Is Aldi a real threat to Woolworths & Coles?

In recent weeks you have probably noticed a dramatic increase in the volatility of Woolworths Limited (ASX:WOW) share price and wondered: what has changed recently? The answer is that something has caused the market to re-think the longer-term prospects of the business.

The detail is found in a very insightful conference call we had recently with the former head of Aldi UK, Paul Foley.

Below are some of our notes from that call – whilst it may not be the only reason – it partly explains the volatility and why we now believe longer-term, serious competition is not only coming to the Australian supermarket industry, but that the newer entrants may threaten the profitability of the incumbents and disrupt the competitive landscape more than you might have previously believed.

The argument is pretty simple and you may have noticed a surge in marketing by this business recently on TV in the lead-up to Christmas for example here.

We are talking about Aldi – the German discount supermarket behemoth which has gone relatively unnoticed to date in Australia since opening its first store in Marrickville and Bankstown Airport in 2001, but has been very, very busy behind the scenes building a network of 350 supermarkets, systematically adding about 30 new sites annually.

Aldi have already taken 10% per cent market share through its promise of “providing customers with incredibly high quality items at the lowest possible prices” – an offering its able to support and maintain with a very different business model to that which many of us have become accustomed.

According to Roy Morgan, “ALDI supermarkets continue to go from strength to strength, quadrupling their customer base over the last eight years from under a million to 4.2 million people shopping there in an average four-week period. While this falls a long way short of the 8.8 million customers shopping at Coles or the 9.5 million at Woolworths, ALDI’s long-term gains in terms of market share indicate that the European supermarket chain is on the up and up.

“As of December 2013, Roy Morgan’s Supermarket Currency report placed ALDI in the Top 3 of supermarkets in terms of market share. Accounting for 10.3% of all grocery dollars, ALDI surpassed even IGA (9.5%). At 39.0%, Woolworths still maintains the largest slice of the pie, while Coles continued to improve, achieving its highest market-share proportion since March 2008 at 33.5%.”

If you walk into a Woolworths or Coles and compare them to an Aldi store, you’ll notice the difference is size. The right size site for an Aldi is very very specific. Each store must be exactly 17.5 meters wide and 40 meters long or 700 sqm. This compares to the footprint of the big guys at >5,000sqm. If you have seen one Aldi store you have seen all 9000 in the world. The larger Australian sites have traditionally been harder to secure, which many believe gives the incumbents an edge, but Aldi has been left alone to secure the right sites for their own model supporting and funding the development of its own rock-solid supply chain.

Having hitherto flown under the radar they are now in a position to begin to accelerate store numbers (they can easily double the number of stores from here), offer more aggressive promotional discounting, comparison advertising and ultimately take 15-25 per cent market share by challenging existing market players through price leadership.

And prices are the key to their highly successful rise. They have succeeded in every market they have selected to operate in and the incumbents have had no response simply because Aldi is 60% more efficient. For example, rather than offering 32 different brands, sizes and types of tomato sauce as Coles and Woolies might, at Aldi you will find only one. Whilst this may cause some frustration initially, is actually the businesses core strength. And the incumbents aren’t even thinking about an appropriate response. Visit the Wesfarmers website and Coles is described as “a national full service supermarket retailer operating 741 supermarkets”. There not even thinking about the competitive force that has destroyed the margins of the incumbents in every market they have entered.

Rather than spreading their buying power over 32 different sku’s, Aldi focus on the best quality product they can secure for the price they can achieve and push all of their buying power through that one product and the one supplier. The benefit of this is pretty clear – this enables the business at just 350 stores to already match or better the terms of the more established players and offer even lower prices. Think about that for a moment, at 350 stores Aldi has more buying power per SKU than Woolies with 872 much larger stores and Coles with 741 stores. Woolworths’ and Coles’ High Quality low Cost strategy cannot compete because they are wedded to a wider range of SKU’s and even if they reduce their range through generic branded products, they play right into the hands of Aldi who is up to 60% more efficient.

And as experienced in other markets, particularly Europe, it is a true recipe for market disruption with Australian independents such as MTS (15-20 per cent market share) and the larger Woolworths and Coles (70-80 per cent market share) being firmly in their firing-line.

The call went on to not only to further discuss Aldi’s business model but the success that discount retail chains such as Aldi and Lidl have had in Europe. Together they have put immense pricing-pressure on the incumbents. We note the pressure on margins might be lessened or the impact may take longer to fully mature because Lidl is not present in Australia.

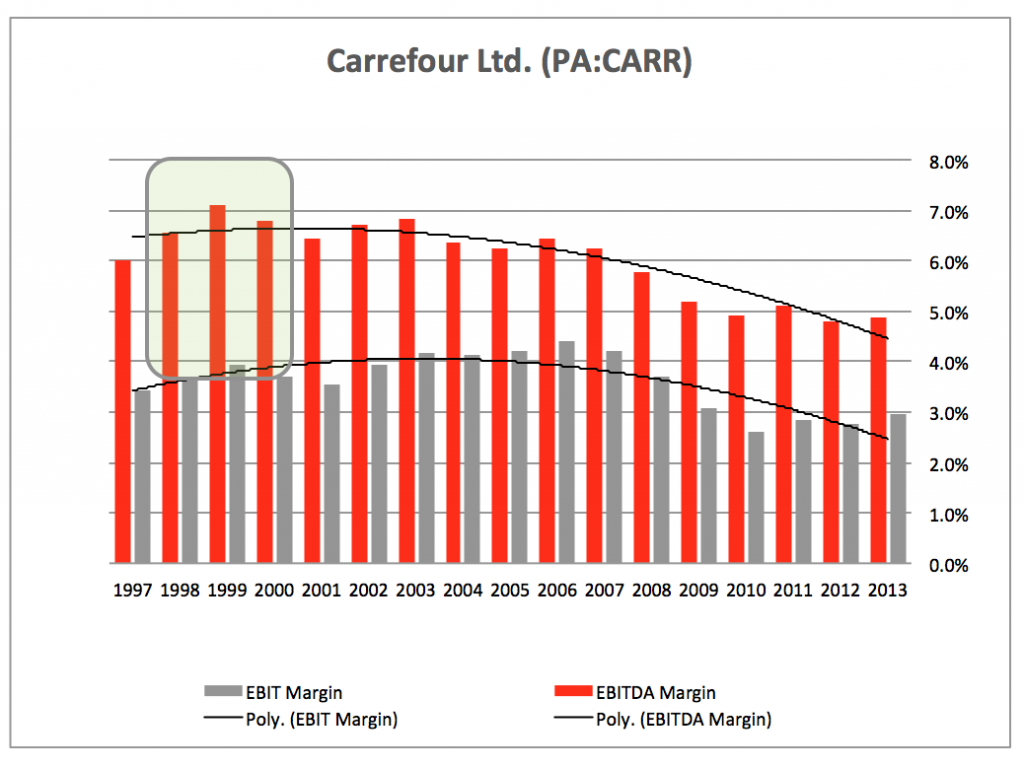

To gain some understanding of the impact a highly evolved discount grocer can have on a large incumbent take a look at Carrefour SA (PA:CARR), one of Europe’s largest food retailers and by no-means a Johnny-come-lately. Carrefour was founded in 1959 in France and operates a network of >10,000 hypermarkets, supermarkets, hard discount stores, convenience stores and cash-and-carry outlets and e-commerce services. The company employees 363,989 staff.

At its peak between 1998 and 2001, Carrefour generated average EBITDA margins of ~6.8 per cent and EBIT margins of ~3.8 per cent.

The impact of ‘hard discount retailers’ such as Aldi and Lidl has been profound on Carrefour. In 2013 margins have fallen to 4.9 per cent and 2.9 per cent respectively. The share price reaction to this falling profitability has been profound. At its peak, Carrefour SA shares traded for ~€70, today they trade at €25.

This is not an isolated story. A quick Google search uncovers numerous articles on Aldi and Lidl and the impact they are having all over Europe:

Morrisons, Asda, Tesco and Waitrose continue to take a battering from discounters

Aldi and Lidl continue to grow in Irish grocery market

Tesco in turmoil

It doesn’t take much imagination to see the same market pressures impacting operators here in Australia and this is exactly what Aldi has positioned itself to do.

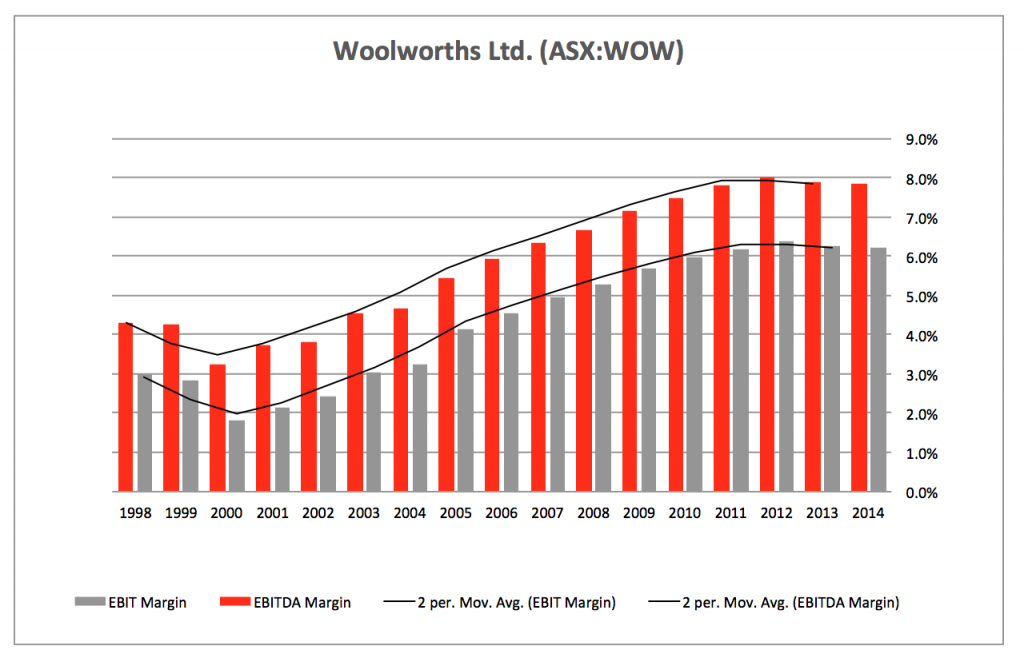

For a business like Woolworths, currently enjoying the best margins in their history – EBITDA margins of ~7.9 per cent and EBIT margins of ~6.2 per cent on average for the past 4 years -there is potentially pain to come.

In its 2008 report, ‘Report of the ACCC inquiry into the competitiveness of retail prices for standard groceries’, the ACCC verified the competitive impact of ALDI generally on supermarket competition and of the establishment of an ALDI store on nearby MSC store prices, “ALDI has been a vigorous price competitor since its entry into Australia and has the incentive and the ability to engage in sustained price competition. This has had a dynamic impact on the grocery sector and brought about competitive responses from Coles and Woolworths on many products” and “Even if a customer does not shop at ALDI, they obtain significant benefits from having an ALDI in their local area or state, as the Coles or Woolworths store prices more keenly”.

Indeed, in 2010 the then ACCC chairman remarked to a Senate Committee on 10 February 2010:

“It has become well known that ALDI – I am not here to advertise for ALDI – through its specific business plan of a limited number of items but at very low prices, home brands – is providing a competitive tension to Coles and Woolworths and other supermarket operators – IGA, Supabarn and the like – in respect of the items that they sell. That has proved to be an important competitive tension. We demonstrated that in the grocery inquiry and I think it has been demonstrated in a number of surveys that have been taken since”. We will leave a discussion about the economic and domestic business destruction caused by government policies that focus only on “consumer benefits” and providing consumers with the cheapest prices to previous posts.

Aldi has a 20 year plus plan. It only enters markets where GDP is high and where people are willing to compromise on high expectations of quality to save money. At the same time it only enters markets where high wages exist so that its efficiency model counts for something in terms of cost. If wages are low in an economy, then the efficiencies of Aldi through employing many less people – because of the limited lines it offers – Aldi won’t enter. Aldi won’t enter if there is no hard discounter already established. We note that Aldi is highly profitable and successful despite TARGETING 3-4 per cent EBITDA and ~2 per cent EBIT margins – which interestingly as we have shown, is where Carrefour’s margins have trended to.

If Australia has similar experience to Europe with discount retailers, Woolworth’s margins could eventually HALVE and earnings fall 30-40 per cent in the years ahead assuming our market continues to grow by 3-5 per cent.

It’s a risk that should not be underplayed given Woolworths is widely-held by investors and the Aldi threat is real and is gathering momentum. With 350 stores and $3.5bln in sales Aldi is positioned to migrate its supply chain from its nearest neighbouring country to local suppliers. Once this happens, its costs fall and prices can start coming down even more aggressively if it choses. You will then start seeing Aldi advertise on the basis of comparison, Australian made and even on the basis of superior quality. Expect to see chefs using Aldi products and advocating the superior local quality.

Further, Aldi is extremely well funded, is debt free and its private shareholders are some of the wealthiest families in Europe and given they do not need the profits, they re-invest EVERY last penny back into the business to constantly improve its efficiency.

We believe this is something worth watching very closely in the years ahead but for now, you will at least know why Woolworth’s share price has been volatile and why, prior to the most recent weakness we ceased to be shareholders in Woolies.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

COLES IS AWESOME!!!!!

Thanks for that Troy. Night quite the constructive comments we usually receive, so happy to hear your more expanded thoughts too.

I fervently hope that my share portfolio, with the assistance of Skaffold and the team, continues to do well, and I never fall on such ‘stoney ground’ that I would be entering an Aldi store for anything other than to conduct research for articles such as this. Thank God we’ve got world-class supermarkets like Coles and Woolworths, and the likes of Aldi will never amount to anything more than a ‘terrier-like’ ankle snapping distraction.

Aldi, which is a mongrel-like hybrid of part big-box, part IGA, will only ever appeal to those tragics that drive 20kms to buy 100Kg of washing powder but now have trouble filling the pantry.

With the recent pull-back, I think I might buy more of Woolworths.

Thanks for sharing Kim.

Just reading the Aldi comments made very interesting reading. I returned to live in Ireland about 4 years ago having lived in Australia for 25 years. When I visited Ireland during the Celtic tiger period 2001 to 2007 the mere mention of shopping at Aldi and people would look twice at you. The massive recession in Ireland and Europe have changed all that. Now in Ireland no supermarkets offer free shopping trollies, plastic bags have been banned since about 2001. Tesco and dunnes stores ( Irish supermarket) are losing market share big time. Whereas Aldi don’t offer all the frills , and their brands are not household names , they have come a long way in their food products. They have a lot of Irish produce ,that tastes better than Tesco or dunnes stores. The range is not as exciting, but if you just want the basics it’s the place to go. If Australia hits recession ,Aldi will skyrocket.

Australia *is* in recession. Real per capita national disposable income has been falling for years, and that’s the only measure that counts in my book. The GDP numbers are propped up by population growth and volumes offsetting price falls in the resources sector.

ALDI rules, and it seems TMF agrees now they are “uncomfortable holding WOW and would prefer to hold cash”. Even better, hold your cash in US dollars.

A smart man once said “buy your stocks like your groceries”. Sure Aldi has good product at everyday low prices and Woolies and Coles have better products to varying degrees but more costly, however, every week they have “specials” so you can buy your quality at not only a discount but cheaper than Aldi prices. You can’t do ALL your shopping at Aldi, their range is insufficient, so you have to go to either Woolies or Coles anyway, so why not go to Woolies AND Coles and just shop their specials. I love Magnum ice creams but they are too dear, recently Coles had them Half price, so I stocked up, now I lie in wait for a similar opportunity at either Woolies or again at Coles. If you want QAN at 50c whenever you want, shop to Aldi, but if you want CSL at $55 once or twice a month, shop the specials at Woolies AND Coles

I do ALL my shopping at Aldi. Sure, Aldi doesn’t stock the same products as Woolies or Coles, but then Coles and Woolies don’t stock the products I can get at Aldi, and after a decade at shopping at Aldi I no longer recognise the so-called “brand name” products.

As far as I’m concerned I’m buying CSL at $55 every day at Aldi, and I don’t have to wait for specials. Just to take one example: Bread.

Coles price: $5.39

http://shop.coles.com.au/online/national/helgas-bread-continental-bakehouse-wholemeal-grain-loaf

Aldi price: $2.69

https://www.aldi.com.au/en/groceries/lower-than-low-prices/lower-than-low-prices-detail/ps/p/bakers-life-bakehouse-wholemeal-bread-750g/

I swear its the same bread. Local bread delivery guy says he picks it up from the same factory.

David, I think you are right.

ALDI IS A CON, the people who shop there don’t know how to shop. I visited one in a nearby town years ago when they came to Australia, I vowed never to shop at Aldi again. Recently I broke that vow when an Aldi opened in my local town, again I have vowed never to shop there again. I hate having to “buy” a trolley, I don’t often have loose change, no handbaskets were provided. I am tired of tripping over boxes in the aisles. Many product types are not stocked and most that are have little or no choices. Fruit and vegetables choices were limited and not good quality. I couldn’t possibly do all my shopping there meaning I have to go to Coles or Woolies anyway. Only 1 or 2 checkouts open and a dozen or more people waiting, no bags provided and pack your own and a credit card surcharge and no petrol discount. I shop at Woolies and Coles, they are virtually side by side in the centre, (Aldi is distant), and only buy what each has on special, in particular the half price specials, so my shopping bill is CHEAPER than Aldi, I get out quicker, use my credit card, get a petrol discount, not to mention undercover parking and free trolleys. The Germans couldn’t take us over with Hitler, so now they’re trying with Aldi, forget it.

Thanks for the sentiments Stephen and for sharing your experience.

I’ve owned WOW shares for many years. And I love the company as an investment and shopping there (most of the time!!). And that’s the problem.

You really do need to take the emotion out of it and really face the facts. I really dislike shopping at Aldi with no packing and credit card surcharge.

But that’s just me. If many others are migrating there (and Costco), then I need to face reality that the threats are large. Franklins was killed off many years ago as they didn’t evolve but Aldi is a different beast.

I really hope for Aust sake, these foreigners don’t destroy our locals but it can certainly happen.

The majors are getting into online in a big way. Are Aldi planning to do something similar?

Its interesting that you bring this topic up. On the call, Paul also discussed at length the economics of this business model – online supermarkets.

To quickly summarise, once you take into the cost of running the website, paying people to pick and pack your order, buying the trucks, maintaining them, filling them with fuel, employing more people to drive around and deliver the goods, and then consider the low margins that super market businesses are already on, then its not much of a surprise that these business units will never be overly successful.

Online food shopping therefore can really only can be considered as a additional service. Not a profit centre.

I had the pleasure of sitting in on a guest talk at Uni by Citi’s retail analyst regarding woolworths and asked about this and got the same response. It makes sense, plus considering that some comments on here have placed big importance on “experience” it leads me to question the viability of online supermarket services. Online alcohol sales though, that’s something I think a lot of money could be made on.

Hi all,

I thought I’d add my thoughts on my experience with Aldi. I decided a few months ago to go there for a ‘serious’ weekly shop and see how it works out. Whilst we got some great bargains, it was incredibly frustrating to not buy other staple products that were sold but weren’t available.

The fruit and vegetable section was extremely unappealing but we buy most of our fruit and veg from a mobile delivery now straight to our front door so Coles and Woolies have lost part of our business mostly for good. But Aldi did nothing for us in terms of attracting us back for fruit and veg.

I’ve done a few big shops there and a few smaller ones for specific items which are cheaper no where else, but for us to get what we want, we’d have to go to Aldi for some products and then a Coles for the rest. With a family and limited time, this is not going to happen so, by default, we sticking with our local Coles who are probably being pressured somewhat anyway by the local Aldi store.

The overall experience for us is that we’ll stick to the major Coles/Woolies as Aldi is just not cheap enough to offset our inconvenience. I don’t dispute anything in the article though and it’s obvious people will put up with their limited options to save money.

Aldi will be a force, there’s no doubt but they will only get a small proportion of our monthly spend. Despite our concerns with Aldi as a customer, I’m extremely glad to have sold our Woolies shares earlier this year.

I took my wife to a local Aldi store.The store was dirty with very old freezers.The home brands at Wesfarmers and Woolworths were very similar to Aldi .My wife said it was like shopping in the backstreets of an Eastern European country and would never shop in this very unappealing environment.There was no deli section with fresh produce like with WES and WOW.Even customers were doing their own packing.My wife will never frequent Aldi based on this inspection.

“Even customers were doing their own packing”

LOL! Everyone packs their own bags at ALDI, not only that you have to bring or own bags or buy them. Yes, no free bags!

Each to their own I guess, but I’d rather save 30% on my weekly groceries than have someone pack my bags for me, and plenty agree with me. I know where the growth is in the supermarket sector and it ain’t the big two.

An excellent article Russ, and one that has clearly resonated with blog members.

I wonder though if Morrisons, Asda, Tesco and Waitrose had large strong pub businesses, or owned the most pokies in their home turf, or were the largest petrol retailer going around.

Many people like to say “don’t say it is different here”, when sometimes it is, our property market is different to most others, and maybe Woolies is different too.

All the best

Scott T

I really hope the managers of The Montgomery Fund have paid attention to this thread. There is more insight into the supermarket sector here than a hundred analysts reports.

Sell WOW.

Since writing I have just found this ABC article:

http://www.abc.net.au/news/2014-11-26/woolworths-ready-for-tough-questions-at-agm/5920380

Great post Russell – thanks.

Wow (not WOW!) this is the 14th comment on this post. It has certainly stirred up the emotions and we can’t even purchase a small part of this incredible company. A good way to get information about ALDI is to visit the website https://www.aldi.com.au/en/ I don’t want to waste time providing information which is readily available.

We have been shopping at Aldi for more than a decade. Apart from some of the fruit and vegetables we have found the rest of the food stock to be as good if not better than provided provided by Coles and Woollies. There is less choice but that makes it quicker to do the fortnightly shop. The Christmas stock of puddings, cakes, chocolates is high class and extensive. The staff are helpful, well paid, content and hard working. Most of them simply enjoy working with the company.

Management of this organisation is superior. For instance staff can sit or stand at the checkout points. Safety is paramount. Staff are well trained and are multi skilled. Its distribution systems work well – they employ their own drivers and have distribution centres within about two hours of their retail outlets. Pricing is the same in every store.

Aldi is about to open stores in SA and WA. This will considerably add to turnover and be a greater threat to C and W.

I used to regret not being able to buy a share in the company but realised it pays a financial dividend every time I visit an Aldi store without the need to invest in the business. The returns are high but there is no dividend imputation credit!

With over 150 award winning products “Everyone wins at Aldi” and I have a badge to prove it! Even the profits are reinvested in Australia.

Andrew

Well done and he summed it up perfectly its a cult. Its new to SA or my local area and people just seem to love it.People who haven’t even been to it yet are excited about it

I wonder what will happen to all the young people who are employed by the big and shrinking two as we also have unemployment rates similar to Greece in certain areas.

I asked a few excited shoppers why they thought ALDI was so great without a really logical answer and sold my Woolworth shares for a premium

“has gone relatively unnoticed to date in Australia since opening its first store”

Unnoticed by whom? Market analysts perhaps but not shoppers. I only shop at ALDI these days. You’d have to pay me to go to Woolies.

Thats a great perspective David. It’s also one that I expect Woolies management don’t share either, given their responses at the AGM/update.

And Jim, if this slump in Woolworths presentation and service is in any way a result of the ‘Aldi effect’ then God help us as the entire segment races to the bottom.

A few days ago, the new head if Aldi in Australia advised that they had no imminent intentions of targeting New Zealand – big mistake Aldi – NZ would be perfect demographics for your operations!

Hi Russell – I am a bit confused by this: “With 350 stores and $3.5bln in sales Aldi is positioned to migrate its supply chain from its nearest neighbouring country to local suppliers. Once this happens, its costs fall and prices can start coming down even more aggressively if it choses.”

According to the company, a majority of their products have been sourced locally for some time – see http://www.smh.com.au/business/suppliers-rate-aldi-above-woolworths-and-coles-20130305-2fidz.html

Am i missing something?

Aldi currently uses its European operations and its buying power overseas to source its heavily discounted merchandise – think about its weekly sales of specific items which drives traffic into their stores.

Thanks for the article. I am a WOW shareholder and shopper. Our local WOW is starting to go downhill. I usually get a 1litre Up and Go. Discontinued at our store. Need to go to Coles to buy. The wave function at the checkouts never works. Ask the manager and he says ” Yes it does that to me also” no thought of fixing it. This morning there were NO checkouts open. Only the self serve and NO discount for that.

I will be thinking of alternatives and certainly watch my WOW holdings which I got on IPOD. Thanks again

I, and everyone I’ve discussed this with, think Aldi are just absolute rubbish. Visiting their stores is a very unpleasant ‘third-world’ shopping experience compared to the world-class Woolworths or Coles supermarket.

Things may well be grim in Europe to make Aldi an acceptable shopping experience, but my bet is that it will be harder to dent our two incumbents than many here and elsewhere are postulating.

The funny thing is that i have noticed Aldi seem to be more popular in higher socioeconomic areas then lower ones. I have been trying to work it out and have two theories but find that really interesting (albeit based on my observations).

I agree that there is not much of an “experience” but the dollars seem to be winning at the moment. Some research done by Roy Morgan has Aldi rising from a 2.9% market share in December 05 which was the lowest of all the groups to being the third biggest player and 10.3%.

In the same time Woolworths has shrunk from 40.2% to 39% and Coles has also declined from 36.9% to 33.5% (albeit with them showing a increasing trend since their low point in the middle of 2010).

It is hard to come to any conclusion other than the rapid rise of Aldi had a big effect on the decline of the two big chains.

http://www.roymorgan.com/findings/5427-market-share-narrows-between-coles-woolworths-while-aldi-makes-gains-201402120013

Aldi will never be able to compete on experience but there are quite a few poeple who i think will trade paying a premium and getting experience to saving dollars by going to a no-frills environment like Aldi. Especially when people think the economy is going down the drain (rightly or wrongly) or find themselves levered up to the hilt with debt.

Andrew, if you want to shop for the ‘fresh food’ experience, then definitely do NOT waste your time going to Aldi.

Delivering a superlative fresh food shopping experience i.e. fresh vegetables, fresh fruit, fresh seafood, delicatessen etc. etc. is really a difficult job and costly part of the supermarket operation – and surely the Australian customer wants that!? Well, they’ll get NONE of that at Aldi – have you experienced their ‘fresh’ produce sections? A bad German joke I think – like all German jokes.

Aldi is nothing more than the ‘big box’ shopping fad – in a 700 sq m small box. It’s therefore, the worst of all options. Aldi is definitely NOT a supermarket operation – they don’t operate a single supermarket! Coles and Woolworths operate supermarkets – and Aldi couldn’t compete in their class in a million years!

Kim, I completely disagree. My local ALDI is a much more pleasant experience than the local Woolies, and much, much cheaper.

Its the little things like the speed of the checkout that make the difference. At Woolies I am either forced to use a self-serve checkout (which I hate) or queue up for an operator who will scan items at around one-tenth the speed they do at ALDI.

Customer satisfaction surveys suggest I am in the majority:

http://www.insideretail.com.au/blog/2014/08/25/aldi-customers-satisfied/

Just a word of warning, this could be a long post.

Just had the “fun” experience of performing research, valuation, analysis and recommendation on Woolworths for a Uni assignment and as such have a bit more to share than usual on this topic. Our sell recommendation would have actually have been getting marked when the stock price first started getting punished in a fun example of good timing.

Woolworths is currently undergoing an attack on all fronts in the food and liqour business in my opinion and suffering from big implementation and strategy headaches elsewhere.

Woolworths had a great period where it effectively had the market to itself as Coles had no idea what they were doing and other competition didn’t have the size necessary to cause any concerns. Now, despite the concentrated market, it is probably one of the most competitive industries around at the moment.

Aldi is a big threat whose business model makes it very immune to the effects of Woolworths. WOW may have greater buying power with the branded products, but Aldi is 90% private label. They can, as you say, just focus on getting the best price for those products. Aldi stores are also operate on far less costs as it is a very “no-frills” environment. There are no fancy displays, people bring their own or otherwise pay for bags which they fill themselves. As a result the only thing Aldi needs to worry about is getting the stock on the floor and moving the customers through in the assembly line like fashion of a german car marker. On a generic price perspective, Woolworths and Coles will not be able to compete unless they change their customer experience to be similar to that of Aldi which i think is unlikely.

Aldi have also been brilliant in the way they have taken advantage of the two big guys trying to prove that they can out-discount or make the more annoying TV ad. I think this goes to my point above, they know that they can’t really compete on price with Aldi, but at least for the moment, most people live closer to a WOW or Coles store and will go their for convenience so are more concerned in taking away market share from eachother. Aldi there for gets to sit back (with some brilliant advertising) and effectively say to the market “Hey, while these two are fighting, why don’t you save real money at our stores and we also won’t make you listen to status quo”. Aldi is now a cult, not a business, and it is a popular and growing one. My wife and I save a fortune by buying generic and staple products from Aldi in bulk and the products really are of a high category. Finding a parking spot is almost impossible as well.

Other things that i think have been causing the gloss to come off from Woolworths and result in a more volatile stock price is its implementation problems with its hardware and general merchandise divisions.

It would no doubt be very embarrassing to have sold Dick Smith and then see it reappear on the market indicating prices and performance that were much better than what it was when they owned it. Big W has seen its sales per store trending downawards as well.

As for Masters, well, they are obviouslly struggling. EBIT is not only staying negative but showing no signs of improving despite the amoutn of money being invested into this business and new stores opening. Bunnings is achieving sales per store almost double to that of Masters and have the better locations. Woolworths are instead needing to open in areas where they aren’t able to get immediate bang for their buck as they are either regional or developing areas. Reading between the lines of the Woolworths commentary, they are still trying to work out what should and should not be sold in masters stores so they seem to accept their strategy is not the best but not sure what exactly they should be doing.

Based on my estimates, currently Masters is shaving $1.11 of its intrinsic value. Another way of saying it i think the intrinsic value for Woolworths would be $1.11 higher if they didn’t bother about Masters.

You also have to wonder as well what Lowes will do with their put option when the time comes. They may simply put their hands up and say it is too hard in which case Woolworths needs to spend cash better used to invest profitably to instead purchase complete ownership and assume all the risk of a loss making business.

It all points to me that Coles has spooked the board and they are focusing on protecting (and seeing it contributes about 80% of revenues, probably with good reason) their food and liquor operation from losing to much market share to their big rival. The result is a loss of focus on the other divisions and a smaller and more nimble competitor slipping in and increasing their market share behind the “main game”.

There are some big problems from the company and the management need to take a good look at what is happening or else their may be some angry shareholders in the future.

In saying that, i actually have the price below my intrinsic value for the business and if the price keeps dropping, the margin of safety may result in a good opportunity as they still obviosuly have some great attributes.

Excellent Andrew. Thank you for taking the time to write this.

“Aldi is now a cult, not a business, and it is a popular and growing one.”

Agree 100% and I’m a paid-up member. A few other things I’ve noticed:

– ALDI employees can multitask. The stores seem to run on about 5 or 6 people, the visible ones at least. If the queues at the checkout are short they’ll be moving stock, cleaning, whatever’s required, but as soon as the checkouts get busy they ring a bell and everyone mans the checkouts.

– No bags, long conveyor belt, no self-serve checkouts, no distracting magazines. Everyone knows the worst part about doing the groceries is waiting at the checkout, and the ALDI system minimises the time you spend here. In fact it can be quite a challenge to get your groceries into the trolley faster than they can scan. Its quite a shock for ALDI novices who have become accustomed to slow service at other supermarkets.

Interesting article. If the same trend happens in Australia we may end up with cheaper grocery prices and at the same time grocery industry profits that are currently distributed to largely small and SMSF investors in Woolworths and Wesfarmers will instead be distributed to a rich family in Germany that owns Aldi. No doubt the shareholders in Woolworths and Wesfarmers will become alarmed as their wealth is transferred off to Germany.

Hi John, that’s certainly something that has not escaped our attention. Worth also considering the larger impact Aldi will potentially will have on what has been described as the “soft underbelly” of our supermarket industry – the independents. MTS etc.. could be in real trouble in the years ahead as they already operate on slim margins.