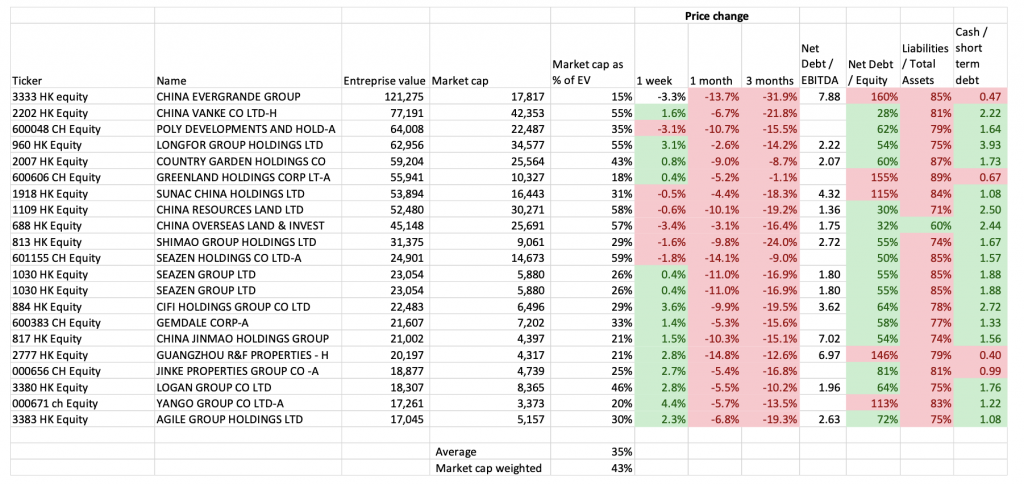

In my previous note, I included this table, which shows that, on average, the market cap of Chinese property developers as a per cent of enterprise value was only 35 per cent showing how little of the total value of the companies actually belonged to shareholders and how much belonged to debtors.

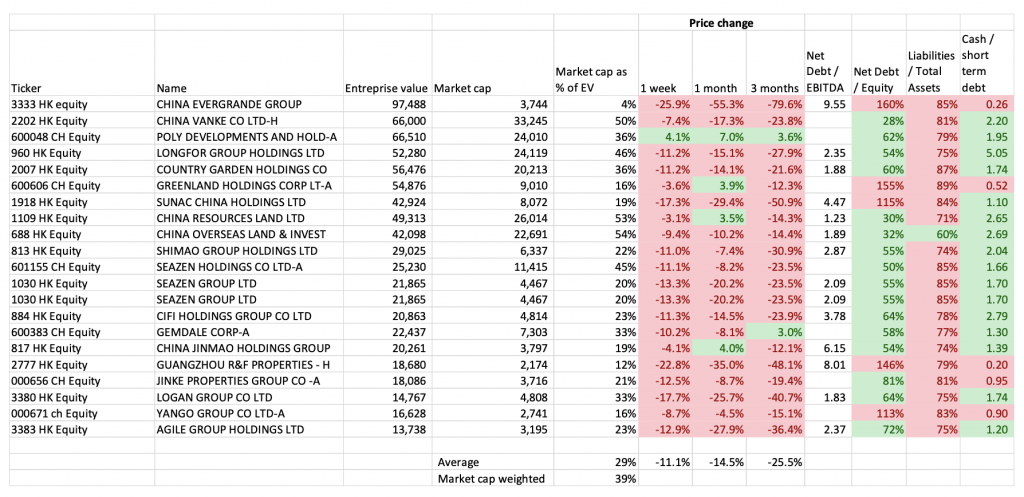

Given the deteriorating environment for the Chinese property developers since my last post, I think it is interesting to look at what this looks like as of today.

There are two points to highlight:

- During the last three months, which corresponds roughly to the period since the last table was put together, share prices have on average fallen by 26 per cent with some of the companies falling by more than 50 per cent, topped by Evergrande which is down a whopping 78 per cent and with only two companies having positive share price performance.

- This has resulted in the Market Cap to EV ratio falling to 29 per cent on average meaning that an even higher portion of the total value of these companies belongs to debtors.

There are definitely a few companies where the current equity value has to be considered an option value for the case that the companies will be bailed out by the Chinese government. We have though yet to see any signs that the government is ready to do this, and they have been quite public in their campaign to reduce moral hazard and curb excess lending.

It will be interesting to see if they can continue to hold this line as it will impact property prices and will have quite profound implications for the wealth of its citizens given that about 70 per cent of Chinese people’s wealth is tied to property ownership, compared to around 27 per cent in the US.

At the moment, my reading of it is that the government will hold the line and not bail out the sector, but I suspect that if we start to see social unrest and significant challenges to the party, this might change.

When it comes to iron ore prices, I continue to see significant downside from this fallout and since iron ore is an input cost for the Chinese economy, I do not think that they are too unhappy with the steep fall and would like it to continue further, especially given the continuing deterioration in the Australia-China political relationship.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

I predict that the HK peg to the US dollar will break in the next 6 months or so.

Chinese investors are desperate to get their money out of China – look no further than Sydney and Vancouver property prices for proof. The easiest way to circumvent China’s capital controls is to move your money via HK.

Foreigners are now waking up to the risks of investing in China. The Government has launched crackdowns on varied industries including Tech, Gambling and Education. The Evergrande bailout may protect domestic bondholders while leaving foreigners out to dry.