Mortgage arrears and mortgage stress following rate cuts

Back in July last year, I had a look at what was happening with mortgage arrears and mortgage stress in this post. Since then, we have had three rate cuts from RBA and everyone who has floating rate mortgages should be paying quite significantly lower interest now than before the cuts. I therefore thought it would be interesting to see how this has impacted a households capacity to service their mortgage.

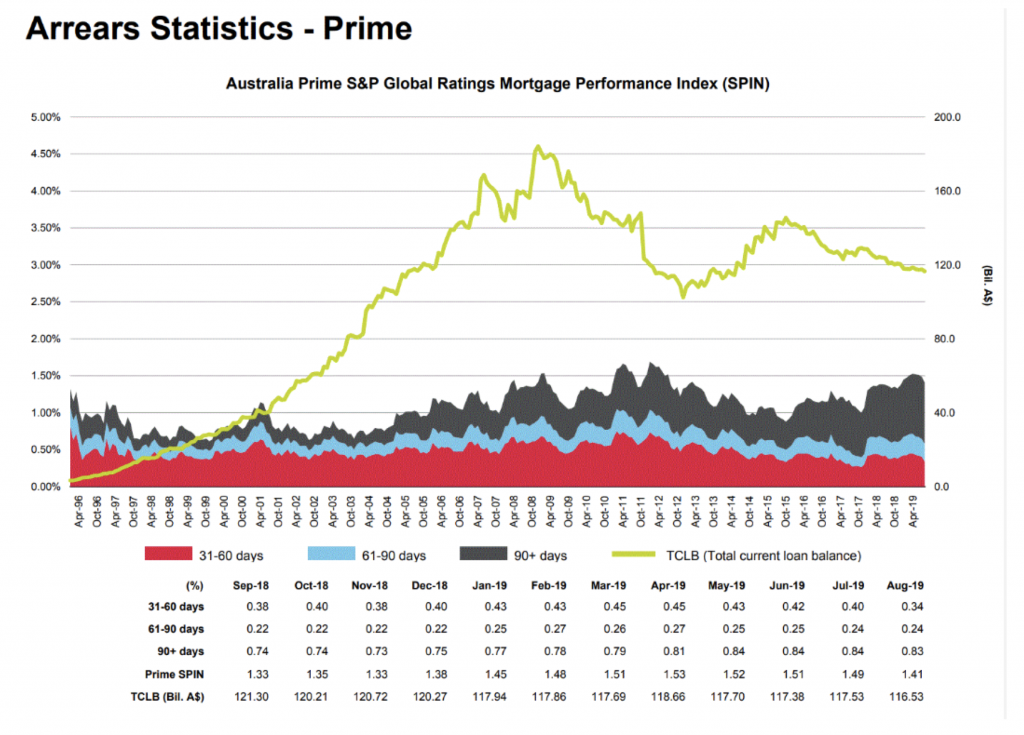

S&P provides data on the RMBS (Residential Mortgage Backed Securities) arrears rate and as can be expected, we have indeed seen an improvement in arrears starting in May which is when the RBA cut interest rates for the first time:

The improvement is though small and arrears are currently higher than they were at the same time last year. It is also interesting to see that it is in the 31-90 days overdue category that the improvement has happened and the 90day + category has actually increased. This tells me that the interest rate cuts have helped the people who are “on the margin” to service their mortgage but that the cuts have not been enough to help people who are in significant financial difficulties.

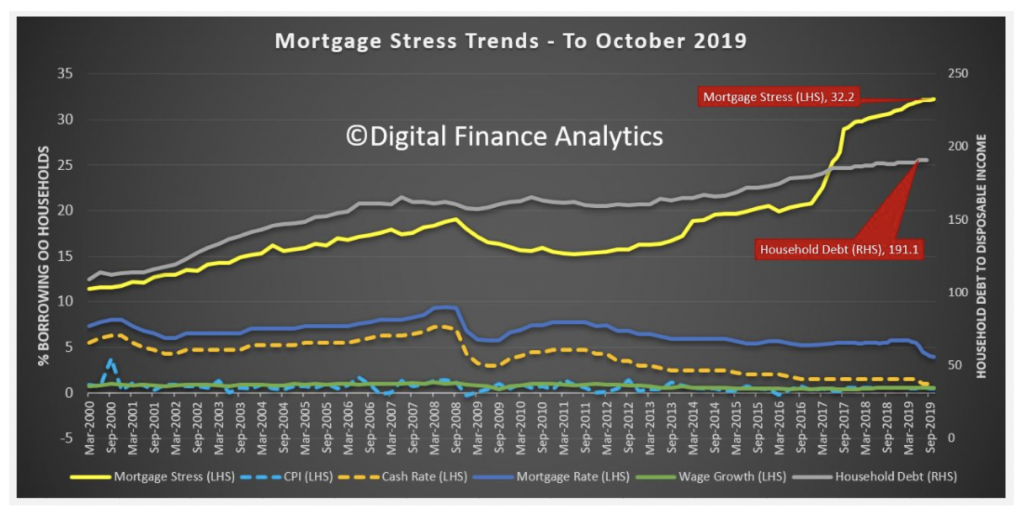

It is though very interesting to see the data from Digital Finance Analytics (DFA) whose survey of Australian Households shows that mortgage stress continues to rise to record levels and 32.2 per cent of households with a mortgage are estimated to be in either mild or severe mortgage stress:

The cause of this can be seen from a couple of other charts from DFA:

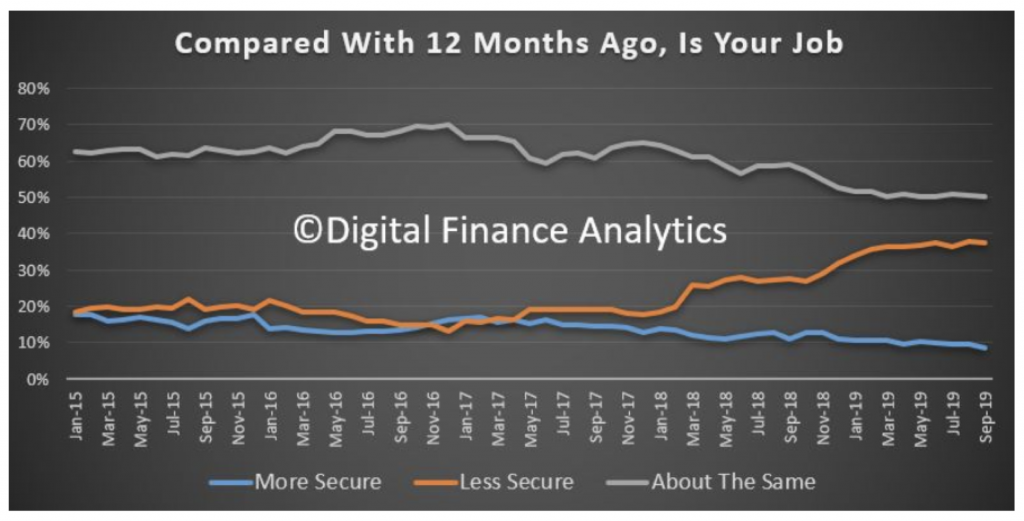

More and more people are reporting that their job security is decreasing:

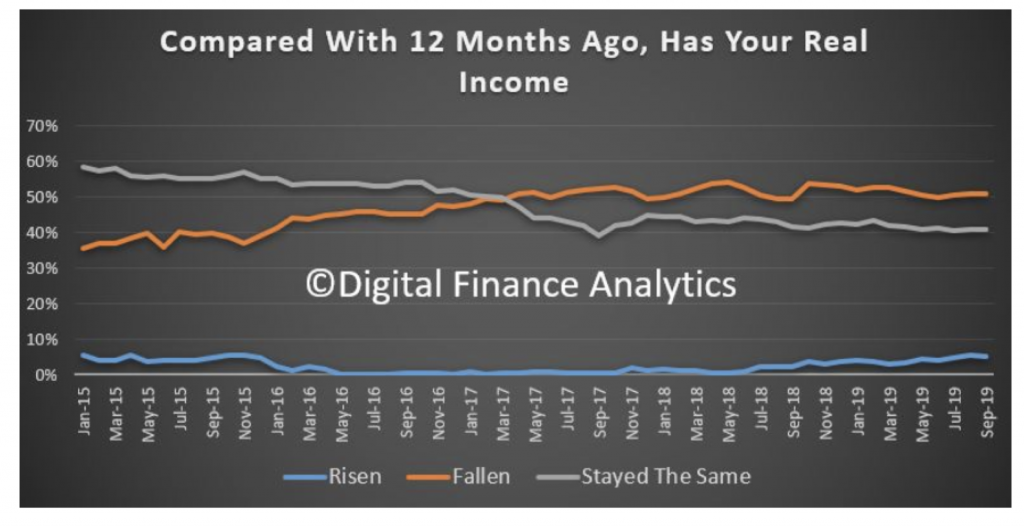

And 51 per cent of people report that their real income is falling compared to only a few per cent who are seeing increased real income:

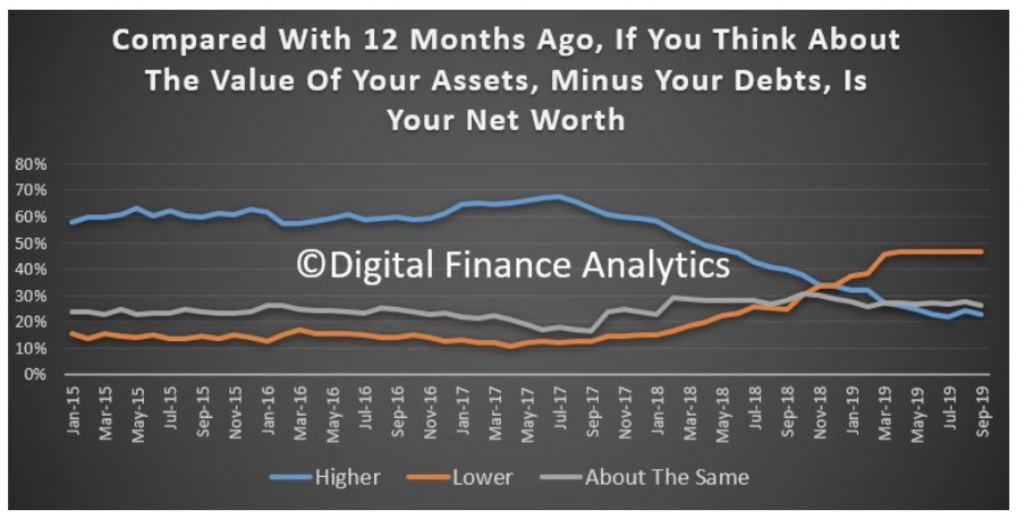

And around 50 per cent have seen their net worth decline during the last year:

The survey also reveals that around 27 per cent of households have no savings at all and would have difficulties in pulling together $500 in case of an emergency. Interestingly, 50 per cent of these households with no savings also have a mortgage…

This data corresponds well with the consumer confidence data which I described in this video a few weeks back and confirms our cautious view on the outlook for consumer spending.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

This info is blatantly obvious to middle class people, With the rising cost of healthcare, energy prices, fuel and food. Whilst also having stagnant wages and eye watering household debts and even though many main stream economists try to act like it’s not a big issue of having half a million dollars debt at record low interest rates.

thanks David. good reminder.

I reckon it’s obvious. Whilst politicians continue to interfere in the work of their statistical agencies, specifically in relation to the massaging of inflation data to the down side, households will continue to be slow boiling frogs dealing with low wage growth and real inflation on necessities in excess of 5%. The convergence here is putting massive pressure on disposable incomes. What staggers me is the buzz phrase of the decade is cost of living pressures on working families, yet statistically inflation is at an all time low. And not one economist or journalist calls it out.

Jimbo, in relation to the cost of living there is the idea of owning a house. People will talk of owning houses when they have almost no equity in them and are carrying all the risk if they should drop. The cost of living also needs to be projected into the future because the risk one faces in these costs dramatically increasing is rising rapidly.

So Roger, what is the cause of this ? It wasn’t that long ago, 2008 that everyone was doing well and fortunes were being made in the stockmarket. The GFC hit and everyone started to pay down their debts (we were at household debt over 100% versus incomes), but that’s a distant memory now.

I’ve probably just answered my own question with that last bit, but what has been the catalyst for this ? My take is that it’s not “something that we can’t do anything” about, e.g. “rising house prices” means a bigger mortgage, it’s that people have borrowed more than they earn and it’s not all to go and buy assets with, it’s been spent on gadgets, holidays and other ‘stuff’.

The cause to me seems like a positive feedback loop (wicked problem) where governments are too afraid to prick the bubble and addicted to encouraging consumers to take on ever more debt (even encouraging spending on things people don’t need – especially investment properties). This compounded by the problem that governments are unwilling to switch from monetary policy to fiscal policy. One might guess that the system will finally buckle when interest rates hit zero for too long a period and all incomes streams go into deflation (wages, dividends, rents, savings). Then, the system have to be reset into a fiscal mode (how long that takes who knows) generating new problems – hey but that’s how systems work there is no magic solutions.