diamond in the rough

We believe we have come across a ‘diamond in the rough’ of sorts and the stock in question is Altium Limited (ASX: ALU), a software design company currently located in San Diego, California. The company creates software that is used for the development of plastic circuit boards.

Altium software has probably helped design some of the circuit boards in the products you use in your everyday life. From car parts (by BMW, Volkswagen & Toyota) to computer devices (by Microsoft, HP & Belkin) and even medical devices (by Cochlear, Philips & Resmed), Altium allows engineers that make Printed Circuit Boards (PCB’s) that drive these devices to move from concept and into mass-production.

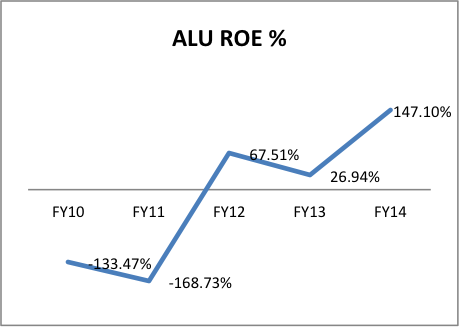

Importantly to us, not only does this represent a true need with the ‘internet-ing of everything’, but the firm has demonstrated improving economics and using its sticky products has delivered its shareholders a 2,500 per cent return on their investment since 2010. Naturally of such a meteoric rise – we ask is there anything left? Well we believe there is reason to be optimistic.

The Business case.

Altium currently offers a licence to use the latest version of Altium Designer (which sells for $7,500 US per licence) and on top of this, users are charged an annual subscription of $1,750 US p.a. Included in the subscription offering are frequent updates, access to a library of pre-made board templates and full customer support.

Computer applications are often known to be “sticky” in that once you start using them, it’s a lot of effort to switch to a competitors application. In this case, the sheer inconvenience of switching in terms of training cost/time is rarely worth it. This stickiness promotes a growing subscriber base (as of December 30 2014, approximately 27,000 subscribers) and hence revenues become increasingly more “annuity” like in nature to the point where they now account for almost half of Altium’s revenues (and this number is growing). This for obvious reasons is a highly desirable investment characteristic.

Further to this, Altium has recently increased prices with apparent little pushback given they are still significantly cheaper than their competitors, and with ongoing reinvestment back into their product and continuously added demanded features, the firm has been taking market share (6 per cent in 2011 to north of 10 per cent in 2014) with seemingly more to come.

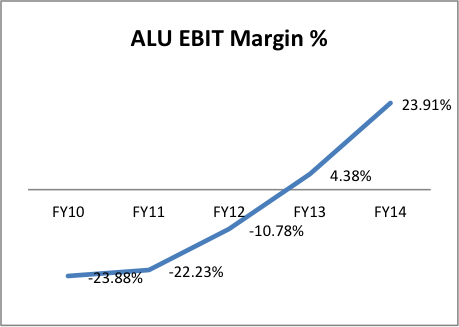

This growth in market share is translating into impressive financial results. One measure of profitability is a firm’s EBIT (earnings before interest and tax) margin and it’s risen from -23 per cent to almost 24 per cent over financial year 2010 to financial year 2014.

Another highly desirable feature is that the business requires little additional capital to expand in its traditional market and in this scenario we would see the stock being worth approximately $4.00-$4.50 (the share price as I write this is $3.30). An upside to this valuation clearly lies in the fact that the company has raised funds for expansion into other parts of the software design market (by acquisition), however this scenario lies outside of our base-case valuation.

Overall, Altium appears to be a high quality company with bright prospects for the future. A great new addition to our funds.

The Montgomery Fund and The Montgomery Private Fund hold positions in Altium Limited.

This article is for general advice and educational purposes only. Before you commit to any investment decision we strongly recommend you seek the counsel of a licenced investment adviser.

Scott Shuttleworth is an analyst at Montgomery Investment Management. To invest with Montgomery, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

It’s certainly a sticky customer base. There isn’t all that much that actually matters between electronics CAD applications. I believe the cost of switching is at least 2-3 months of lost productivity for a well established professional, and that is far and away the most important factor to me. Recently I paid 1/3rd the list price for Altium with the “advanced training” course thrown in. That was by purposely bumping into an Altium sales rep in person and faking disinterest, pretended I was happily using a competitors product which I’ve never touched. Naughty me but that’s the market, I played to their weakness.

Altium’s product is coming off a fairly ordinary period in the 00’s. There was a string of updates that consistently failed to address serious existing bugs and seemingly created as many new bugs as it did (often gimmicky) new features. I got to the point of switching applications for a simple product, despite already having a fair idea of the cost of this move. But that only lasted for a single and relatively small project anyway, ultimately delaying Altium updates for 3-4yrs at a time to “stick with the devil you know” was the best bet, the software was never that bad provided you relied on redundant automated backups in the background.

They started to get their act together around 2009/10. Of course investors would see something entirely different. I think that is because there was a lagging recognition of this fact, and a slow regaining of trust. The product is still less than perfectly reliable but I would be willing to sign up to a regular update plan now more than ever before, the fear of bugs in the new releases has largely subsided.

Despite the problems of the past, I’ve always been a bit surprised that Altium’s market share is as low as it is, I believe there is more potential for growth than risk of new competition. That said, I wouldn’t be surprised if most of the current revenue growth is due to signing up existing clients on more regular upgrades following the reasoning I have provided above. That is a positive change, but it leaves me questioning how far forward one can reasonably project this current growth rate. It’s a great product, but I am less optimistic than analysts and investors seem to be right at the moment.

BTW, I don’t think the “internet of things” has all that much to do with this company. If anything, the IoT push is better aligned with free software that competes with Altium due to the IoT market being more strongly tied to the free & open source push than other electronics design markets. Furthermore, IoT is also largely about modules being provided that are more user-friendly than they have been in the past. From these modules, thousands of very simple application-specific circuits can be designed by every man and his dog – but these circuits are so “simple” that the free software alternatives are more than adequate.

Great insights Josh. Thank you for sharing them with our blog community!

Thanks for posting this. I had previously looked at Altium but for some reason that I can’t recall now decided against investing. Looking at it again now I think this was a mistake. The company seems to be offering value and great growth – even after the recent increase in price increases. My valuation came out a bit higher than yours, so I’ll be having a very close look over the weekend.

Thanks for sharing your thoughts Patrick. Be sure to conduct your own thorough due diligence. Keep in mind we could be wrong and/or the share price could halve at any time.

hi Scott, does Altium have any competitive advantages ?

surely there are lots of other software companies that could compete with and overwhelm Altium, particularly in a place like California ?

thanks

Carlos

I wil ask Scott to come back and answer that one for you.

Thanks for your question Carlos.

Altium software is typically viewed as the best in the middle market of PCB design and it’s been taking market share from it’s competitors for a number of years. So yes, there are other companies but Altium appears to be besting them.

There are some higher-end, more advanced products, but their price tags are much higher ($50k – $100k per licence as opposed to Altium at $7.5k per licence).

By our research, it would take a well funded new entrant between 3 & 5 years to develop a competing product and this is assuming you know the future technological direction of the market (which is very difficult). Whether new entrants would find it worthwhile enterring the PCB market (which is only about $1B worldwide) to compete against established players with “sticky” customers is another question entirely.

Best,

Scott

Interesting company indeed! However, the obscure remuneration report does put me off a little as it seems that management’s remuneration is fixed with 0% at risk (for both LTI and STI) and that includes a lot of options/retention rights.

“During the period to 30 June 2013 the Directors of the company granted 3,550,000 shares to 23 employees of Altium Limited and its subsidiaries”

(from FY14 financial report – note 39)

A bit too generous without any clear KPIs perhaps?

Good thoughts Tom and one Scott will come back to you on. STay tuned.

Hi Tom

Firstly it’s great to see you’re reading the financial statements thoroughly, you’d be surprised how many other investors (even professional investors) don’t.

As you would know, a great way to develop an edge is to understand more than the market does about any particular company.

Whilst there are positives about Altium, the issue you raised (and a couple of others) in terms of renumeration did catch our eye. The question is whether it’s enough to completely derail the investment thesis.

In our opinion it’s not (there’s more than enough positives to offset this issue) but every investor will need to make their own decision.

Should also note that the company is expected to be bringing in an LTI in FY15.

Best,

Scott