5 burdens of Bitcoin

With all the volatility and noise around Bitcoin – we’ve written a few pieces about it here and here. Whilst it may have a first mover advantage – that doesn’t make it the only cryptocurrency worth understanding. Today I want to discuss some of the technical limitations of bitcoin.

In part 2 I will explore some alternative cryptocurrencies, both those that are promising and some more tongue-in-cheek.

Burdens of Bitcoin

Judging by the price of Bitcoin and the press we’ve been seeing – I’m sure you’ve heard many pro-blockchain arguments – indeed in many ways it is revolutionary. For a 101 on the technology you can read my very first blog post here. Today I want to discuss five of the limitations that the Bitoin blockchain implementation has:

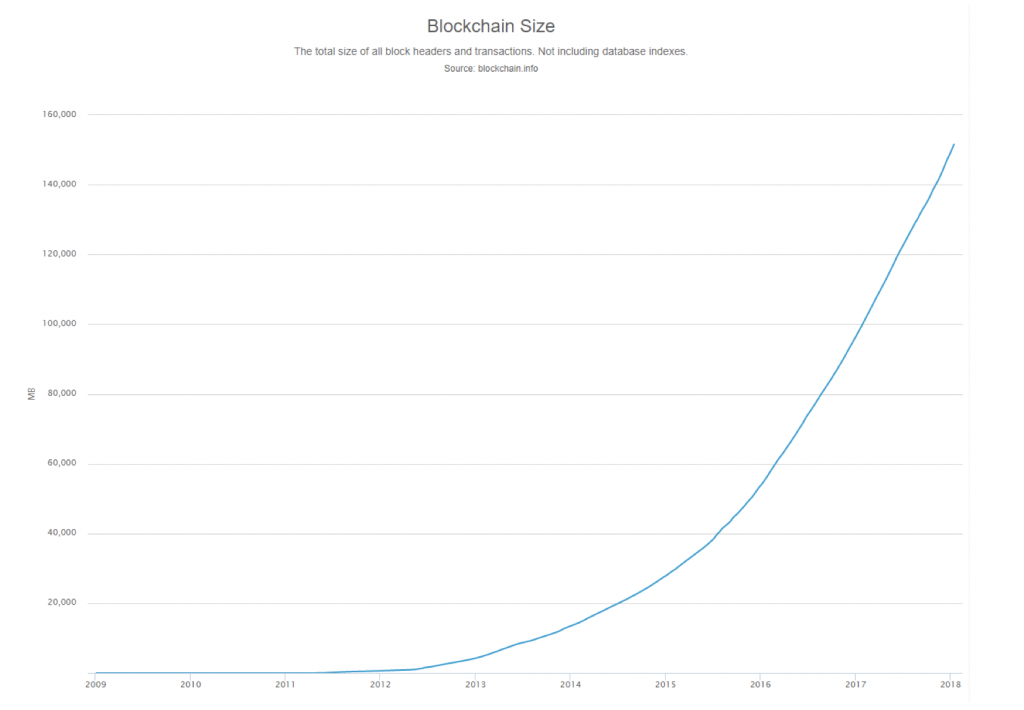

1. Storage practicalities: The basic premise of bitcoin is that it records and stores all historical records. As it gets bigger – this becomes rather a lot of data – currently over 150GB[1] to be precise. That’s a painful download! Also unlikely to fit in your spare computer capacity. This explains why many Bitcoin users opt not to store the blockchain on their computer and rather use an online wallet. This requires trusting a third party server to do this for you – the third party crypto is supposed to avoid. This problem is so large (pun intended) that “Bitcoin, as it currently exists, will never be able to support anywhere near the world’s total transaction volume.”[2] That’s not to say this will be the death of bitcoin – more likely it will change its current form. 2. Transaction speeds: Transactions on Bitcoin are slow. Firstly, the Bitcoin network is only able to process a maximum of seven transactions per second[3] (Visa does thousands). Further, transactions are only recorded to the blockchain once every 10 minutes. The reality is even worse as records regularly roll back, this has led to standard practice being to wait for 50 minutes – not exactly a tap and go payment.

2. Transaction speeds: Transactions on Bitcoin are slow. Firstly, the Bitcoin network is only able to process a maximum of seven transactions per second[3] (Visa does thousands). Further, transactions are only recorded to the blockchain once every 10 minutes. The reality is even worse as records regularly roll back, this has led to standard practice being to wait for 50 minutes – not exactly a tap and go payment.

3. Transaction costs: Bitcoin relies on the computing power provided by miners. This is fine when mining is an attractive profitable business – but what happens when we approach the upper limit of 21 million units? There will be less miners, providing less processing power. For more mining incentives, transactions costs must increase or bitcoin will need to be reformed to permit more supply (this would be deflationary). Another thematic driving up cost more recently (up to $0.32 for a transaction), is paying for priority in transactions. Whilst this can be compared to bank fees, we note banks are already taking steps to combat this (e.g. no more ATM fees).

4. Pseudo-anonymity: Whilst you are anonymous as a user, your transactions are public. This has actually led to some very interesting work studying chains of crime transactions (here is a good article on it). If you can identify one user – you can see everyone they have ever transacted with, but also watch all future transactions. Clearly not a favourable characteristic for the black market, but also egregiously intrusive for personal transactions (would you want to make your credit history public? Or if you’re a corporate, say Woolworths, would you want your competitors seeing all your supplier contracts?)

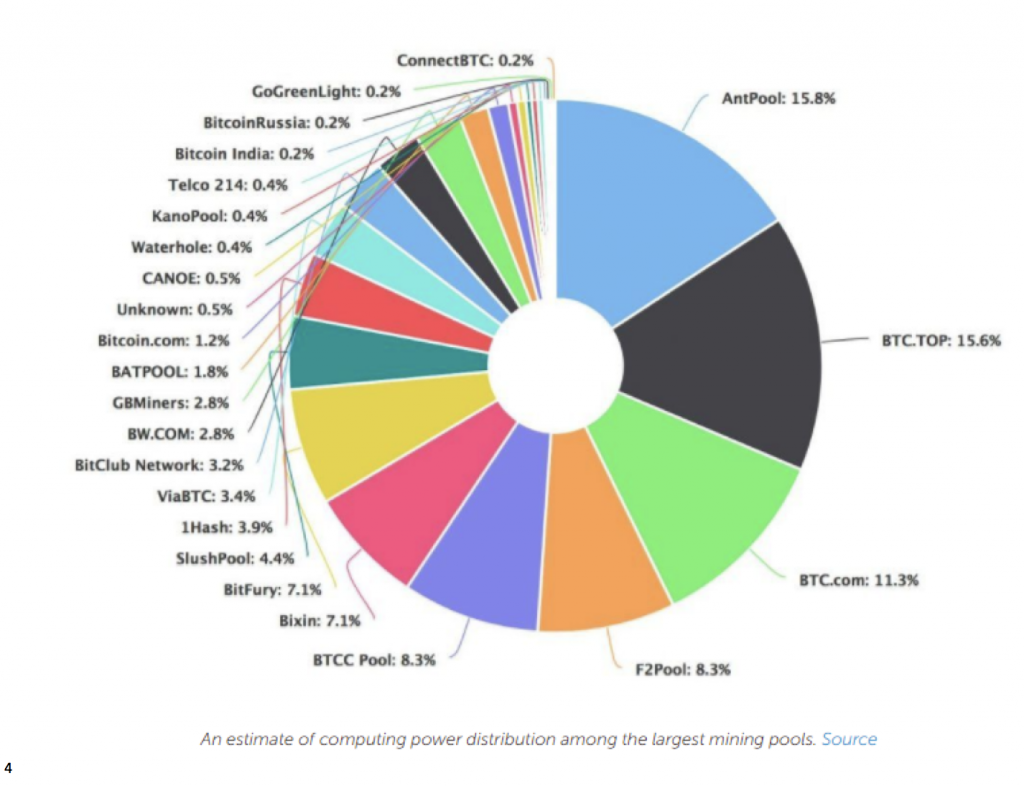

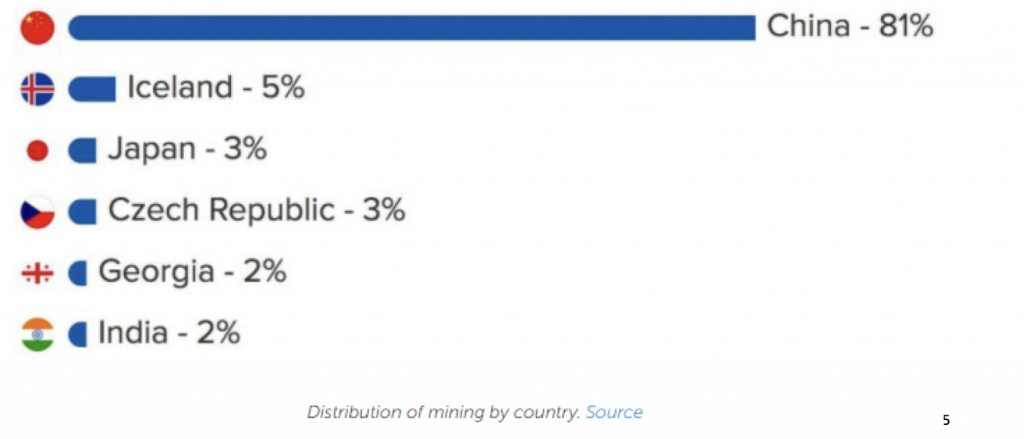

5. The 50% rule: Controlling the majority of the computing power being used for mining permits you to write alternative financial histories i.e. you can spend the same coin twice. Whilst this may seem far-fetched, consider that this only requires control of four mining pools.

Furthermore, 81 per cent of the computing power is in just one country, China:

Although Bitcoin is today’s mainstream cryptocurrency, this doesn’t guarantee it will be the top choice in 10 years. In part 2 I will discuss some alternative cryptocurrencies, some of these actively address the limitations of the Bitcoin implementation, others appear made in good humour.

With all the volatility and noise around Bitcoin Lisa discusses five of the technical limitations of bitcoin. Share on X

[1] Source: https://blockchain.info/charts/blocks-size

[2] Source: https://trends.ufm.edu/en/article/beyond-bitcoin/

[3] Source: https://www.kaspersky.com/blog/bitcoin-blockchain-issues/18019/

[4] Source: https://www.buybitcoinworldwide.com/mining/pools/

[4] Source: https://www.buybitcoinworldwide.com/mining/pools/

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

look , these cryto currencies are worthless. Why? money only has value if it is backed by coercion. Today that means the state will back it by enforcing laws relevant to it and more importantly will collect taxes in it. Tax is of course coercion. If states want to use blockchain they can create there own currency and it will have value if they enforce it.

Lisa, What i want to know is, who gets the money when you invest in this dubious asset? OK I presume the seller of course. So the originator of Bitcoin idea made a fortune selling invisable coins to start up the whole process I guess?

Hi Paul, several people make a profit from the rise. To continue with the Bitcoin as gold analogy – the shovel makers do well, here’s a good article on it: https://www.thetimes.co.uk/article/who-profits-from-mania-for-bitcoin-btgbzxt9p

Thanks Lisa for that info.

My pleasure