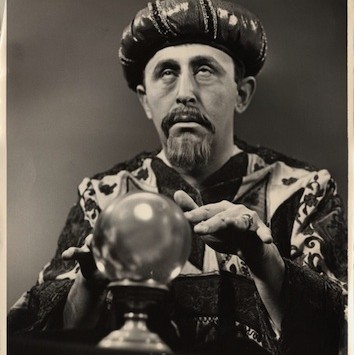

Forecasts and predictions

With the market having woken up in a good mood in January, we have recently seen a number of commentators revise upwards their forecasts for where the index may finish the year. Declaring 2013 to be a year for the bulls is very much in fashion. Admitting how wrong most of these forecasts were for 2012 is rather less fashionable.

To add some context, I thought it might be helpful to refer to some interesting research that has been done on the reliability of expert forecasts.

In 2005, Philip Tetlock, a research psychologist at Stanford University, published some work on the reliability of expert judgments, having analysed tens of thousands of predictions made by 284 people who made their living commenting on or forecasting political or economic trends. Tetlock tracked their forecasts over a 20 year period and found a couple of interesting things about the accuracy of the forecasts:

· Firstly, the experts were no better than non-experts. In general they could have been beaten by dart-throwing monkeys; and

· Secondly, the accuracy of predictions was inversely related to how often the expert appeared in the media. The highest profile commentators had the least insight.

In 2010, research published by McKinsey & Co. entitled ‘Equity analysts: Still too bullish’ laid out in black and white what many have long suspected: that equity analysts consistently overestimate the future earnings growth of the companies they cover.

The consultant found that in the past 25 years, average earnings-growth estimates of 10% to 12% for companies in the Standard & Poor’s 500 stock index were almost 100% too high. Average actual growth over the period was closer to 6%.

Authors of the report said: “Analysts, we found, were typically overoptimistic, slow to revise their forecasts to reflect new economic conditions, and prone to making increasingly inaccurate forecasts when economic growth declined.”

This tendency for optimism is reflected by the fact that analysts forecast growth of more than 10% for 70% of companies in the U.S. benchmark index. The only times analysts hit the mark occurred after bursts of strong economic growth, when actual earnings growth caught up with optimistic forecasts–in 1988, from 1994 to 1997, and from 2003 to 2006.

It’s only human for investment managers to think about the future and what it means for markets, but at Montgomery we are quick to admit that we just don’t know where the equity market might go in the short term.

We also knock back many more invitations to speak with the press or appear in the media than we accept. This is simply because we often have little to say or add and there are only so many times that we can be quoted as saying ‘we have no idea where the market is going’.

When the Oracle of Delphi proclaimed Socrates the smartest man in Athens, Socrates spent time trying to find someone in Athens smarter than himself.

He then proclaimed to understand the Oracles meaning for while many in Athens proclaimed to know ‘everything’, Socrates admitted that:

‘I understand that I do not understand’.

Your saying something similar here:

‘admit that we just don’t know where the equity market might go in the short term.’

This is the basis of any independent observations.

Thanks Roger, insightful as always.

Tend to agree with you on market forecasts. A mug’s game in the main. The only reliable data these days is what gets published and at time some of that could be a bit rubbery! I think we have to deal with the here and now. What are the earnings and what does this tell us about the company and its prospects? If it is a good business with reliable earnings, decent management and the fundamentals stack up then that’s the paradigm in which to frame your investment decisions. I often ask myself why do I want to own a part of this business and try and keep the emotions from influencing too much of my thinking.

Gary

Thank you Roger,

I can see the difference in the two valuations, appreciate your effort to advise me of same

Hi Tim,

It is a little bit worrying that Skaffold bases its valuations on the forecast of expert analysts, this article gives us some food for thought.

Regards,

Phil F

Hi Phil,

Thats not quite right. You will fine two valuation lines and one has nothing to do with analyst forecasts!

I must admit I too have noted with concern that the estimations of future increases in EPS, I.V and other measures of a positive, growing valuation profile in Skaffold are derived from the very same analyst recommendations derided in this forum (and many others) – though without them Skaffold remains a rearward looking product – telling me what the value was, rather than what it will be… I find it a deliciously vexing question!

That’s why we have two valuation lines in the Skaffold Line Evaluate Screen. One is there to tell you waht it could be if analysts are right and the other is based on a continuation of recent business performance.

One of the best financial articles I have read in a long time – priceless!

maybe I’m wrong (hopefully) but I doubt this is the next new big bull market, imo just the January effect

“Give me a one-handed economist! All my economists say, on the one hand…… on the other”

Harry S Truman