Is $5.00 unreasonable for Ainsworth?

Ainsworth Game Technology (ASX: AGI) is not a business that will appeal to all investors. Problem gambling is a genuine concern, but for many a night at the casino is a valid form of casual entertainment. Spending my pocket money on video games all those years ago held similar enjoyment while having a similar impact on my own finances.

Ethical issues and our ongoing internal debates aside, AGI is currently the #2 player in gaming machine sales in Australia, behind Aristocrat Leisure, and the business has been aggressively taking market share on the back of three years of very strong growth following the release of their new suite of games and A560 cabinet machines.

We expect the growth to continue apace, so we ask a simple question: could AGI replicate the past success of Aristocrat Leisure?

At their peak, Aristocrat Leisure (ASX: ALL) had a 70 per cent market share in Australia and 10 per cent in the US. If analysts are to be believed, AGI are expected to capture similar levels in the US, and a 30 per cent share in Australia over time. With Len Ainsworth and his very experienced management team behind him (with 200 years of collective experience), and given very strong sales growth momentum, it’s possible that current expectations may prove conservative.

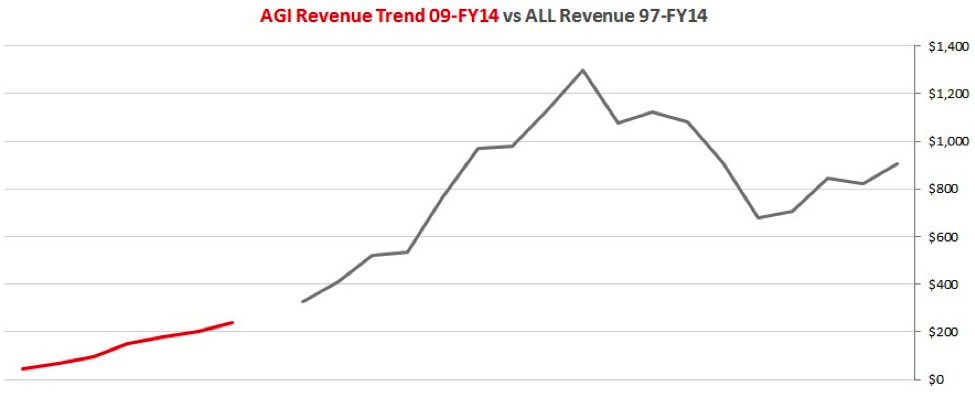

As shown in the graph below, revenues (sales) for Aristocrat grew strongly from $258m in 1996 to $1.3b at their peak in 2005. Full year revenues in 2012 for AGI are presently $150m and are forecast to grow to $240m in FY14. In FY14, AGI will have only caught the tail of ALL’s revenue just before their own tipping point. Even though they are catching up, the potential for AGI is still 5.5 times larger, based on ALL’s peak.

While I’m sure their competitors will pull out all the stops to prevent losing buckets of market share, it has been an interesting exercise to graph Ainsworth’s revenue growth over the past few years with that of Aristocrat’s from the mid 1990s.

In 1996, Arisocrat had 1.3b shares on issue and earnings of 0.02 cents per share. In 2012, AGI had 322m shares on issue and normalized earnings (backing out of the sale of a property for example) of 0.095 cents per share. Arisocrat was not generating this level of earnings per share until they had ~$500m revenue. AGI is doing it on just $150m.

The reason is due to AGI’s gross margins of 66 per cent (measured over 2 years) vs 63 per cent for Arisocrat, measured since 1996. On NPAT margins AGI is again superior at 20 per cent vs Arisocrat’s 11 per cent. AGI seems to have controlled costs on a higher revenue base (not so for Arisocrat) resulting in more of the revenue dropping to the bottom line. Early evidence is of a highly scalable operation and a management team that have the formula set right this time round.

Is a $5.00 share price possible in time? Assuming AGI can replicate Arisocrat’s revenue trajectory and maintain the current 20 per cent profit margins, AGI in the years ahead could conceivably generate $500m, $600m or even $700m in revenue.

With these numbers, net profit after tax could grow from its current levels to $100–$140m per annum. At these levels, earnings per share will range between $0.31–$0.43 and a share price closer to $5.00 would not be completely unrealistic.

Please be aware that Montgomery holds Ainsworth shares and investors must seek and take their own personal professional advice.

Postscript: Australia has been stable at installed base of 200k machines for some time – replacement cycle historically been around 10-12 years because of the reluctance of NSW pubs to invest – this cycle has blown out to closer to 15-17 years since TAH and TTS stopped buying machines. However, there has been a mountain of catch-up in recent months.

United States – total market has grown from around 900k to 1m machines in recent years. Since the GFC market replacements have been around 70k per annum (cycle of say 14 years) – but recent data from IGT, WMS and Bally suggest the market has pushed back to around 100k replacements. It was doing closer to 150k replacements a year in the glory days.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

hedley.calvert

:

So what makes their suite of new games more appealing than others and is this a sustainable advantage? The last time I went to a casino was 20 years ago so I am no expert but would have thought it relatively easy for competitors to produce similar or better machines.

rmassera

:

Out of interest…….What drives the competitive advantage of gaming machine makers? What is AGI’s unique competitive advantage? Is it likely to endure? Has ALL’s competitive advantage deteriorated (presumably so given loss of market share to AGI) or has it just lost focus on cost control? Why will AGI not experience a diminished competitive advantage like ALL in the future?

eoin.cuinn

:

This company has been on the radar for awhile now for me. It’s a shame I have such a stance on problem gambling, but as you have said, some people can enjoy it as informal entertainment, while others obviously have a real issue with it.

Ethically though you could stand on the fence and say “these guys don’t run the machines, places that put them run them”

It’s splitting hairs, but for some this could justify it.

Ethic aside, they look like a solid investment, and I do think they can and will hit $5.00

Roger Montgomery

:

Russell adds…Australia has been stable at installed base of 200k machines for some time – replacement cycle historically been around 10-12 years because of the reluctance of NSW pubs to invest – this cycle has blown out to closer to 15-17 years since TAH and TTS stopped buying machines. However, there has been a mountain of catch-up in recent months.

United States – total market has grown from around 900k to 1m machines in recent years. Since the GFC market replacements have been around 70k per annum (cycle of say 14 years) – but recent data from IGT, WMS and Bally suggest the market has pushed back to around 100k replacements. It was doing closer to 150k replacements a year in the glory days.