…You can’t touch this?

“Yet you do not know about what may happen tomorrow. What is the nature of your life? You are but a wisp of vapor that is visible for a little while and then disappears“. James 4:14

“Suddenly a mist fell from my eyes and I knew the way I had to take.” Edvard Grieg

“Fog and smog should not be confused and are easily separated by color.” Chuck Jones

With apologies to 90’s rapper M.C Hammer, today I plan to lift the lid, ever so slightly, on a misconception about the value of tangible assets. I’ll throw in a few Value.able intrinsic valuations for you too.

Were you as fascinated recently, as I was, to read Harvey Norman suggesting that the price premium to book value of JB Hi-Fi compared to that of itself was unjustified? The company pointed out – and allow me to paraphrase – that the market capitalisation of JB Hi-Fi ($1.9 billion) against just $365 million of book value is high, when Harvey Norman’s market capitalisation is $2.7 billion and its book value is expected to be $2.2 billion at the end of this financial year.

The attachment to physical assets held by many is not unusual, nor is the belief that intangible assets are akin to a puff of smoke. Premiums to book value however are justified when that ‘book’ generates above average rates of return. And it is assets of the intangible variety – the economic goodwill (rather than the accounting variety) – that are more valuable anyway. Physical assets can be replaced, imitated and replicated. Any competitor (with deep enough pockets) can purchase almost all of them. Ultimately, any unusual returns these generate will be competed away as competitors secure the same machines, tools, equipment etc. Many in the printing game experience this phenomenon. A new machine gives them a marginal advantage only for as long as it takes their competitor to make the same investment.

Assets of an intangible nature are less easily copied and so high rates of return can be sustained longer, and are therefore worth more.

A company’s book value is the net worth of its assets. Book value is made up of both tangible assets and intangible assets. Tangible assets are physical and financial and include property, plant & equipment, inventory, cash, receivables and investments. Intangible assets aren’t physical or financial and may include trademarks, franchises and patents.

To demonstrate the difference in value between intangible and tangible, have a look at Google; That company’s market capitalisation is US$165.5 billion and yet its book value is just US$48.6 billion. Its price to book value is 3.42 times. JB Hi-Fi’s price to book value is 5.2 times and Harvey Norman’s is 1.22 times. But Google’s ‘book’ generates returns of 19.16%, JB Hi-Fi; 41.5% and Harvey Norman; 11.6%. There is indeed a relationship between the price premium to ‘book’ and the profitability of that ‘book’ (‘ROE’). A business is worth much more than its net tangible assets when it produces profits well in excess of market-wide rates of return.

I wrote about the capital intensity of airlines in Value.able (re-read Pages 60-63, 122, 164, 172-3), so you should know my thoughts about this already (You can also read any of these articles and transcripts for a refresher: Taking-off or crash-landing?, Qantas cuts costs to stay in profit, Qantas cuts staff, flights to counter fuel price hit and Flights reduced, jobs cut at Qantas).

When it comes to physical assets, less is more. For a business to double sales and profits, there is frequently the requirement to increase the level of physical assets. The higher the proportion of physical assets compared to sales that are required, the less cash flow available to the owner. This is the antithesis of the intangible-heavy business that continually produces profits without the need to spend money on maintenance, upgrades or replacements.

Let me demonstrate with an admittedly rudimentary example. Take two companies Rich Pty Limited and Poor Pty Limited. Both companies earn a profit of $100,000. Rich Pty Limited has net assets of $1 million. Intangible assets, such as patents and a brand, represent six hundred thousand dollars while physical assets, including machinery running at full capacity and inventory, represent $400,000. Poor Pty Limited also has a net worth of $1 million, but this time the intangible/intangible mix is reversed and eight hundred thousand dollars represents tangible assets and $200,000 is intangible.

Rich P/L is earning $100,000 from tangible assets of $400,000 and Poor P/L is earning $100,000 from tangible assets of $800,000.

If both companies sought to double earnings, they may also have to double their investment in tangible assets. Rich P/L would have to invest another $400,000 to increase earnings by $100,000. Poor P/L would have to spend another $800,000.

For many investors a large proportion of physical assets – also reflected in a high NTA – is seen as a solid backstop in the event something catastrophic should befall a company. I would suggest that the opposite may just be true. A high level of physical assets may be a drag on your returns.

Physical assets are only worth more if they can generate a higher rate of earnings. Any hope that they are worth more than their book value is based on the ability to sell them for more, and that, in turn, is dependent on either finding a ‘sucker’ to buy them or a buyer who can generate a much higher return and therefore justify the higher price.

With these ideas in mind, its worth looking at a list of companies that further investigation may show have very high levels of tangible assets compared to their profits. Let’s also throw in those companies that have highly valued intangible assets too. If they are generating low returns on these, the auditors should arguably take a knife to their stated ‘book’ values.

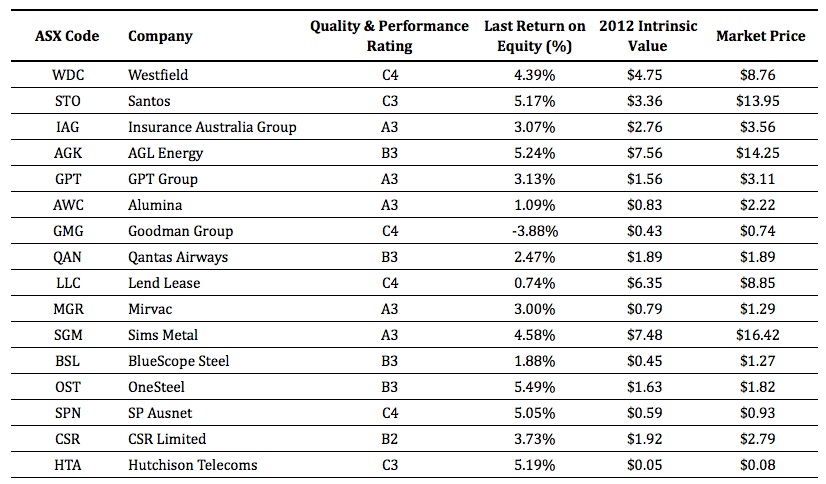

Starting with those companies whose market captitalisation is more than $1 billion (156), I then ranked them by return on equity (return on book value) in ascending order. 49 (31 per cent) companies generate returns less than your bank term deposit. The 16 largest (based on market capitalisation) companies with low ROE, possibly indicating either high levels of tangible assets or possibly overstated intangible assets carried on the balance sheet, are:

I have excluded resource companies. For while there are plenty that qualify, their returns are dependent on commodity prices.

Something to remember about the Quality & Performance Rating…

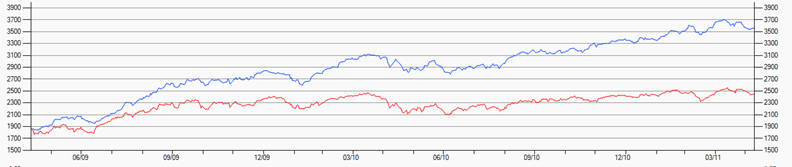

Rated A1 to A5, B1 to B5 and C1 to C5, every listed company is rated based on a series of over 30 discrete metrics, measured at both a point in time and over time. Most importantly, the Quality and Performance Rating is applied without any subjectivity. All companies are judged according to the metrics they generate. A1s have the lowest probability of a liquidation event. “Lowest probability” however doesn’t mean a liquidity event won’t occur. It just means far fewer A1s will have a liquidity event imposed on them compared to C5s. A liquidity event includes a capital raising, debt default or renegotiation, administration, receivership etc. An A1 company could of course raise capital if it needs to fast track construction of a new factory. MCE is an example of a high quality company whose cash flow has needed supplementation for this reason. Sticking to A1s and avoiding C5s should, over time, produce better returns. I demonstrate in the following chart:

The above chart shows the performance of a portfolio of the 20 biggest companies listed on the ASX rated ‘A1’. The red line is the poor old ASX 200.

There is merit with sticking to A1s (just as those who like the taste of Coca-Cola don’t settle for Pepsi). My team and I are fine-tuning something that will make the identification of A1s extraordinarily simple. So ignore those ‘Beat-the-tax-man’ pre-June 30 ‘special’ offers from various investing experts and other ‘helpers’. Avoid the temptation of an extra one, two or three month ‘subscription’, a show bag full of tips, a free magazine, DVD, or even a set of free steak knives.Wait for an A1 opportunity instead. Your patience will be rewarded.

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 service for stock market investors, 13 June 2011.

From Macca

Re HVN & JBH

It should be noted that most of the tangible assets in HVN’s book vallue is the ownership of properties; that it or it’s franchisee’s operate from. If the profits of the business fall, these properties will fall in value.

JBH could drop the rents without revaluing the properties.

This would mask the true position for a short period.

What worries me about JBH is not their current business (it’s great), or their current ROE, but overexpansion, and dependence on price cutting to get people in the door. Also the fact that they seem dependant on high street locations (with high rental) rather than the move to the HVN warehouse type of store. Yeh, I know they are rolling out those stores as well, but those type of JBH stores that I have been to, have nobody in them. It’s just the stores in the main mal’s that seem busy.

But the biggest worry of all to me is their high volume products (CD’s, DVD’s, Blu rays, games etc) can all now be purchased on line direct from the US and UK or with even more efficiency as digital downloads from stores like itunes…at 20-30% of the cost. Whereas their harder to shift higher cost items that they have to discount to get a sale (TV’s, electronics etc) have absolutely NO competitive advantage (other than price)..when it comes to a customers purchasing experience. Plainly you get zero customer service in a JBH store.

So in the years to come, with high volume sales gone, and nothing to distinguish them as a specialty hifi/TV retailer, just what is their “unique”, “build a moat” property that justifies them as an A1 business? I just don’t get this.

They may not always be an A1. Quality changes over time. ARB for example has been an A1 or A2 every year for the last ten. Qantas has jumped around every year…JBH may yet change. Its good to say you just don’t get it. That means you will be open to new ideas and more importantly they will have an impact.

Many posters on this blog like JB HiFi because of the negative sentiment currently surrounding the ‘traditional’ retail sector, the fact that it has been a wonderful business over the last years and is currently trading below Roger’s estimate of their real value.

It is widely believed amongst value investors that this contrarian attitude will surely bring investment success! And often investing in wonderful businesses which for whatever reason are currently out of favor will bring financial reward.

Although caution is called for.

In his wonderful investment book, “Common Stocks and Uncommon Profits” Philip Fisher gives the excellent example of how foolish it would have been to invest in the horse and buggy industry when the car industry was just beginning its ascent. To have invested contrarily in this instance would have been extremely unwise.

I agree with all of the points made by Alex above and whilst JBH may currently have wonderful metrics and a very able management the future prospects are looking very ordinary.

Hi Roger,

If I forecast a valuation for 2013, and want to work out the expected return, is this done by adding the change in IV plus the dividends forecast to be paid? Also, how do I factor in franking credits, as presumably you would be willing to pay more for a company that pays franked dividends compared to one who doesn’t.

Thanks

Hi Michael,

I have spent almost a year thinking about this. A possibly superfluous number is produced either way. Of course that statement is not my complete view on the matter…

For the franking credit part, when you use the table 1 in the book to value the earnings paid out component, can you just divide that by 0.7 for a fully franked div? Then add this to the retained earning portion calculated from table 2. This seems to give a slightly higher valuation but I think that’s justified because franking credits are paid.

Is this mathematically correct Roger? I’ve been thinking about this for a while as well.

Great piece in today’s Oz business section by Terry McCrann on FXJ, the new ‘tab sheets’ and classified advertising.

In the words of the Molly, “do your self a favour!” ….

This is the one I have been talking about…its produced by SMedia and its about to change the way we read newspapers for the better and potentially rebuilds the moats and bridges newspapers once had…

Smedia are doing the same for other papers in AUstralia and Globally. Melbourne ideas, Singapore execution and look out world!!!

I watched the Alan KOHLER interview on Inside Business with Fairfax CEO Greg HYWOOD where a discussion on “new media” took place.

Mr HYWOOD made a number of interesting remarks during the interview but four in particular made me stop and think.

The first dealt with traditional classified newspaper ads..the ones you find concerning jobs, cars, and houses. They are in his opinion done and dusted with classifieds now moved into the online sphere. No going back.

The second dealt with journalism and journalistic content. Fairfax’s new model sees them investing in journalistic quality as the way to bring an audience to the on line paper. This differs to the traditional paper models where journalism played somewhat of a second fiddle to attracting advertisements.

The third (and perhaps most fascinating) was Mr HYWOOD’S view that it made little sense to him to invest in a better grade of journalism only to have the audience you’ve worked hard to attract turned away by high priced pay per content. He felt it better to charge smaller amounts for more niche products thus keeping the broadening audience attracted to the actual news and therefore publication (my interpretation). A specific reference was made to the AFR and the high cost for its line content, something that Fairfax may review into the future as it’s considered too high and a possible impediment going forward.

The fourth and last comment of interest to me was the value of the news papers “bannerhead”. It is their brand just the same as coke and Apple. Everyone recognises the bannerhead of The Age or the Herald Sun or The Australian. The replication of the bannerhead and the actual newspaper by SMedia is the crucial piece of the puzzle going forward.

Right now, we can look at The Age and Herald Sun websites and catch up on news, BUT a replicated recognisable interactive newspaper delivered to my ipad…now that’s exciting.

Stephen

I only have to look around on my train trip into work to see that newspapers in their traditional form are dying an agonising death. I seem to be the only one who reads one (other than the free mx on the way home). Instead i see many people on laptops and smart phones reading newspapers, playing apps etc on the way home. So there is no doubt that newpapers will need to be innovative and find a clever way to bring in their revenue as the traditional price per issue way is gone as people can go online and read it for free. (Also in the case of some papers like the SMH, reading it does not take up an entire carriage)

It will be interesting to see how they get around this. Obviously they m,ay be able to extract higher advertising prices for online content as their are more options available to advertisers but i don’t think this will be enough.

I also think that the publishers will have a battle on their hand getting people to pay for online news content. Especially if one other paper is offering free news, they all basically coevr the same thing with slightly different (and in politics big differences) in their quality and viewpoints, so people would transfer over to that.

The key would be to come up with some really innovative packages that encourage people to pay for it. There is no doubt the future of news is online but we need papers to be profitable to keep that up, in order to be profitable they need revenue to exceed costs which means they need money from advertising and anything else needed from the users. So it is obvious to me at some point we will need to also pay for online content.

The question will be whether the first mover advantage is exaclty that or a disadvantage that loses customers to a paper offering free services and switches to a pay format after the first company (news from most discussion) makes it acceptable for people to pay. That might not make any sense but i can’t draw pictures to describe what i mean.

I would be very interested if Roger and others involved in this discussion about SMedia and the ‘new’ classifieds would care to share some more information about this. It’s all very cryptic at the moment. Would love an explanation of what’s going on and who stands to benefit. Could this be a big positive for the trouble-prone media companies (Fairfax, News etc.)? I certainly hope newspapers are able to find a new and sustainable revenue source. It would be very sad to see the end of quality journalism from the likes of publications such as the SMH. Sometimes I think their investigative journalism is better at weeding out corruption in politics and other areas than the Police are!

Hi Steve,

Thanks for your comments Steve. I am sorry that the brevity comes across cryptic. It looks like fairfax is running a multi-platform strategy to their online newspaper offerings. One is the popular app you see advertised everywhere in their media, but I think the better one (in terms of business potential) is this one: http://itunes.apple.com/au/app/the-age-newspaper/id407622380?mt=8

Terry Mccrann had some very forthright suggestions about where FXJ was headed which culminated in the idea that there is not enough time now to get their digital strategy in order before the value of the business dies with the death of the broadsheets. FXJ has the content, Vodafone, Telstra and Optus have the contact and a campaign to get The Age app onto every Australian Ipad and Iphone may just get users rethinking their consumption (or lack therefore) of newspapers, while getting the FXJ brands into the hands of the next generation. The app has the potential to alow FXJ to reclaim some of the ground lost in classifieds (they have lost all the ground). Thats all.

Hello bloggers,

Hi Ron and Ash, we have discussed VOC and BGL on this blog before i have come across this micro cap MNZ ,i would like to open for discussion. I know its very illiquid and it doest tick all the valueable boxes,but if you believe in a hi tech ditigal mobile future this one might be a good fit.

MNZ Mnet Group Limited is a full service mobile solutions company. It provides mobile marketing services to enable clients to market and sell their products and services via mobile devices as well as providing the platforms and content to enable telecommunications carriers, media companies and enterprises to retail mobile content.

Interested in any feedback.

hi garry, currently this company is not of any interest to me. i cant seem to see any thing special or unique about its services and its financials are not attractive to me. do you think it enjoys high margins? how competitive is its industry? some stuff to think about.

on another note, BGL at 28cents…… :-)

Yes I agree with Ron

This company is in a very competitive enviroment and would not get my money.

$8 Million Market cap. They might, actually they proably will. get crushed in this enviroment.

As you say Ron BGL at 28c is very good and still not at a silly price in my view

Attenion class! Could everyone get out there textbook and turn to page 81: “The Reverse Of Raising Capital: Share Buy-Backs“. Roger could you start please? “There is a way that equity can decline and have a positive impact on the value of the company on a per share basis: when the company uses its cash to buy back shares at attractive prices.” Thankyou Roger now class lets look at the most recent announcement by ASX: MLX

Metals X Limited is an Australia-based company engaged in the exploration for and the mining, processing, production and marketing of tin concentrate in Australia; exploration for nickel in Australia; exploration for phosphate in Australia; development of nickel projects, and exploration and mining for precious and base metals in Westgold Resources Limited, Aragon Resources Limited and Jabiru Metals Limited. Metals X also owns 50% of the Renison Tin operation that is generating strong profits.

Today Metals X is continuing to review various investment opportunities within the resource sector.

16 June 2011 (Perth, WA)

Metals X Limited announces today its intention to commence an on-market

buy-back of up to 10% of the issued capital of the Company in accordance with the ASX guidelines and Corporations Act.

It is the intention of the Company that the share buy-back will commence from 1 July 2011 for a period of 12 months having provided 14 day notice to ASIC and the ASX.

Now Roger could you please read on “Companies that buy back shares are doing the right thing from a shareholder perspective, and acquisitive companies,if disciplined, should always compare the purchase of another business to the purchase of its own shares. Sometimes, its own shares may be cheaper. By buying back shares, the company can permanentely increase its return on equity, and, depending on the price paid for the shares, increase its value.” Excellent reading Roger thankyou. Now class lets review Metals X currently holds cash reserves and receivables of over $100M, investments in other listed and unlisted entities of over $75M and has no debt.

In addition this company has recently announced an agreement with Jinchuan Group Ltd (“Jinchuan”) to cancel Jinchuan’s 176,000,000 shares in Metals X in exchange for a 20% direct interest in its Central Musgrave Nickel Projects (“CMP”) (which includes the world-class Wingellina Nickel limonite deposit). At the time of the announcement Wingellina was valued at over $250M. This transaction remains subject to shareholder

approval for the sale of the 20% interest in CMP and selective share buy-back of Jinchuan’s 12.9% of issued capital.

Now class before we calculate Metals X intrinsic value lets read what its board is thinking by reading out a statement provided by Warren Hallam Peter Cook (Managing Director/Chairman). “Given the current market conditions and its current share price, the Board of Directors believes that an on-market buy-back of the Company’s equity is a sensible and effective use of the Company’s capital. If completed in full this share buy-back and the selective buy-back under the Jinchuan deal will result in the buy-back of approximately 23% of Metals X’s current issued capital.”

So there you have it! A textbook example of a share buy-back being proposed by a company listed on ASX. However although it seems a good idea buy- backs MUST be conducted at prices below MLX intrinsic value, in order to increase the value of the company for all remaining shareholders.

Despite the fact that MLX share price has fallen 28.8% this year if the board thinks that this is the “best” time to purchase its own shares it may be right if it only takes its leads from the markets share price alone, but we Value.able graduates know better dont we ?

Could I please get as many graduates to submit their I.V

calucations for MLX, with the corresponding MOS for the purcahse of MLX today for your homework. Class dismissed.

Hi Anthony

with a profit for the first time last year and trading at what I think well above value , I will leave it alone. Sorry

You can’t take buying back shares in isolation and decide that a company is a good company to invest in. Have a look at how many shares they have issued in the last 5 years. Have a look at the losses they have made. Anyone who even proceeds to perform a valuation on this company has failed the class.

Another commodity play. A price taker in one of the most abundant of the commodities on the planet. No interest to me, no matter how many shares they buy back. The latter is essentially irrelevant when compared to the factors beyond management control (tin price, exchange rate , etc.) that determine its value.

PS It is probably worth adding that if you intend to invest for the long term (rather than speculate in the short term) in a commodity business, then you should ensure that you do so in the lowest cost producer.

The only competitive strategy in a commodity business is superior execution, which manifests itself in the lowest long run unit cost of production when compared to the global peer group producing a commodity.

In the case of the noted company this is unlikely to be the case. This problem may be exacerbated by having the cost base struck in strong AU dollars, against a commodity priced in US dollars and one in which most of the global producers have US dollar linked cost bases in developing countries.

As a general observation, buying into a commodity business based in Australia, at current commodity price and AUD exchange rate highs is a bit problematic, if not high risk. So the least risky way to play the long term investment game in commodity businesses is to buy into the lowest cost producer at a cyclical low in the commodity price. Its all upside from that point, but that is far from the current market situation.

And there endeth the lesson! Thank you Lloyd.

An Excellent contribution ! Just wish that you still did the homework though so we could all compare our answers.

IV is the last thing I consider and calculate and only then once I am assured that the business that I am looking at as an investment opportunity has some quality and substance to it, sufficient to warrant an investment grade rating.

It is probably no coincidence that the IV calculation chapter falls at the back of Roger’s book.

It is the last consideration of all in the investment decision, as far as I am concerned, and not even worth calculating for at least 98% of companies listed on the ASX.

Unfortunately, I think too much of the blog blather in recent months been given over to the minutiae of IV calculation and attempts at reconciliation of such to Roger’s calculation. Yet the IV calculation is full of major assumptions regarding the sustainability of ROE, projected future earnings, and the like, to the point that it can be very misleading as an investment tool unless you as an investor have critically determined each of the underpinning assumptions to your own satisfaction and to the best of your judgement.

The IV calculation is anything but the be all and end all of an investment decision process. Build your portfolio on the basis of IV calculations alone, using analysts forecasts and without consideration of the the business and competitive dynamics of the companies concerned and the outcome will be just as miserable as jumping into the market with a random selection.

Hear hear. Thanks Lloyd.

That would be “hear, hear”.

There there?

Priceless information. Thank you Lloyd

Cheers

Jim

I’m sorry but these companies can be valued, and in my opinion MLX is undervalued (but I don’t think MLX is investment grade and will explain why below). You need to look in depth at a companies figures before making a valuation.

Firstly the figures:

Shares outstanding: 1365 million (with 176 million to be bought back for 20% Wingellina), so let’s say 1189 million.

Share price: 0.235

Market cap: 279 million

Cash: 104 million

Value of listed investments: Approx 70 million currently (*rough figure)

Enterprise value: 105 million

From the half-yearly- operating cashflow of roughly 11 million, they have still have large amounts of accumulated losses so don’t expect them to be paying tax anytime soon, but for valuation purposes using corporate tax rate of 30% gives an (approximate) long-term NPAT of 15 million. Tin has very tight supply, is difficult to mine and the Rennison mine is approximately 4% of the world’s supply, and no new sources coming online anytime soon.

Using a NPAT of 15 and a required return of 10%, with no growth factored in, gives a 150million enterprise value (or 0.27c/share).

The main problem I have with MLX is that the Wingellina project IS a world-class nickel deposit, but MLX is currently too small to actually develop it without incurring significant risks or debt. Implementing a buyback indicates that MLX is not going to develop this project anytime soon. So the question remains- what is MLX going to do with the excess free cashflow? Buying back the shares at a price below intrinsic value is one appropriate way of doing things.

MLX has demonstrated ability in the mining investment business (eg. JML) and it would not surprise me if westgold turns out to be a very profitable gold producer in the future, but with a small margin of safety and few organic avenues for growth, it is not for me.

Excellent alternative viewpoints Mal. Thanks for sharing.

Who is paying for the investing outflows, which were $8m for the half?. You can’t just use operating cashflow to perform a valuation – I think this is misleading. They are spending money on exploration and mines and capitalising it to the balance sheet, so the profit is an illusion as well. For speculators only.

Whats your IV Simon? Do you think management are conducting this buyback at a discount to intrinsic value?

Its not a business i would be interested in. usually give up when i hear the word mining, but when i hear the words mining and exploration i tend to run even faster away from it. I just think before graduates go and start performing IV’s and putting them here you might want to let us know what you think. Is it a good move or not?

At last! Mal, Well done and thankyou! You have gone beyond the limits of the task set and no doubt have broadened both yours and our knowledge bank in the process. Its contributions like these that really are value.able.

Until we know outcome of carbon tax and the fallout, the valuations are meaningless for most

I agree in part that current valuations might not be the most accurate at the moment as the carbon tax might have an impact on companys results and there for affect the valuations it also shows why the value.able approach will be even more of an asset to have.

Value.able grade companys (Rogers A1’s for example) will be less effected by this tax than others as they will still be great companys after the tax. The tax does not make any difference to most companys as to whether they are investment grade or not.

Also, companys with a huge competitive advantage should be able to pass this cost on without sacrificing their profitability.

So lets not just give up, there are some things in the future that can.will affect valuations but it doesn’t change whether the companys are good or bad.

Hi Roger

An article in the AFR dated 15 June 2011 commented on short selling of Australian stocks. It stated that “JB Hi Fi was the most shorted stock….and about 14.3% of its shares on issue were reported as short as at June 6.”

Given that retail stocks are not the flavour of the month, JB Hi Fi recently bought back 10% of its shares, and after they came within my MOS, I recently purchased shares in JB Hi Fi

Could you please explain what short selling is and what effect, if any, it will have on the long term price of a stock.

Thats a good topic for a blog post. I will write something up.

Darrell – no need to be concerned. The principles of value.able investing do not change due to short selling. Short selling may decrease share prices in the short term, but if the intrinsic value of the company is higher than the share price, then the share price will still rise over time. You only need to be concerned if the share price is too high compated to IV, or the company has solvency issues. In both cases under the value.able methodology you wouldn’t have purchased the shares, or you would have already sold.

Once the selling runs out, the short sellers become buyers, and this will likely make the share price gains more rapid.

I hold JBH, and when I read that there is a high level of short interest – it makes me think I am on the right track. This may be why value investing is suited to me – I have a contrarian nature – which really is part of value investing.

Hi Darrell,

Very loosley, shorting is when people borrow shares from another party and sell it down with the idea of buying it back at a lower price. Where as conventional investing is neatly summed up as Buy low sell high, shorting reverses it by being Sell high, buy low. The difference between the selling price and the cover (buy) price is the profit or loss. it is a complete short term trading method.

It should have very little effect on the long term price of a stock, but that is the least important factor. The most important from a value.able perspective is that it doesn’t change anythign about the underlying quality of the company.

In the case of JB Hi Fi the business (at least in my opinion) is still a great one so i am not worried about people shorting it, the lower they push the price the more of an opportunity to buy at a discount to value.

There will be other cases though where people get loaded up on the short side because they can see some type of catalyst that could cause the price to plummet. Think Enron, ABC. Companys which are about to go under, misrepresenting accounting etc.

So shorting causing a price to drop could be a good thing for a good company as it could allow you to purchase at a discount and also something that is flagging a servere problem.

Either way you don’t need to be concerned about it and follow the value investing principles as if you have you would already know which side of the coin it is on.

In the above case, i haev looked into JB Hi Fi and apart from its growth slowing down i don’t see anything to concern myself and a growing margin of safety for a company that has grew NPAT year on year since 2001 (albeit the cashflow has not been as consistent).

Calculating the IV from ROE assumes that ROE is constant.

Another way is to the ‘Incremental principle’ (see Simmons book referenced in Valueable) However this calculation is not always sensible. (I expect the calculation to fail for JBH next year with the buy back).

This assumption is that an ROE larger than the IP will fall to the IP.

Interpreting the numbers is not easy. If an IP is larger than the ROE then the ROE is a better choice. I now calculate both.

Hi Roger,

I recently read that George Sorros increased his steak Amazon.com.. Amazon recently announced that for the first time eBooks outsold paper books by a ratio of 115:100.. So, speaking of the tangible, if this trend continues (it should – Amazon is forecast to grow by something like 37% next year – apparently), there will be far less need for warehouse space. And it might just be time to do that Value.able e or i edition (Or maybe even your next book “Suit.able” – a guide to credit worthiness – sure to be a best seller). Assuming the price was right (I haven’t looked yet), Amazon looks good.. But even if the price was right, the whole currency thing bothers me, apparently it doesn’t bother George.

RobF

Roger,

Given HVN book value is 2.2b and trading at 2.7b. If it ever trades below book value say 2.0b ( this would drive share price below $2), would you consider buying, if everything else remains the same?

I am asking this question from a completely different value perspective. Do you consider buying a “reasonably” good and consistently profitable business only because it is trading below book value with margin of safety (possible take over)?

Buying at a discount to book can change the way you look at ROE. But be very careful. Low ROE businesses are not good businesses.

A great post Roger. When I read Buffetology (my first investment book) over 10 years ago the calculations surrounding IV were highly focused on book value and lent itself to searching for companies with lower Price to Book (P/B) values. Whether Buffet actually used this formula I’m not sure as he didn’t write the book of course. Certainly not the attention to detail and complete philosophy of Value.Able

So with this notion the first company I ever purchased was Austrim Nylex which would take pride of place on your list Roger and a great example of physical assets which ultimately diminished returns – But a great lesson to learn and don’t bother looking it up anyone as you won’t find it!.

I believe Benjamin Graham focused a lot of his investing on purchasing below book value or asset value and Buffet has said numerous times of his superior returns when he refined his approach away from this. He recognised that a higher P/B was not an issue if the quality of the intangibles and subsequent return on the book were superior.

Finally, a tell a lie as I just recall the first compnay I purchased was Securenet in 1999 at 30c which I sold at $2.00 to go overseas for 6 months. I returned to see the stock peak at $16. Now I made money out of this company but it was speculation as a broker recommended it in the paper. And the mindset it gave me as the tech boom turned th bust set the moulding of my investment philosophy back a significant step.

I say this because I feel there is a some speculation creeping into the blog. Some companies that have been mentioned do have bright prospects but they make very little money now. Peter Lynch in “One Up on Wall Street’ talks of being able to still make lower risk outstanding returns once a company with great prospects is starting to establish itself with consistent profits over 2-3 years. This is still before it hits the radars of the major brokers and managed funds. The opportunity to purchase with a MOS will be there and if it isn’t we wait.

Let’s not forget there are some wonderful established A1 companies in Australia, just very few are cheap at the minute. But the opportunities will come over time if we are patient. Think about what companies we would’ve been talking about in March 2009.

On that note Flight Centre is slowly starting to look cheap but not quite a large enough MOS at the minute by my calculations. However, does Roger or anyone have a view on their cashflow statement? Receipts vs payments is a little concerning unless I am missing something.

Just some thoughts for the what it’s worth basket anyway.

Hi Allan,

I had a look at the 2010 report for Flight Centre and cash flow is looking quite healthy – see figures below. This is compared to a reported 2010 profit of 139.9 million.

’09 vs ’10:

Operating Cash profit = 158.8 million

Company Cashflow = 184.7 million.

The 2009 position (versus ’08) was less healthy…but still company cash flow positive.

Operating cash profit = -13.0 million

Company cashflow = 44.2 million

versus

Profit = 38.2 million

In the latest half year report, there’s a statement that recent floods haven’t impacted travel as much as first thought, as people are simply flying to different destinations, and not postponing planned travel.

Guess we’ll see in the full report in Sept/Oct just how true that is.

Regards

MarkH

Thanks Roger.

The standout failure in this list is, in my opinion, Westfield

Sure Qantas and airlines as you continually say is the example of what industry you should avoid.

And the others are all commodity businesses, so no surprises here…but Westfield?

I mean they are a monopoly business, who ever year are in a position to increase their prices (to tenants)

Just how they continue to generate such a low ROE simply defies belief. Id love your insight into just what has gone wrong with this company

They have been such a disappointment to so many investors

Regards.

Can only squeeze so much out of bricks and mortar, capital intensive, lack of intangibles, debt funded, too big? and too much scale for efficiency? Like any large cap. stock that is capital intensive, once they get this big management always seem to struggle to extract further value at an acceptable rate simply due to their size?

Re your comments re HVN and JBH.

Is this not only valid if the ROE of JBH remains where it is. The evidence so far is that it is falling, year to year. Does that not mean that eventually the premium to book will also falls as the markets marks it down. The fall for JBH will be greater than a company like HVN, ditto with Oroton.

Of course Es. The more sustainable the rate, the greater the premium (present value etc). But the comment was at a point in time.

Interesting comment re JBH. Using brokers NPAT forecasts for 2012 and taking into account the recent share buy back my anticipated 2012 IV is $24.50 (in round numbers). I crunched some projections into my spreadsheet, forecasting NPAT increases at a pedestrian 5% p.a.for the five years from 2013 to 2017. My calculations assume no change in issued shares, a payout ratio of 60% and a 12% Required Return Rate. My IV increases to $27 and then fluctuates a bit, ending the 6 year period at $26. Given that I collect around $6 in dividends over the period I am pretty comfortable that the current price represent value and wonder how JBH managed to buy back 10.8 million shares at $16 – seems a steal to me.

Grant, holding your payout ratio assumption at 60% ignores the fundamental issue. I suggest you read the section on Implied Growth in Value.Able again.

Thanks for your input – always appreciated I think you may have misunderstood what I am conveying.

“When it comes to physical assets, less is more. For a business to double sales and profits, there is frequently the requirement to increase the level of physical assets. The higher the proportion of physical assets compared to sales that are required, the less cash flow available to the owner. This is the antithesis of the intangible-heavy business that continually produces profits without the need to spend money on maintenance, upgrades or replacements”- This paragraph brought back memories of mid-1997 where deregulation in Australia and overseas freed up a huge amount of space on international cables at rock bottom prices. One.Tel was able to purchase calls to the USA & Europe for 15c per minute and sell them to its customers for more than double that, yet at a discount to rates offered by Telsta & Optus, which provided a cheap cost effective way to grow its customer base. In regards to physical assets however, in 1998 One.Tel expanded globally in L.A, London, Hong Kong, Paris and in doing so reached and secured an extra 100 000 customers, but this time at great expense, spending a fortune on new offices, marketing and PR campaigns, putting sales reps on street corners to sign up new customers. 12 months later One.Tel was spending an additional 50 million per year for its extra 100 000 customers. Jodee’s rich answer to this negative cash flow business plan was for One.Tel to create its own mobile network! This would cost $1 billion to build and another $500 million to recruit enough paying customers to make it produce a profit. At the time One.Tel book value was only worth $208 million ! History tells a story of a company that didn’t survive the dot.com bubble, that had tried to grow not by M&A activity but by increasing its physical infrastructure and financing its projects with large deb and in the end. One.Tel results for the 2000 financial year was a net loss of $295 million, and a capital intensity of doing business of $750 million! The Packer family had spent over the life of the business 400 million dollars to learn a very value.able lesson.

Great insights Simon. Thanks for sharing.

Hi Roger,

True, true, have look at Apple again, though they spend money on hardware, but that hardware will be passed onto consumers, so that hardware is not on Apple books, as per say. Please see link below.

http://www.fastcompany.com/1758338/apples-not-buying-more-chips-than-everyone-else-its-buying-a-future

Regards,

SG

Clever angle Sergey. Nice insight.

Hi All,

Apple is doing very well indeed, and it’s interesting to note that the company that actually manufactures Apple’s products (and almost every other gadget by every other company) isn’t. I was inspired by Sergey post – in light of Rogers post – to have a quick look at Foxconn’s ( Hong kong 2038:HK) financials. This is no doubt a capital intensive business, With (I’m guessing) no ability to bargain for higher prices, and it’s 5yr average ROE is 9.08% and this yr it’s -6% and it’s price to book is 0.98. Even in China, where the wage bill is comparatively low, running equipment 24/7, capital intensive businesses generate poor returns.

RobF

I personally have a different slant on this, and I would be interested to hear other people’s thoughts.

I personally feel that the reason capital intensive and generic manufacturing companies are doing poorly is due to global labour cost disparity. For years we have seen outsourcing to Asia as a way of reducing unit labour costs, but as these economies grow, there is wage inflation and subsequent reduced profitability. The problem is, due to large income disparities in a globalised world, there will become a stage where it will be more profitable to export manufacturing to lesser developed areas (eg. Africa) and for the process to start.

In the much longer term, as wages equalise, there will be less outsourced undercutting and you will actually be able to tell the wheat from the chaff so to speak, as the truly efficient businesses thrive. Over time they would be able to start setting and increasing prices, and I think the large capital costs to enter the market at that stage would be a very enormous competitive moat. Obviously this is a very long-term horizon.

Hi Roger,

A picture paints a thousand words; the graph at the end of this post demonstrates a consistently better return for the A1s, 15%pa for the ‘ASX 200’ vs 38%pa for ‘A1 20’. Would be useful to see this graph over a longer period of time (10 years), maybe we will be able to when you launch your new product?

One thing that has confused me for some time is the difference between equity and Book Value. I understand equity is made up of funds that have been contributed to and retained by a company. In your post you state “I then ranked them by return on equity (return on book value)”, which would imply there is no difference between equity value and book value, this is what I thought was the case.

But where I get confused is where you have “the auditors should take a knife to their stated ‘book’ values”. If ‘book values = equity = contributed and retained funds’, then how can this figure be changed by the auditors? I would have thought there could only be one correct value for equity. If anyone can explain this it would be appreciated.

In this post where it’s stated “Rated A1 to A5, B1 to B5, and C1 to C5” I can see some new readers may misinterpret this to think all of the ‘A’ companies are better than all of the ‘B’ companies etc. It took me a while to figure it out when I first started reading this blog over a year ago. But in actual fact if you were to rank all of the ratings in order there would be some mixing of the AB & C’s. I figured this out only when I heard Roger state on Switer once that B1 companies are better than an A5 companies.

The important thing to realise is that the letters and the numbers of the MQRs are ranking two totally different things about each company. The letters represent the chance of a default event occurring and the numbers refer to the performance of the company.

Thanks for another great post.

Regards,

Dave.

You make some excellent points there Dave about A1-C5s. I will address this in coming posts. Regarding the auditors and “book” values; I am using the word “book” but probably should say; “stated on their “books”.”

Thanks Dave for your comments – these have helped me better understand MQRs. It would seem to me Roger that ‘number of liquidity events’ could be readily quantified on an historical basis. I would be interested to know if you have historical verification of the number of recorded liquidity events for A, B and C classified companies e.g. over 5 years, say, x% of A classified companies recorded a liquidity event, y%.of B rated companies and z% of Cs. Also, I would also be interested to know whether you are keeping a real time track record of the same or are contemplating doing so. I do not doubt for a minute the soundness of your objective classification but independent verification is very persuasive (for example your chart of historical performance of large A1s posted here). [[[[Please do not feel obliged to either post or answer these questions – I just really wanted to share the thought with you, particularly as I am eagerly awaiting your new database. Data such as this would be a great selling point]]]

Yes, Have the data. Plenty of it. But importantly, from the inputs, the efficacy is self evident.

Roger, I would not doubt the efficacy of your rankings for a minute. However I do not believe you have shared the ‘inputs’ in the sense of providing the objective ranking formula per se (and nor should we expect you to). I’m sure if you were to reveal the ‘input’ (i.e. your objective ranking formula) the efficacy would, indeed, be self evident. I’m simply suggesting that, in lieu of disclosing the formula (i.e. your IP), an assessment of the ‘output’ would be very powerful.

agreed.

Hi Dave,

Was reading your post and your question about how auditors can change the book value of intangibles etc, got me thinking as well. I think what you are asking is how can the auditors alter the stated value of intangibles, and have this balance on the balance sheet.

While I’m not certain, I think this is what happens: If the stated value of intangibles is amortised, resulting in a $100 decrease on the assets side of the balance sheet, this is also recorded as an expense in the profit and loss statement. Thus, if there are no other changes in the business, it has made a loss of $100, and therefore retained earnings falls in value by $100.

Hope this is correct, happy for any of our resident accountants to correct me.

Cheers

Tim

Thanks Roger.

One of the stocks mentioned (MGR), like many on this list has a great track record of destroying shareholder value.

If you do a quick balance sheet reconciliation of their cash flow from 2007-1H11, they have accumulated $2.6bn of negative cash flows.

Looking at the statement of cashflows, they have generated $558m in operating cash flow over this time and spent $966m so they have funded the shortfall by raising equity from shareholders….$2.8bn in total during this period!

Value destruction!

Also, if you take their FY10 NPAT of $237m and look at their net tangible asset base of $5.4bn, they earnt 4.4% return. If your hurdle rate is 10%, MGR should be earning $540m!

Well done Michael. You are a fine value investor!

Hi Roger

What is the MOS that you employ when in consideration of buying A1s.

Also what degree of gains in past and future ROE’s, IV’s would you consider as reasonable for A1s.

cheers

darrin

I am pretty sure you have asked this previously Darrin and also had some responses.

The relevant margin of safety is up to you, each person has their own specific preference. Some might be 10%,20%,30% even 50%, It is something you need to have a think about and decide upon.

I am sure if you have a look at the body of information in rogers book, this blog etc you will find some information already written that will help but at the end of the day it is your decision and something you need to decide upon.

There comes a point where others can’t really help you and you need to sit down and work it out. Appropriate margin of safety is one of them.

Roger,

I think you are being kind to Origin Energy.

At 30/6/10 its equity was $11.4bn and it had $2.4bn in goodwill.

Since then it has issued new equity of $2.3bn and has paid a lot for the goodwill attached to NSW electricity consumers.

In 2010 it made a profit of $0.6bn and analysts forecast $0.7bn for 2011.

ORG is about to spend up big on unproven CSG to LNG technology and its ROE must inevitably fall away even further until it actually makes profits from LNG.

My IV for every year of the 5 years 2009 to 2013 has remained pretty constant at under $6 (using RRR of 10%), but the share price since 2009 has always been more than double that and is currently $15.70.

Deduct a MOS from the IV and the share price looks even more inflated.

Certainly ORG is going to grow its balance sheet a lot, but not EPS. ORG looks like making less money than term deposits for several years.

I don’t have anything to add. Fantastic Martin.

Thanks Martin but I have to say that ORG has been very kind to me. I’ve been in it for 11 years, since its birth, and it has returned 48% p.a., including dividends, over that time. I do though have the problem that it is now too great a proportion of the portfolio.

Excellent article Roger, i found it very interesting.

A good example of this is the list websites that are highly profitable. They require very little in the way of physical assets and there for the amount of money looking after those physical assets can be better spent elsewhere, which we hope management does.

When i think physical asset heavy i always think of an airline and you have made mention of this in both this blog and your book.

The problem with physical assets is that they depreciate over time but also usually get more expensive to buy, they can also be easily copied.

In an airline case not only do they have this problem but are also dependent on other costs which are increasing and competition forcing ticket prices to be in a downward rather than upward trend. I know i don’t need to go into airlines here as we are pretty much all on the same page i think.

I was speaking to someone recently about brand value (you could call that an intangible asset).

I used the holy symbol of quality that is the Coca Cola Company.

My question was and i know Warren has said something similar so i am basically loosley paraphrasing him.

“If i gave you all the money you need to buy the exact same machines, ingredients, processes and systems, recipe and can have everything set up to make a cola drink the exact same as coke (without getting into a law suit). Do you think this will change people from coke to your beverage and there for make a serious hit into coca cola’s customer base?

Even if you are able to sell this product at a decent discount, i still think the affect on Coke will be small. It is the intangible assets which are the power behind that company.

I have only scanned your list but i can see some things that stand out.

Westfield would have a lot of tangible assets as that is their business. They own property (tangible asset) as do mirvac and lend lease.

Insurance Australia Group, in my mind should not have a very large tangible asset base so i would expect that if i looked into them i would find that maybe some of these assets should possible have their values written down.

I look forward to having a more detailed look into this area and thank you Roger for writing a post like this. I conciously think about these things but haven’t actual sat down and had an in depth think about it.

Good insights ANdrew. As always I sincerely appreciate the time you take to contribute to the body of work here.

Great post.

Over the years I have seen the market reward companies that make relatively modest use of physical assets, while penalising those that are more heavily capital intensive. These great companies have products or services that have high consumer demand, repeat business and have withstood competitive pressures over time.

Companies with particular economics can have a sustainable advantage over their competitors because dominant intangible assets are difficult to create or replicate. Physical assets, on the other hand, can be easily replicated leading to excess capacity, price competition, and lower returns on invested capital.

I whole heartily agree with you on this one Roger!!

Regards,

Matt

I am trying to get my head around this whole issue, ‘accounting intagibles and goodwill’ vs economic intangibles.

But here lies my inherent dilemma:

(a) company (a) no company buyouts, or private equity relisting (with a good will component upon IPO)

(b) company (b) a large good will component, that is artificial, yet there is some component of valid underlying economic goodwill.

Using the ROE screeening (a) will show glowing results, (b) wont.

(b) is ignored simply because it will show an accounting ROE that is ‘deemed’ to be undersirable.

But which is the BETTER UNDERLYING COMPANY

I think i need to go into this idea in more detail.

Lets assume two scenarios, with the SAME UNDERLYING COMPANY. ie the company is exactly the same, its just way its presented in the finacial staments that is different.

(a) an IPO listing, except that it current owners wish to list for purposes other than a short term exit, there is no buy out, private equity relisting etc. The IPO price for whaterver reason was at a reasonable level, so there is no sigificant ‘fudge factor’ that is intagibles/goodwill, and hence no artificial ‘equity’.

(b) an IPO listing that had fudgefactors, except now Mr Market is ‘smarter’ he is on the ball, he realises the underlying fudge factor.

Now lets go to the traditional way of ‘valuing’ a company.

Under scenario (a) everyone would be raving about the quality of this company because it had a high ROE. The only problem would it would be selling on a multiple to book value.

Under scenario (b) everyone would be saying that this is a dog of a company because of low ROE, even though the company may be trading on a bookvalue less than 1.

Yet the two underlying companies are EXCACTLY THE SAME UNDERLYING BUSINESS

and let me highlight this with an example of a Montgomery favourite ‘oroton’.

Two scenarios, the same company.

If oroton had been the subject of an IPO listing with a huge ‘goodwill’ accounting factor, its ROE wouldnt be anywhere near its current level.

But has this anything to do with the underlying business???

ie is its ECONOMIC GOODWILL EFFECTED BY ACCOUNTING GOODWILL.

On an intial screaning using ROE, one would have passed on oroton under this scenario regardless of the underlying ‘VALUE’ of the business, only because ROE would have been potentially low. Yet ROE is caclulated on equity which itself is dependent on the balance sheet which itself is dependent on accounting assumptions.

What about if under this scenario, oroton was trading at only a fraction of its book value.

Do we deem the ‘quality’ of the investment based on only ROE, or on the UNDERLYING QUALITY OF THE BUSINESS.

Hi Rici Rici,

I think you might have left one critical detail out. It serves the argument to leave it out. Its to do with company (a). Trying a spreadsheet might help. BTW, ORL is expensive – why is it a favourite?

Hi Rici Rici,

Need a little more clarity; Is a’s goodwill the accounting variety thanks to a purchase of the business pre-float by the listed vehicle?

Hi Rici,

It is dependent on the situation, you can use return on tangible book value (RoTE) or just ROE, however if you think the company wont go out & buy something for way to much (e.g. WES & coles) you can use RoTE, however is you think that is a possibility you should use ROE. RoTE is probably a good indicator of underlying quality & ROE is a good indicator of management & the underlying quality of the business.

I know ive said it loosely but i hope u get what im saying