Is this company a master of the mine?

PORTFOLIO POINT: Coal mining services provider Mastermyne is attractive if you consider its work in hand, revenue and earnings prospects. Cash flow, however, must be watched closely and value has recently taken flight.

Investors can be an irrational lot. When share prices are low, investors are reluctant to buy, preferring first a rise in prices to confirm their beliefs. Yet when those beliefs are confirmed and after share prices rise, the reluctance to buy remains; now the investor waits for lower prices to provide a more attractive entry point.

Mastermyne (ASX:MYE) has enjoyed a recent surge in its share price. Even though the rise has pushed its share price above a rational estimate of intrinsic value, it should not dissuade an investigation of MYE as conventional wisdom suggests favourable industry dynamics bode well for its earnings prospects over FY2012 and beyond. For now, turn the stockmarket off and focus on the business.

Mastermyne, established in 1996, is Queensland’s “leading” provider of specialist underground coal mining services. The company’s operations are primarily in the Bowen Basin, but the company also enjoys a growing presence in NSW’s Illawara. The company counts BHP, Rio, Vale and Anglo Coal among its Tier 1 customers. Demand for the company’s services is tied to coal production volumes and the short and medium-term outlook for coal production is positive, thanks to demand from emerging economies.

Bright prospects do assume the following: a benign environment for union action against coal miners (union action is currently underway for the BHP-Mitsubishi JV); no impact from litigation by the “Stopping the Coal Export Boom” movement that has also carefully planned and funded litigation action to delay development of port and rail infrastructure; and the spread of new production in Queensland’s Galilee Basin and NSW’s Hunter Valley.

Mastermyne’s three business segments are:

Mastermyne Underground (Mining Services) (>90% group revenue) (underground conveyor installation, extension and maintenance; underground roadway development; underground ventilation device installation).

Electrical and Mechanical Services (>1% of group revenue) (above ground electrical and mechanical services, including construction, maintenance and overhaul of draglines, wash plants, materials handling systems and other surface infrastructure).

Engineering and Fabrication (designs and fabricates attachments for underground equipment; general engineering and fabrication; supply of consumables for underground coal mines).

Since listing in May 2010 and under the direction of Tony Caruso (CEO since 2005, MD since 2008 – pictured above at far left during Mackay’s best business 2010 gala awards), MYE is off to a good start as a listed company. Importantly, investors should note that of the $40 million raised in the float, not a dollar went into the business. About $2.3 million went to the deal’s brokers and vendors received $37.7 million. Equally importantly, the company didn’t say in its prospectus that the proceeds had been used as ‘working capital’. I have seen plenty of companies that did, even though not a cent went in.

Supported by a strong order book, MYE exceeded its prospectus forecast revenue and earnings for 2010 by circa 4%, and earnings for 2011 by 10%.

Citing limited ‘through-the-cycle’ performance transparency, many investors get nervous about a company that is either new or newly listed. There is no escaping the argument in this case. Not only that, but the fact remains these types of mining contractors typically have high operating leverage and feast can quickly turn to famine, especially where barriers to entry are low (such as in this case) and competitors are willing to price irrationally when pickings get slim. However, between FY2007 and FY2010, MYE achieved compound annualised growth of 17% in earnings before interest, tax and amortisation. Encouragingly, the company grew operating earnings during the GFC and, in a more recent six-month period to August last year, grew its FY2012 contracted order book by 30% – this on top of the previously mentioned prospectus-exceeding growth for FY2011 and second-half 2011 operating earnings growth of 22%.

During MYE’s annual general meeting (AGM) late last year, a very strong start to the current financial year was also cited. Growth in the two smaller divisions is being targeted (expect strong growth off a low base) and the company is positioning to engage in larger projects that are coming online over the next three to four years. Specifically, Mastermyne said that demand for its services remains strong and is increasing.

While several analysts have cited MYE’s strong employee growth as evidence of its statements about pipeline growth, it also serves as a reminder of the operating leverage that engineering contractors typically display. A leading position is essential in the event that industry-wide revenue ever turns south.

Watch the cash

On a work-in-hand, revenue and earnings basis, this is a company with bright prospects. The one caveat, however, is cash flow. Ultimately, it is by cash flow that a company lives and dies. A company waiting for its customers to pay while growing fast must manage its cash flow very carefully.

As is typical in a capital-intensive business (note: reason to moderate any plans for grand portfolio allocations), growth requires significant capital expenditure, as well as more typical variable expense increases. For 2011, net operating cash flows declined from $15.1 million to $9.4 million (take a look at the $20 million jump in receivables for a partial explanation). However, after subtracting $2.6 million for capex, the company was still able to pay its borrowings down by $6.7 million (the apparent increase in ‘borrowings’ is due to finance leases – another cost associated with expansion). Finally, a dividend of $2.6 million arguably caused the bank balance to decline by $2.2 million in 2011.

Using my method to estimate business cash flow, an $8.7 million business cash outflow can be offset by an $11 million increase in property plant and equipment, but the company really needs some of those 1200 additional staff it has taken on to be working in the receivables management part of the back office.

I suspected the accrual accounting used to record revenue would be based on effort expended, and indeed, the annual report confirms this:

“Revenue from services rendered is recognised in profit or loss in proportion to the stage of completion of the transaction at the reporting date…”

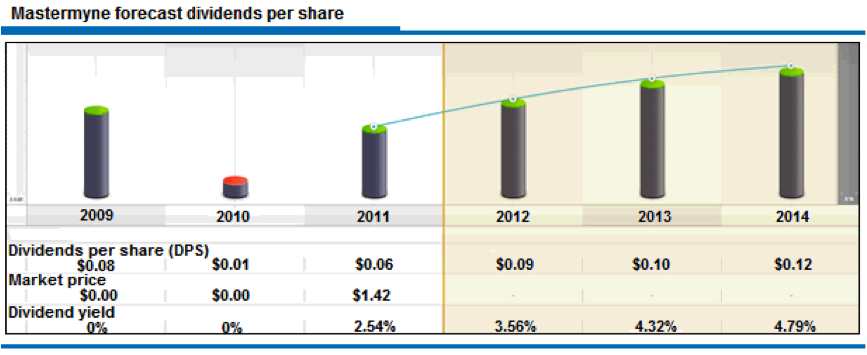

However, clients like BHP, Rio, Anglo Coal and Vale, while making a great looking CV, will also ensure Mastermyne won’t be dictating cash payment terms. The impact of this should not be underestimated, because Mastermyne will require cash to maintain and expand its equipment fleet, as well as maintain dividends (forecasts for per share dividends can be seen in the graph below).

Source: www.Skaffold.com

Only once you are comfortable with an understanding of how the cash flows through the company, its quality and its prospects do you move to analysing its intrinsic value.

Intrinsic value is a function of a company’s equity and the profitability of that equity, as well as a conservative required return.

The make-up of Mastermyne’s equity is therefore important and an examination of the balance sheet reveals that a not-insubstantial portion of the owner’s equity is comprised of intangibles, namely goodwill. The payment to the vendors of around $40 million was well in excess of the book value of net tangible assets, and so the accountants created a common control reserve to ensure the balance sheet balanced. The upshot is this would be a problem if the company were required to borrow meaningful funding. The combination of operating leverage and higher debt (if it were to grow) is itself less than perfect, and debt backed by goodwill leaves shareholders with precious little to support share prices if revenue or operating margins were to turn down.

That appears unlikely in the near term and so we move to the other element of the intrinsic value equation, which is return on equity. For the next two to three years, these returns are expected to remain high and stable at around 31%.

Based on these expectations, and turning the stockmarket back on, Mastermyne is trading at a premium to its current value. A pullback to $1.80, if it were to transpire and all else being equal, should be a trigger to pull the file out and conduct some due diligence on the company’s prospects at that time.

*Mastermyne (ASX:MYE, Score B1) is a small Montgomery [Private] Fund holding.

Posted by Roger Montgomery, Value.able author, Skaffold Chairman and Fund Manager, 26 March 2012.

Cheers Roger,

That’s a great website

Hi Roger,

I am bullish on thermal coal and tempid to say the least on coking coal.

I can’t quickly determine the exposure in this area for Mastermyne…….I presume with the areas they are in it’s mostly thermal coal but I don’t know……….Do you have figures on that?

Cheers

Hi Ash,

ANglo American job at Moranbah North is coking coal and you can get all of the Bowen Basis data here: http://www.bowenbasin.cqu.edu.au/basin_data/operating.html