Is $4.00 unreasonable for G8?

A few months ago, with their shares trading for $3.80, we asked the question: “Is $5 unreasonable for Ainsworth?” After the subsequent, high quality profit announcement for 2013, and very bright prospects indicated by management for 2014, we believe $5.00 in the next 12-24 months, might not be unreasonable at all.

Today we ask a similar question of G8 Education Limited (GEM). Is $4.00 unreasonable?

A bit of background first. Over the past 18 months, GEM has made the following announcements:

2012

24 Feb – Increased bank facility to $56.5m (replaced NAB with Bank of WA)

24 Feb – bought 1 education centre for $1.6m 4xEBIT

26 Apr – bought 6 education centres for $13m 4xEBIT

11 Sep – bought 3 education centres for $6.2m 4xEBIT

18 Sep – bought 7 education centres for $9.2m 4xEBIT

22 Oct – bought 1 education centre for $9.8m 4xEBIT

12 Nov – bought 14 education centres for $28m 4xEBIT

In total, GEM acquired 32 centres and spent $67.8m

To June 2013 (first 6 months)

6 Feb – raised $35m in equity @1.45 to fund more acquisitions.

19 Feb – bought 12 centres for $18.7m @ 4xEBIT

8 Mar – bought 5 centres for $6.4m @ 4xEBIT

15 Apr – bought 2 centres for $4.8m @ 4xEBIT

30 Apr – bought 3 centres for $3.3m @ 4xEBIT

11 June – bought 17 centres for $24m @ 4xEBIT

To June, GEM has acquired 39 education centres and spent $57.2m.

What we take away from the above is GEM’s clear strategy of rolling-up / acquiring smaller mum and dad-operated childcare centres on an EBIT (Earnings Before Interest and Tax) multiple of just four times.

Management regard this as a continuing opportunity given the fragmented industry left in the wake of the ABC Learning Centres’ collapse and the chance to build an operation with genuine scale efficiencies.

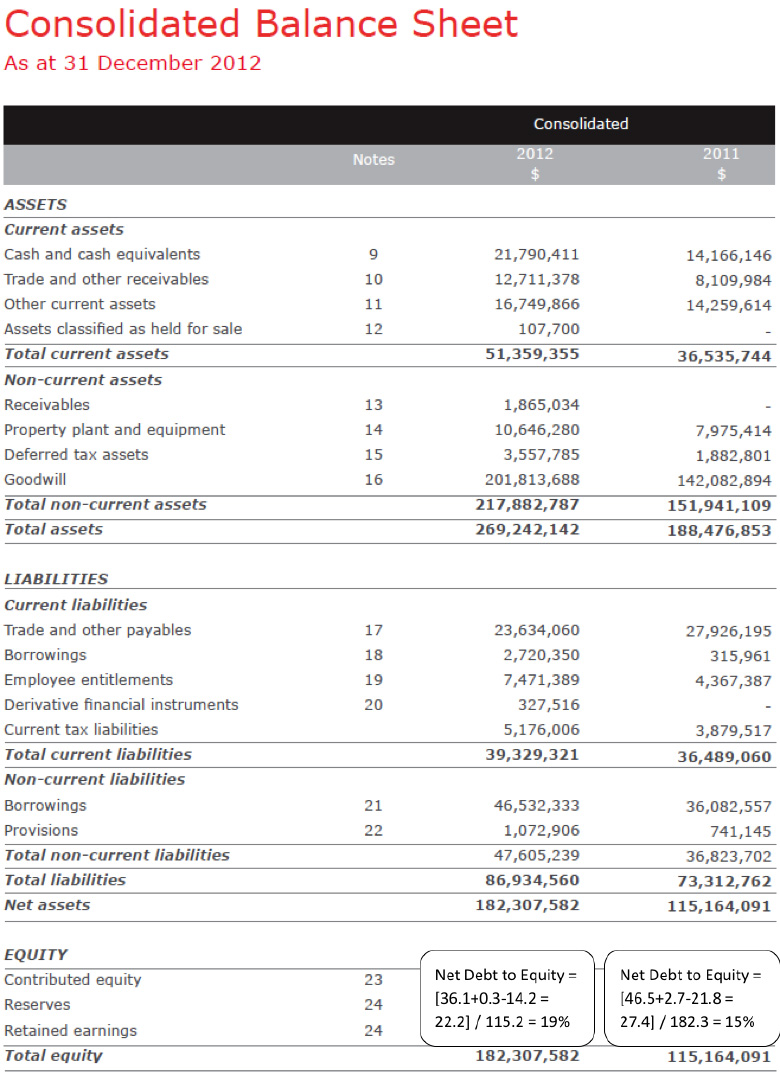

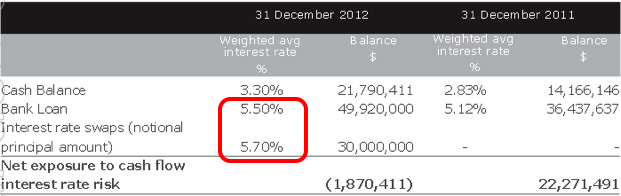

To date, growth has been funded via a combination of internally-generated cash flows, new equity and debt. Looking at the balance sheets for 2011 and 2012, we observe an equity / debt financing mix of ~ 80/20 (as shown) with debt costing 5.5 to 6 per cent per annum.

Reverse engineering the business’s acquisition metrics, we discover that by employing a 4x EBIT multiple, each additional purchase is generating impressive returns on every dollar of incremental equity deployed. Using $10m in purchases as an example:

Purchase price of Childcare Centres: $10m ($8m equity /$2m debt)

Earnings Before Interest & Tax purchased: $2.5m (4x EBIT multiple)

Interest Expenses: $0.12m (20%*$10m*0.06%)

Tax: $.0714m ($2.5m-$0.12m adjusted for 30% tax)

Profit After Tax: $1.67m

Return on Incremental Equity (ROIE): 20.87% ($1.67m / $8m).

An after tax return on incremental equity of 20.87 per cent is impressive, and a characteristic we have seen frequently in rollup type businesses (IIN, TPM, MTU, BGL, CDD, QBE, etc…).

In 2012, GEM deployed an additional ~$67.8m in acquisitions. In the first 6 months of FY13, the company has already deployed $57.2m, and management recently stated that they have a planned ‘floor’ (minimum planned purchases) of $65m and a ‘ceiling’ of ~$100m in incremental capital in any 12 month period. We are quite confident about this projection under current market conditions and at this stage of their business cycle.

Applying the same 4x EBIT metrics to $100m of purchases:

Purchase price of Childcare Centres: $100m

Earnings Before Interest & Tax purchased: $25m

Interest Expenses: $1.2m

Tax: $7.125m

Profit After Tax: $16.67m

Return on Incremental Capital (ROIC): 20.87%

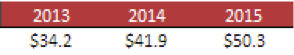

Bear in mind that consensus forecasts currently look like this:

Now consider the facts: In 2011, 2012 and 2013, $148.8m in purchases have been made, equating to an NPAT of $31m at 20.87 per cent after tax return equity vs consensus of $34.2m. And this excludes the business’s profits prior to 2011. If we also focus on the $ value of acquisitions, their trend is accelerating. Hence, we would argue that this number might be conservative.

If $65m is the ‘floor’, we can assume that they will add at least $13.6m in additional NPAT in 2014 and a further $13.6m in 2015. As a base case therefore, we get $58.1m NPAT in 2015.

Considering the bullish case and assuming ~$100m of purchases are made in each of 2014 and 2015, an NPAT forecast of $72.7m emerges, which is well above current market expectations.

Using these numbers rather than consensus, and on current shares outstanding, earnings per share could range between 21-26c per share. With the average industrial company currently trading on ~16x forward earnings, a share price closer to $4.00 is not completely unrealistic.

GEM only has ~3-4 per cent of the market, so they have plenty of room to grow. That’s not the risk. The real risk we see is an irrational competitor coming into the market and destroying the 4x EBIT multiple currently available. This would likely render the business’s economics a less compelling proposition and something any prospective investor must keep an eye out for.

In particular investors in GEM should closely watch developments with Navis Capital, a US based $3b private equity firm, that acquired Guardian Childcare on 8x EBITDA over the weekend – a multiple not seen since the ‘ABC Learning’ days.

The response from GEM has been that they have overpaid in order to get a footing in Australia. Navis paid an equivalent of $4m per centre vs GEM’s $1m average. We would agree that the economics do not stack-up. Hence the current expectation is for the market to remain rational.

There are 6000+ LDCs (Long-Term Day Care Centres) in Australia, with 4000 in GEM’s addressable market, so even if Navis are planning on becoming a second market consolidator, there is plenty of room for both to continue doing well.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Hi Roger, another fast growing company making earning accretive purchases with caps on how many it makes per annum that you might like to look at with this methodology is GXL. Unfortunately it is now part of the ASX300 so its price has risen strongly this last year but that’s also a good thing for existing shareholders.

with my previous experience with abc learning centres, now belly up , this one is a no brainer , your right roger 4 bucks is unreasonable for g8 , more like 6 bucks plus ……

Mmmm > 90% – see what you mean – wonder what the industry benchmarks are/is for this metric?

If i count correctly there are 272 million shares on issue now; half year profit up to 11m cash flow to 16m.

they are growing fast i remember similar company not long ago in the same business.

it is only question of time when they going to make mistake in acquisitions… and managers do not have skin in the game.

ill pass, no my type.

ned

Thanks Ned. Keeping the purchase discipline is key.

Hi Russell,

I know that the models used by Montgomery for company valuation are slightly different to Skaffold, but currently Skaffold ascribes a value of roughly $1 or so to GEM. I was just wondering what could be the possible cause of divergence between these two values? I also note that Skaffold only has Ainsworth’s value going from around roughly $2.50 to $3.50 in a couple of year’s time. Your guidance would be much appreciated.

Hi David,

ROll your mouse over the skaffold intrinsic value line and you will see a bullish and bearish range of valuations appear based on the most optimistic and pessimistic analyst expectations. If our valuation is higher one of the contributing differences is that we are more bullish than even the most bullish analyst and yes, we might be wrong too.

Hi Roger,

Thanks very much for clarifying. I was just filtering out these stocks because their average analyst consensus was miles away from the current price. I can see that it looks a bit more compelling if you take the most bullish analyst expectations, however it looks like the team at Montgomery have crunched the numbers and come up with an even more bullish estimate. These fairly unique insights may be a further reason to back the funds and pay for some great expertise.

…keeping in mind of course nobody and no firm is omniscient. We will get it wrong too. Indeed as we recently noted in an earlier blog post if we can get 55% right over the very long term, we’ll be doing a brilliant job.

Seeing that >90% of their non current assets is goodwill is enough to scare me off.