Gen Y will be buying cheaper houses soon

Ben Hurley – the AFR journo typical of Gen Y – will soon be buying a house cheap from boomers who have no-one else to sell to.

Last week Ben (here) wrote:

“I would love to own a home. I could upgrade my crappy electric stove, get a hot water system that actually fills the bathtub, and stop asking the landlord for permission to put a nail in the wall.

But I’m reluctant because I think buying a home is a dud deal. And renting, while expensive, is less of a dud deal because renters typically give the landlord a return of about 3 per cent on the asset’s value. A lot of my friends in their early 30s feel the same way.”

Ben goes on to explain why renting makes more sense than buying and I reckon he’s right, but for an entirely different reason.

The arguments over whether renting is better than buying is as old as the aspiration to own a home. I can remember in 1994 Paul Clithero arguing in his book Money that you will be better off renting rather than buying because inflation was expected to be low and prices for houses wouldn’t rise. WIth the benefit of hindsight that was a pretty great time to buy a house just about anywhere.

The debate however can only be settled with the benefit of hindsight unless some seriously long term thinking comes into play.

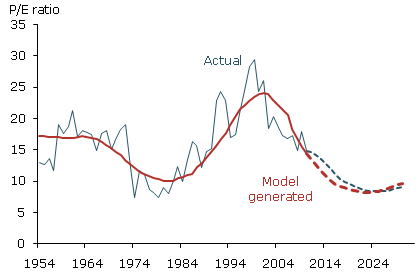

Remember this chart? Its the chart of share price P/E ratios being plotted against the ratio of of the middle-age cohort, age 40–49, to the old-age cohort, age 60–69 (M/O ratio) from 1954 to 2010.

As Zheng Liu, a research advisor in the Economic Research Department of the Federal Reserve Bank of San Francisco and Mark M. Spiegel, vice president of the Economic Research Department of the Federal Reserve Bank of San Francisco note; The two series appear to be highly correlated. For example, between 1981 and 2000, as baby boomers reached their peak working and saving ages, the M/O ratio increased from about 0.18 to about 0.74. During the same period, the P/E ratio tripled from about 8 to 24. In the 2000s, as the baby boom generation started aging and the baby bust generation started to reach prime working and saving ages, the M/O and P/E ratios both declined substantially. Statistical analysis confirms this correlation. In our model, we obtain a statistically and economically significant estimate of the relationship between the P/E and M/O ratios. We estimate that the M/O ratio explains about 61% of the movements in the P/E ratio during the sample period. In other words, the M/O ratio predicts long-run trends in the P/E ratio well.

What it suggests is that the multiple of earnings investors are willing to (or have to) pay for stocks is generally declining because the number of boomers accumulating wealth through the stock market is declining because they are dissavers.

I reckon the same will happen in housing so Ben Hurley need not worry too much and he’ll be changing his tune in the next decade.

You see boomers need to sell their homes. Plain and simple. On average there is not enough socked away in super to cover the rising costs of healthcare and lifestyle for a generation that will longer than they may have originally believed.

WIth most of the wealth tied up in houses, it leaves the family home the single biggest source of funds and therefore the one most likely to hit the chopping block.

But Gen X and Gen Y can forget about inheriting it. You see Mum and Dad need the cash tiger! You’ll get a bit but Mum and Dad need it for that knee operation or hip reconstruction or maybe that Cruise – ‘you know the World AND the QE2 is in Sydney champ!’

When you have a generation that need to sell and a generation that cannot afford to buy, there is only one solution. Lower prices.

So thanks to Ben and his ‘friends’, refarining from buying and feeling good about renting may just mean that prices will drop so Ben will be able to buy after all.

Here’s the only two problems to the thesis: 1) while share price P/E ratios are expected to fall, the S&P500 and the Dow Jones total return indices are at all time highs…perhaps prices can rise, and 2) Maybe the boomers rent their houses out at increasing rates of rent to sustain their living expenses…

What do you reckon?

This whole ‘baby boomer’ bust has little evidence. It’s flouted around all too commonly and it’s a nice magical concept but we don’t really have a large population of baby boomers.

The median age of Aussies is 37.

If you look at the age distribution of Australians and its predicted distribution in the future (from extrapolations of ABS data) you see that in 2050, most Australians will fall under the 30-65 age group – a solid workforce.

You need to do objective research rather than predict an economic apoclypse with no data to back it up.

Thanks Brad,

I’d take a look at the following graphic from the ABS…http://betaworks.abs.gov.au/betaworks/betaworks.nsf/projects/MeasuresOfAustralia'sProgress/population/index.htm

The reference is always about the large growth in the number of elderly as the wave ages. Hope that clarifies.

I was talking to the manager of a bank when intrest rates were 1% us and 7% in Australia, he said he couldn’t see it happening in Aust. Well I think we should keep an eye in the US, there dollar is sliding because of national debt levels. Guese what our Country is number 12 in the most indebted countries in the world. The only way I can see us solving this crisis is through skilled immigration. This will put pressure on the housing market, and if the dollar is sliding hay presto house prices will increase. The key areas or immigration should be engineering, mining and manufacturing industries this will enable us to get out of the debt crisis.

In my experience, its bet to hedge your betts both ways, if you have money to go around have some in each core strategy. As Roger says don’t pay more then the intrinsic value. Look at your rental return vs rates etc. Mortgages are great in the sense at the moment you are getting record low intrest rates, and you can haggle…try to do that with shares. There is no better way to discipline your savings then paying of a rental home. I sold off my apartment in Darwin 5 yrs ago for 220k its now worth 440k. Anything can happen what if Australia starts debasing the dollar, in turn house prices will go up and the value of the money in your savings account will go down. I always tell people to get preapproved for a loan and start with ridiculous offers nock of 20k, and wait a week, then 15k, then 5k. If your fair dinkum realestate agents will know negotiate a good deal rent it out. Wait for 10yrs and sell.

I don’t think so. With all the money printing going on inflation , or worse ,

stagflation , is possible. In nominal terms I don’t think prices will decline

much , but I could see a decade or more of prices not keeping up with inflation.

But then again , I might be wrong.

Sigh!

Hasn’t Gen Y learnt anything yet?

Observation 1 – the poor rental yields on expensive property can be fixed two ways, property gets cheaper or rents get higher. It’s basic fact of life that living costs always expand to meet incomes. Get used to single living in tiny high-rise apartments or share housing in big 4 x 2 detacheds.

Observation 2 – the Nuclear Family is an anomaly in modern human history. Don’t fight against the idea of staying at home with Mum and Dad. Celebrate the return of the extended family and bring your spouse/partner home and raise your children under the same roof as their grandparents.

So obvious!

Sounds like you’ve had a chat with your parents, Roger. My own parents are heading off goodness knows where somewhere next month – how dare they!

I feel that people generally are not hurting enough for property prices to fall imminently. Almost everyone that wants a job has one and the corporate earnings have been stable enough that those self funded retirees have enough fully franked dividends from CBA to get by. So at the moment, if you really want to buy a house, you can and the retirees don’t need to sell…yet.

I was talking to my brother who lives in Melbourne and he was telling me about some of his mates that have bought houses that they can barely manage to pay off, even with incomes of $120000-150000. So the 30somethings will splash out on that grouse house in Kooyong and the banks obviously still lend. When the economy gets the wobbles and unemployment rises, and people start to realise that there won’t be a quick turnaround that is when house prices will come down properly. Then you’ve got the triple whammy of retirees realising they need extra cash and the recently unemployed being forced to sell into a market that all of a sudden is short of buyers.

Speaking of Paul Clitheroe, Roger, did you know that he once owned most of the first estate of Tawonga South, including Gustav’s old block? I don’t think he made any money on transaction.

“I was talking to my brother who lives in Melbourne and he was telling me about some of his mates that have bought houses that they can barely manage to pay off, even with incomes of $120000-150000. So the 30somethings will splash out on that grouse house in Kooyong and the banks obviously still lend.”

Theres definitley some truth in that, my wife and i were offered a loan up to $1 million when we went to get the pre-approval. We politley declined and said all we need is something much less than half of that. We were asked by some others why we didn’t take it so we that way we could have got a much better place. We could have but there is an unfortunate side effect from taking out a mortgage and that is that you have to pay it back and we would have been struggling to do so.

We have no problems paying back the loan we have now and make a certain amount above the minimum repayments every fortnight. Until we can afford the more expensive house we will just have to be content in walking 100 metres to the beach rather than 50. Such difficult sacrifices are needed though.

Hi All

I am not sure about the boomers/Gen X argument but I do know that a sustainable increase in a price of a houses over time is related to the increase in average wages. To paraphrase someone else who is much smarter than me “This makes sense… earn a bit more money….. pay a bit more for a house.” This can be temporarily put off the rails by interest rates, leverage and exuberance but over time it will all mean revert as everything does.

If nominal wages grow over time by 5% then you can expect housing prices to go up 5%. Investors who are extrapolating forward the last 10 years returns of 10-15% capital growth will be very sorry indeed.

This is a no brainer, forget the noise and hyperbole from the real estate prople, by my rough maths the noughties has made houses about 30% overpriced and they will mean revert.

Two things can occur. 1) Prices fall now, or 2) Prices stay flat until an extended period of time that makes them mean revert. The politicians want option 2 but history suggests option one is a better long term solution.

Cheers

You are probably right over the long term Roger but recently the Labor government ruled out having to sell the family home for aged care. Baby boomers continue to mimic a plague of locusts

http://www.theaustralian.com.au/national-affairs/family-home-safe-in-aged-care-overhaul/story-fn59niix-1226333818804

Hi Roger.

You haven’t covered the expected influx of refugees that will come into Australia over the next decade. The ‘Arab Spring’ is well underway and with next technologies like mobiles and the internet the poor in those countries now see great wealth and freedom in countries like Australia. Like a man said yesterday ‘it doesn’t matter if the Australian government is going to send us to the moon, we will still come”.

The GFC has seen new housing slow to a crawl, the medium term there will not be enough housing to support those we have.

Also, like a friend of mine likes to say ‘MelSyd is the only game in town’. We are not like the USA where there are 100 cities livable for Americans to live in. In Australian Melbourne and Sydney are the only places to buy. (Usually), people living in Sydney don’t sell us and move to Adelaide, but people in Adelaide (or New Zealand for that matter), sell us and move to Sydney.

If property can be seen like a casino, Melbourne and Sydney are the only games in town. In the USA by comparison, there are over 100 of them (New York, LA, Chicago, St Louis, Las Vegas, San Fran, San Dieago, Miami, the list goes on and on.

I think in 10 years time you will be looking back saying ‘I should have bought property then’. Hindsight is a wonderful thing.