Some encouraging updates from Avita Medical

If you are a longer-term shareholder of Avita Medical (ASX:AVH), it is likely you would have experienced a rather disappointing journey over the past 12 months. COVID-19 and lockdowns in the US have stymied the RECELL roll-out just as it was gaining steam, as well as preventing recruitment for its various label extension plays in vitiligo, paediatric scalds and wound care.

Price-agnostic index selling in October, a cash-burning business combined with a surprise capital raising in February that helped killed short-term price momentum, topped off by an uninspiring share price chart and it was relatively easy to paint a negative picture.

(Somewhat ironically, during its meteoric rise in the December 2019 half, Avita was a cash-burning business with a larger-than-expected capital raising but with significantly less sales. The difference between 2019 and 2021 – price-agnostic index buying and an inspiring share price chart!)

It has also been by far the biggest detractor for The Montgomery Fund over FY21, after being the biggest positive contributor in the first approximately 12 months of our investment.

Throughout this entire period, we have continuously retested our thesis to justify our investment. One of the key pillars has been RECELL eventually becoming the “standard of care” in treatment of large burns in the US. While this remains some time away, there have been a couple of encouraging developments in June which we view as positive signposts along the journey.

FDA expanded label

In June, the company received FDA approval for expanded use of RECELL for pediatric patients. Included in the approval was expanded indication for treatment of full-thickness burns exceeding 50 per cent total body surface area (TBSA).

While we viewed FDA approval as a matter of when – not if – the earlier approval allows Avita to commence sales activities immediately to existing accounts for pediatric burns patients, as well as the handful of pediatric-only accounts.

Source: Avita Medical

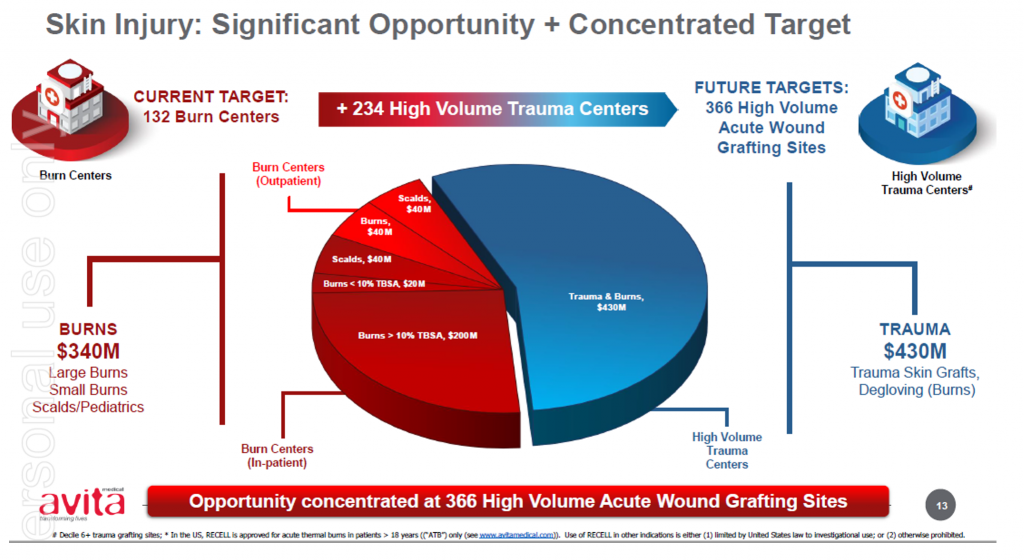

The expanded label expands Avita’s addressable and serviceable market opportunities, which Avita has previously estimated at approximately 25 per cent of US$240 million its initial target market. We understand some accounts had already been using the product off-label on pediatrics given the benefits of the RECELL system underpinned by the large body of evidence and real-world cases.

The expanded label highlights the regulatory barriers to entry enjoyed by RECELL. RECELL has Pre-market approval (PMA), which means the device manufacturer needs to prove both efficacy and safety by providing data showing the device’s performance in humans. A recent Harvard study showed total expected out of pocket costs of > US$500m to develop a Complex Medical Device for the U.S Market – once adjusted for probability of success and failure – given failure rates and cost of non-clinical and clinical studies.

This is different to a 510(k) designation, where the manufactures must “demonstrate only that these devices have the same intended use and are substantially equivalent to similar legally marketed devices”.

Given the large and growing body of evidence underpinning the benefits of the RECELL device in donor skin sparing, scarring and time to healing (and hence costs), we believe this is another key step in RECELL’s journey in becoming the standard of care vs traditional grafting over time.

Sales uplift

In Mid-June, Avita also updated it sales guidance for the quarter, lifting its sales guidance from US$8.2 – 8.6 million to US$9.5- $9.7 million. The upgraded guidance consists of an increase in commercial revenue of around US$1 million or 20 per cent (from US$5 to 5.3 million to US$6 to 6.2 million).

We understand the upgrade in guidance reflects both an increase in movement in the US – which unfortunately has led to greater burns incidents – as well normalisation of activity as the US “exits” the pandemic given its advanced vaccination programs relative to other regions.

While the take-up is significantly slower than we had originally anticipated in 2019 given the positive early feedback we received from Key Opinion Leaders (KOL) and those involved with the original trials, there are two factors that we had not accounted for:

- A global pandemic that struck just as commercialisation activities were gaining momentum;

- A lag between first order and use of RECELL – as in some cases, doctors wait for a “suitable” patient (generally a high % TBSA patient) prior to using the device for the first time.

As higher TBSA burns patients can be relatively uncommon, this has obvious implications for the pace of adoption beyond the general reticence in adopting innovation given skin-grafting remains a viable option.

For RECELL, we understand the natural progression of adoption starts with deeper burns where RECELL used is in conjunction with meshed autograph, and progresses toward smaller wounds where RECELL is promoted stand-alone. As the incident rate for large burns can be quite rare, we expect a greater focus from the company’s reps on targeting training for smaller burns given the higher volumes (note a 10 per cent TBSA burn is still relatively large and is considered the size of a limb).

Going forward

With the burns business now cash-flow positive on a direct costing basis, we anticipate improved sales should help the company fund its various label-extension opportunities in vitiligo and soft tissue and alleviate some concern around the company’s level of cash burn (which we note is an investment for future revenue growth).

We remain optimistic the company will expand its addressable markets through both label extension and geographic expansion given the extensive evidence of real-world cases in its targeted indications, while also growing its current burns business for years to come.

The Montgomery Funds own shares in Avita Medical. This article was prepared 29 June with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade Avita Medical you should seek financial advice.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Hello Joseph: waiting with great interest for AVH quarterly report due out tomorrow. I note it is still a holding in the Mont Fund, and even added to late last year (according to Simply Wall Street), so I was wondering if you could (or plan an) update on the progress of the science and finances at AVH? Your last analysis of AVH was excellent and most appreciated.

Very informative and helpful reply, thank you Joseph.

What do you think the odds are that Recell will get approval in Japan before the end of the year?

And if they do get approval in Japan, do you think it will be for just burns or for multiple indications including soft tissue wounds and vitiligo as well?

Do you have a stock forecast price for Avita in the next 12 months?

Hi FM,

Impossible to know re: timing of regulatory decisions – but as you are probably aware the company has pointed to calendar year end target.

re: multiple indications – again, very hard to know. I think there’s a decent chance of vitiligo given the wide body of real-world cases and evidence, but soft tissue wounds may be more challenging in terms of approval for funding / rebate perspective.

I don’t have a specific forecast but improving traction in the burns market and some positive regulatory updates should hopefully see some interest come back into the stock.

Thank you for the positive update on Avita. Like your fund, I am a long- (suffering in my case) term holder of Avita, as I judge their potential to be significant, and that patience is required to see that potential. You pointed out that AVH has acquired significant barriers to entry in this field via expense of gaining FDA approval, however is it not so that other competitors, such as Polynovo (PNV), have achieved similar progress. PNV is also closer it seems to positive cash generation (within 1 year) than is AVH (2-3 yrs)? Would appreciate your comments on this.

Hi David,

Thanks for your comments.

While the comparisons are inevitable between Avita and Polynovo, it must be noted one is a dermal matrix (ie below the skin) while RECELL is targeted at the epidermis (the outer layer of skin).

You are correct in that Polynovo has FDA approval, as does Avita.

However, there are different designations of FDA approval for medical devices, which I have discussed briefly in the blog. One of them is known as a 510(k) and the other a PMA – a quick google search will explain the difference, but the hurdle to receive PMA approval is generally significantly higher than a 510(k) as the device needs to demonstrate both safety and efficacy – which is proven up with clinical trials with statistical parameters set by the FDA. This means a PMA device study will require the full timeline of preliminary to phase 3 studies which usually takes many many years, and has a high rate of failure.

We understand this distinction has important implications when it comes to sales and rebate discussion in the US Healthcare system, which is focused on minimising costs. For example, the FDA may approve upwards of 2,000 510k devices in any given year, vs < 50 PMA devices.

Re: Cash-flow break comment, there are important distinctions there too. Avita does carry higher corporate and admin costs relative to its current revenue, but a significant component of their spend is related to funding studies to expand RECELL's treatment indications with the afore-mentioned PMA designation. I understand PNV is doing a clinical study as well, but believe this initial trial is BARDA funded (note BARDA funded AVH's initial burns study back in 2017-18).

Regardless, much of this "cash-flow breakeven" will depend on the rate of future revenue growth (as well as costs), which is inherently uncertain.

Hope that helps David