Where are we in the valuation cycle?

This is a frustrating market for value investors. Like many of our ilk, we are struggling to find high quality companies trading at prices that we consider attractive. As a result, we now hold significant cash balances in our funds waiting for opportunities to emerge.

There is a deluge of IPOs hitting the market that one can sift through in search of gems, and to be fair, we are finding some of these to be attractive. However, the fact that so many vendors are jumping through the IPO window at the moment is another reminder that listed market valuations are higher than they have been for some years.

Holding cash in a rising market is painful, but that is the nature of long-term investing. Being willing to endure some pain in the short term is one of the requirements for longer-term success, and so we suffer (somewhat) gladly. The suffering ends when valuations again become cheap and we can put the cash to good use.

To get a sense of how much suffering may lie ahead of us, we did some indicative valuation analysis this week. The analysis indicated that we should not respect relief any time soon. Indeed, after reviewing the results we began to look to the example of Antarctic explorer Lawrence Oates for inspiration.

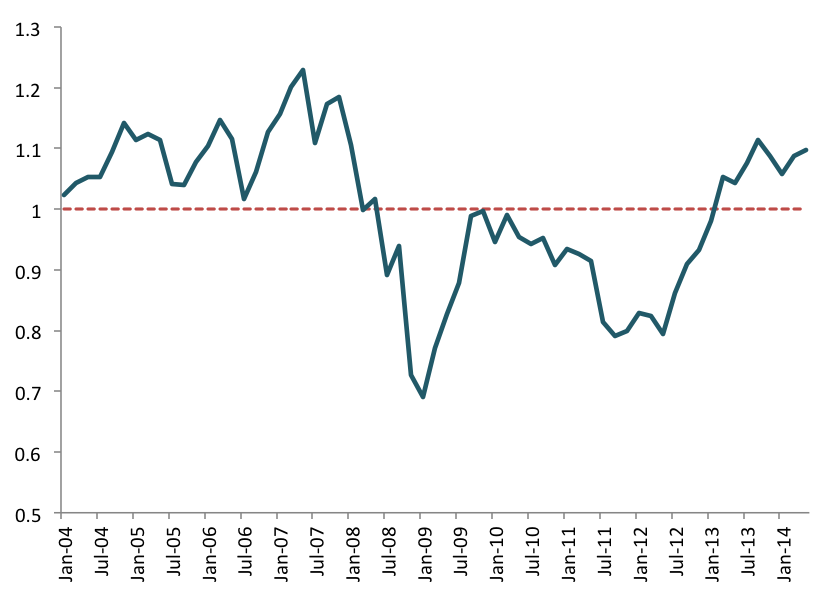

What we did for the analysis was select a group of large listed companies that have delivered reasonably steady performance over a period of ten years (which makes them easier to value). We then asked our valuation models to estimate the value for each company at 2 month intervals over the last 10 years. The appeal of this analysis is that the valuation models are completely objective and consistent, and can take into account a wide range of factors including, financial performance, balance sheet condition, and growth prospects. While the valuations might not be completely accurate for each company, the average of the group provides a pretty reliable measure of average value.

As expected, we found the current market to be on the expensive side of fair value. The model indicated an over value to the order of 10 per cent, relative to the 10 year average. However, we can also see from the analysis that the market has gone above this level before, and has stayed at high levels for extended periods of time. The peak was around 23 per cent, overvalued in 2007 just ahead of the GFC, and at this time valuation had appeared expensive on average for more than 3 years.

The current market “feels” unduly expensive to us (and to others), but this may be due to the fact that valuations have generally been cheap in the years since the GFC. We have become accustomed to seeing attractive prices, and being in an overvalued market after so long away feels odd.

It is impossible to predict what the market will do in the short term, but the longer-term implications are easier to understand. At some point in the future we should expect to see prices return to the cheap side of the chart, and when that happens having some cash set aside will be very welcome. This could happen tomorrow for reasons that nobody can foresee today, but market cycles can be very slow and it is more likely that it won’t happen for quite some time yet.

We aim to make good returns for our investors and missing share price gains is painful, but the first part of our job is to avoid losing investor capital. This means taking money out of the market when the long-term picture is not sufficiently compelling, even if it means suffering underperformance for an unknowable period while markets remain buoyant.

We still have a majority of our funds in the market but, unable to find that compelling home, a substantial portion has now been left for the sidelines. It may be some time.

I like to be reminded occasionally that others are sitting on the sidelines and playing the waiting game (as frustrating as it is). It helps me not to be ‘jumpy’ with my finger on the trigger (errr … mouse) and remember it is a completely different market than 2 years ago.

Indeed. It’s what motivates a 37% cash weighting in The Montgomery [Private] Fund and simultaneously motivates our frustration! Patience is key.