Lamenting the Australian Index

One of the strategies available to people who lack the time or inclination for active portfolio management is to “buy the index”. This is normally done via an index fund, which invests in companies according to their index weights. These funds have a certain intuitive appeal, as they typically charge low fees and are easy to understand.

However, if you step back and think about it, we think some serious issues arise. In essence, an index fund invests in a company, simply because it is there. This may be a satisfactory rationale for climbing a mountain, but we think it falls short as an investment strategy, particularly in the Australian context.

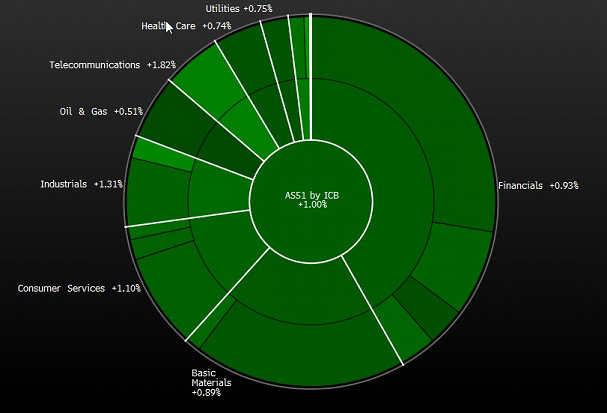

The chart below shows the industry composition of the ASX200 index. Ignore the % numbers – they are the daily price changes from yesterday – and look at the size of the slices. What stands out is that financials and basic resources together account for more than 60% of the total. If you buy the Australian index, your returns will be dominated by the big 4 banks and a handful of large resources companies. This doesn’t look like a sensible portfolio construction to us, and the rationale “because they’re there” doesn’t provide much comfort.

ASX200 Index Composition

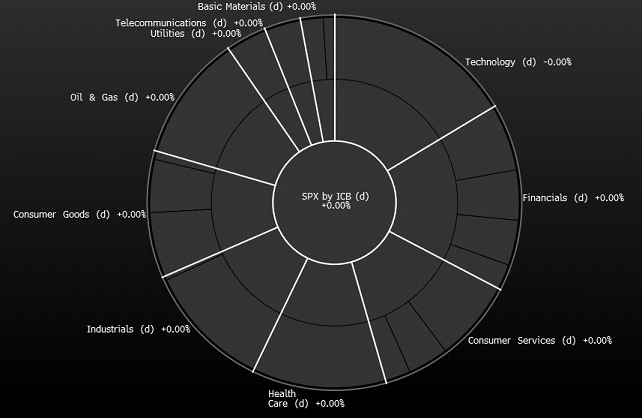

For comparison, the second chart, below, shows the composition of the US S&P500 index. A few things to note:

– Firstly, the US index has a much more even distribution, with 7 different industry groups representing a material part of the whole.

– Secondly, it’s interesting to note that technology is the largest single component of the US index, but is nothing more than a rounding error in the Australian index. In an age where commerce is being transformed by technology, is it good enough for Australian investors to have a <1% allocation to this sector ?

S&P500 Index Composition

Unbelievable comparison between TRS and Dollar Tree. I really wonder why Dollar Tree is trading at such a discount? Just had a precursory look but definitely worth yof another look. I wonder what is going on here?

Increasing margins, increasing buybacks, increasing ROE, new store openings, increasing online sales. hmmmm. I guess I have chosen the wrong company at the wrong time again.

What do you think Roger? Am I starting to get the idea of what to look for in this investing game, or am I really barking up the wrong tree?

I have had a quick look at Skaffold global and must say I am very impressed. Seems to be plenty more value on offer compared to the ASX index companies! Didn’t know where to post this comment, but thought this was as appropriate as any. Has anyone had a look at Varian Medical Systems?

Really impressed with US company annual reports. The section on risks is very comprehensive and everytime I read one I wonder how I could invest in any company at all – with the amount of detail on industry dynamics and competitors.

Getting back to Varian, it reminds me a little of ARP on the ASX. They have not had a backward year in the last ten in terms of earnings. ROE is forecast to head south in the next few years but not dramatically and still above 20%. Is this the sign of a competitive advantage even though they have so many bigger competitors. Is the consistent high ROE a sign of some competitive advantage? When I compare it to bumper bars, medical imaging equipment must have at least some technical moat to provide a competitive advantage. Many tech companies out there look undervalued, but as some famous investors quipped, if you don’t know that the earnings are going to be in ten years how can you own it for 10 minutes?

What do people think?

I for one personally have never bought the index idea.

When I first started investing 20 years ago I couldn’t find a list.

it is still rather hard to find, in one place, and one piece.

and mention on the news of the all ords rising or falling 2% daily didn’t quite make sense.

I base my performance on what I could have earned in a safe bank account vs what I have made, rather some elusive temporal index.

Each to their own I suppose.

Regards,

Eddie.

Hi roger, the merits or otherwise of a index’s components is kind of irrelevent .

If I want to follow the Aussie markets performance that’s

what I must use,

‘

I too think they are irrelevant but for a completely different reason!