Value in REA-lty

There’s no doubt that REA Group Limited (ASX: REA) has been an excellent performer in terms of share price over the past decade, it’s up over 2,600 per cent. We now ask, with questions arising about a potential housing bubble and maybe even a looming burst just around the corner, will REA be able to maintain this?

The answer may surprise you.

REA isn’t a business that traditional value investors would love. With a historical price-to-earnings ratio of 28, high growth hurdles, earnings seemingly linked to an unpredictable and fluctuating housing market (the list goes on), yet on closer inspection we believe that the investment case for REA is strong.

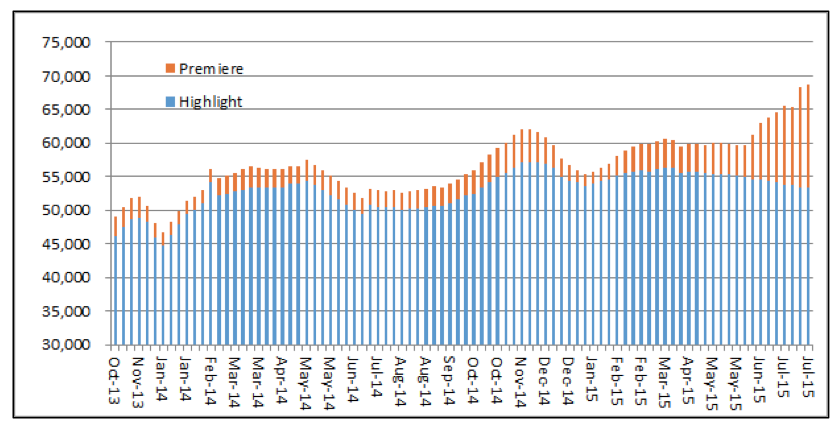

For those unfamiliar, REA operates www.realestate.com.au where real estate agents can list the properties of their clients (the vendors). REA charges a subscription fee from the agents for access to the website as well as charging for each property listing (known as depth revenues). Prices for property listings range from a few hundred dollars for a ‘feature’, circa $500-$1,500 for a ‘highlight’ and thousands for a ‘premiere’ ad. It’s important to note that the listing costs are passed from the agents to the vendor – costs of which are marginal relative to the ticket price of their property.

Prices for listings on REA have increased considerably over the past several years (increases of circa 20-50 per cent per annum). With the next pricing review expected in February of 2016, we asked the question ‘how much further can REA raise the prices of its ads?’ This is a tricky question, but answering it will provide a guide as to how much further the business can grow.

We believe that the best way to answer is to consider the marketing budget of a prospective house seller. Of course there’s REA, but then there’s also Domain (owned by Fairfax Media Limited (ASX: FXJ)), other online listing sites, newspaper advertising and of course, the seller is most probably using a real estate agent who’ll take a commission.

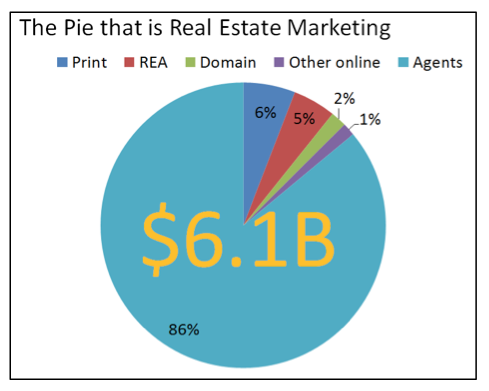

We’ve developed a fairly good picture of what the real estate advertising “pie” in Australia looks like (below). The share of REA, Domain, Print (newspapers) and ‘other online’ are sourced from various reports whilst the agents revenues have been estimated by taking 2 per cent (the standard commission for a real estate agent per house sold) of the total transaction volume of real estate in Australia.

Notably despite REA’s prominence in the market, it only earns 5 per cent of all market revenues. From our research, we believe that REA’s contribution of value to housing transactions is considerably higher for most other market segments given they effectively tie up a seller with a potential buyer.

From our research, we believe that REA’s contribution of value to housing transactions is considerably higher for most other market segments given they effectively tie up a seller with a potential buyer.

What we mean by this is because REA has a strong value proposition, it can over the years charge higher and higher prices due to the competitive advantage afforded to it by its ‘network effect’. I.e. the website attracts the largest audience of homebuyers / searchers in the market (by some magnitude) and hence ‘leads’ for agents (which ultimately drives their commission income from the sale of a property).

Because of this, there is an incentive for agents to continue listing properties and advertising and in a self-reinforcing loop that grows stronger and stronger each year, so does REA’s competitive advantage and ability to increase prices.

Note however, that it’s not always the case that value provided should equal revenue earned, although it can do when the firm holds a strong competitive advantage as in this case.

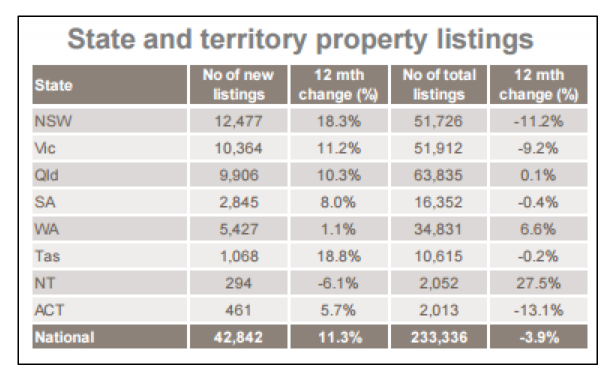

Of course, revenue equals price multiplied by volume, and the above will mean little if the number of listings on REA drops substantially. Interestingly, whilst the number of listings in the overall market is falling, the number of highlight and premiere listings on REA has been increasing. Due to their high price, the latter two generate the bulk of REA’s depth advertising revenues and their increasing popularity bodes well for its bottom line. Source: Data provided by CoreLogic (see the full report here)

Source: Data provided by CoreLogic (see the full report here)

Source: Data provided by Morgans Financial Limited

Source: Data provided by Morgans Financial Limited

Incorporating these factors as well as some numbers around the firm’s profit margins, we see the shares of the firm being worth over $60 each. At a current market price of circa $43.72, the upside is quite apparent.

The information in this blog is general in nature and is not a recommendation or a solicitation to deal in any security. Please do your own research and consult a licenced financial advisor where appropriate.

The Montgomery Fund, The Montgomery Private Fund, The Montgomery Global Fund & The Montaka Global Fund hold positions in REA Group Limited.

Scott Shuttleworth is an analyst at Montgomery Investment Management. To invest with Montgomery domestically and globally, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Scott,

You covered well on the upside from the REA’s “network effect”.

What is the downside from both general property market condition (how REA’s listing and business performed during GFC?) and future market competition (what would disrupt REA’s network effect) perspective?

Keen to hear your thoughts.

Hi ANdy, Scott and I visited the company recently and asked for some data from them that would mitigate our concerns. What we have learned that in difficult economic or property market conditions, more houses are listed and they stay listed for longer. In booming conditions such as we are experiencing today, many homes sell before even being listed for sale and REA sees no benefit from that ‘hyper’activity.

That’s right Roger, the local agents I know here on the upper north shore of Sydney tell me it is cheaper to sell a house now, as you may not need to list it on REA at all, and if you do it is for 2 weeks or so. As they recount, not like “the bad old days” in 2007 to 2009 when listings lasted for 90 days. If demand for property slumps and the length of time a property is listed grows, that just benefits REA, regardless of where the price goes.

All the best

Scott T